The Will you have found is for a divorced person, not remarried with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

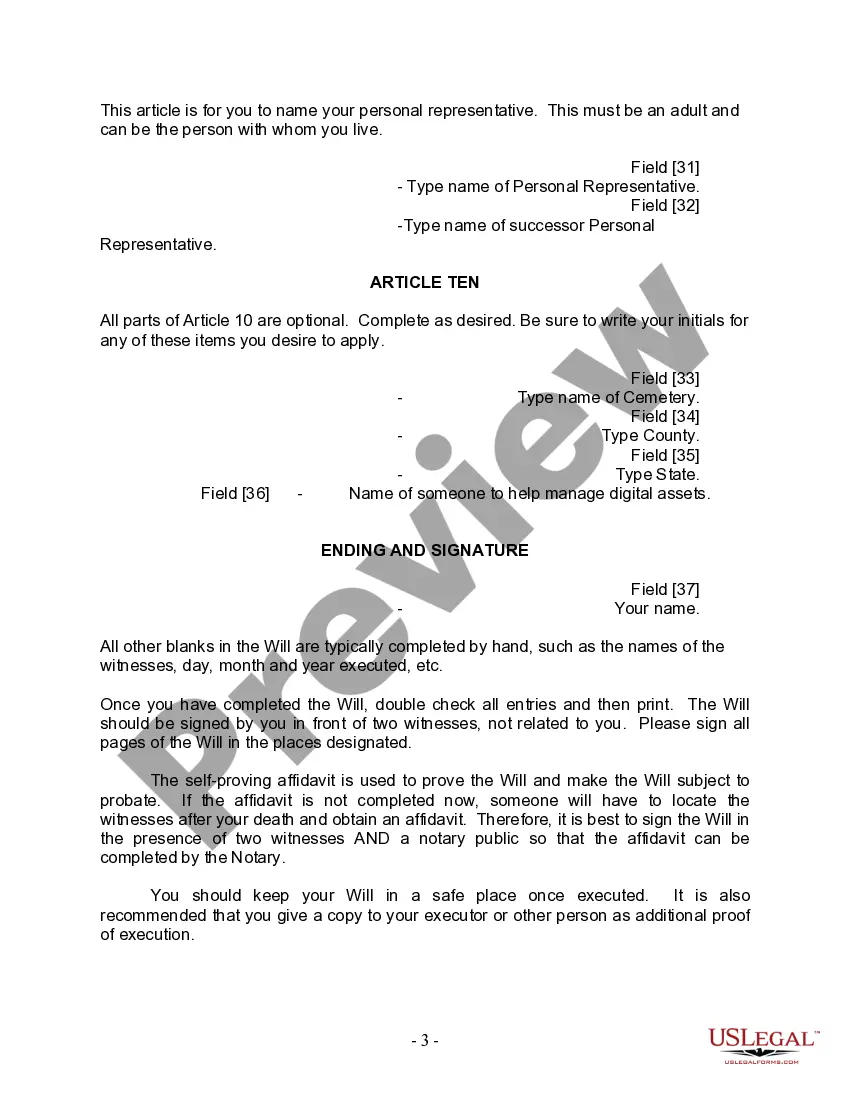

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

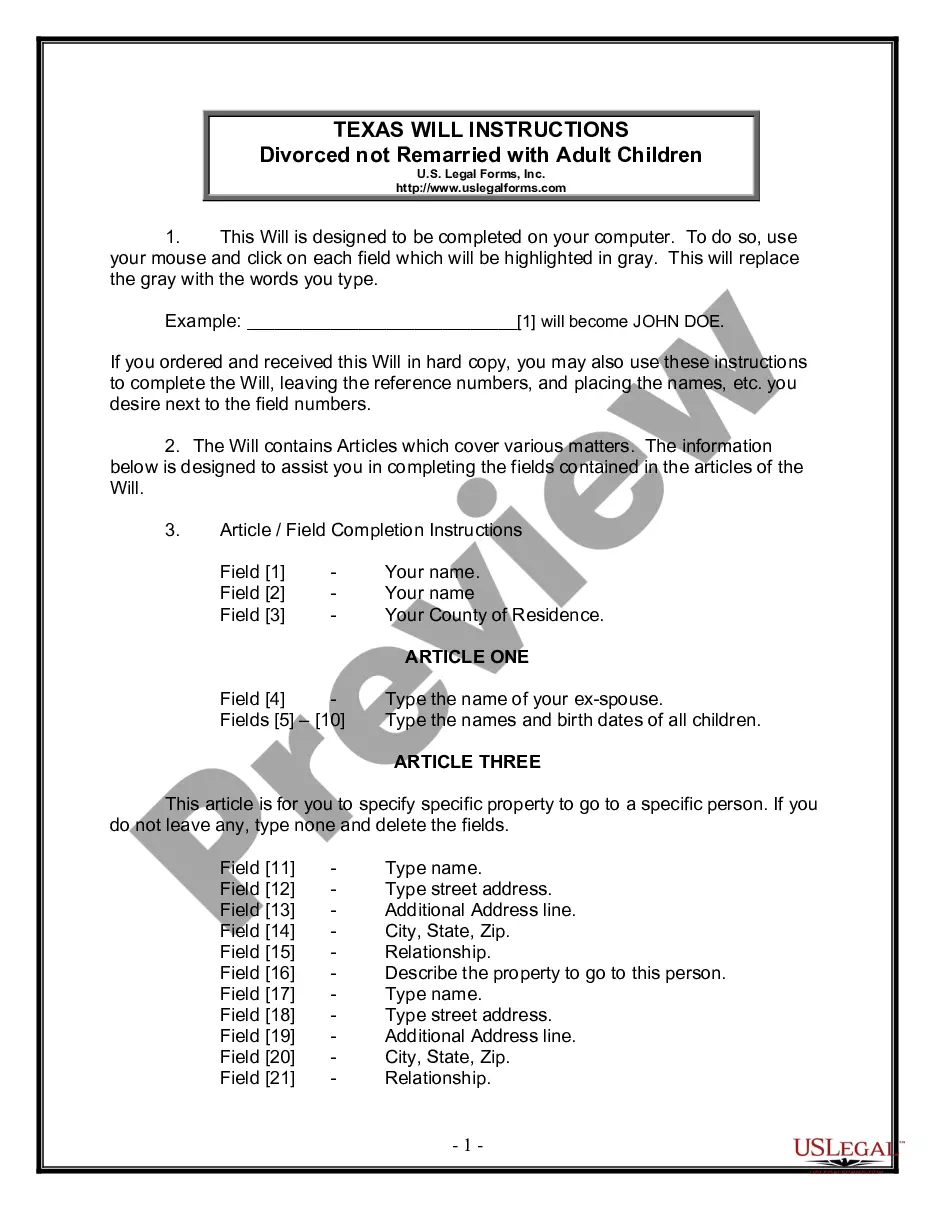

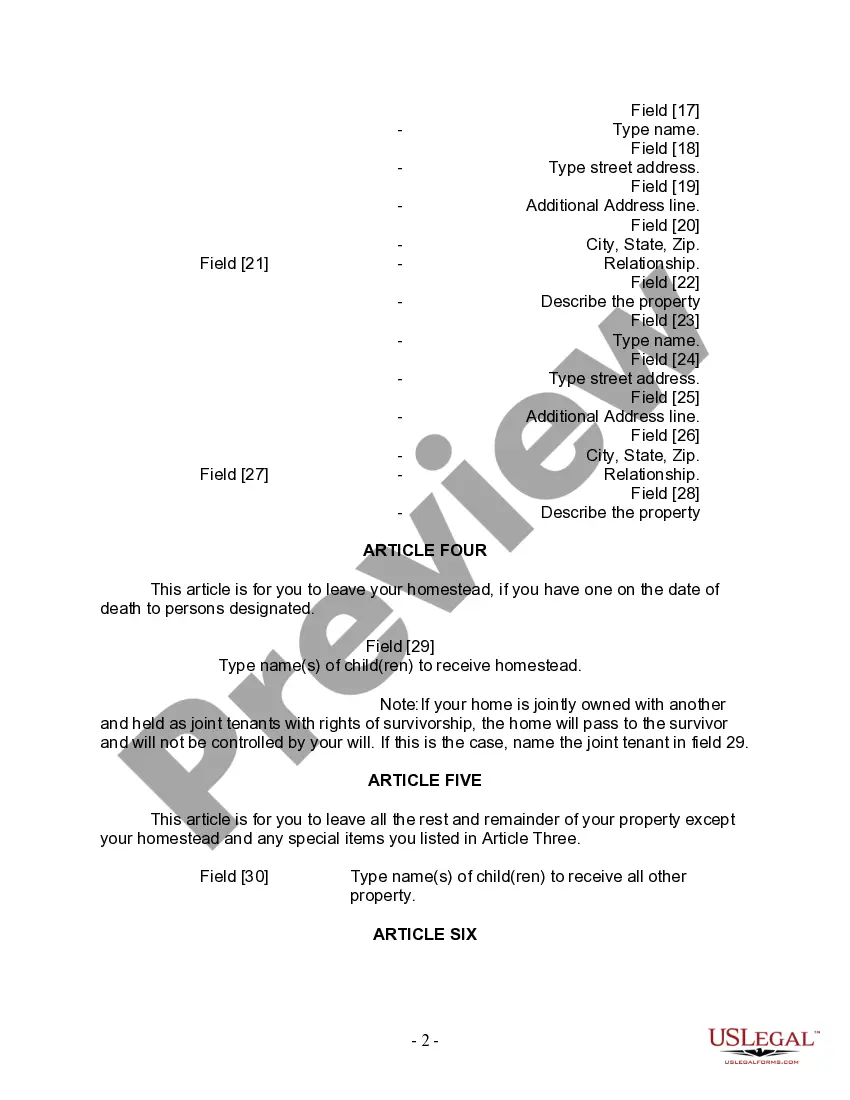

Title: Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children Introduction: A Last Will and Testament form is a crucial legal document that allows individuals to outline their wishes regarding the distribution of their assets, guardianship of dependents, and other important matters after their passing. For divorced individuals in Round Rock, Texas, who are not remarried and have adult children, it becomes essential to create a specific will tailored to their unique circumstances. This article will provide a detailed description of the Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children, including its purpose and key features. Keywords: Round Rock Texas, Legal, Last Will and Testament Form, Divorced Person, not Remarried, Adult Children. Purpose of the Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children: The primary purpose of this legal document is to specify how assets, debts, and other belongings should be distributed among heirs upon the death of the testator, who is a divorced individual not remarried with adult children. This document ensures that the testator's wishes are legally binding and provides clarity, minimizing potential conflicts or disputes among family members. Key Features and Considerations: 1. Asset Distribution: The form allows the testator to explicitly state which assets, such as property, investments, bank accounts, personal belongings, etc., should be distributed among their adult children. 2. Debts and Liabilities: The form provides an opportunity for the testator to address any outstanding debts or liabilities and how they should be settled from the estate. 3. Appointment of Executors: The testator can appoint one or more individuals as executors of the will, responsible for executing the instructions outlined in the document and handling the estate's administration. 4. Appointment of Guardian (if applicable): If there are minor children or dependents involved, the testator can name a guardian who will take care of their well-being and finances until they reach adulthood. 5. Specific Bequests and Legacies: The form allows the testator to make specific bequests or legacies, such as donating to charities, giving sentimental items to certain individuals, etc. 6. Contingency Plans: It is essential to include contingency plans in case one or more beneficiaries predecease the testator, ensuring that the estate distribution plan remains updated. 7. Relevant Tax Considerations: The document may address any tax implications related to the estate, providing guidance on how tax obligations should be handled. 8. Witnesses and Notarization: To ensure the document's legal validity, it is typically required to be witnessed by competent individuals and notarized as per Texas state laws. Different Types of Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children: While there may not be specific variations of this form for different situations within the given criteria, such as varying asset portfolios or family arrangements, individuals may consult with an attorney to customize the form according to their specific needs and preferences. Conclusion: Creating a Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children is an important step to ensure that your wishes are carried out after your passing and to provide clarity and peace of mind to your loved ones. It is highly recommended seeking legal counsel from an attorney experienced in estate planning to ensure compliance with Texas state laws and to address any unique considerations relevant to your circumstances.Title: Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children Introduction: A Last Will and Testament form is a crucial legal document that allows individuals to outline their wishes regarding the distribution of their assets, guardianship of dependents, and other important matters after their passing. For divorced individuals in Round Rock, Texas, who are not remarried and have adult children, it becomes essential to create a specific will tailored to their unique circumstances. This article will provide a detailed description of the Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children, including its purpose and key features. Keywords: Round Rock Texas, Legal, Last Will and Testament Form, Divorced Person, not Remarried, Adult Children. Purpose of the Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children: The primary purpose of this legal document is to specify how assets, debts, and other belongings should be distributed among heirs upon the death of the testator, who is a divorced individual not remarried with adult children. This document ensures that the testator's wishes are legally binding and provides clarity, minimizing potential conflicts or disputes among family members. Key Features and Considerations: 1. Asset Distribution: The form allows the testator to explicitly state which assets, such as property, investments, bank accounts, personal belongings, etc., should be distributed among their adult children. 2. Debts and Liabilities: The form provides an opportunity for the testator to address any outstanding debts or liabilities and how they should be settled from the estate. 3. Appointment of Executors: The testator can appoint one or more individuals as executors of the will, responsible for executing the instructions outlined in the document and handling the estate's administration. 4. Appointment of Guardian (if applicable): If there are minor children or dependents involved, the testator can name a guardian who will take care of their well-being and finances until they reach adulthood. 5. Specific Bequests and Legacies: The form allows the testator to make specific bequests or legacies, such as donating to charities, giving sentimental items to certain individuals, etc. 6. Contingency Plans: It is essential to include contingency plans in case one or more beneficiaries predecease the testator, ensuring that the estate distribution plan remains updated. 7. Relevant Tax Considerations: The document may address any tax implications related to the estate, providing guidance on how tax obligations should be handled. 8. Witnesses and Notarization: To ensure the document's legal validity, it is typically required to be witnessed by competent individuals and notarized as per Texas state laws. Different Types of Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children: While there may not be specific variations of this form for different situations within the given criteria, such as varying asset portfolios or family arrangements, individuals may consult with an attorney to customize the form according to their specific needs and preferences. Conclusion: Creating a Round Rock Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Adult Children is an important step to ensure that your wishes are carried out after your passing and to provide clarity and peace of mind to your loved ones. It is highly recommended seeking legal counsel from an attorney experienced in estate planning to ensure compliance with Texas state laws and to address any unique considerations relevant to your circumstances.