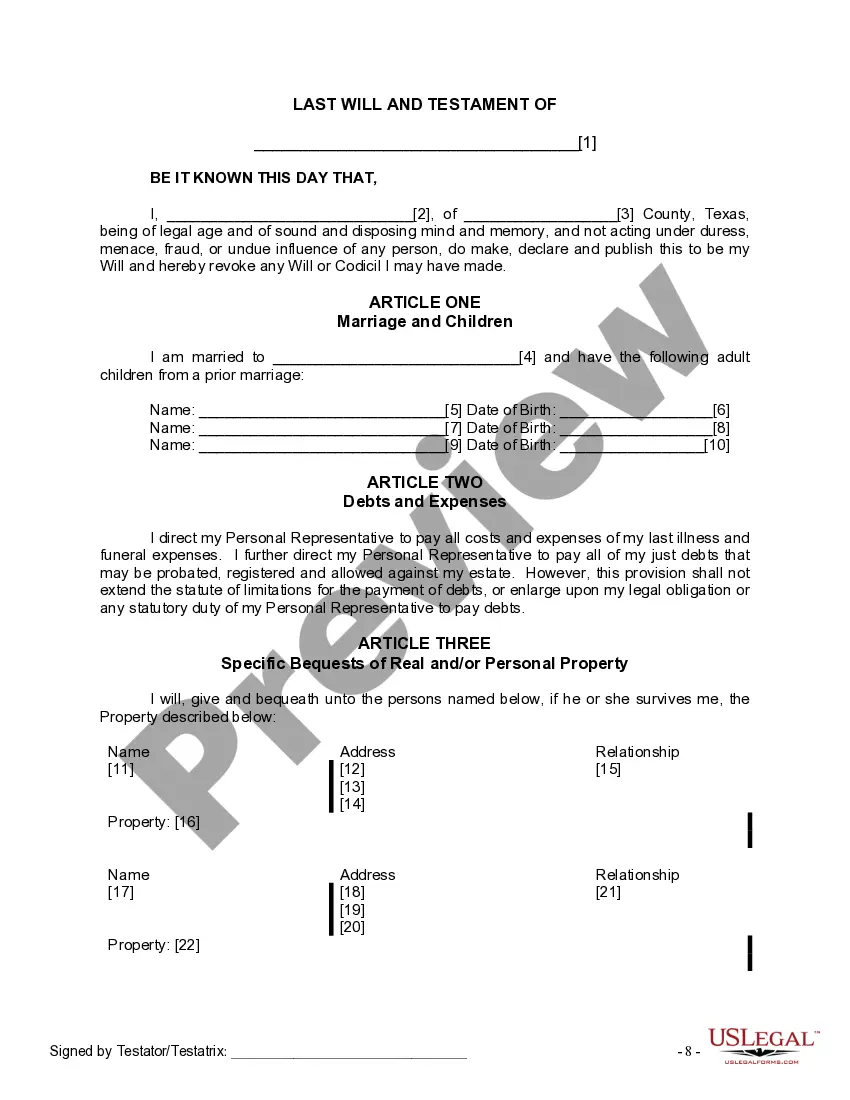

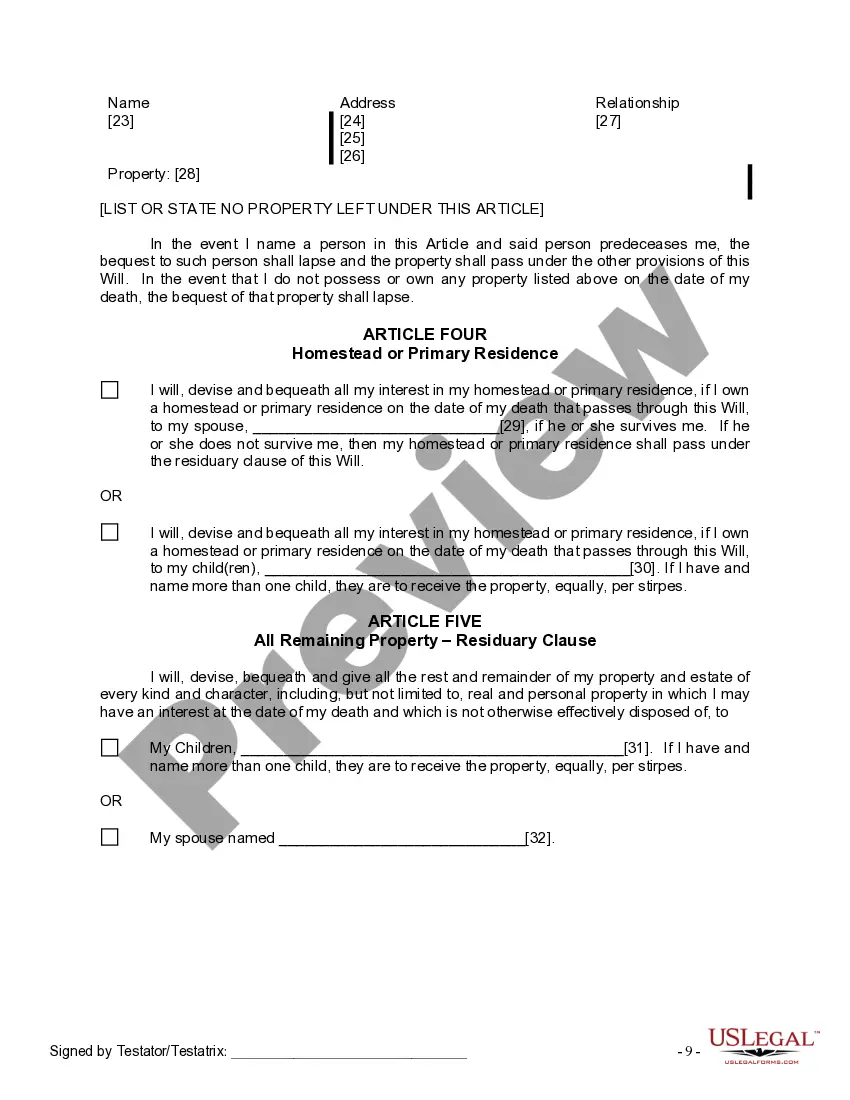

The Will you have found is for a married person with adult children from a prior marriage. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for provisions for the adult children.

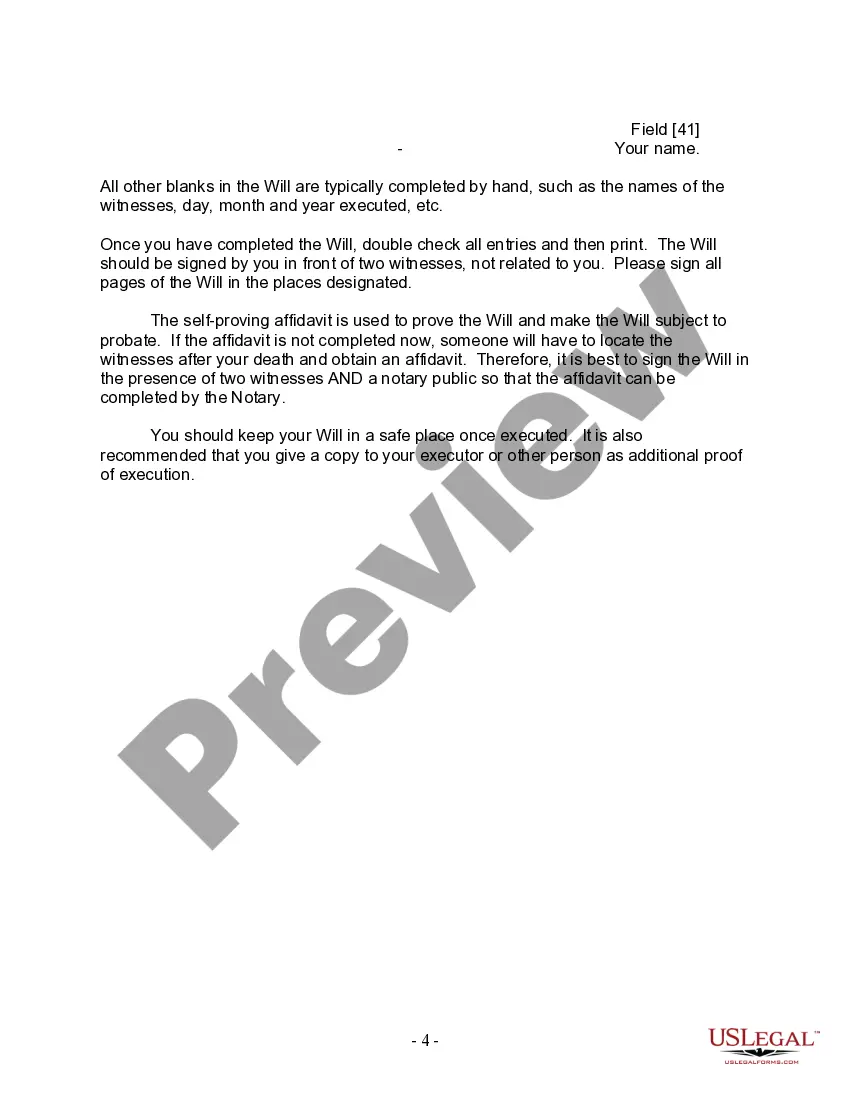

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

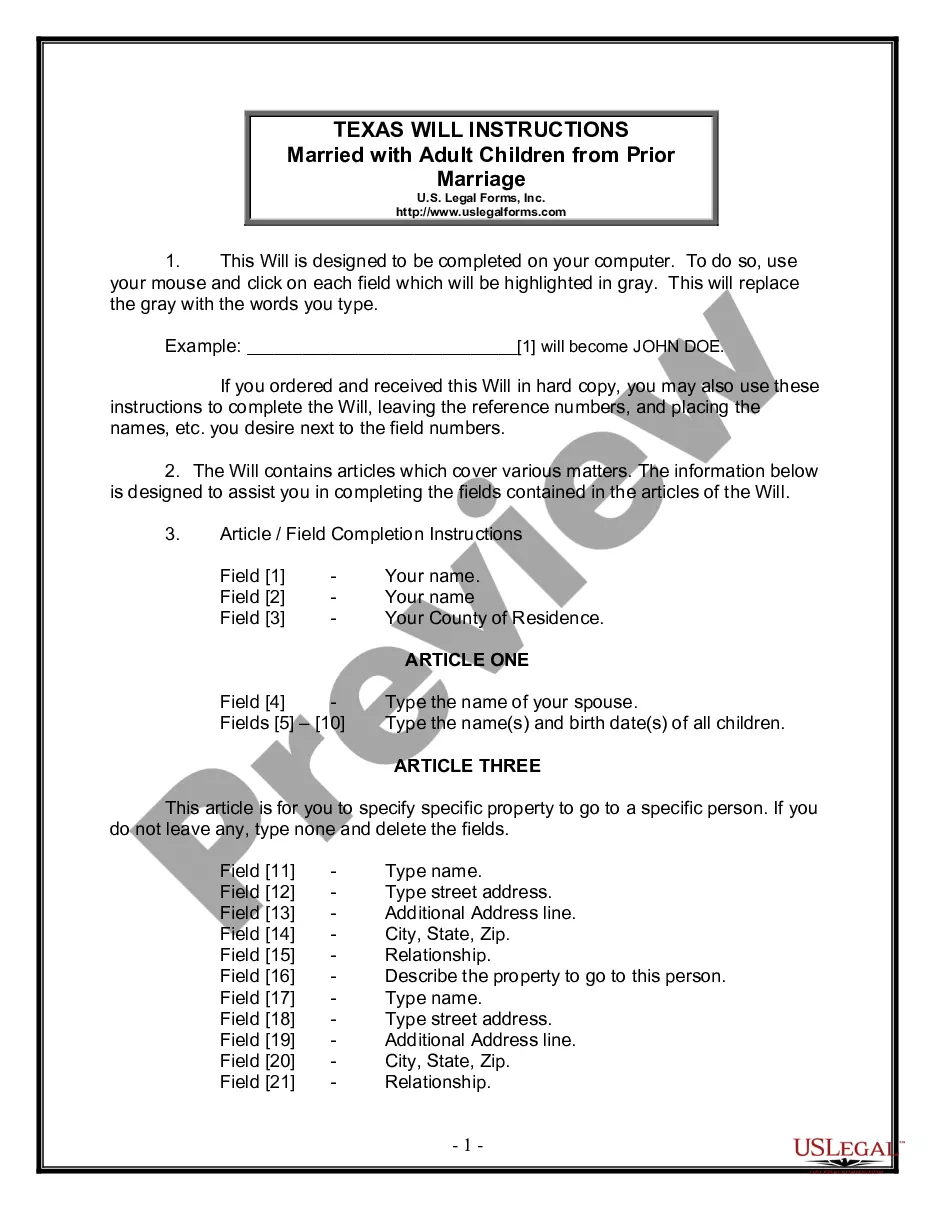

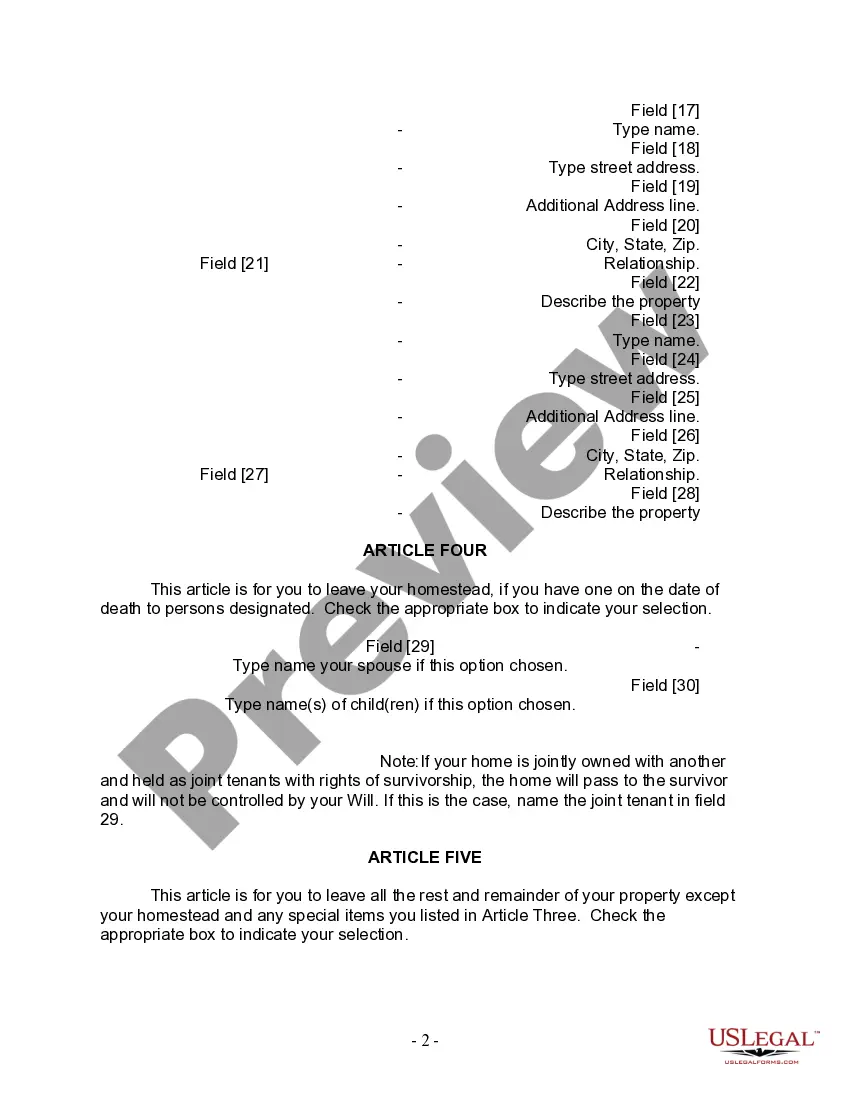

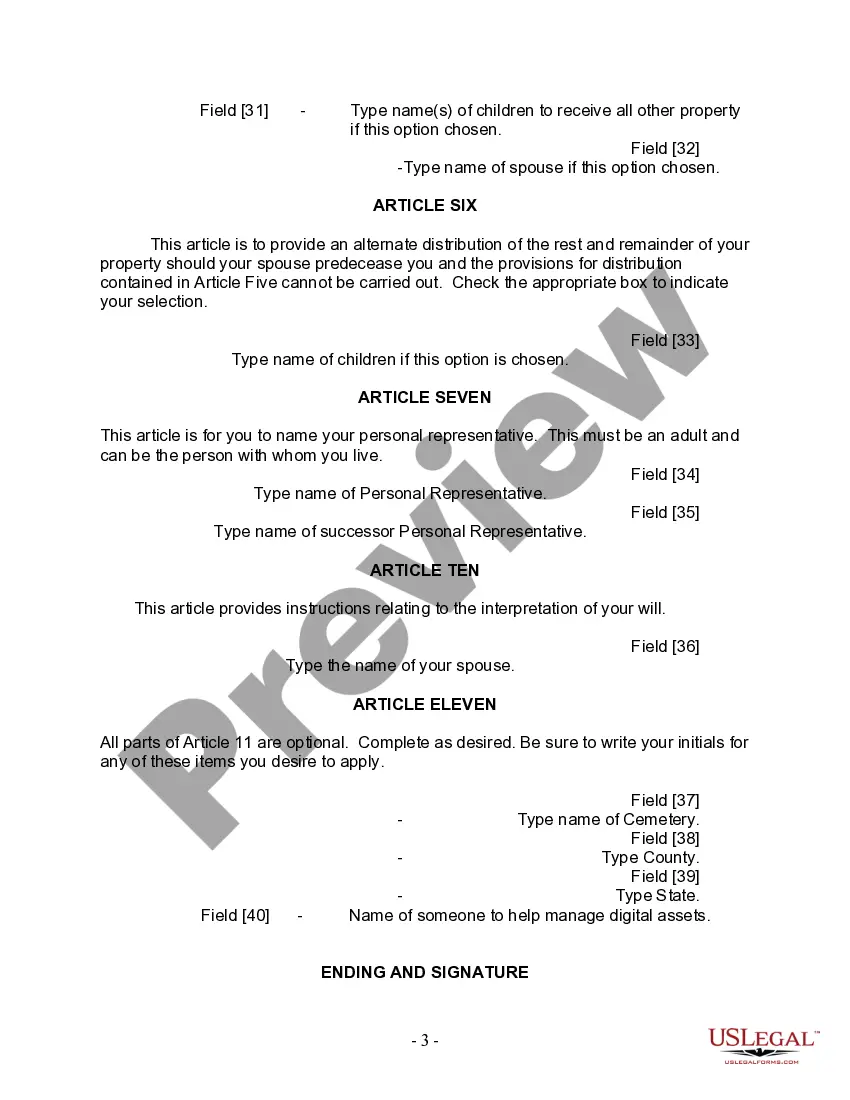

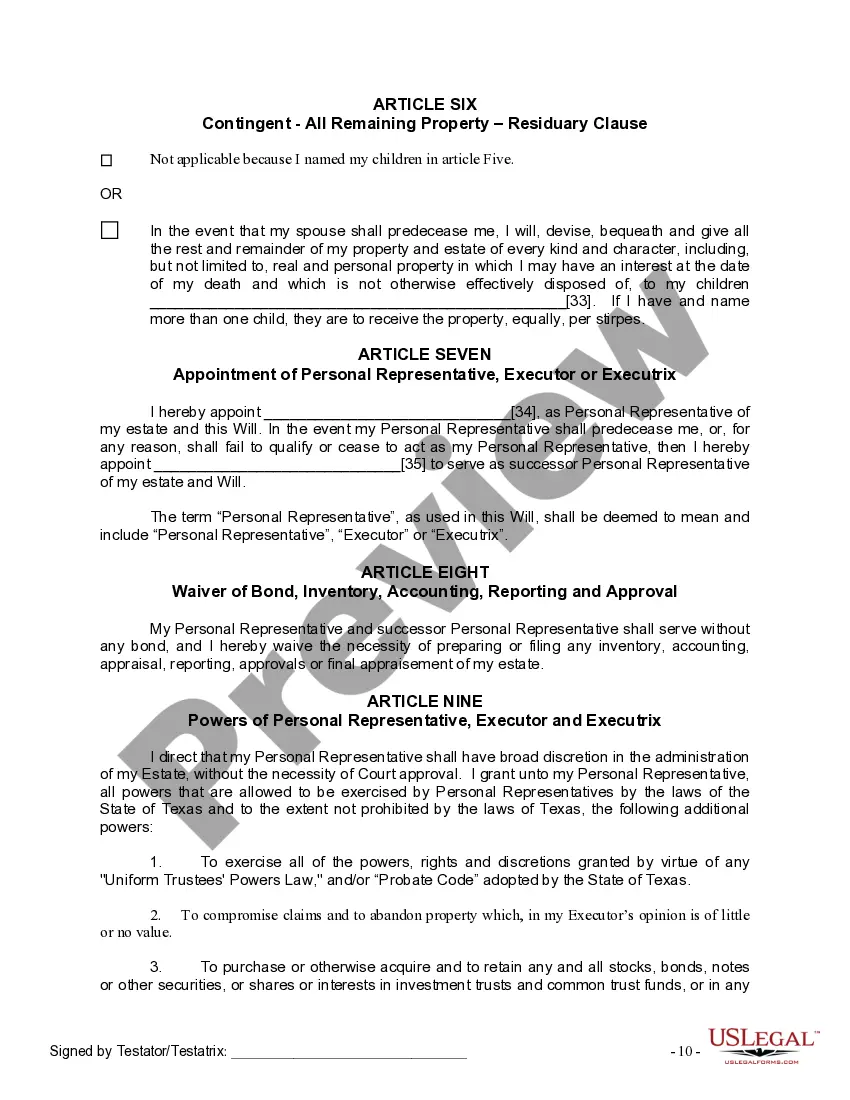

The Sugar Land Texas Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage is an essential legal document that allows individuals in Sugar Land, Texas, to outline their final wishes regarding the distribution of their assets and other important matters after their passing. This specific form is tailored to married individuals who have adult children from a previous marriage. A Last Will and Testament is a crucial part of estate planning and ensures that your assets are distributed according to your wishes. In the case of a married person with adult children from a prior marriage, it becomes particularly important to specify the division of assets to include both your current spouse and children from a previous relationship. The Sugar Land Texas Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage typically covers the following key areas: 1. Identification of the testator: This section requires the full legal name, address, and contact information of the person creating the will. 2. Appointment of an executor: The testator can name an executor, also known as a personal representative, who will be responsible for managing the estate's distribution as per the will's instructions. 3. Distribution of assets: The form allows the testator to specify how their assets, including property, bank accounts, investments, and personal belongings, should be divided among their current spouse and adult children from a prior marriage. 4. Guardianship of minor children: If there are any minor children involved, the testator can appoint a guardian who will be responsible for their care and well-being in the event of the testator's passing. 5. Alternate beneficiaries: The form allows the testator to name alternate beneficiaries, who will receive the assets if the primary beneficiaries predecease the testator. Different variations of the Sugar Land Texas Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage may exist based on specific clauses and provisions tailored to the unique circumstances of the testator. Some additional variations include: — Living Will: This version of the Last Will and Testament form allows individuals to include specific healthcare-related instructions in case of incapacitation or inability to make medical decisions. — Testamentary Trust: In situations where the testator wishes to create a trust to manage assets and distribute them over an extended period, a testamentary trust variation of the form can be used. — Codicil: This is an amendment to an existing Last Will and Testament, allowing the testator to make changes or additions without creating an entirely new document. It is crucial to consult with a qualified attorney who specializes in estate planning and understands Texas state laws and regulations to ensure that the Last Will and Testament effectively reflects your intentions and adheres to all legal requirements of Sugar Land, Texas.The Sugar Land Texas Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage is an essential legal document that allows individuals in Sugar Land, Texas, to outline their final wishes regarding the distribution of their assets and other important matters after their passing. This specific form is tailored to married individuals who have adult children from a previous marriage. A Last Will and Testament is a crucial part of estate planning and ensures that your assets are distributed according to your wishes. In the case of a married person with adult children from a prior marriage, it becomes particularly important to specify the division of assets to include both your current spouse and children from a previous relationship. The Sugar Land Texas Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage typically covers the following key areas: 1. Identification of the testator: This section requires the full legal name, address, and contact information of the person creating the will. 2. Appointment of an executor: The testator can name an executor, also known as a personal representative, who will be responsible for managing the estate's distribution as per the will's instructions. 3. Distribution of assets: The form allows the testator to specify how their assets, including property, bank accounts, investments, and personal belongings, should be divided among their current spouse and adult children from a prior marriage. 4. Guardianship of minor children: If there are any minor children involved, the testator can appoint a guardian who will be responsible for their care and well-being in the event of the testator's passing. 5. Alternate beneficiaries: The form allows the testator to name alternate beneficiaries, who will receive the assets if the primary beneficiaries predecease the testator. Different variations of the Sugar Land Texas Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage may exist based on specific clauses and provisions tailored to the unique circumstances of the testator. Some additional variations include: — Living Will: This version of the Last Will and Testament form allows individuals to include specific healthcare-related instructions in case of incapacitation or inability to make medical decisions. — Testamentary Trust: In situations where the testator wishes to create a trust to manage assets and distribute them over an extended period, a testamentary trust variation of the form can be used. — Codicil: This is an amendment to an existing Last Will and Testament, allowing the testator to make changes or additions without creating an entirely new document. It is crucial to consult with a qualified attorney who specializes in estate planning and understands Texas state laws and regulations to ensure that the Last Will and Testament effectively reflects your intentions and adheres to all legal requirements of Sugar Land, Texas.