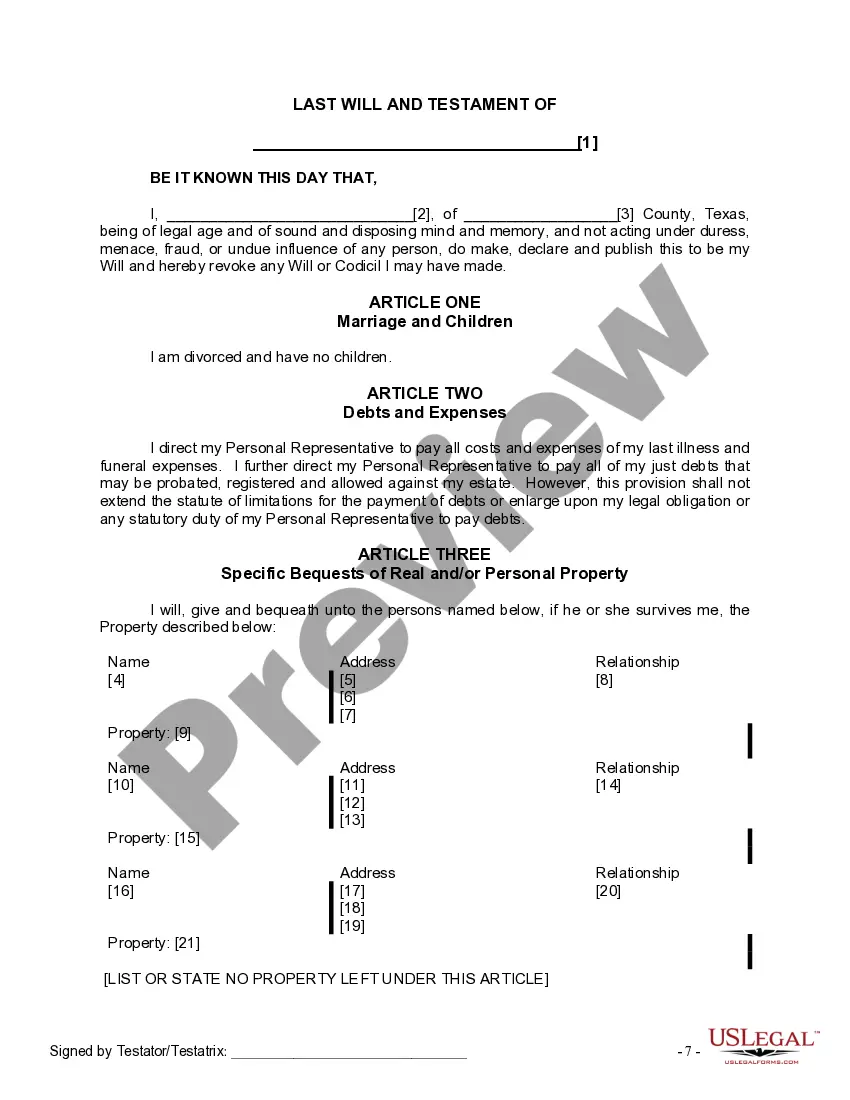

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

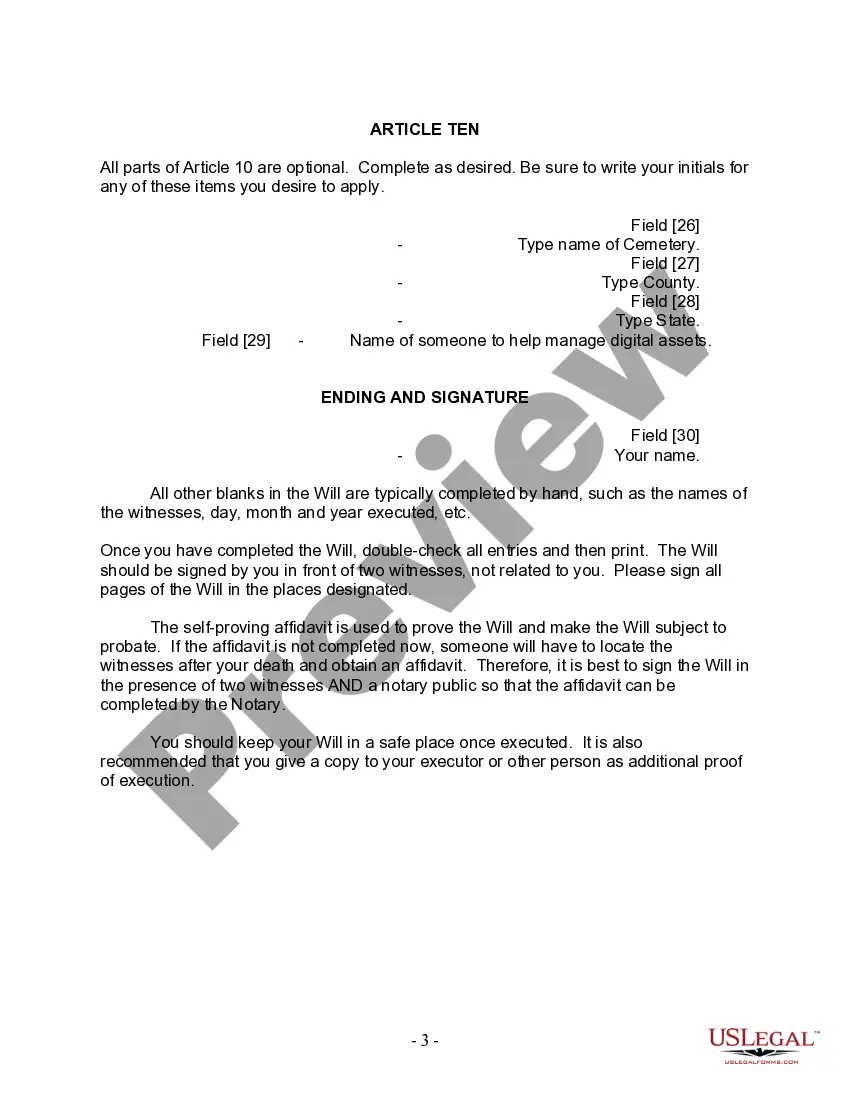

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

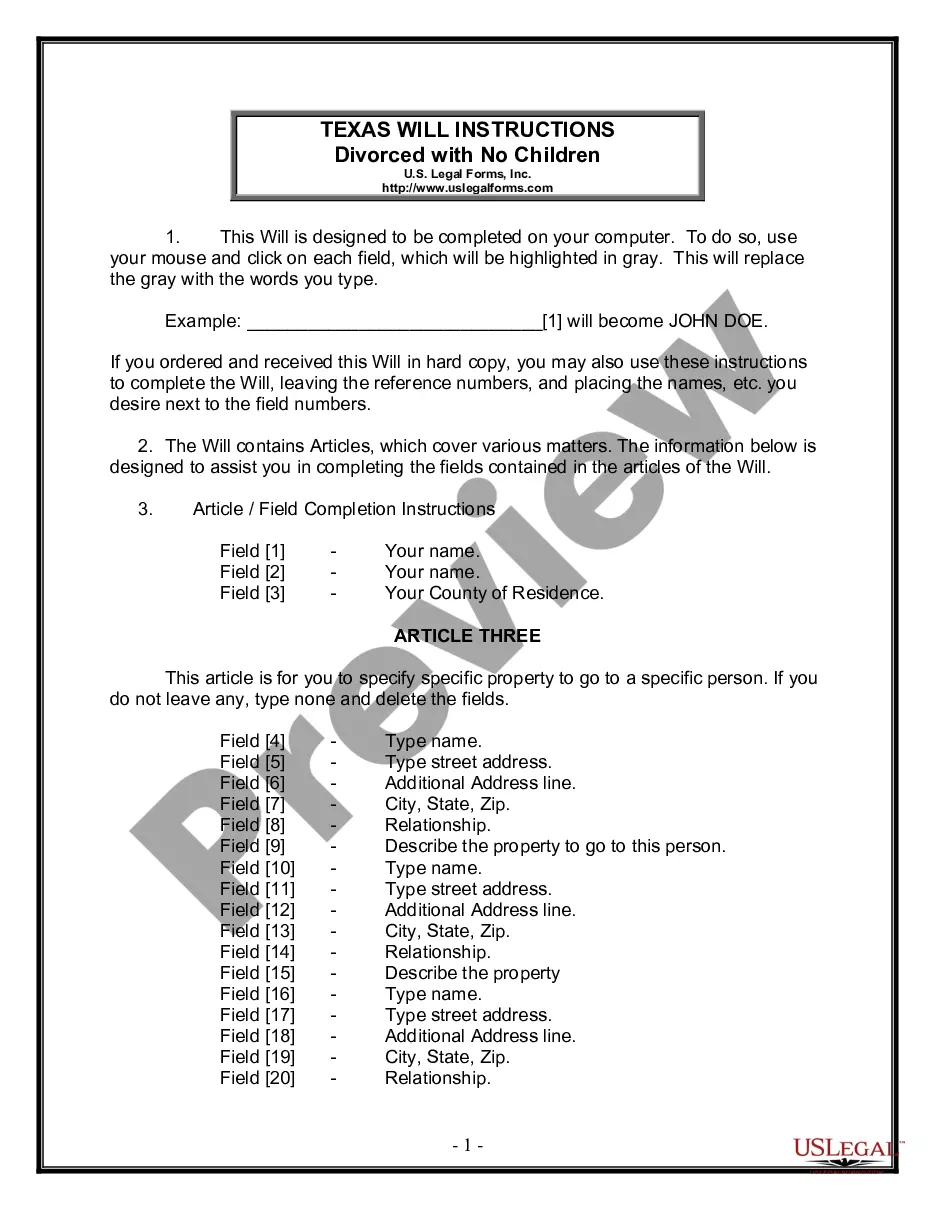

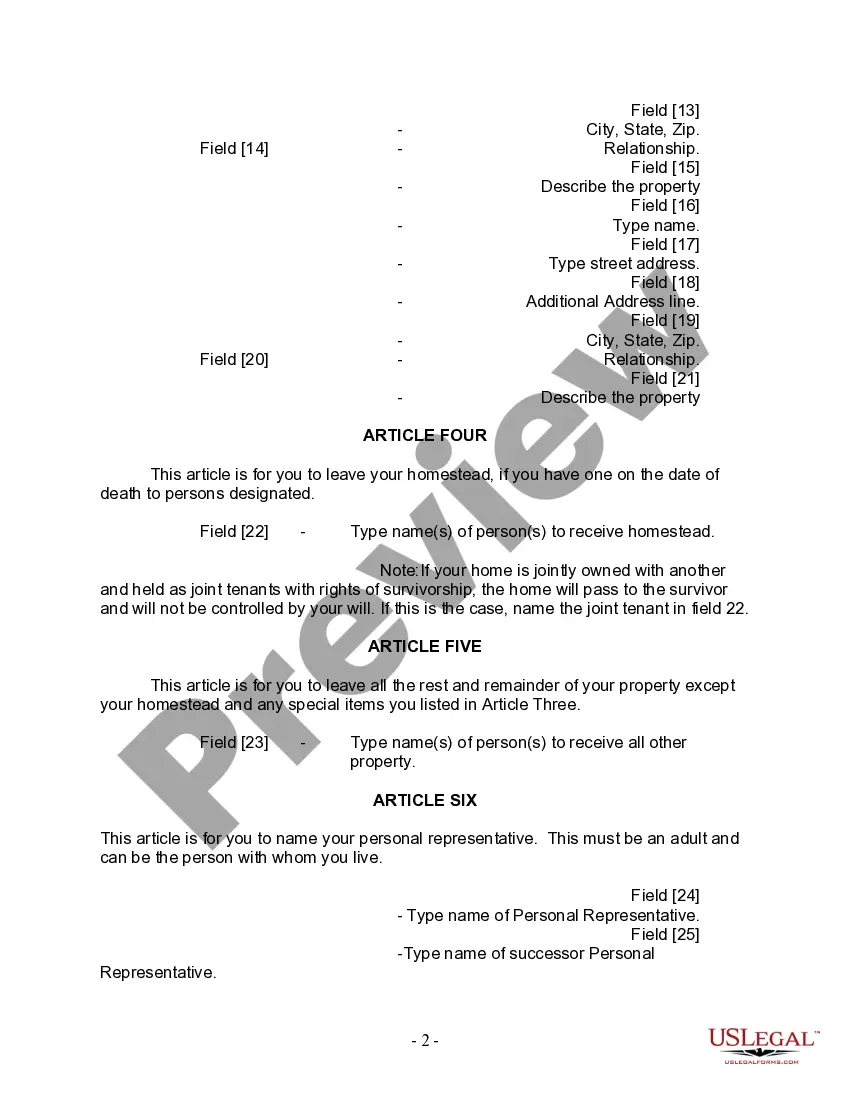

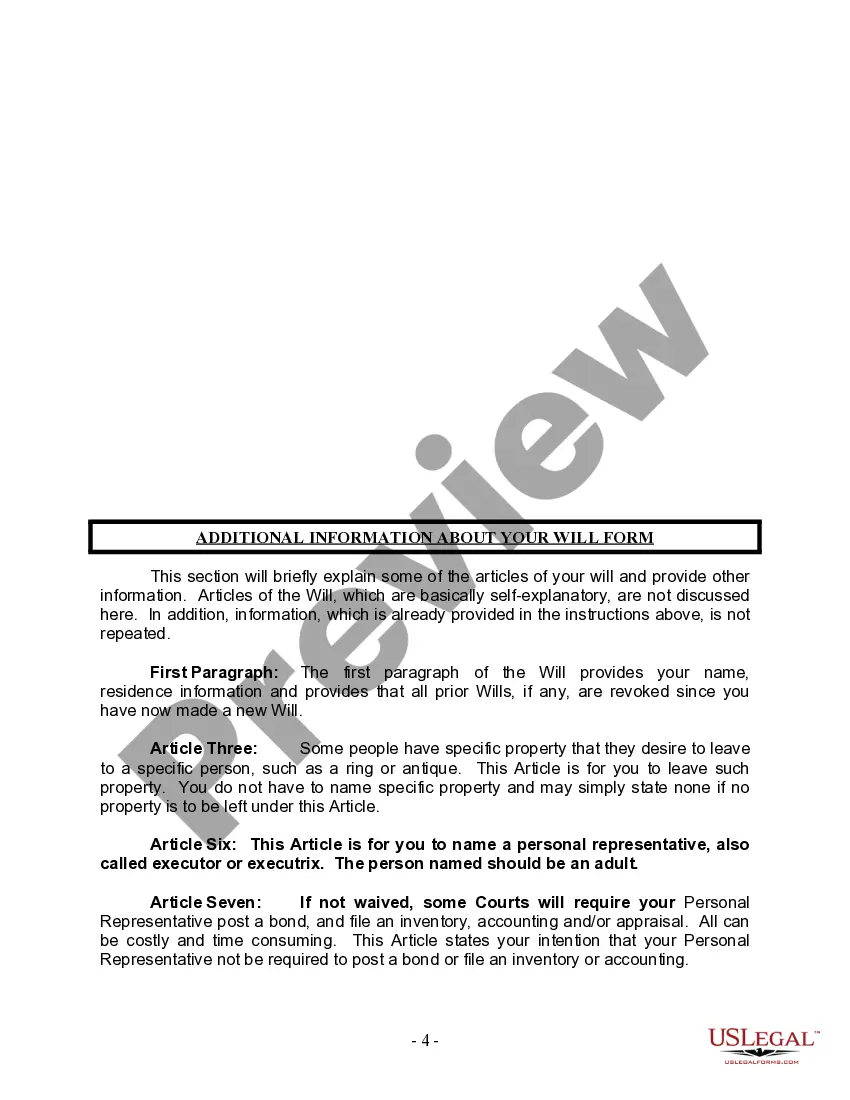

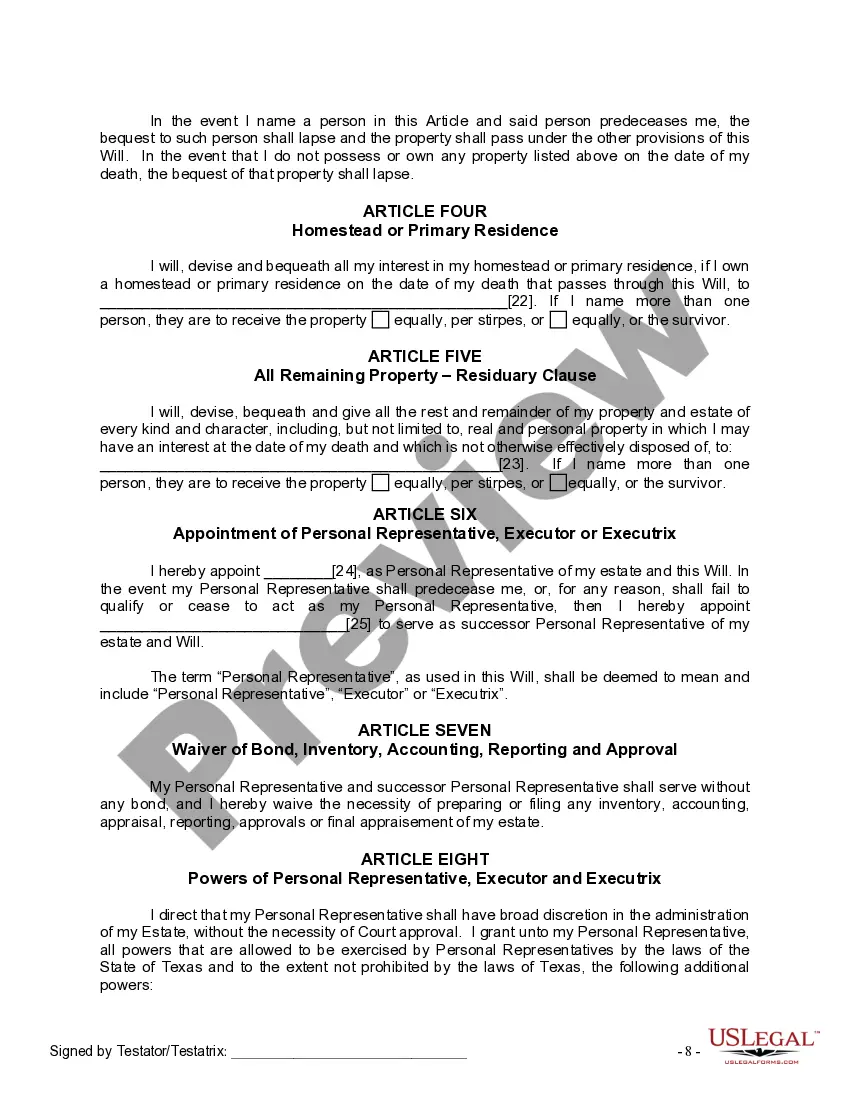

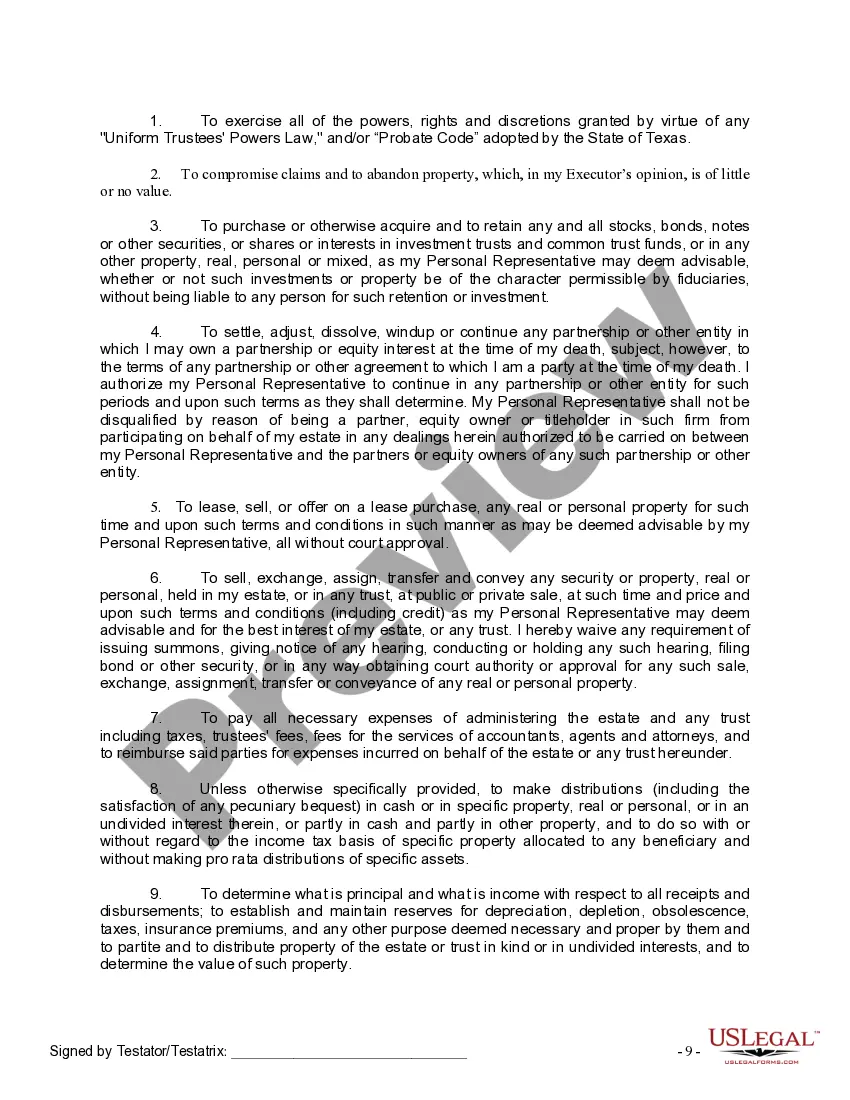

The Abilene Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals in Abilene, Texas, who have gone through a divorce but have not remarried and do not have any children, to outline their final wishes and distribute their assets after their passing. This specific form is tailored to meet the specific needs of divorced individuals without children, ensuring that their wishes are clearly expressed and legally enforceable. The Abilene Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children typically includes the following key elements: 1. Personal Information: The form requires the individual's full legal name, address, and contact details to establish their identity. 2. Executor: The person creating the will, also known as the testator, must designate an executor. The executor is responsible for managing and distributing the testator's assets according to the instructions outlined in the will. 3. Asset Distribution: The form provides a section where the testator can specify how they wish to distribute their assets, such as properties, bank accounts, investments, personal belongings, and other possessions. The testator can allocate specific assets to specific individuals or organizations as beneficiaries. 4. Alternate Beneficiaries: In case the primary beneficiary predeceases the testator or is unable to inherit, the form allows for the designation of alternate beneficiaries. This ensures that assets are not left unallocated. 5. Debts and Taxes: The form may include a provision to address how remaining debts, taxes, and expenses should be handled after the testator's death. This provision ensures that the testator's estate is managed responsibly and any outstanding obligations are settled appropriately. It's important to note that while this description covers the general aspects of the Abilene Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, there may be multiple versions or variations of the form available. Variations can exist due to updates in state laws or individual preferences. It is recommended to consult with a legal professional or obtain an updated version of the form to ensure compliance with current regulations.The Abilene Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals in Abilene, Texas, who have gone through a divorce but have not remarried and do not have any children, to outline their final wishes and distribute their assets after their passing. This specific form is tailored to meet the specific needs of divorced individuals without children, ensuring that their wishes are clearly expressed and legally enforceable. The Abilene Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children typically includes the following key elements: 1. Personal Information: The form requires the individual's full legal name, address, and contact details to establish their identity. 2. Executor: The person creating the will, also known as the testator, must designate an executor. The executor is responsible for managing and distributing the testator's assets according to the instructions outlined in the will. 3. Asset Distribution: The form provides a section where the testator can specify how they wish to distribute their assets, such as properties, bank accounts, investments, personal belongings, and other possessions. The testator can allocate specific assets to specific individuals or organizations as beneficiaries. 4. Alternate Beneficiaries: In case the primary beneficiary predeceases the testator or is unable to inherit, the form allows for the designation of alternate beneficiaries. This ensures that assets are not left unallocated. 5. Debts and Taxes: The form may include a provision to address how remaining debts, taxes, and expenses should be handled after the testator's death. This provision ensures that the testator's estate is managed responsibly and any outstanding obligations are settled appropriately. It's important to note that while this description covers the general aspects of the Abilene Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children, there may be multiple versions or variations of the form available. Variations can exist due to updates in state laws or individual preferences. It is recommended to consult with a legal professional or obtain an updated version of the form to ensure compliance with current regulations.