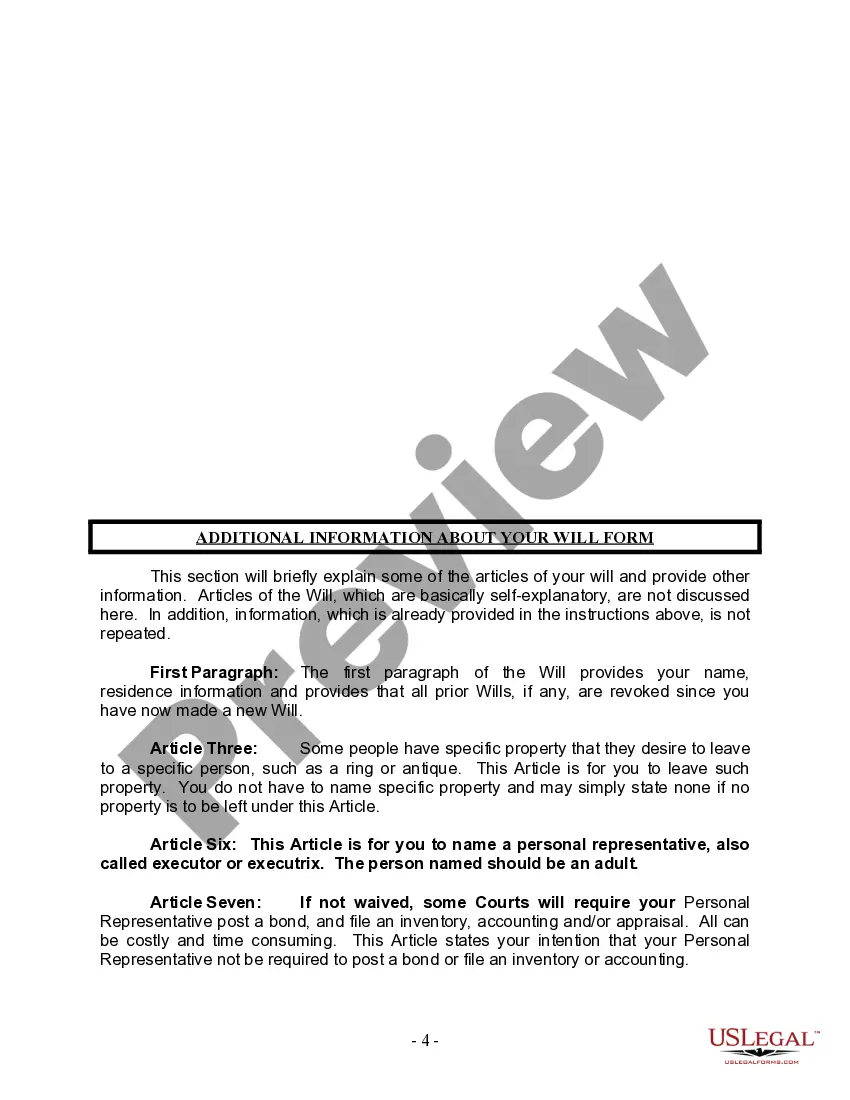

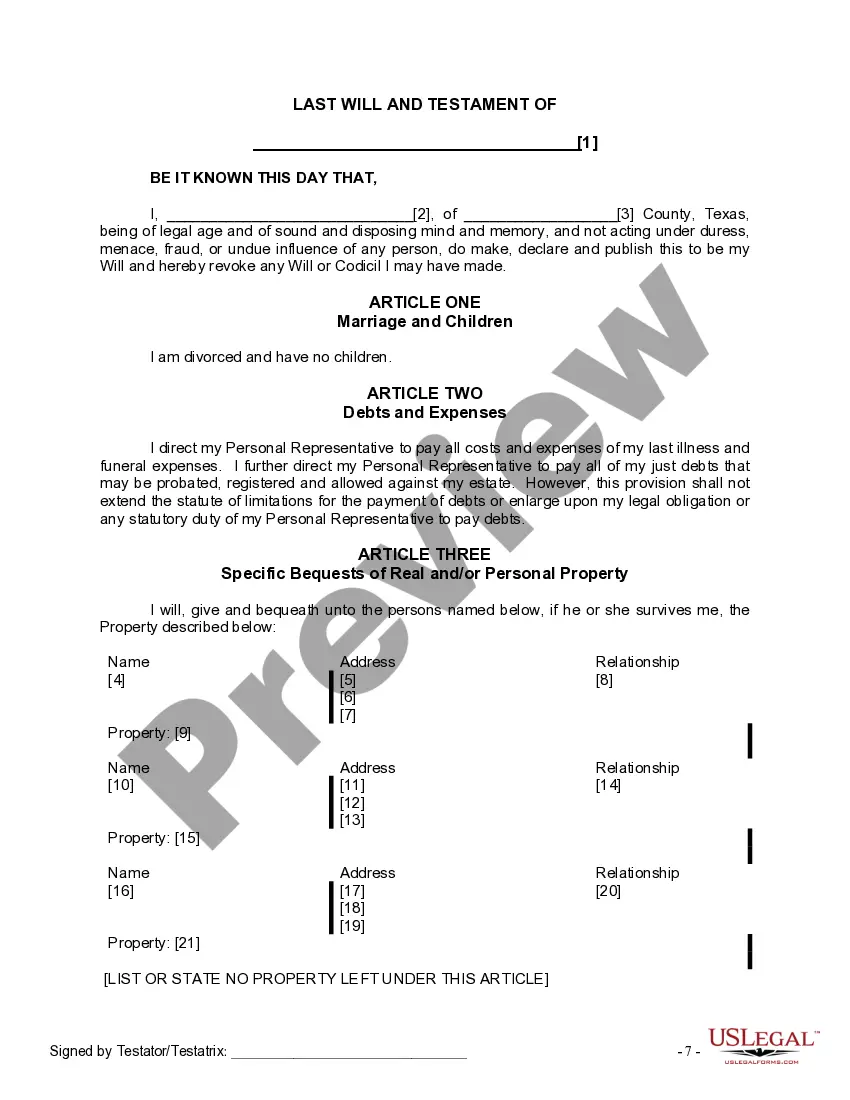

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

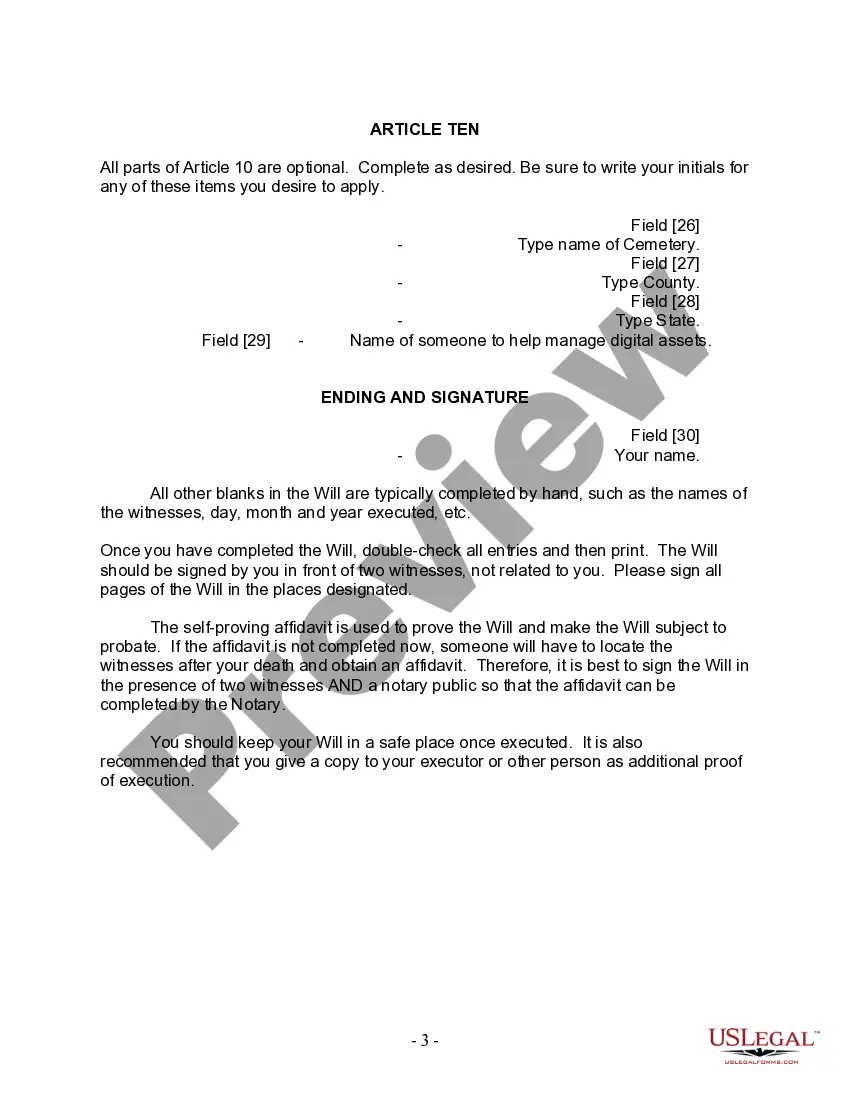

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

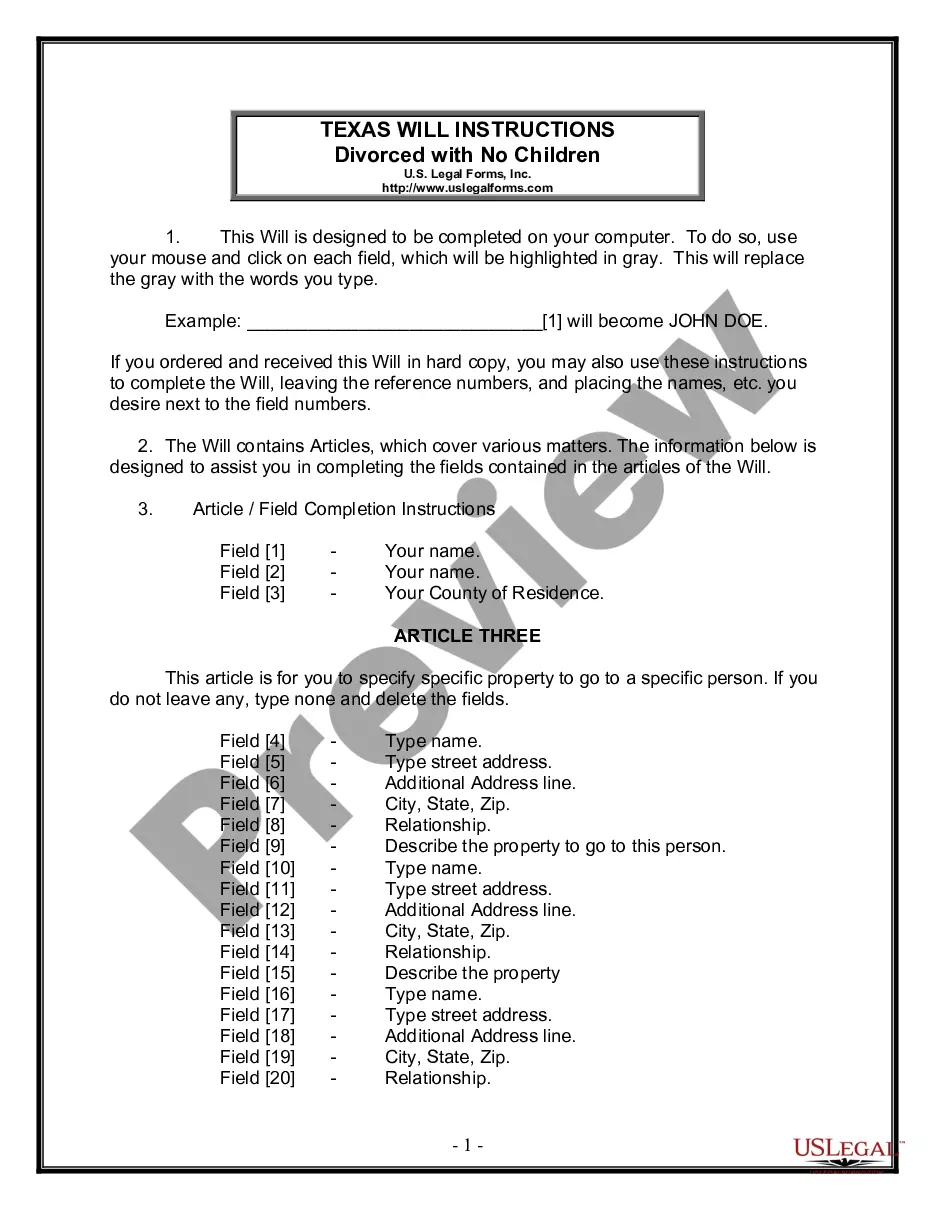

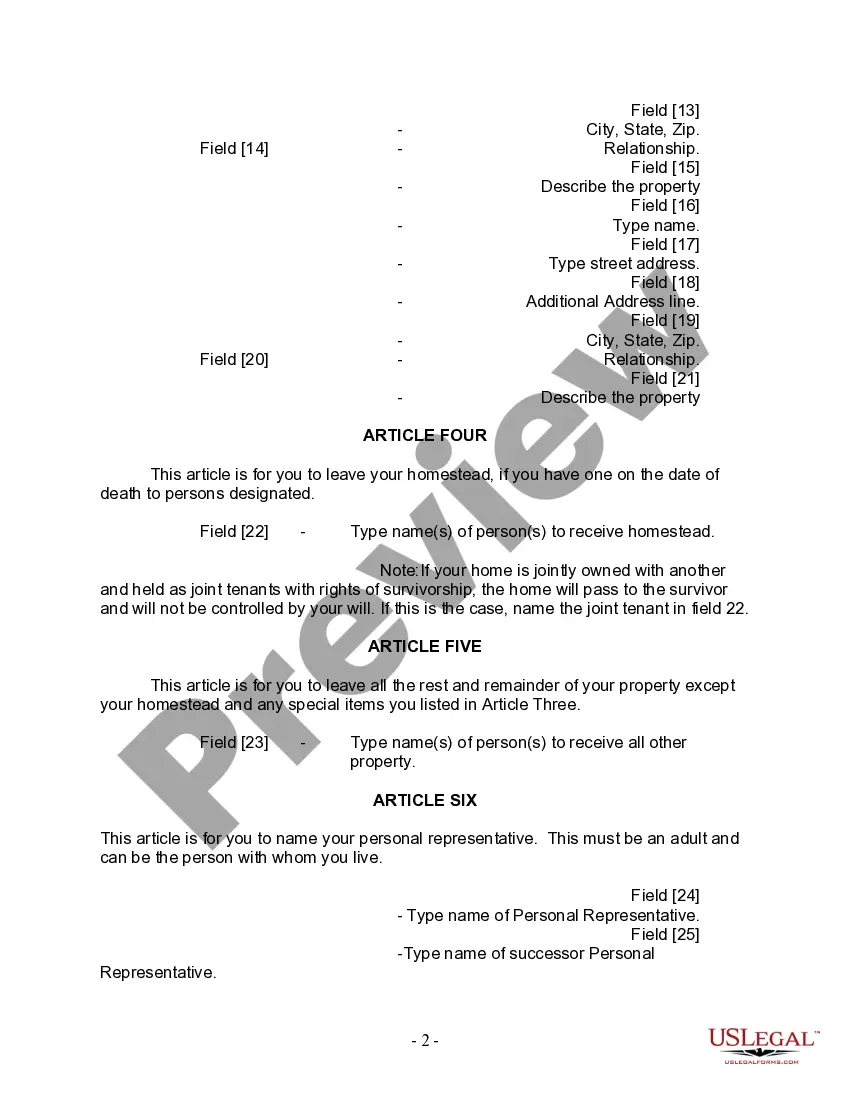

A Brownsville Texas Legal Last Will and Testament Form for a Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced and not remarried, and who do not have any children, to outline their final wishes regarding the distribution of their assets, debts, and property upon their death. This form ensures that their wishes are followed and reduces the chances of any disputes among family members or other potential beneficiaries. Keywords: Brownsville Texas, Legal Last Will and Testament Form, Divorced Person, Not Remarried, No Children, final wishes, distribution of assets, distribution of debts, distribution of property, death, potential beneficiaries. Different types of Brownsville Texas Legal Last Will and Testament Forms for Divorced Persons Not Remarried with No Children may include: 1. Basic Last Will and Testament Form: This is a standard form that allows individuals to specify how their assets and property should be distributed among siblings, parents, close friends, or any other chosen beneficiaries in the absence of a spouse or children. 2. Beneficiary Designations Form: This form enables individuals to name specific beneficiaries for certain assets, such as life insurance policies, retirement accounts, or investment accounts, which may not be covered by a standard Last Will and Testament form. By designating beneficiaries, individuals ensure that those assets bypass the probate process and go directly to the named beneficiaries upon their death. 3. Digital Assets Last Will and Testament Form: In today's digital age, it is crucial to consider the distribution of digital assets, such as social media accounts, online banking information, or digital photo libraries. This form allows individuals to specify who should have access to or control over their digital assets, including online accounts and intellectual property. 4. Living Will and Healthcare Proxy Form: Although not directly related to asset distribution, these forms are essential for individuals to express their medical treatment preferences in case they become incapacitated. A Living Will states the person's desires regarding life-sustaining medical treatments, while a Healthcare Proxy designates a trusted individual to make medical decisions on their behalf. It is important to consult with a legal professional to determine which specific Last Will and Testament form best suits an individual's needs and addresses their unique circumstances as a divorced person not remarried and without children in Brownsville, Texas.A Brownsville Texas Legal Last Will and Testament Form for a Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced and not remarried, and who do not have any children, to outline their final wishes regarding the distribution of their assets, debts, and property upon their death. This form ensures that their wishes are followed and reduces the chances of any disputes among family members or other potential beneficiaries. Keywords: Brownsville Texas, Legal Last Will and Testament Form, Divorced Person, Not Remarried, No Children, final wishes, distribution of assets, distribution of debts, distribution of property, death, potential beneficiaries. Different types of Brownsville Texas Legal Last Will and Testament Forms for Divorced Persons Not Remarried with No Children may include: 1. Basic Last Will and Testament Form: This is a standard form that allows individuals to specify how their assets and property should be distributed among siblings, parents, close friends, or any other chosen beneficiaries in the absence of a spouse or children. 2. Beneficiary Designations Form: This form enables individuals to name specific beneficiaries for certain assets, such as life insurance policies, retirement accounts, or investment accounts, which may not be covered by a standard Last Will and Testament form. By designating beneficiaries, individuals ensure that those assets bypass the probate process and go directly to the named beneficiaries upon their death. 3. Digital Assets Last Will and Testament Form: In today's digital age, it is crucial to consider the distribution of digital assets, such as social media accounts, online banking information, or digital photo libraries. This form allows individuals to specify who should have access to or control over their digital assets, including online accounts and intellectual property. 4. Living Will and Healthcare Proxy Form: Although not directly related to asset distribution, these forms are essential for individuals to express their medical treatment preferences in case they become incapacitated. A Living Will states the person's desires regarding life-sustaining medical treatments, while a Healthcare Proxy designates a trusted individual to make medical decisions on their behalf. It is important to consult with a legal professional to determine which specific Last Will and Testament form best suits an individual's needs and addresses their unique circumstances as a divorced person not remarried and without children in Brownsville, Texas.