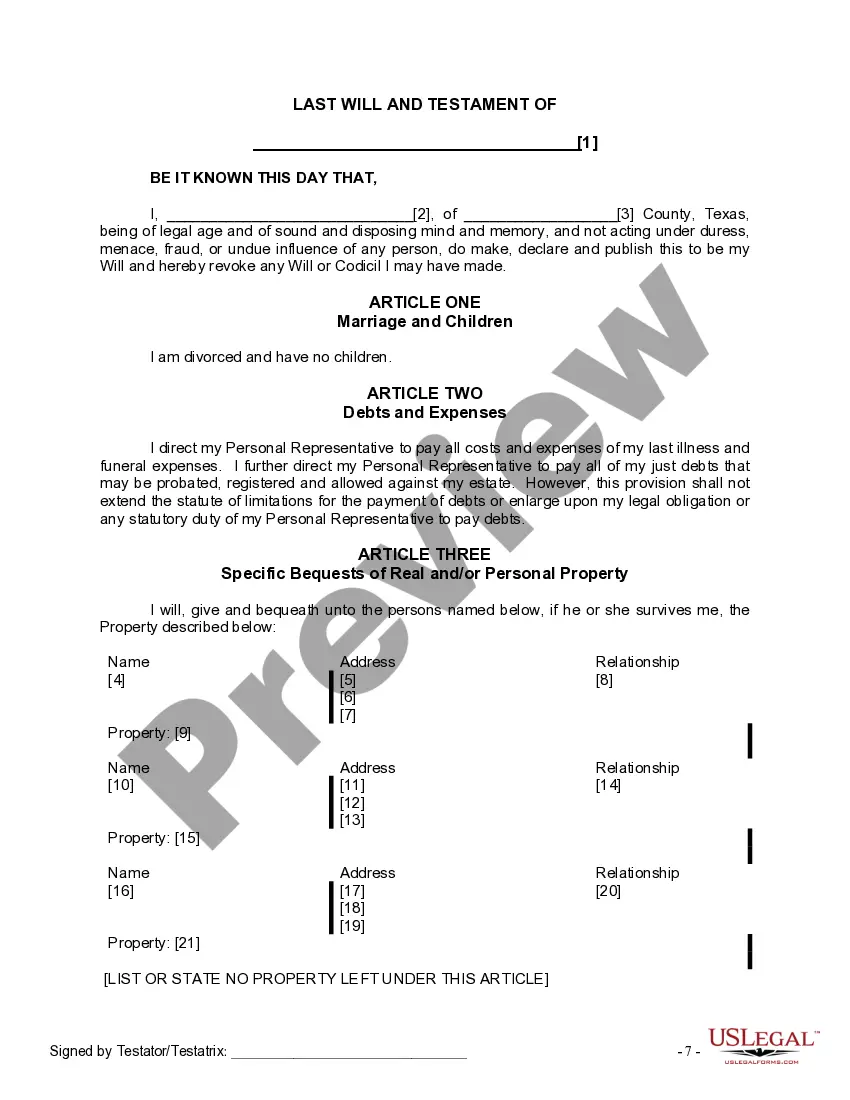

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

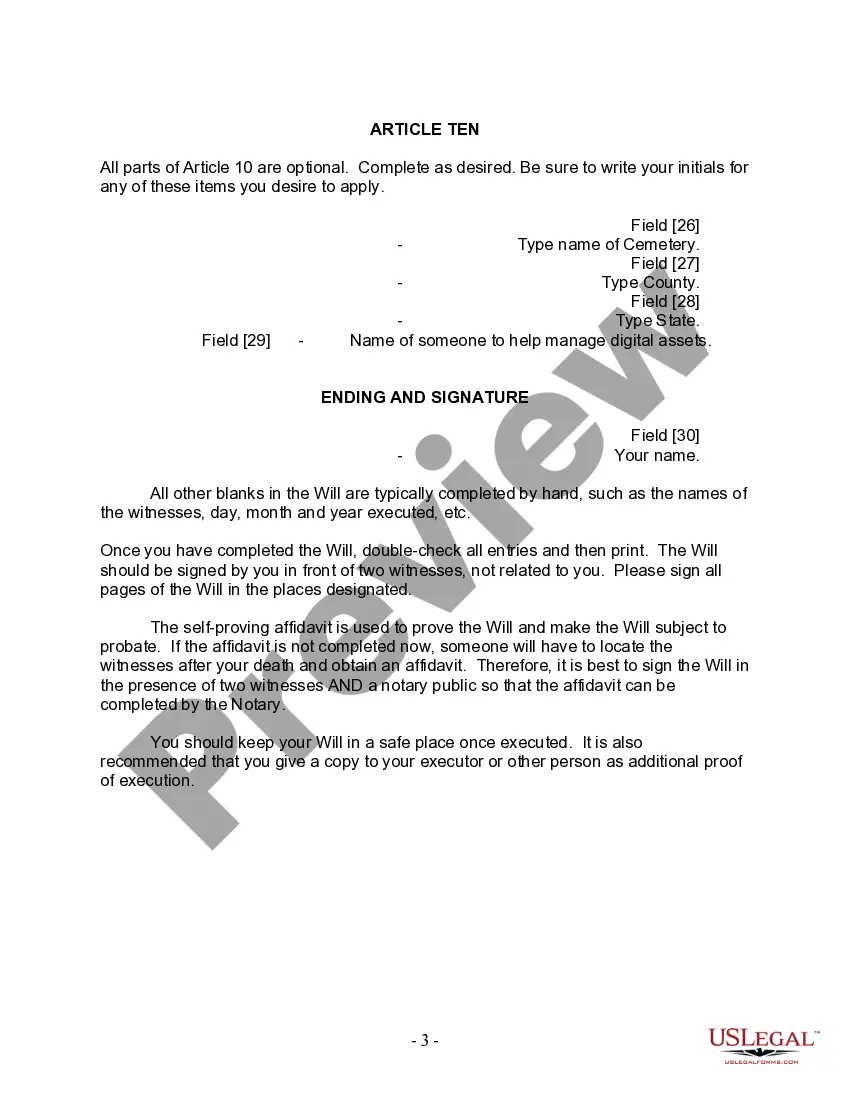

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

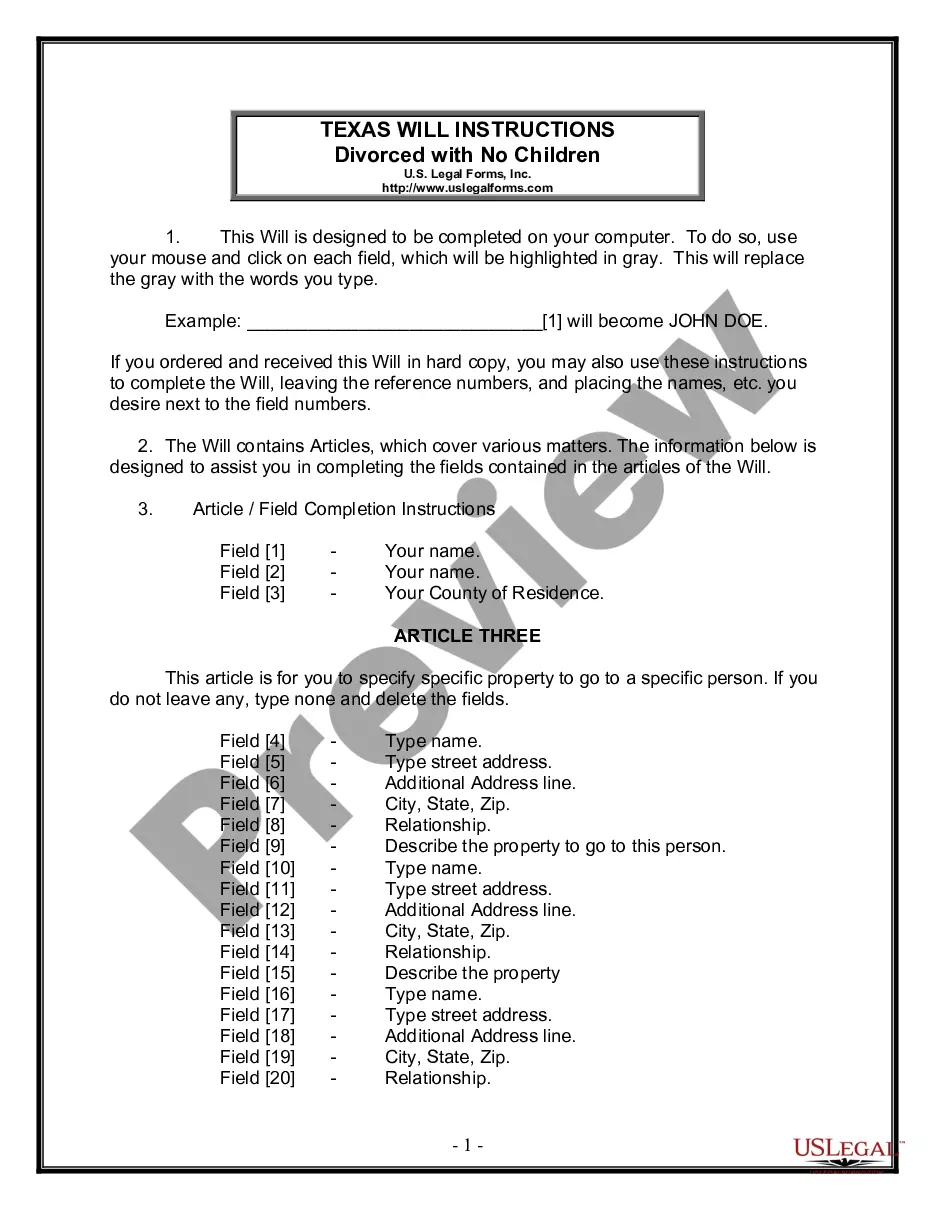

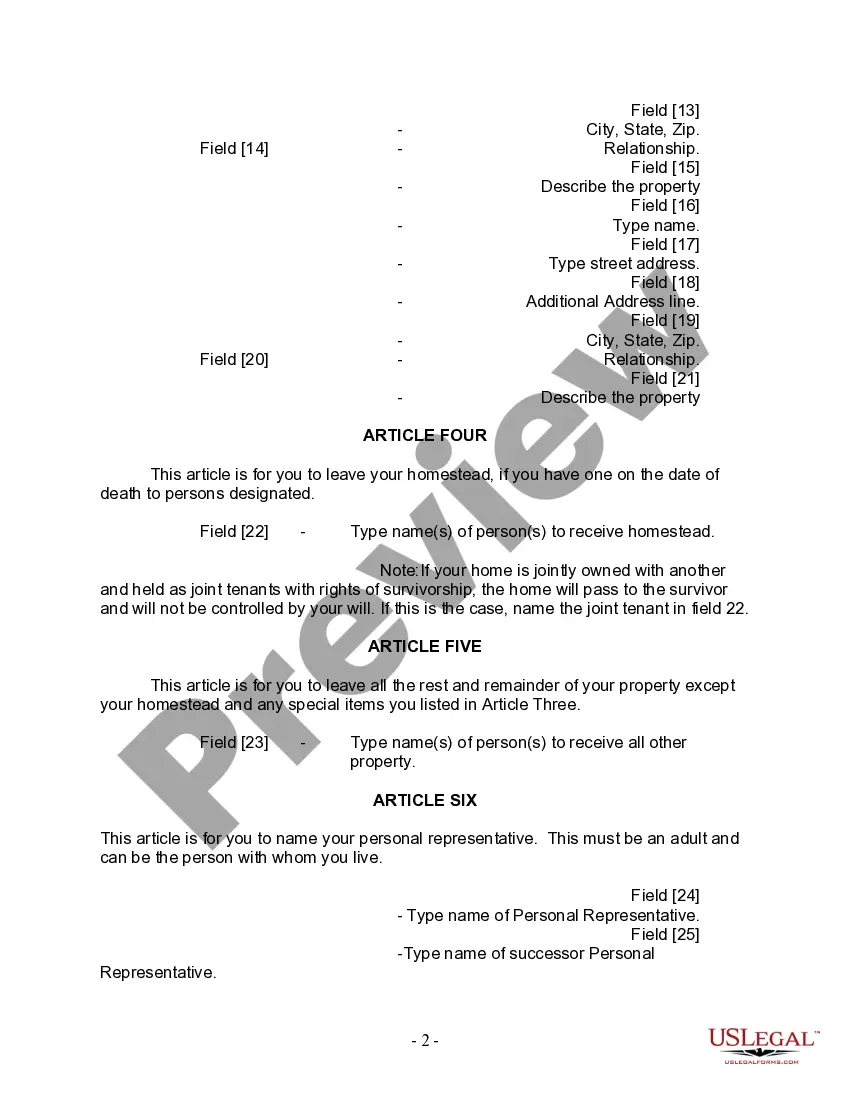

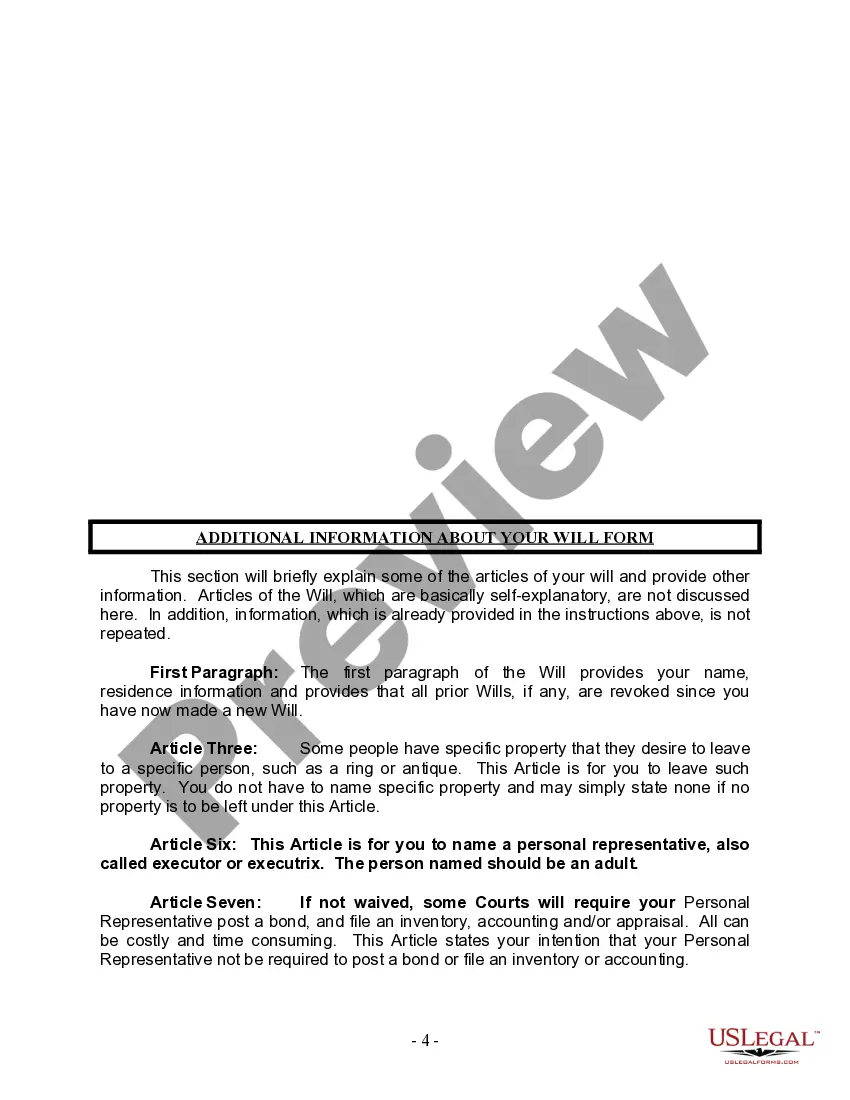

The Collin Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is an important legal document that allows individuals in this specific situation to properly outline their final wishes and ensure their assets are distributed as desired after their passing. This comprehensive form provides a clear and legally binding outline for the distribution of the individual's estate and assets. Keywords: Collin Texas, Legal Last Will and Testament Form, Divorced Person, Not Remarried, No Children There may be slight variations in the Collin Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children based on specific circumstances or preferences. Here are some potential variations or types of this form: 1. Simple Will: This type of form is intended for individuals with relatively straightforward estates and uncomplicated wishes regarding the distribution of their assets. It provides a basic template for outlining the desired beneficiaries and their respective shares of the estate. 2. Alternate Beneficiary Will: This form includes provisions for alternate beneficiaries in case the primary beneficiaries predecease the testator (the person creating the will). It ensures that the estate is distributed according to the testator's wishes even if the primary beneficiaries are unable to inherit. 3. Contingent Executor Will: This variation of the form allows individuals to name a contingent executor who will step in and handle the estate in case the primary executor is unable or unwilling to fulfill their responsibilities. It provides an added layer of security and ensures that the testator's wishes are carried out effectively. 4. Trust Will: A Trust Will is a specialized form that establishes a trust to manage the distribution of the estate's assets. This option may be useful for individuals who have significant assets, wish to provide for specific beneficiaries over an extended period, or want to minimize estate taxes. It is crucial for individuals utilizing the Collin Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children to carefully review these options and select the type of form that best suits their needs. Seeking legal advice or guidance during this process is highly recommended ensuring the document aligns with their specific situation and desires.The Collin Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is an important legal document that allows individuals in this specific situation to properly outline their final wishes and ensure their assets are distributed as desired after their passing. This comprehensive form provides a clear and legally binding outline for the distribution of the individual's estate and assets. Keywords: Collin Texas, Legal Last Will and Testament Form, Divorced Person, Not Remarried, No Children There may be slight variations in the Collin Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children based on specific circumstances or preferences. Here are some potential variations or types of this form: 1. Simple Will: This type of form is intended for individuals with relatively straightforward estates and uncomplicated wishes regarding the distribution of their assets. It provides a basic template for outlining the desired beneficiaries and their respective shares of the estate. 2. Alternate Beneficiary Will: This form includes provisions for alternate beneficiaries in case the primary beneficiaries predecease the testator (the person creating the will). It ensures that the estate is distributed according to the testator's wishes even if the primary beneficiaries are unable to inherit. 3. Contingent Executor Will: This variation of the form allows individuals to name a contingent executor who will step in and handle the estate in case the primary executor is unable or unwilling to fulfill their responsibilities. It provides an added layer of security and ensures that the testator's wishes are carried out effectively. 4. Trust Will: A Trust Will is a specialized form that establishes a trust to manage the distribution of the estate's assets. This option may be useful for individuals who have significant assets, wish to provide for specific beneficiaries over an extended period, or want to minimize estate taxes. It is crucial for individuals utilizing the Collin Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children to carefully review these options and select the type of form that best suits their needs. Seeking legal advice or guidance during this process is highly recommended ensuring the document aligns with their specific situation and desires.