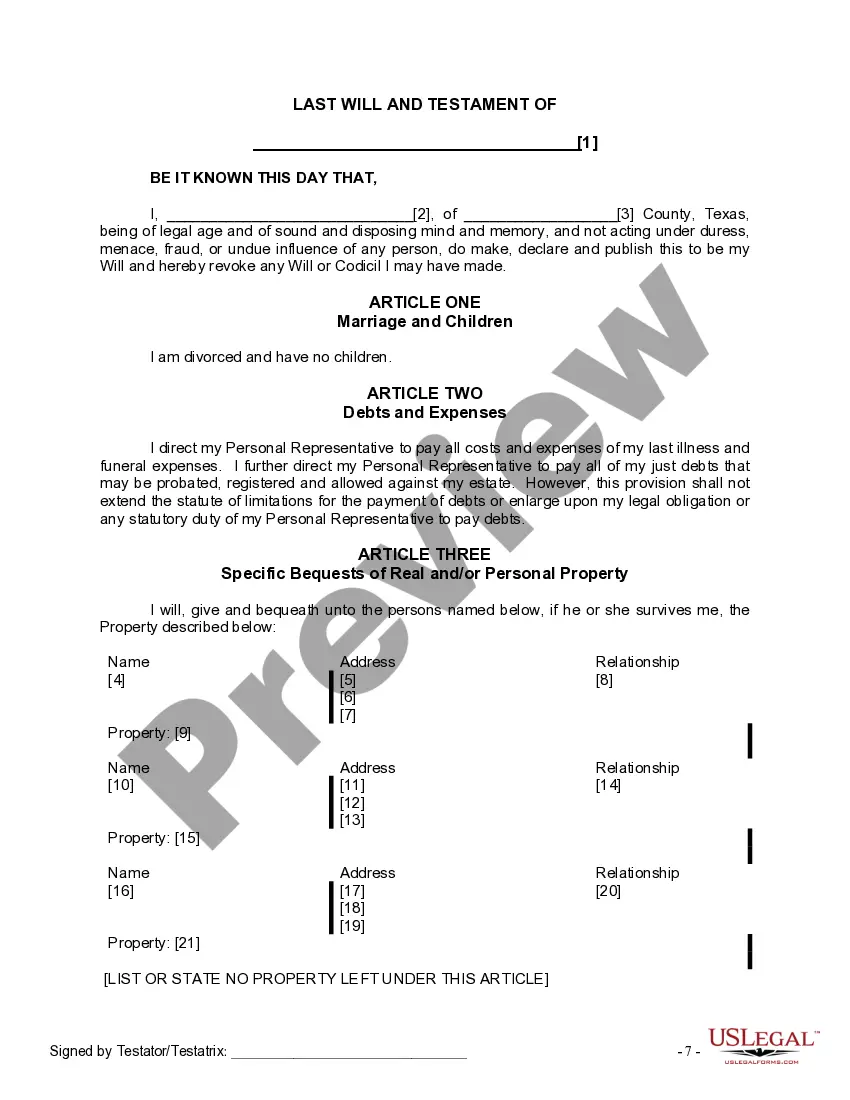

The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

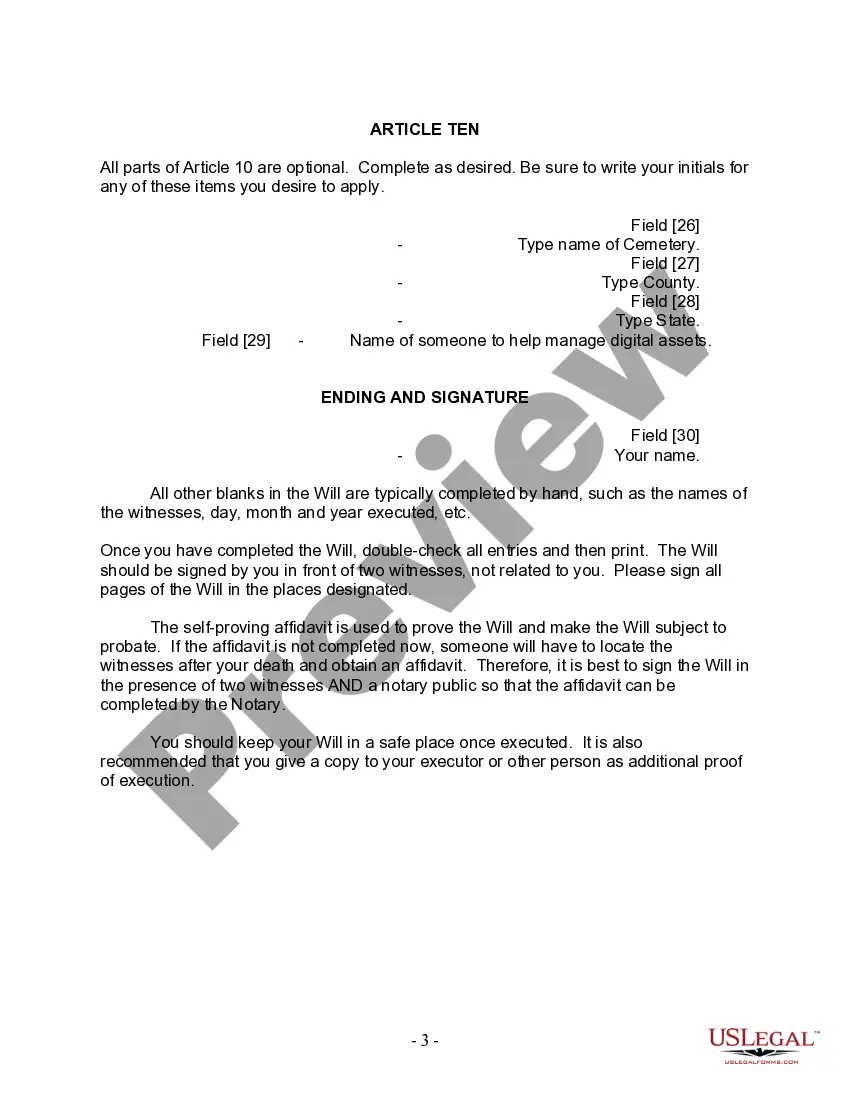

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

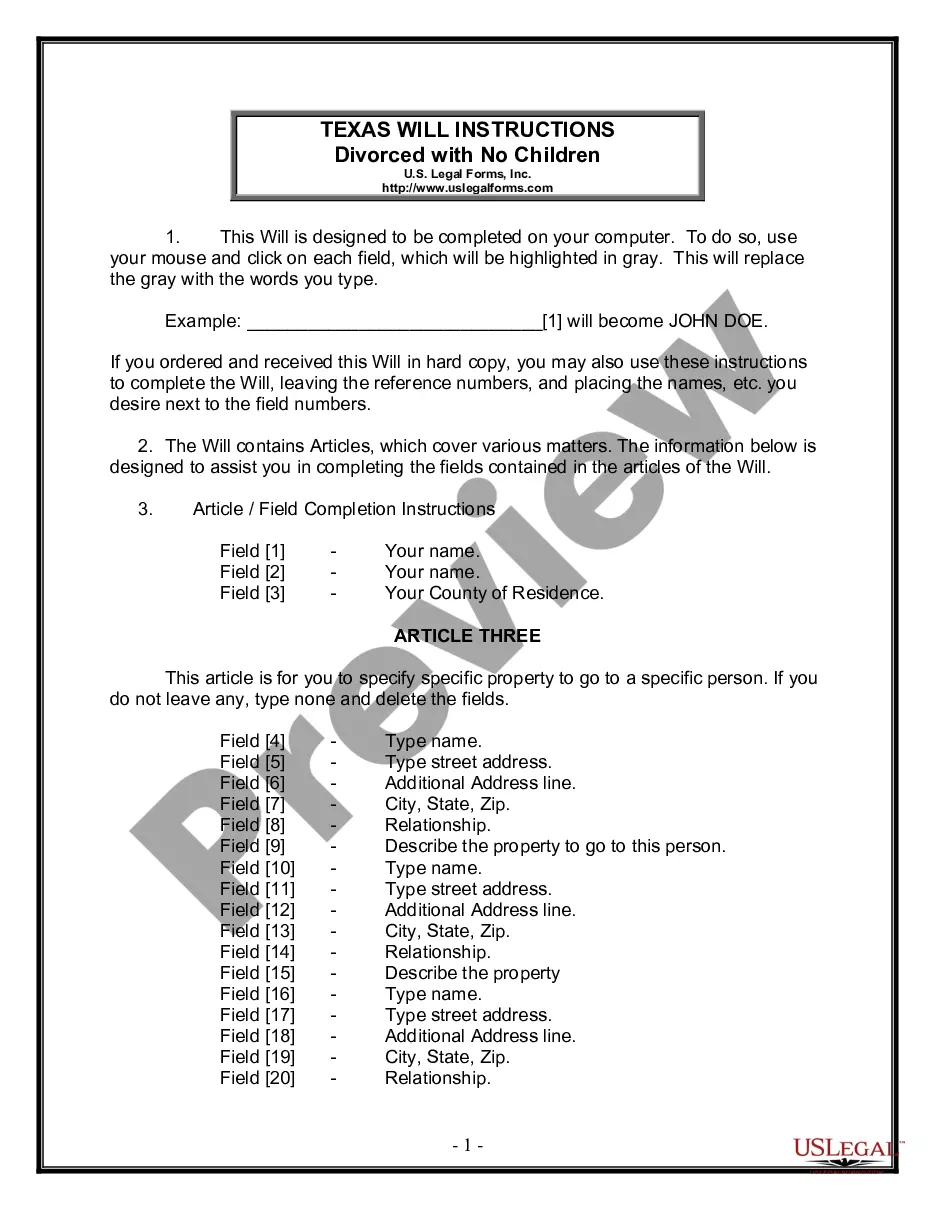

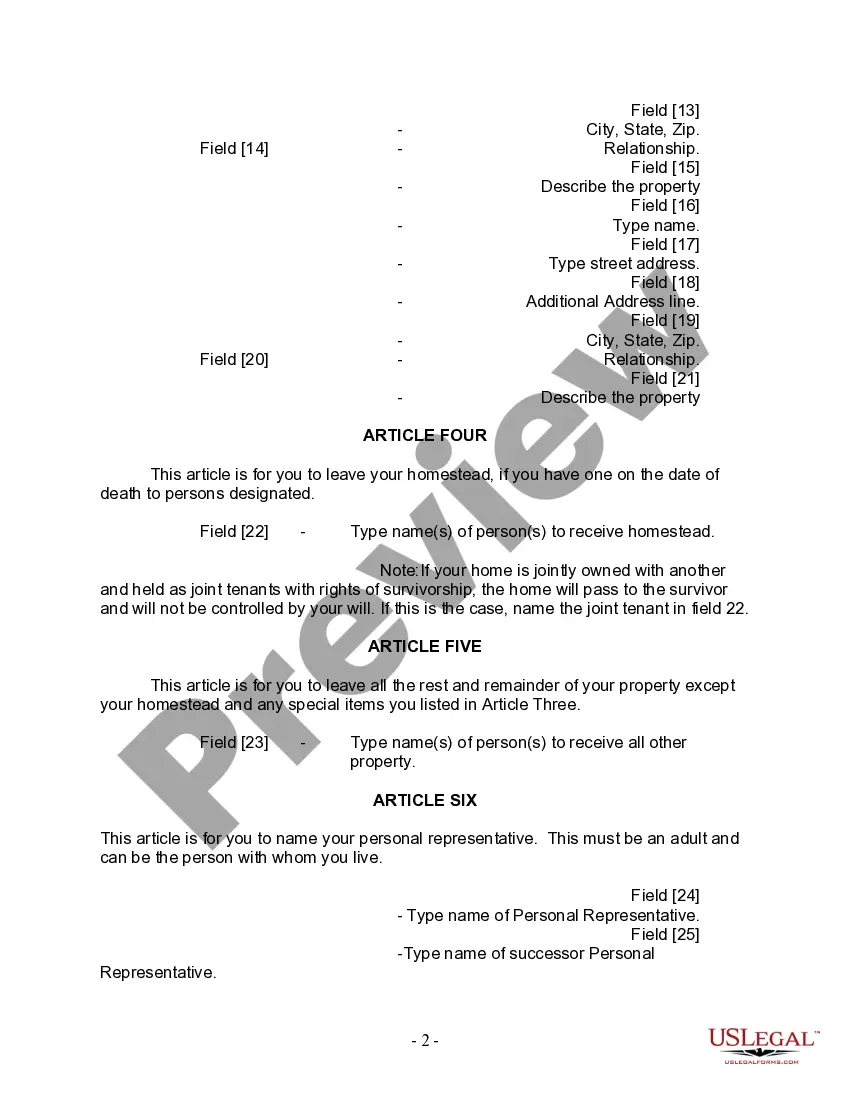

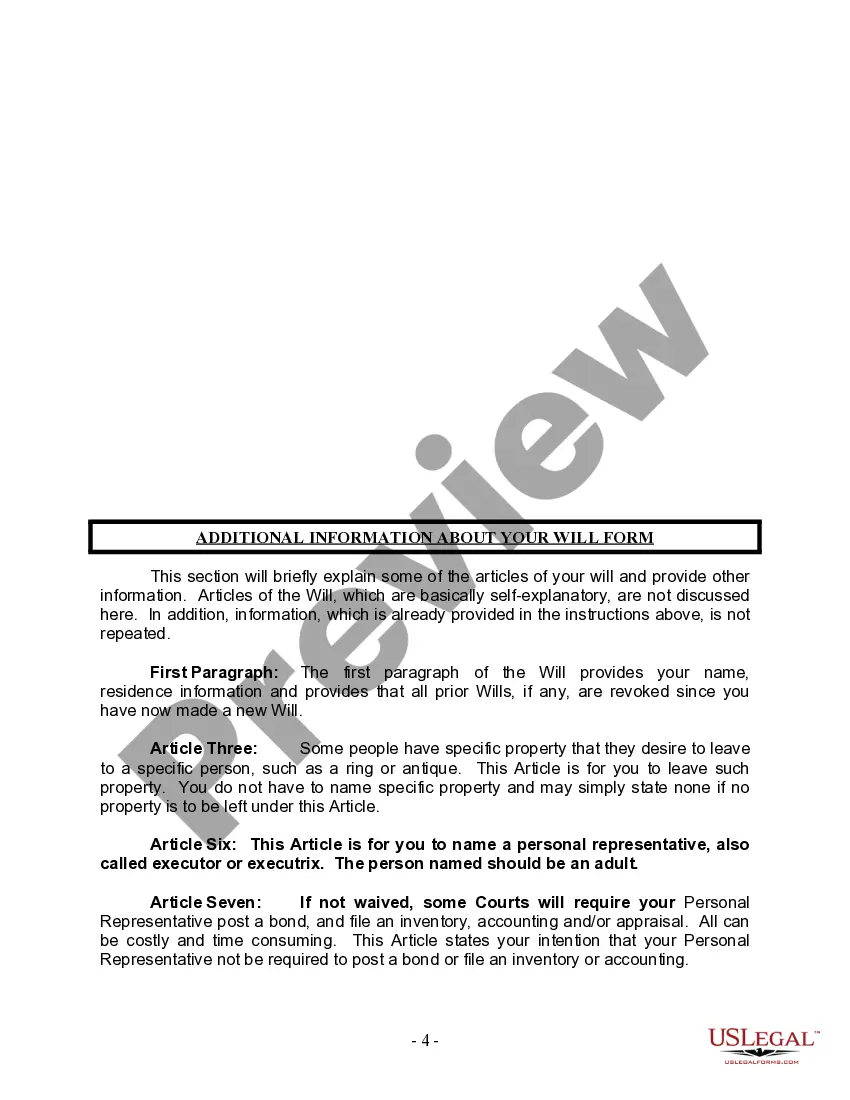

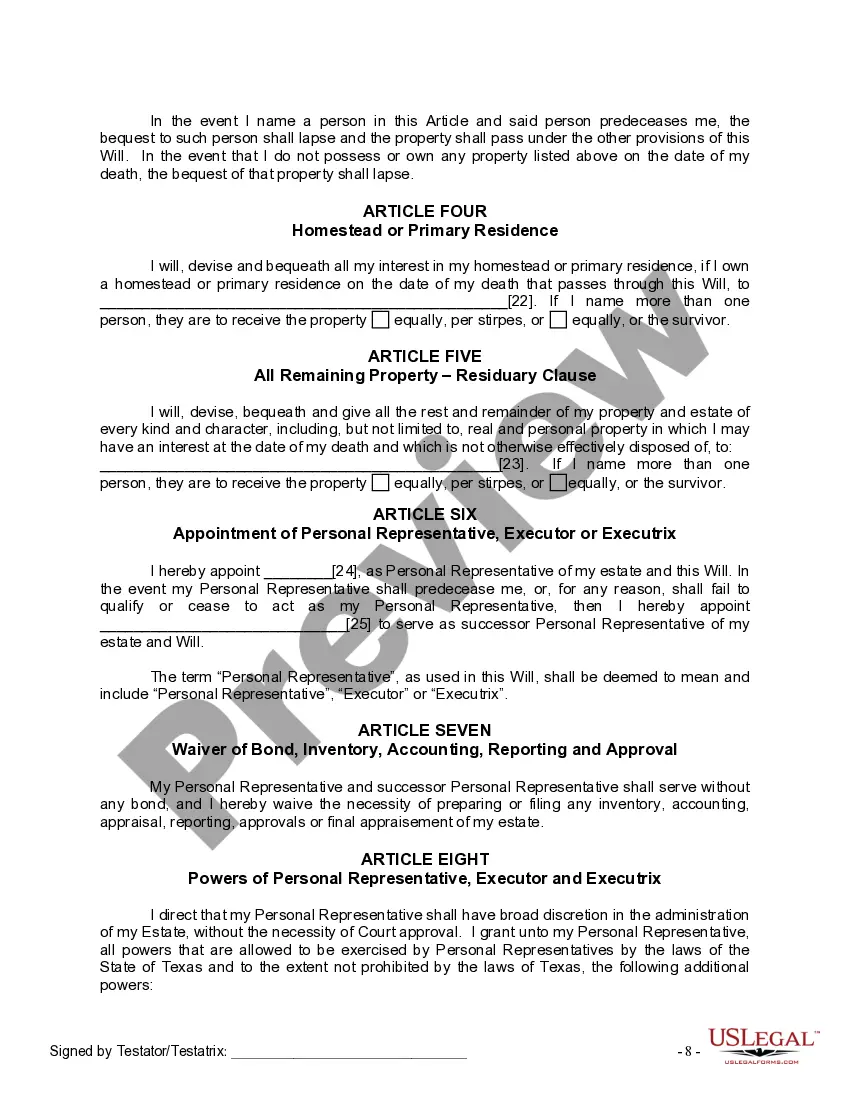

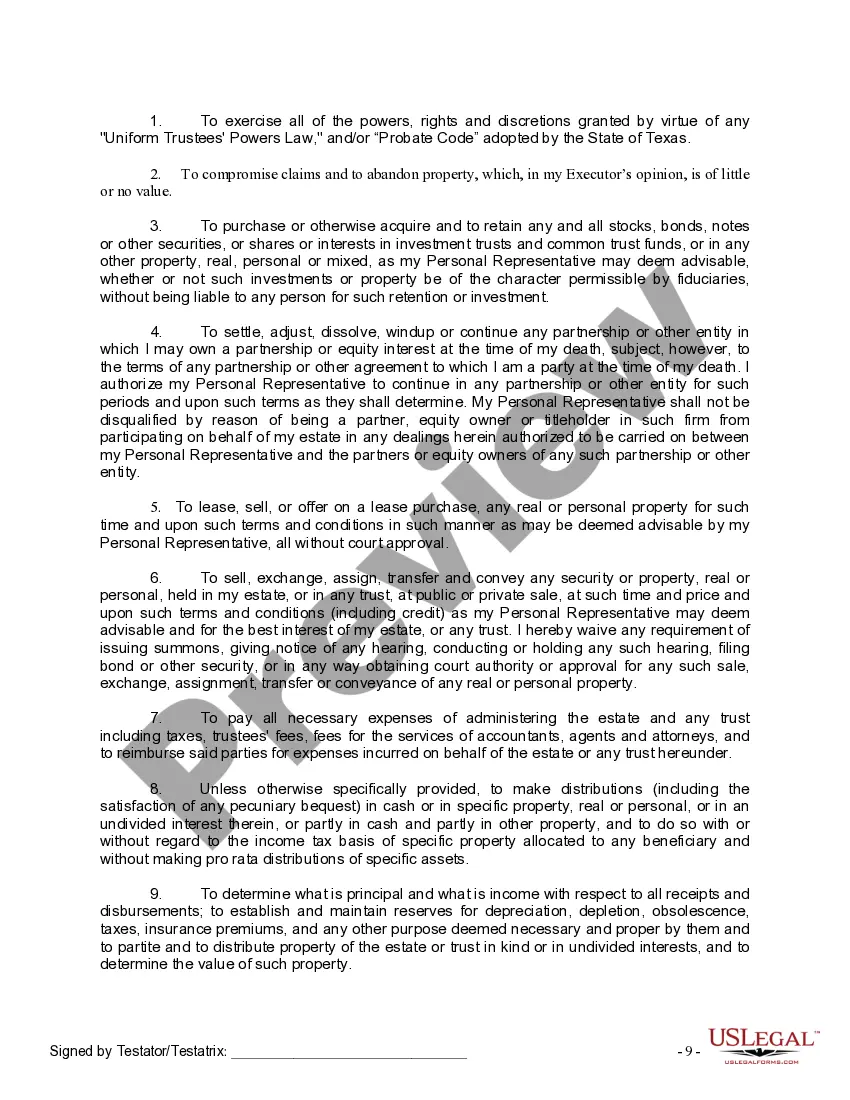

Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced and not remarried, with no children, to outline their final wishes regarding the distribution of their assets and appoint an executor to carry out their wishes after their passing. This specialized form caters to the unique circumstances of individuals who are divorced and do not have any children. The Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children covers several key components: 1. Personal Information: This section collects the divorced person's basic details, such as their full legal name, address, and contact information. 2. Executor Appointment: The form provides a section to designate an executor, who will be responsible for fulfilling the deceased person's wishes and managing estate matters. The executor can be a trusted friend, family member, or even a professional. 3. Asset Distribution: Here, the individual can outline how their assets should be distributed after their death. This includes properties, investments, bank accounts, personal belongings, and any other valuable possessions they own. 4. Beneficiary Designation: The form allows the divorced person to name specific individuals, organizations, or charities as beneficiaries of their assets. These beneficiaries will inherit the respective assets as designated in the will. 5. Alternate Beneficiaries: In the event that a named beneficiary is unable or unwilling to receive the assets, the divorced person can name alternate beneficiaries to ensure their assets are not left unclaimed. Different types or variations of Tarrant Texas Legal Last Will and Testament Forms for Divorced Person Not Remarried with No Children may exist with slight modifications in format or additional sections, but they typically serve the same purpose. For example: 1. Basic Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children: This is the most common form catering to the needs of divorced individuals with no children who wish to outline their asset distribution and appoint an executor. 2. Enhanced Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children: This version may include additional sections for specific instructions, such as funeral preferences, digital asset management, or charitable bequests. These forms are legally binding documents that should be filled out carefully and reviewed by an attorney to ensure they accurately represent the individual's wishes and comply with the laws of Tarrant County, Texas.Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legally binding document that allows individuals who are divorced and not remarried, with no children, to outline their final wishes regarding the distribution of their assets and appoint an executor to carry out their wishes after their passing. This specialized form caters to the unique circumstances of individuals who are divorced and do not have any children. The Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children covers several key components: 1. Personal Information: This section collects the divorced person's basic details, such as their full legal name, address, and contact information. 2. Executor Appointment: The form provides a section to designate an executor, who will be responsible for fulfilling the deceased person's wishes and managing estate matters. The executor can be a trusted friend, family member, or even a professional. 3. Asset Distribution: Here, the individual can outline how their assets should be distributed after their death. This includes properties, investments, bank accounts, personal belongings, and any other valuable possessions they own. 4. Beneficiary Designation: The form allows the divorced person to name specific individuals, organizations, or charities as beneficiaries of their assets. These beneficiaries will inherit the respective assets as designated in the will. 5. Alternate Beneficiaries: In the event that a named beneficiary is unable or unwilling to receive the assets, the divorced person can name alternate beneficiaries to ensure their assets are not left unclaimed. Different types or variations of Tarrant Texas Legal Last Will and Testament Forms for Divorced Person Not Remarried with No Children may exist with slight modifications in format or additional sections, but they typically serve the same purpose. For example: 1. Basic Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children: This is the most common form catering to the needs of divorced individuals with no children who wish to outline their asset distribution and appoint an executor. 2. Enhanced Tarrant Texas Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children: This version may include additional sections for specific instructions, such as funeral preferences, digital asset management, or charitable bequests. These forms are legally binding documents that should be filled out carefully and reviewed by an attorney to ensure they accurately represent the individual's wishes and comply with the laws of Tarrant County, Texas.