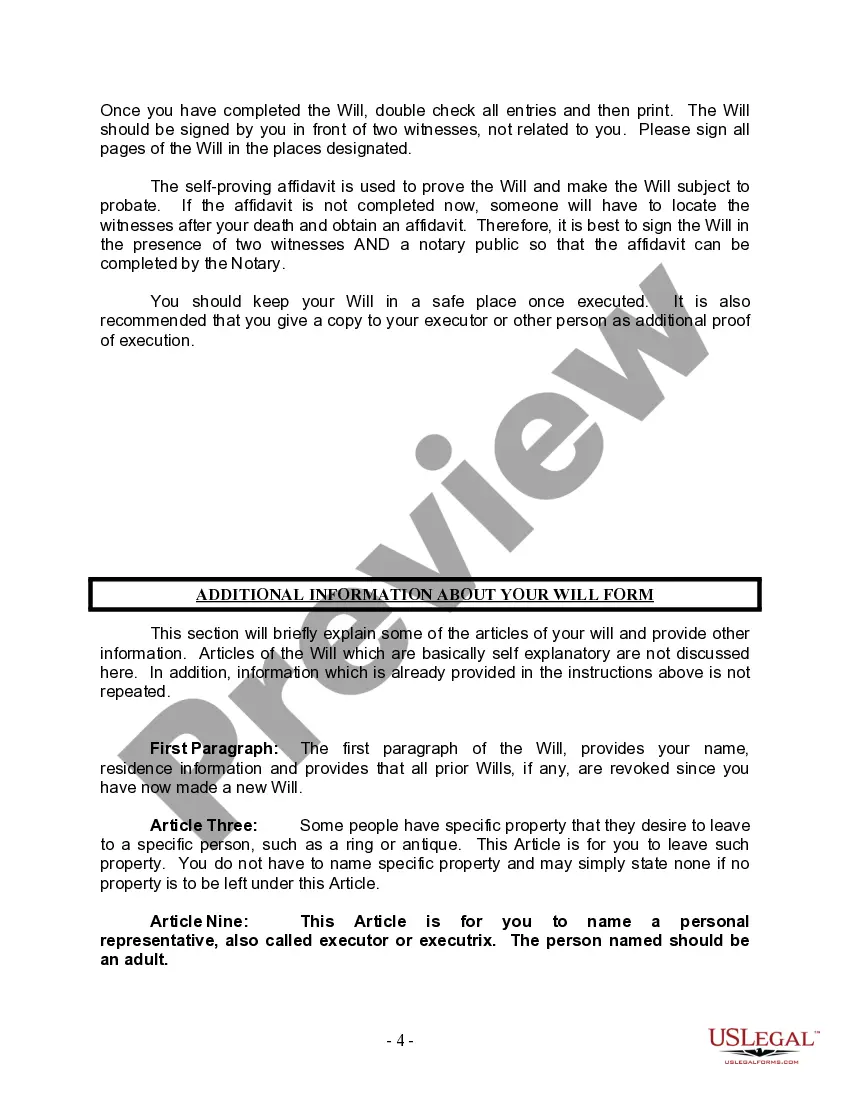

The Will you have found is for a divorced person, not remarried with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

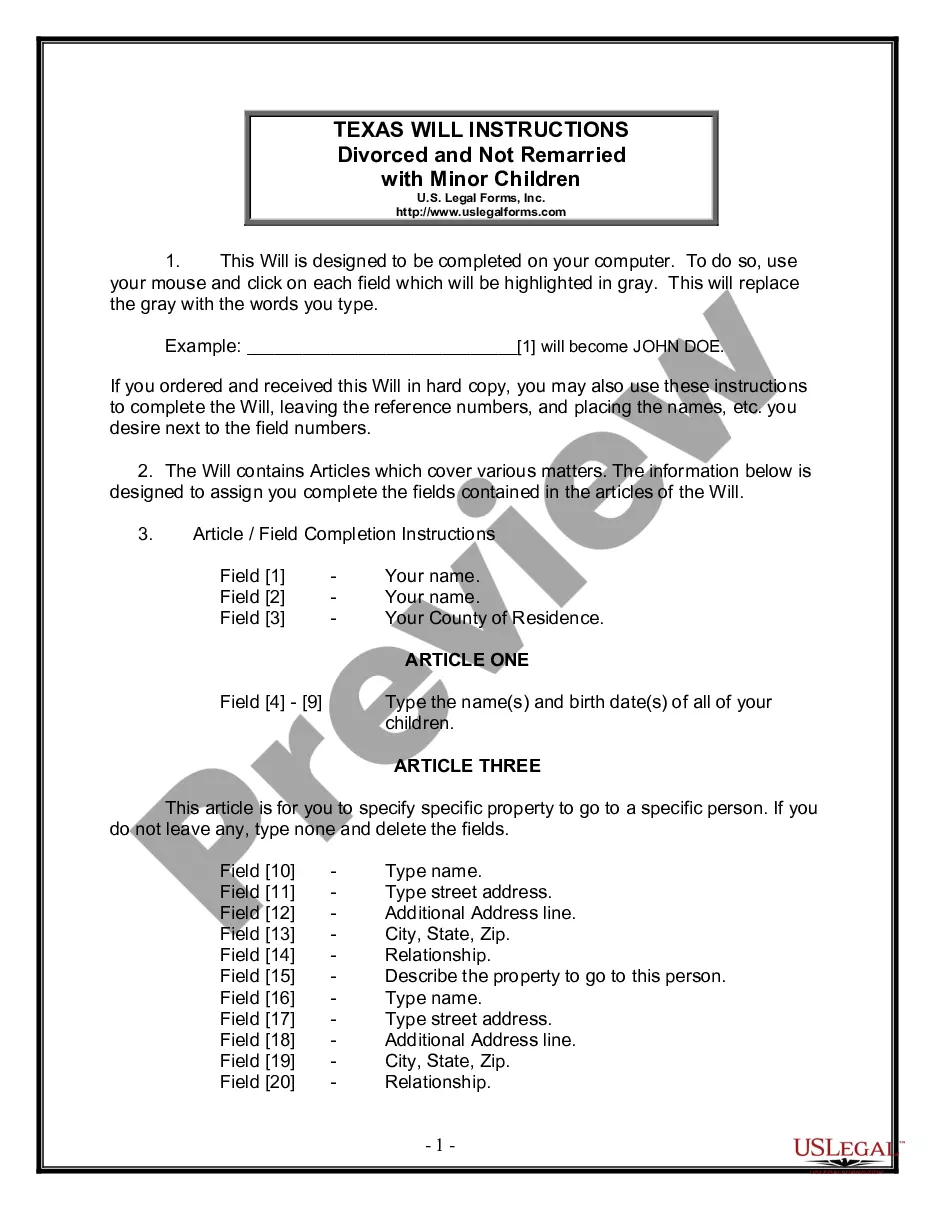

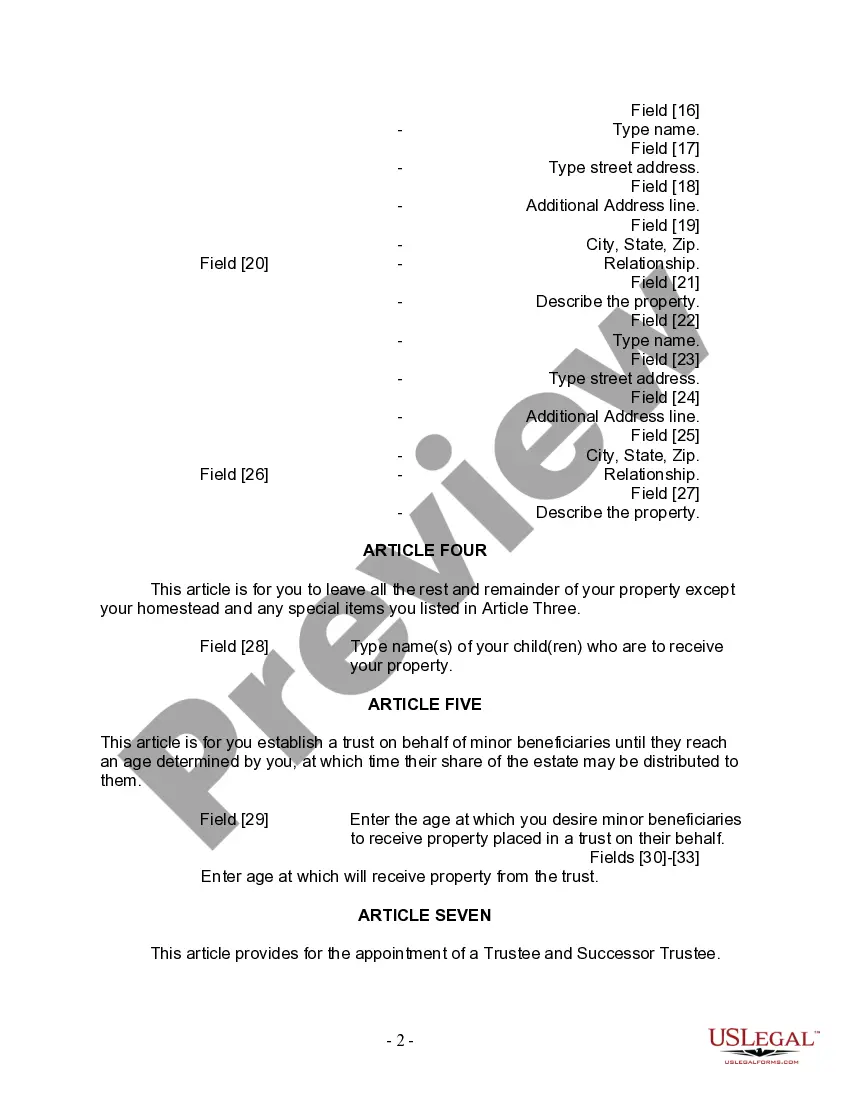

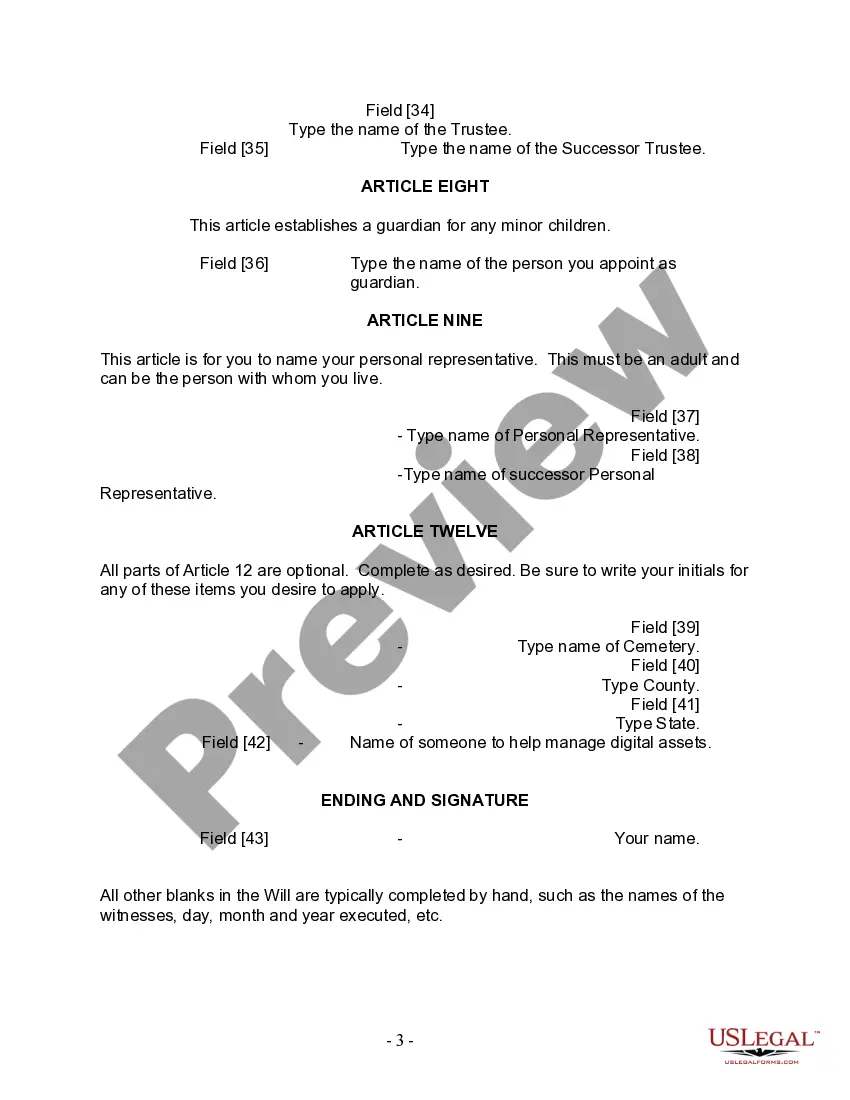

The Harris Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Minor Children is a legal document designed for individuals who have gone through a divorce, are not remarried, and have minor children. This form enables divorced individuals to outline their final wishes and distribute their assets and possessions after their passing. By using the Harris Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Minor Children, individuals can ensure that their minor children are cared for and their assets are distributed according to their preferences. The form allows them to appoint a guardian for their minor children, specify how their assets should be distributed, name an executor to handle the administration of their estate, and address any other specific instructions they may have. There are various types of Harris Texas Legal Last Will and Testament Forms for Divorced Person not Remarried with Minor Children that can be tailored to meet differing circumstances and needs. Some of these types include: 1. Simple Last Will and Testament: This form is suitable for individuals with uncomplicated estates and straightforward wishes. It provides a basic framework for dividing assets among minor children and appointing a guardian. 2. Testamentary Trust Will: This form is useful if the individual wants to establish a trust to manage and distribute their assets on behalf of their minor children until they reach a specified age or milestone. 3. Living Will and Testament: This form not only outlines the distribution of assets and appoints a guardian for minor children but also includes provisions regarding medical decisions in case the individual becomes incapacitated. 4. Pour-Over Will: This form is designed for individuals who have established a revocable living trust during their lifetime. It ensures that any assets not already included in the trust are "poured over" into the trust upon their death. Remember that it is essential to consult with an attorney or legal professional familiar with estate planning laws in Harris County, Texas, to ensure that the chosen form aligns with individual circumstances and preferences.The Harris Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Minor Children is a legal document designed for individuals who have gone through a divorce, are not remarried, and have minor children. This form enables divorced individuals to outline their final wishes and distribute their assets and possessions after their passing. By using the Harris Texas Legal Last Will and Testament Form for Divorced Person not Remarried with Minor Children, individuals can ensure that their minor children are cared for and their assets are distributed according to their preferences. The form allows them to appoint a guardian for their minor children, specify how their assets should be distributed, name an executor to handle the administration of their estate, and address any other specific instructions they may have. There are various types of Harris Texas Legal Last Will and Testament Forms for Divorced Person not Remarried with Minor Children that can be tailored to meet differing circumstances and needs. Some of these types include: 1. Simple Last Will and Testament: This form is suitable for individuals with uncomplicated estates and straightforward wishes. It provides a basic framework for dividing assets among minor children and appointing a guardian. 2. Testamentary Trust Will: This form is useful if the individual wants to establish a trust to manage and distribute their assets on behalf of their minor children until they reach a specified age or milestone. 3. Living Will and Testament: This form not only outlines the distribution of assets and appoints a guardian for minor children but also includes provisions regarding medical decisions in case the individual becomes incapacitated. 4. Pour-Over Will: This form is designed for individuals who have established a revocable living trust during their lifetime. It ensures that any assets not already included in the trust are "poured over" into the trust upon their death. Remember that it is essential to consult with an attorney or legal professional familiar with estate planning laws in Harris County, Texas, to ensure that the chosen form aligns with individual circumstances and preferences.