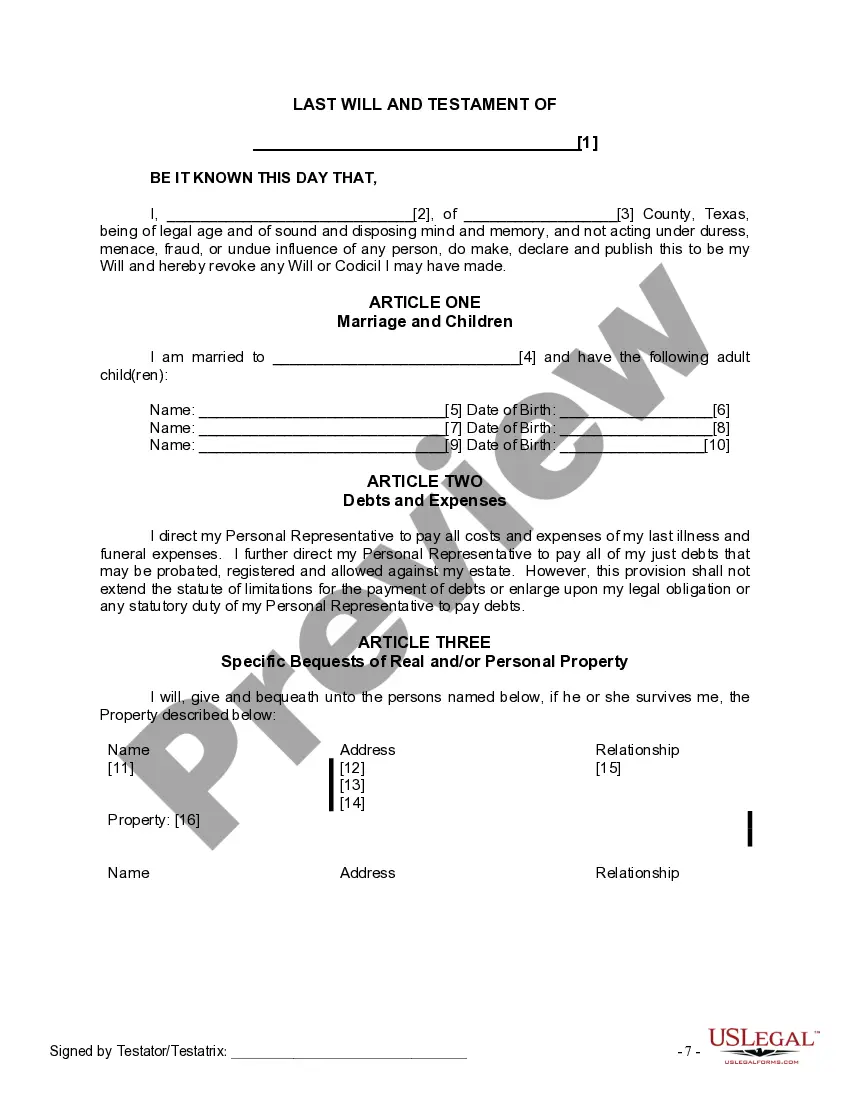

The Mutual Wills package with Last Wills and Testaments you have found is for a married couple with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children. This package contains two wills, one for each spouse. It also includes instructions.

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills.

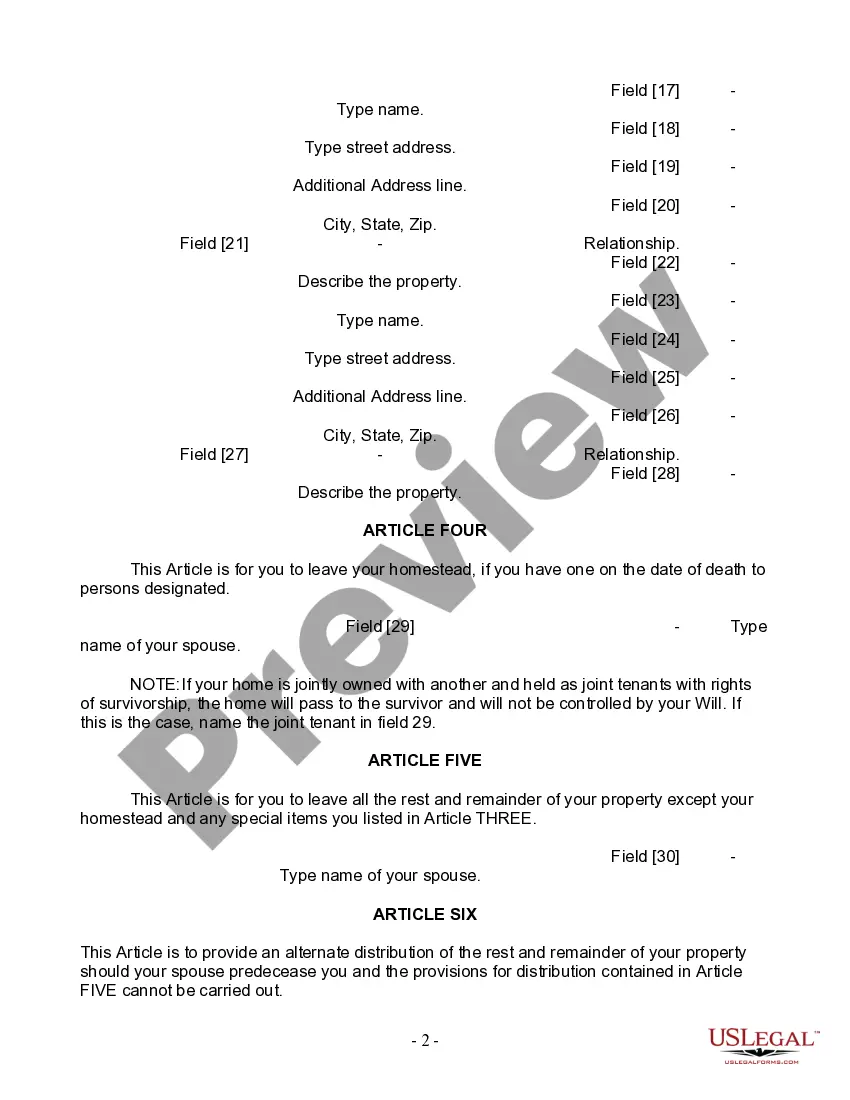

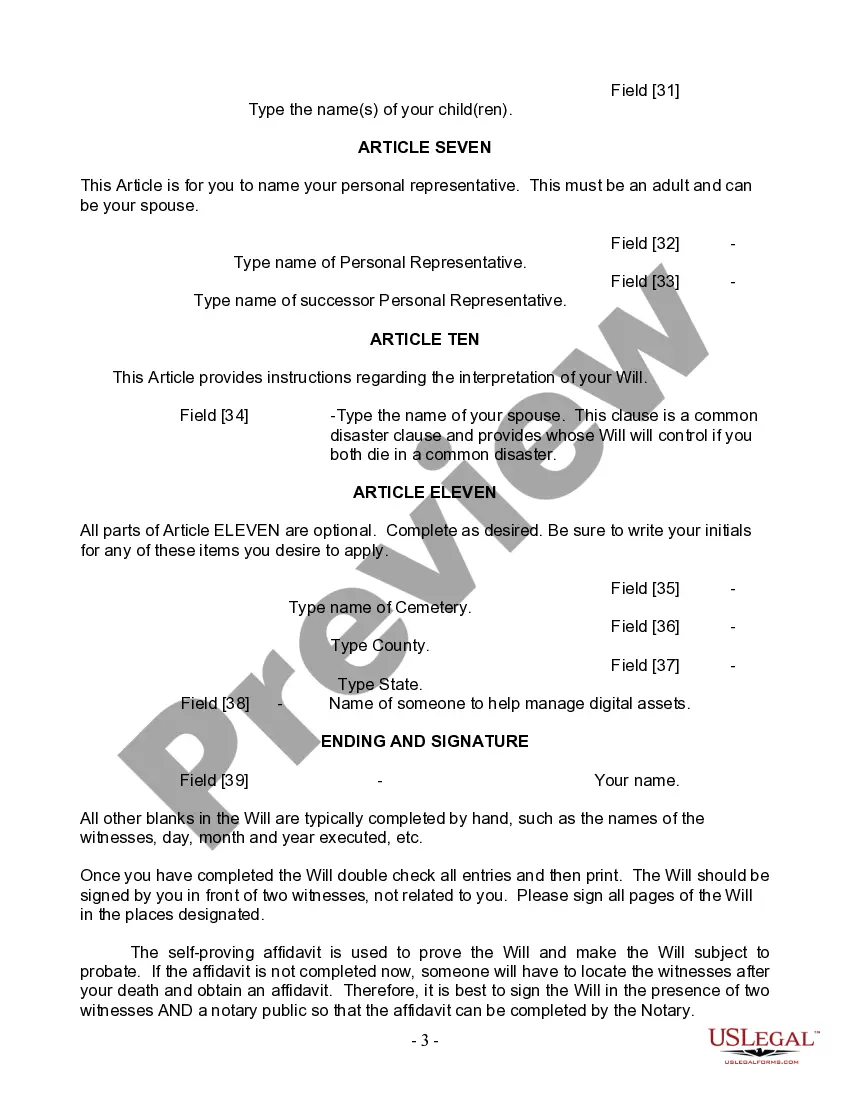

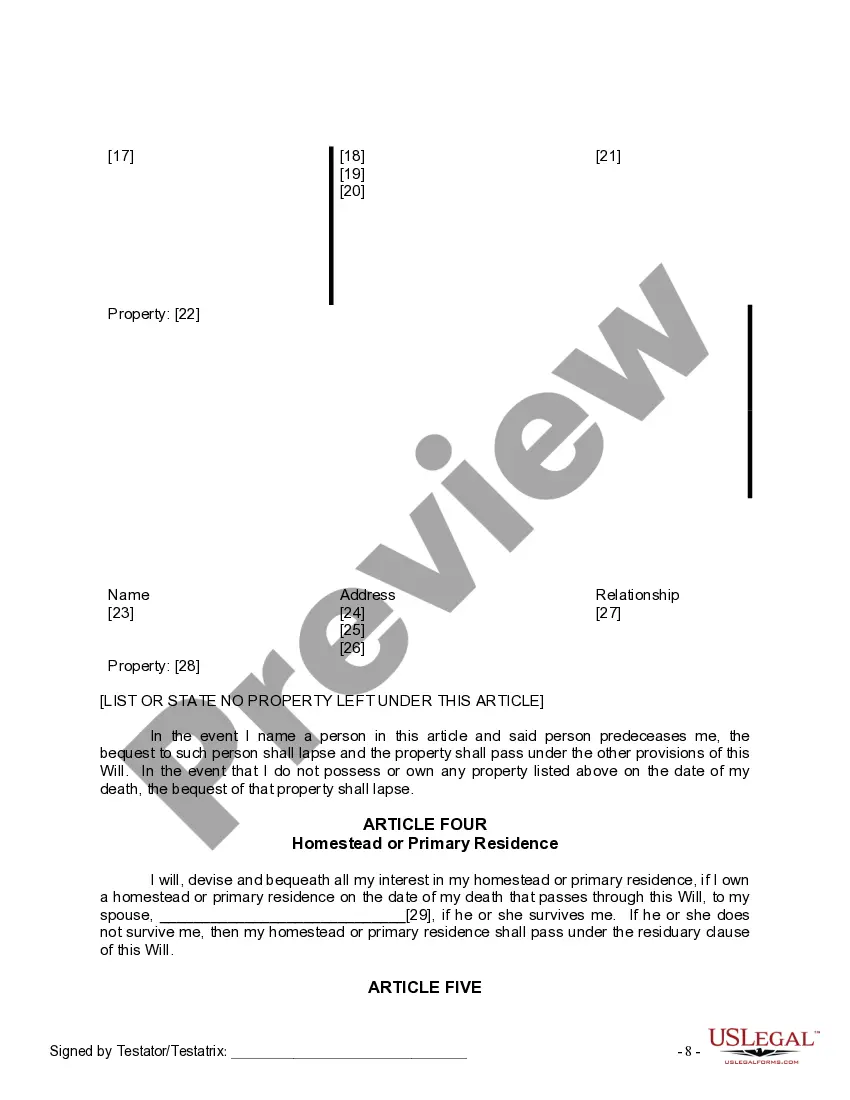

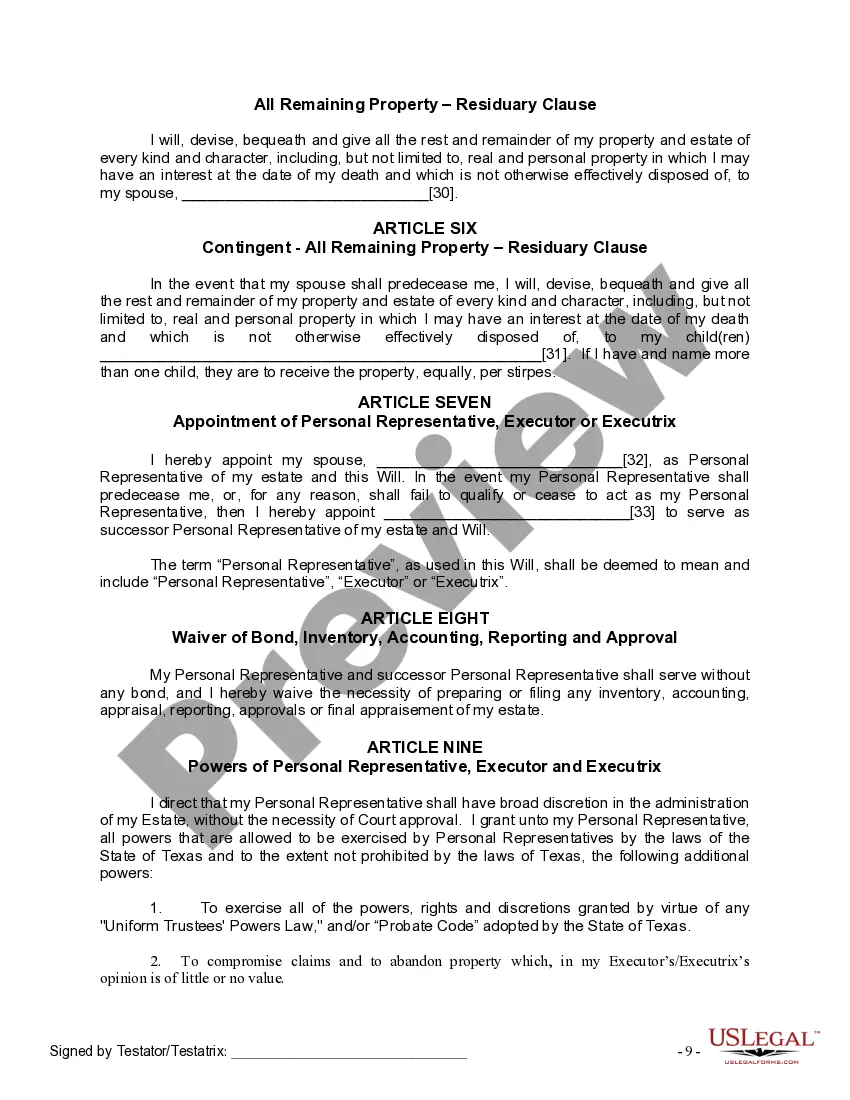

The Harris Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult Children is a comprehensive legal document that addresses the estate planning needs of married couples in Texas who have adult children. This package includes various essential components to ensure that the couple's wishes are followed regarding the distribution of their assets and the care of their children after their demise. The main purpose of the Harris Texas Mutual Wills Package is to create identical wills for both spouses, reflecting their common decisions about their estate and beneficiaries. By choosing this package, married couples can streamline their estate planning process by utilizing a standardized format that covers all pertinent aspects. The key elements covered in the Harris Texas Mutual Wills Package include: 1. Last Will and Testament: This document outlines the testator's (individuals creating the will) wishes regarding the division and distribution of their assets, properties, and debts. It covers the selection of executors, guardianship for minor children (if applicable), and directives for funeral arrangements. 2. Mutual Will Agreement: This agreement ensures that both spouses' wills mirror each other in terms of asset distribution and beneficiaries. It provides a legally binding agreement that neither spouse will alter their will without the consent of the other, maintaining consistent terms between their wills. 3. Appointment of Executor: The package allows the couple to designate a trusted individual who will take responsibility for administering their estates and ensure that their wishes are carried out correctly. 4. Distribution of Assets: The Harris Texas Mutual Wills Package assists in outlining how the couple's assets, including properties, finances, investments, and personal belongings, will be divided amongst their adult children upon their death. This ensures that the assets are distributed as per their preferences. 5. Guardianship Provisions: If the couple has minor children, the package helps appoint a legal guardian who will be responsible for caring and making decisions for them in the event of both parents' passing. Other types of Harris Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult Children may include: 1. Harris Texas Mutual Wills Package with Trusts: This package extends the basic mutual wills, allowing the couple to establish trusts for their adult children. It provides greater control over the distribution of assets and safeguards against potential mismanagement or unwise financial decisions on the part of the beneficiaries. 2. Harris Texas Mutual Wills Package with Advanced Healthcare Directives: In addition to the essential components of mutual wills, this package includes advanced healthcare directives, such as a medical power of attorney and a living will. It ensures that the couple's healthcare wishes are known and respected if they become unable to make medical decisions themselves. 3. Harris Texas Mutual Wills Package with Life Insurance Planning: This package incorporates provisions for life insurance as an effective tool for leaving a financial legacy to beneficiaries. It helps the couple determine who will be the beneficiaries of the life insurance policy and how the proceeds will be distributed. In summary, the Harris Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult Children provides a comprehensive estate planning solution that addresses the unique needs of married couples in Texas with adult children. It covers will creation, asset distribution, guardianship provisions, and more. Additional packages may include provisions for trusts, advanced healthcare directives, or life insurance planning.The Harris Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult Children is a comprehensive legal document that addresses the estate planning needs of married couples in Texas who have adult children. This package includes various essential components to ensure that the couple's wishes are followed regarding the distribution of their assets and the care of their children after their demise. The main purpose of the Harris Texas Mutual Wills Package is to create identical wills for both spouses, reflecting their common decisions about their estate and beneficiaries. By choosing this package, married couples can streamline their estate planning process by utilizing a standardized format that covers all pertinent aspects. The key elements covered in the Harris Texas Mutual Wills Package include: 1. Last Will and Testament: This document outlines the testator's (individuals creating the will) wishes regarding the division and distribution of their assets, properties, and debts. It covers the selection of executors, guardianship for minor children (if applicable), and directives for funeral arrangements. 2. Mutual Will Agreement: This agreement ensures that both spouses' wills mirror each other in terms of asset distribution and beneficiaries. It provides a legally binding agreement that neither spouse will alter their will without the consent of the other, maintaining consistent terms between their wills. 3. Appointment of Executor: The package allows the couple to designate a trusted individual who will take responsibility for administering their estates and ensure that their wishes are carried out correctly. 4. Distribution of Assets: The Harris Texas Mutual Wills Package assists in outlining how the couple's assets, including properties, finances, investments, and personal belongings, will be divided amongst their adult children upon their death. This ensures that the assets are distributed as per their preferences. 5. Guardianship Provisions: If the couple has minor children, the package helps appoint a legal guardian who will be responsible for caring and making decisions for them in the event of both parents' passing. Other types of Harris Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult Children may include: 1. Harris Texas Mutual Wills Package with Trusts: This package extends the basic mutual wills, allowing the couple to establish trusts for their adult children. It provides greater control over the distribution of assets and safeguards against potential mismanagement or unwise financial decisions on the part of the beneficiaries. 2. Harris Texas Mutual Wills Package with Advanced Healthcare Directives: In addition to the essential components of mutual wills, this package includes advanced healthcare directives, such as a medical power of attorney and a living will. It ensures that the couple's healthcare wishes are known and respected if they become unable to make medical decisions themselves. 3. Harris Texas Mutual Wills Package with Life Insurance Planning: This package incorporates provisions for life insurance as an effective tool for leaving a financial legacy to beneficiaries. It helps the couple determine who will be the beneficiaries of the life insurance policy and how the proceeds will be distributed. In summary, the Harris Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult Children provides a comprehensive estate planning solution that addresses the unique needs of married couples in Texas with adult children. It covers will creation, asset distribution, guardianship provisions, and more. Additional packages may include provisions for trusts, advanced healthcare directives, or life insurance planning.