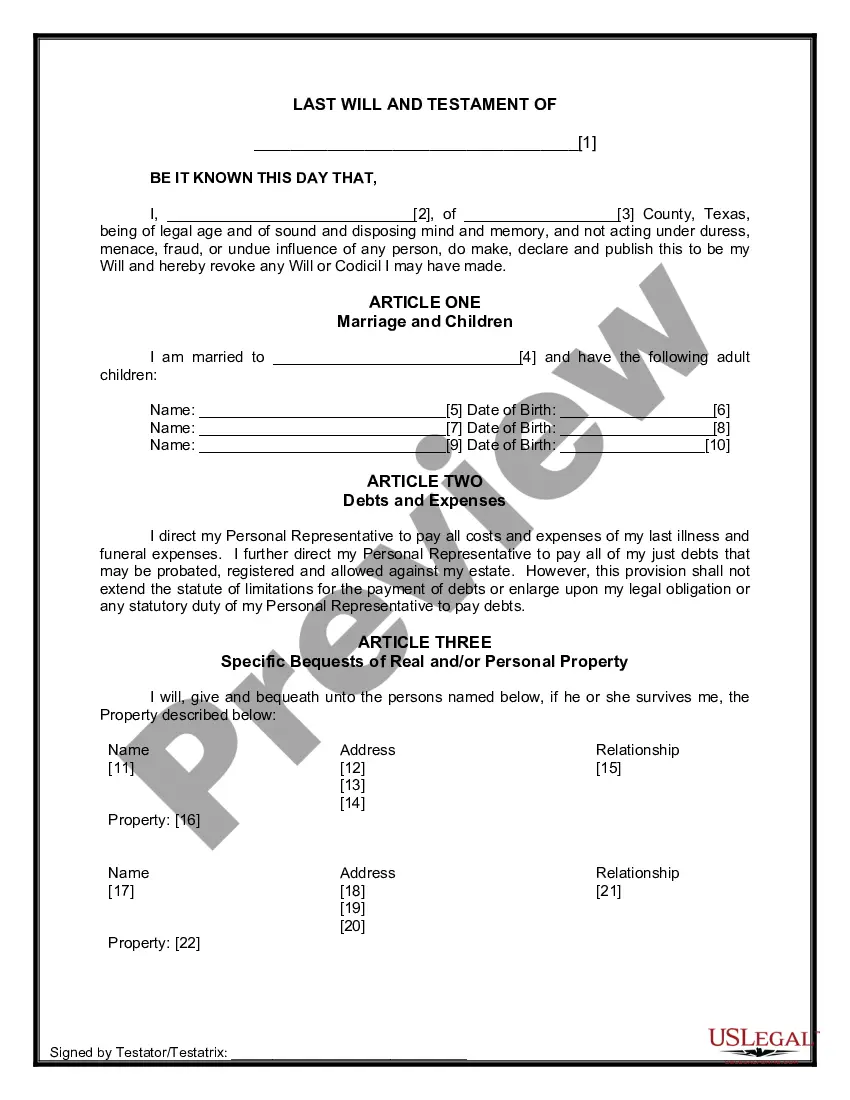

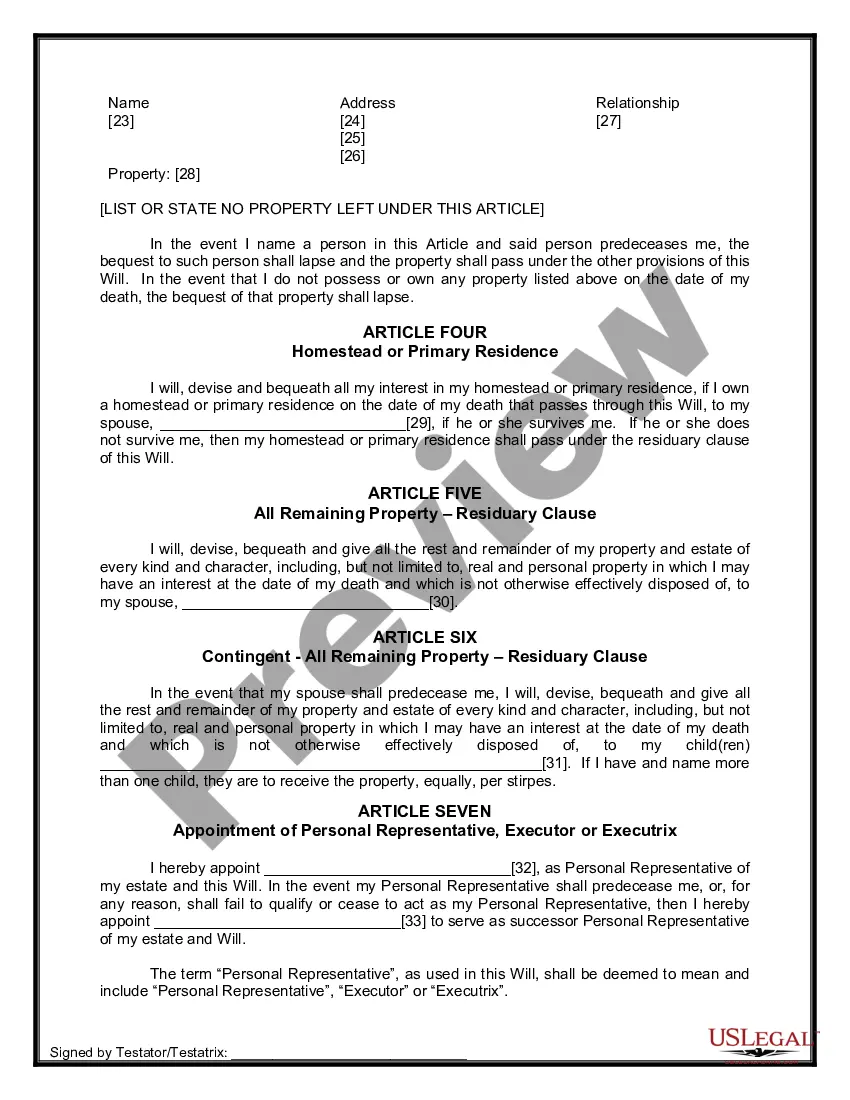

The Will you have found is for a married person with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children.

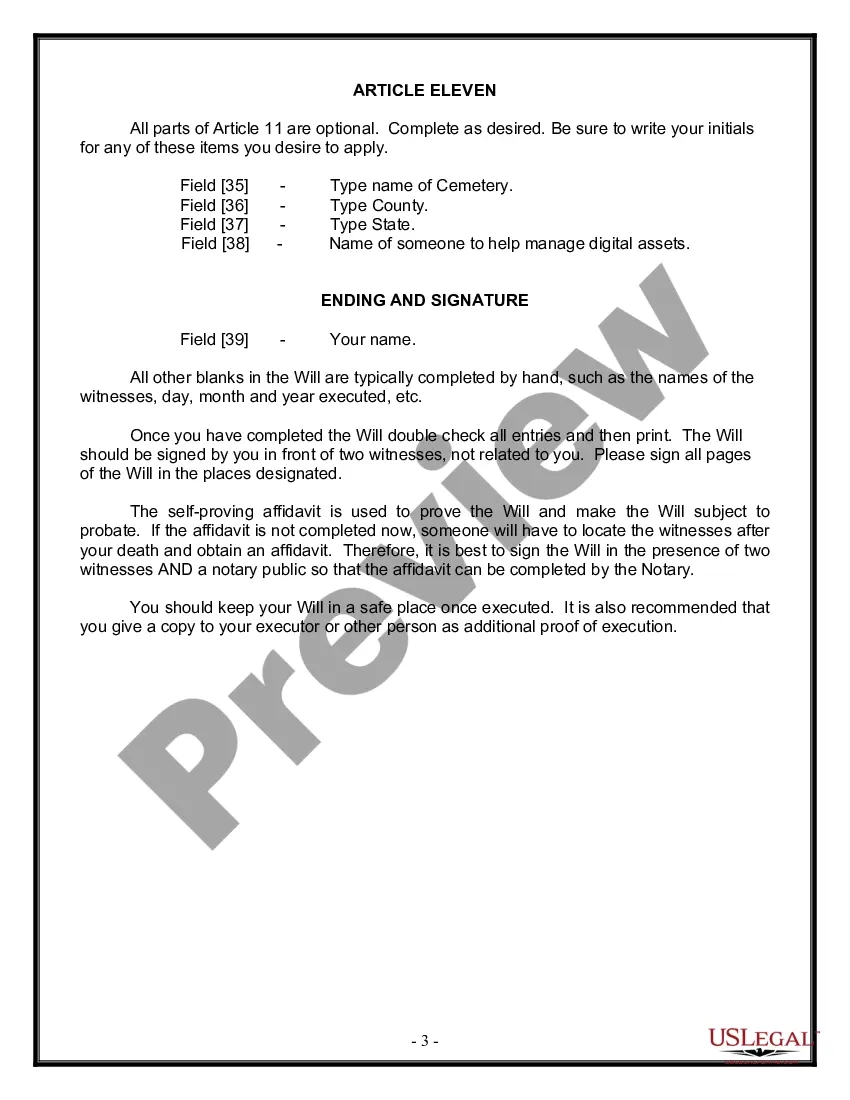

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

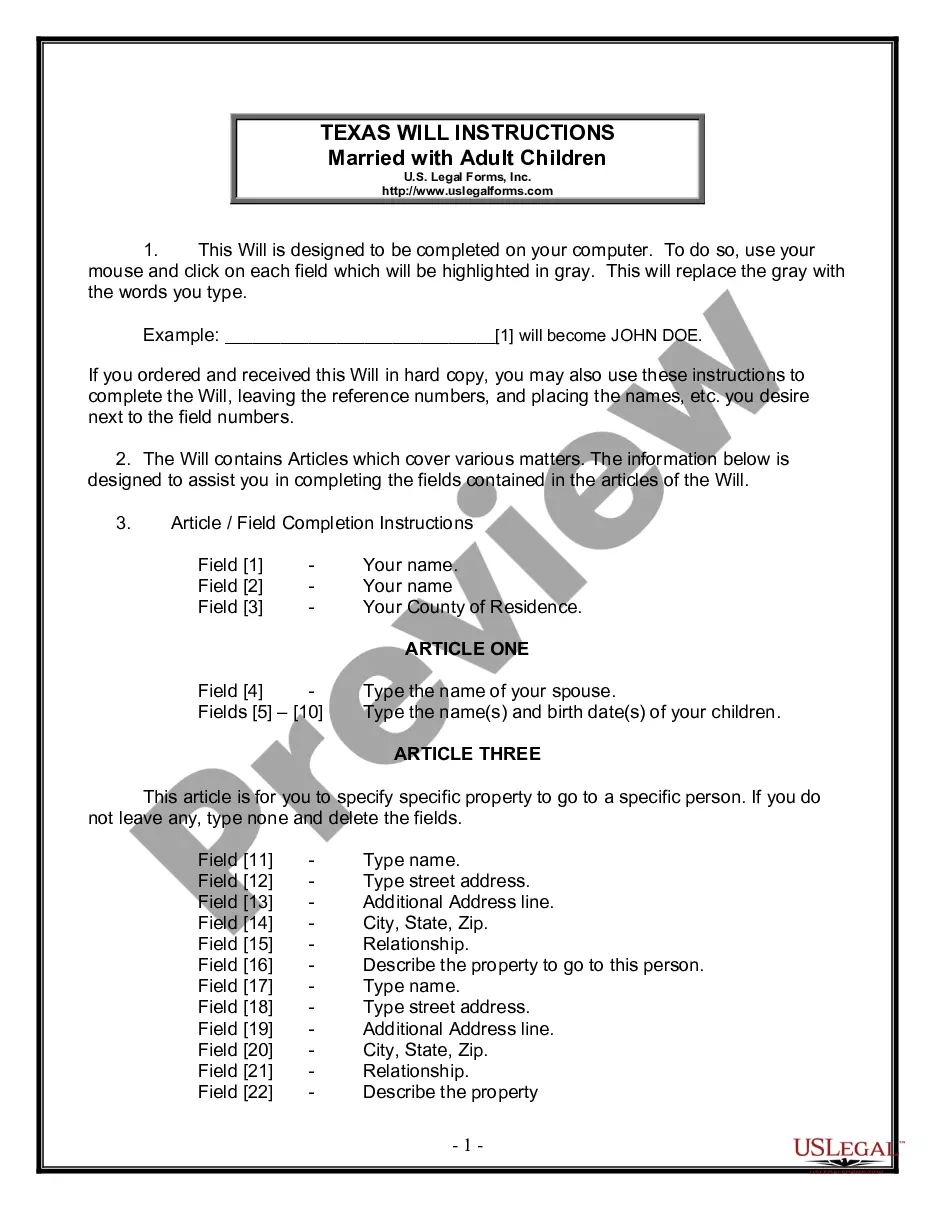

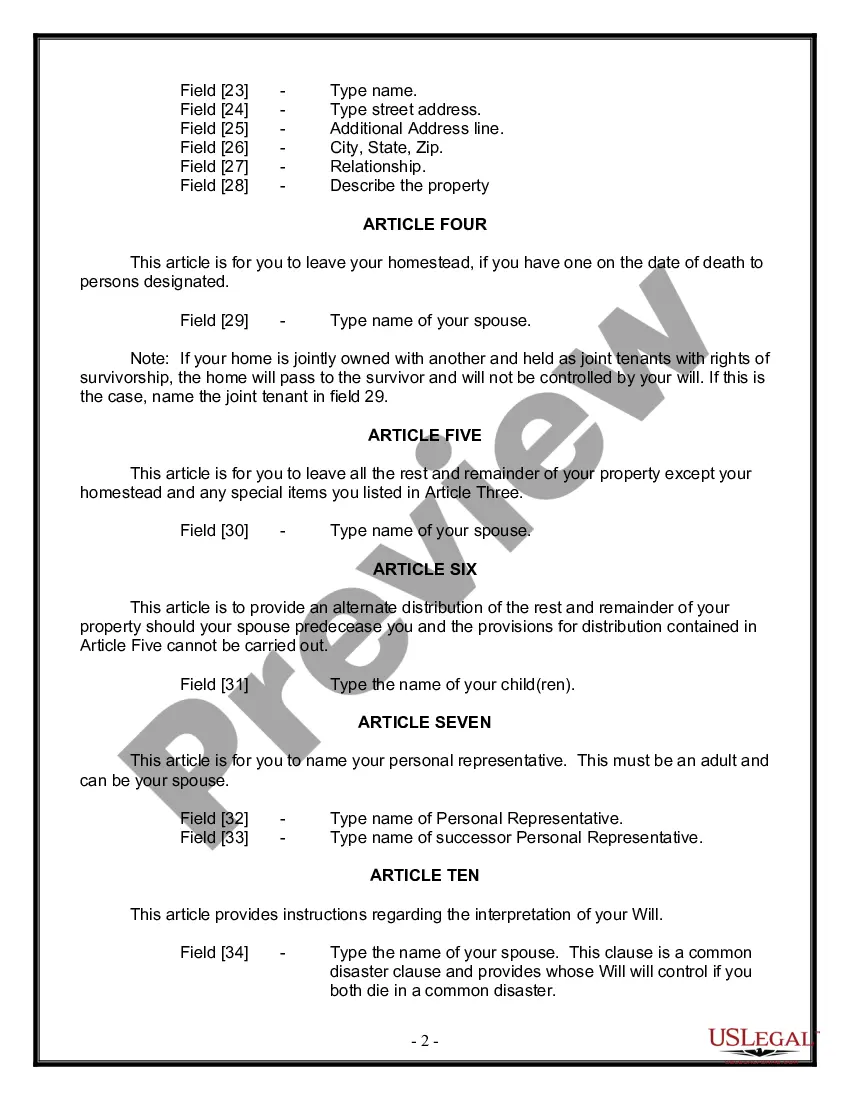

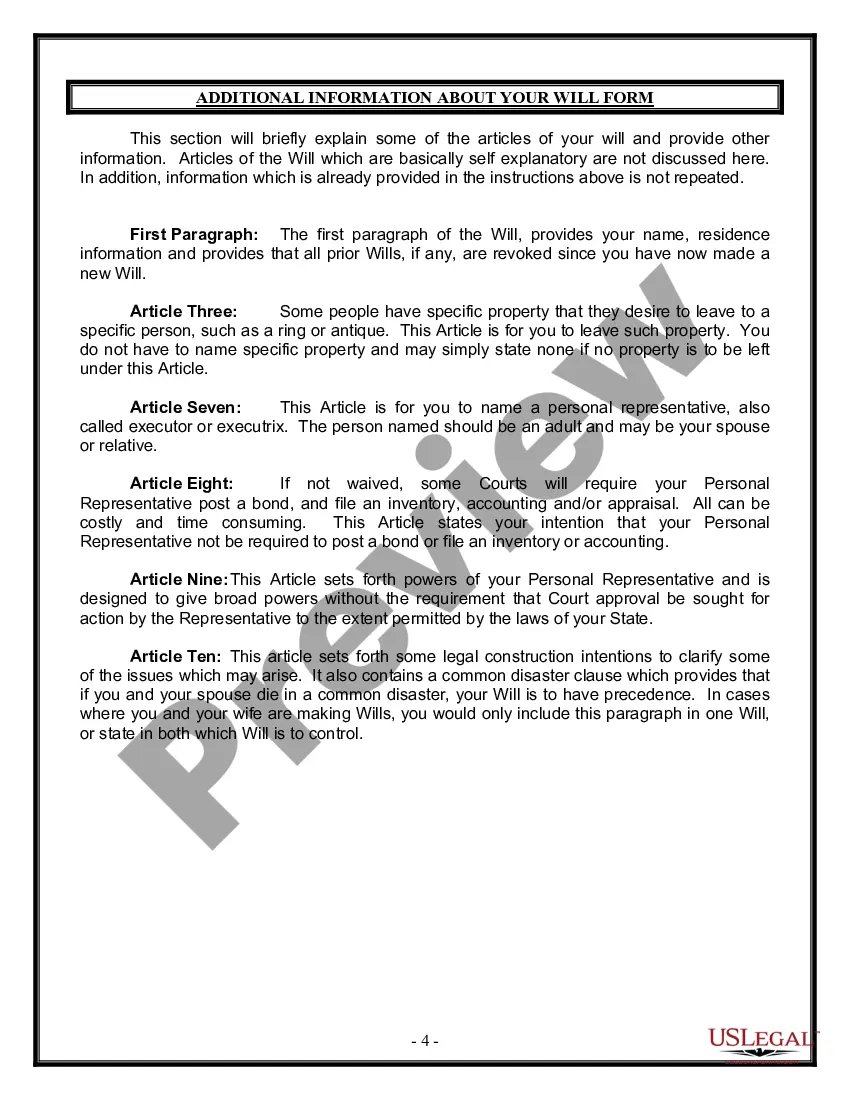

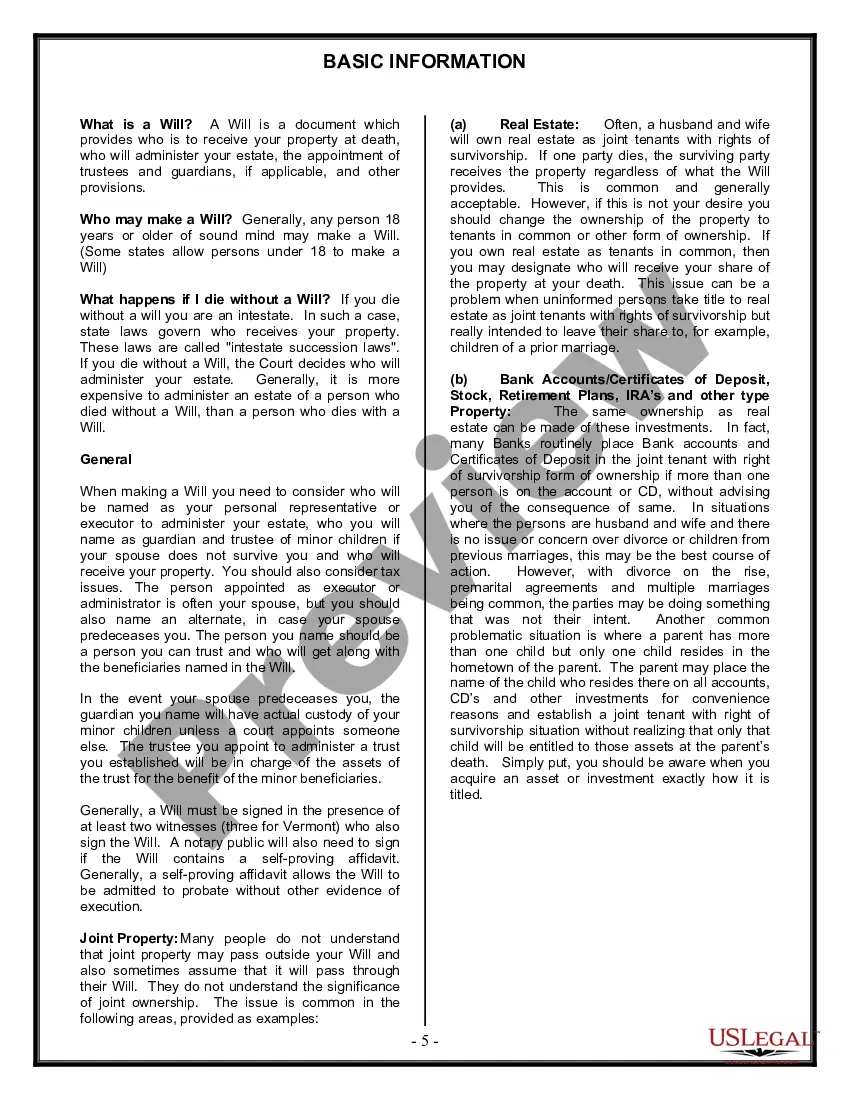

The Carrollton Texas Legal Last Will and Testament Form for Married Person with Adult Children is a legally binding document that allows individuals in Carrollton, Texas to outline their final wishes and distribute their assets upon their passing. This specialized form is specifically designed for married individuals who have adult children. It enables them to ensure that their assets are distributed according to their preferences, providing clarity and avoiding confusion or potential disputes among family members. The Carrollton Texas Legal Last Will and Testament Form for Married Person with Adult Children includes various sections that address different aspects of a person's final wishes. These sections typically cover: 1. Identification and Introduction: This section includes personal information such as the individual's full legal name, date of birth, marital status, and the information of their spouse, as well as a brief introduction stating the purpose of the document. 2. Appointment of Executor: Individuals can designate an executor, responsible for carrying out their wishes and distributing their assets as outlined in the will. The executor ensures that all debts, taxes, and expenses are settled before distributing assets to beneficiaries. 3. Distribution of Assets: In this section, individuals can specify how they want their assets, including property, investments, and personal belongings, to be distributed among their adult children and potentially other beneficiaries. They can assign specific items to particular individuals or divide their assets equally among their children. 4. Guardianship Provision: If the individual's minor children are still under the care of their surviving spouse, they may include a guardianship provision in the event that the surviving spouse is unable to fulfill the role. This provision identifies a guardian who will assume responsibility for the care and upbringing of the minor children. 5. Residuary Clause: This clause ensures that any remaining assets not specifically mentioned in the will are distributed according to the individual's overall wishes. It covers any unforeseen circumstances or newly acquired assets that were not explicitly addressed in the will. It is important to note that while the aforementioned sections are common in most Last Will and Testament forms, the specific content and structure may vary depending on the individual's personal preferences and circumstances. As for different types of Carrollton Texas Legal Last Will and Testament Forms for Married Person with Adult Children, there may be variations based on factors such as the complexity of the individual's financial situation, the presence of trusts or charitable donations, or other specific requirements they wish to incorporate into their will. However, the basic structure and provisions outlined above generally remain consistent.The Carrollton Texas Legal Last Will and Testament Form for Married Person with Adult Children is a legally binding document that allows individuals in Carrollton, Texas to outline their final wishes and distribute their assets upon their passing. This specialized form is specifically designed for married individuals who have adult children. It enables them to ensure that their assets are distributed according to their preferences, providing clarity and avoiding confusion or potential disputes among family members. The Carrollton Texas Legal Last Will and Testament Form for Married Person with Adult Children includes various sections that address different aspects of a person's final wishes. These sections typically cover: 1. Identification and Introduction: This section includes personal information such as the individual's full legal name, date of birth, marital status, and the information of their spouse, as well as a brief introduction stating the purpose of the document. 2. Appointment of Executor: Individuals can designate an executor, responsible for carrying out their wishes and distributing their assets as outlined in the will. The executor ensures that all debts, taxes, and expenses are settled before distributing assets to beneficiaries. 3. Distribution of Assets: In this section, individuals can specify how they want their assets, including property, investments, and personal belongings, to be distributed among their adult children and potentially other beneficiaries. They can assign specific items to particular individuals or divide their assets equally among their children. 4. Guardianship Provision: If the individual's minor children are still under the care of their surviving spouse, they may include a guardianship provision in the event that the surviving spouse is unable to fulfill the role. This provision identifies a guardian who will assume responsibility for the care and upbringing of the minor children. 5. Residuary Clause: This clause ensures that any remaining assets not specifically mentioned in the will are distributed according to the individual's overall wishes. It covers any unforeseen circumstances or newly acquired assets that were not explicitly addressed in the will. It is important to note that while the aforementioned sections are common in most Last Will and Testament forms, the specific content and structure may vary depending on the individual's personal preferences and circumstances. As for different types of Carrollton Texas Legal Last Will and Testament Forms for Married Person with Adult Children, there may be variations based on factors such as the complexity of the individual's financial situation, the presence of trusts or charitable donations, or other specific requirements they wish to incorporate into their will. However, the basic structure and provisions outlined above generally remain consistent.