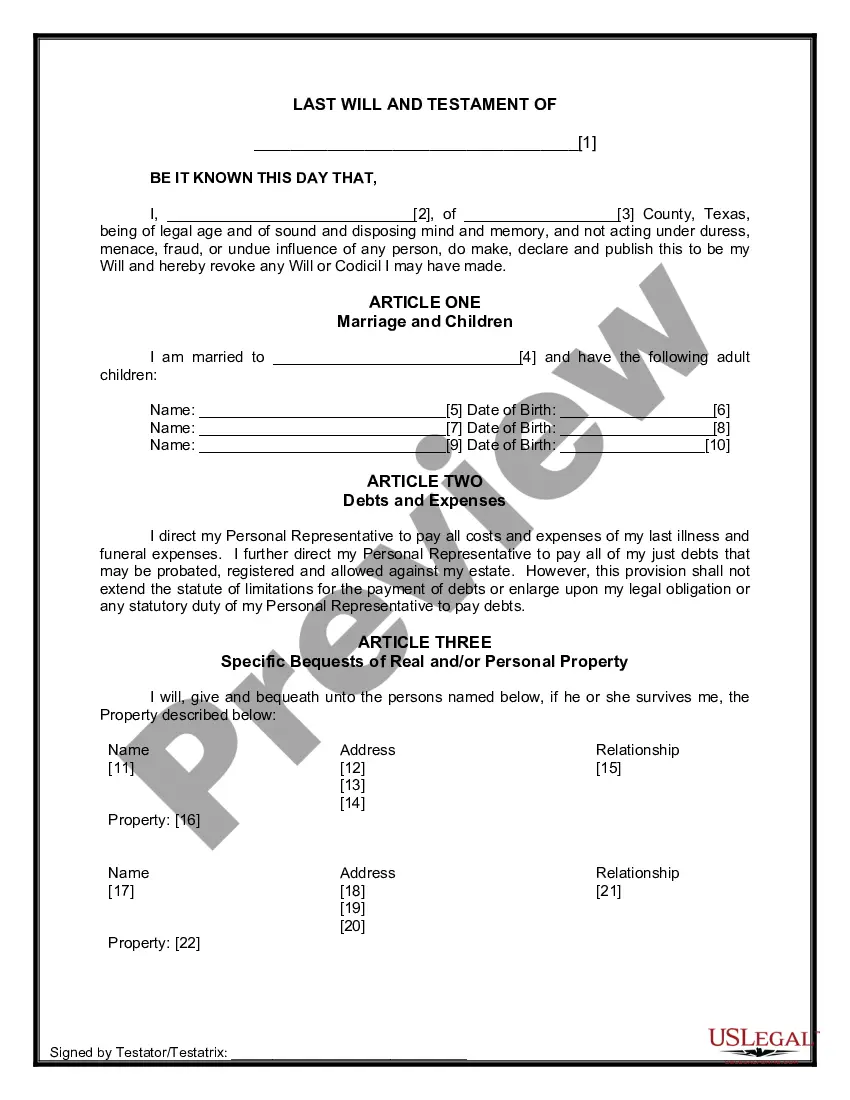

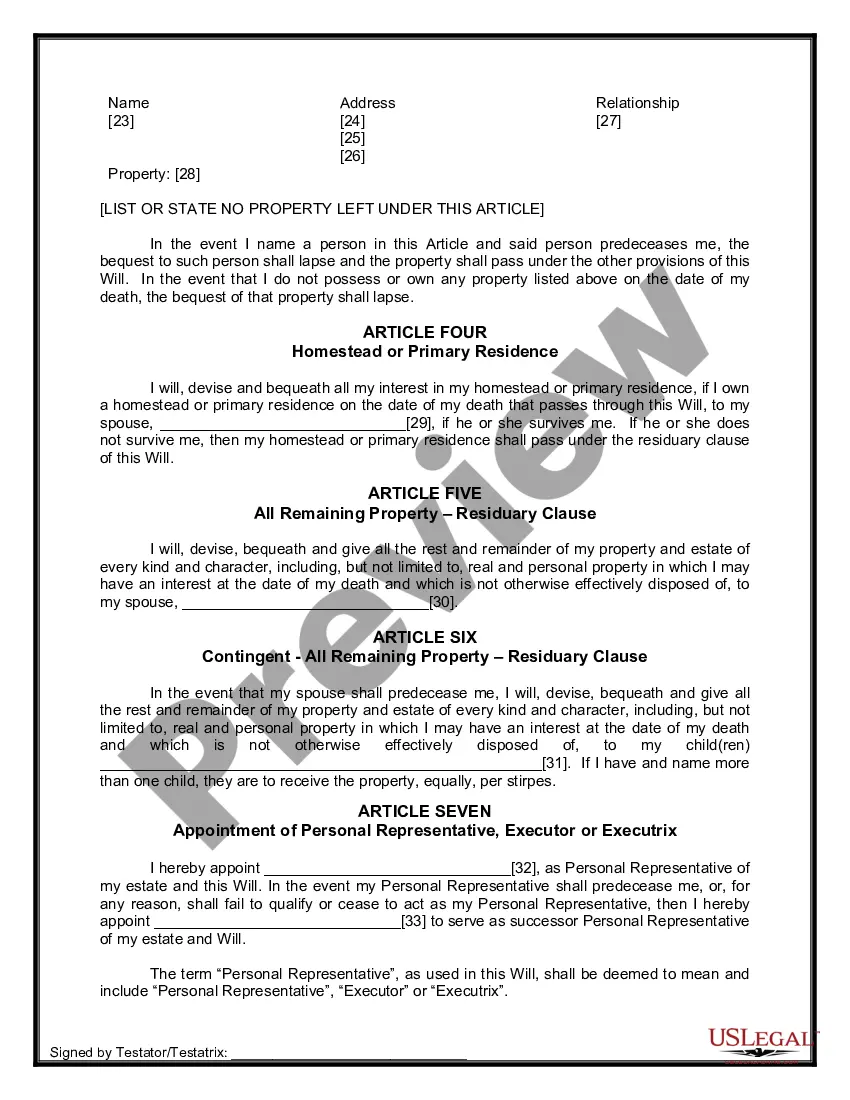

The Will you have found is for a married person with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children.

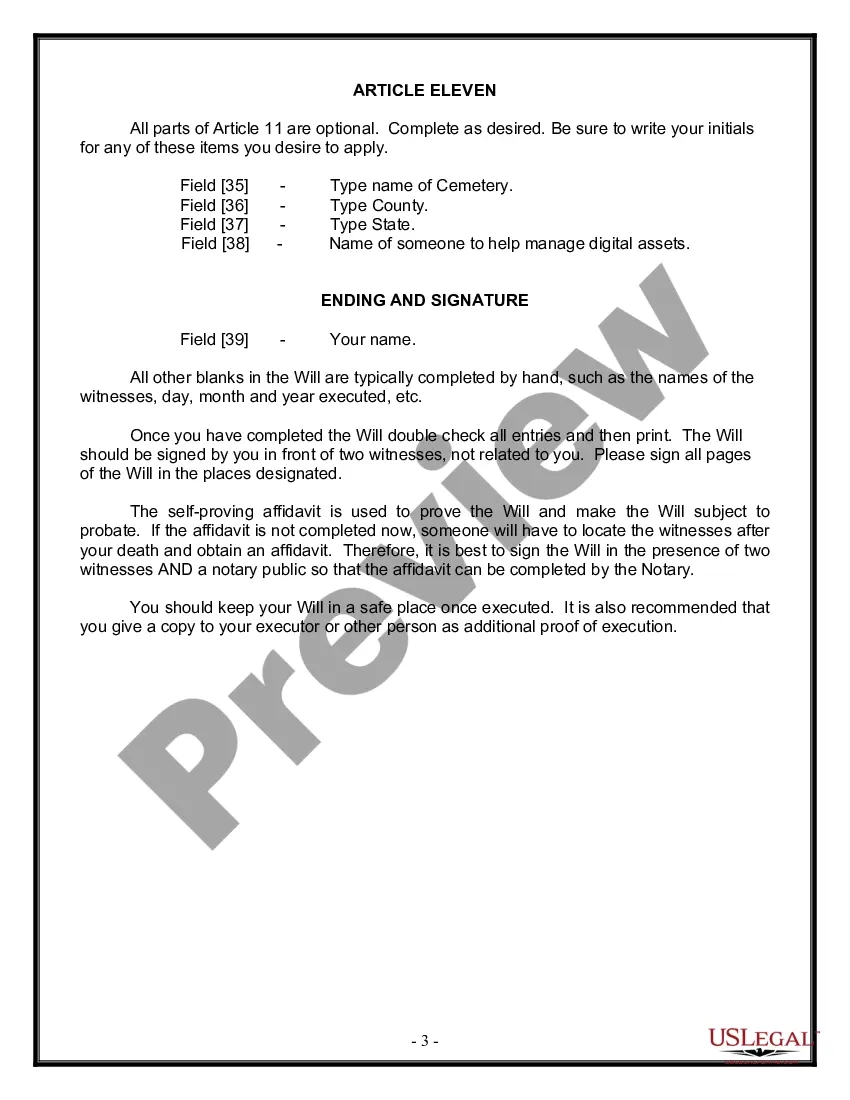

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

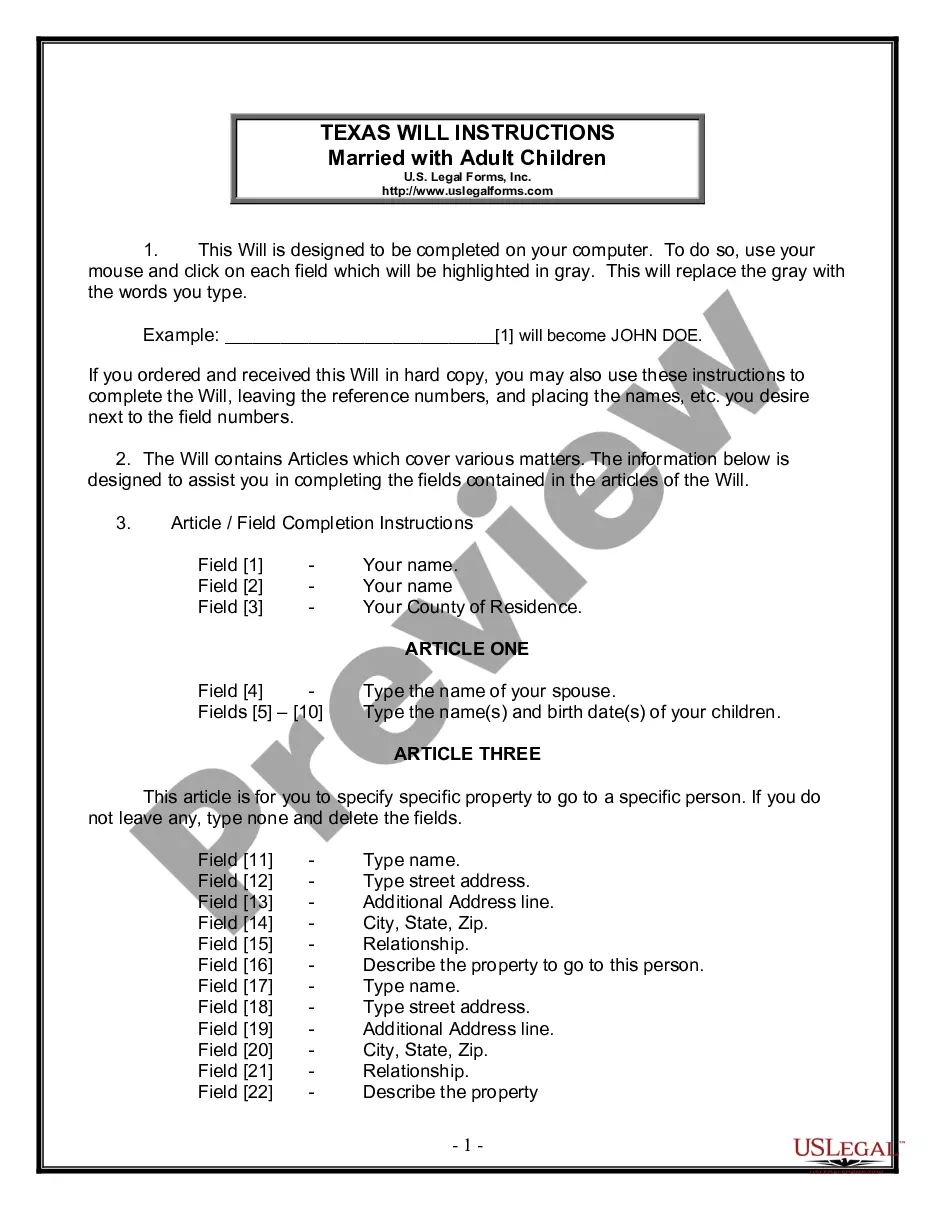

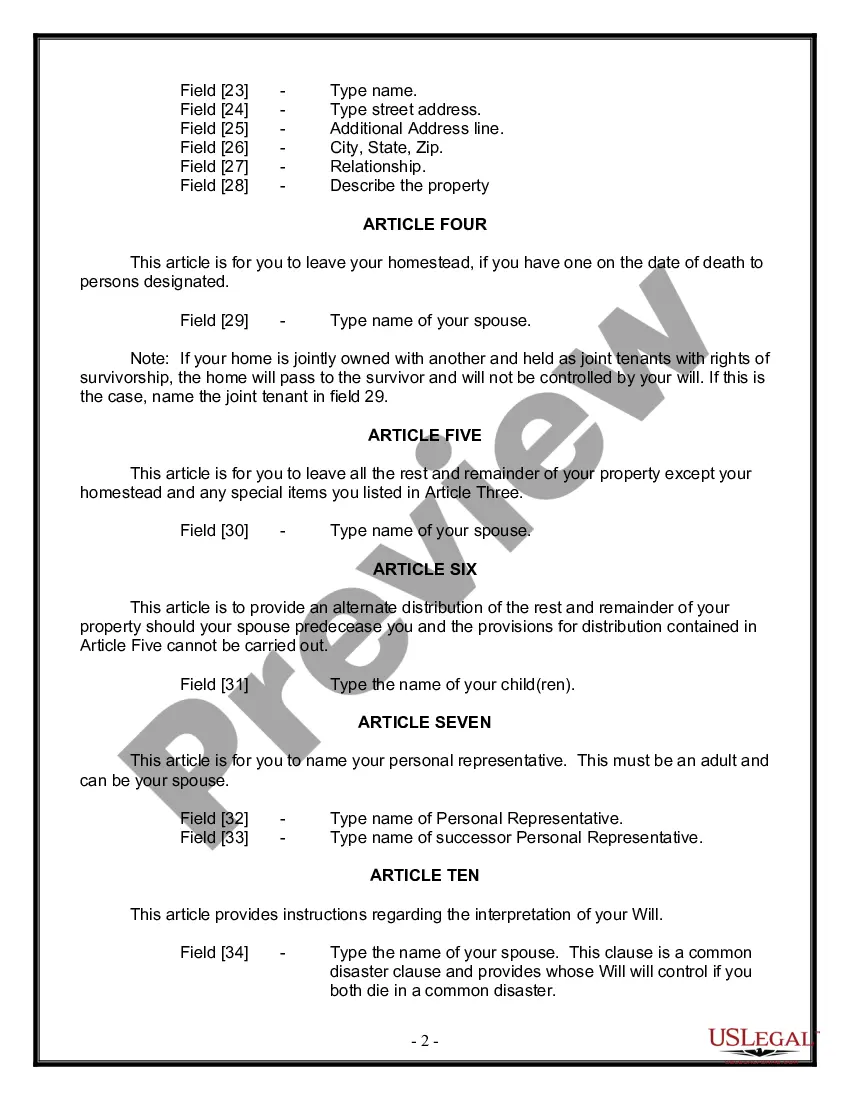

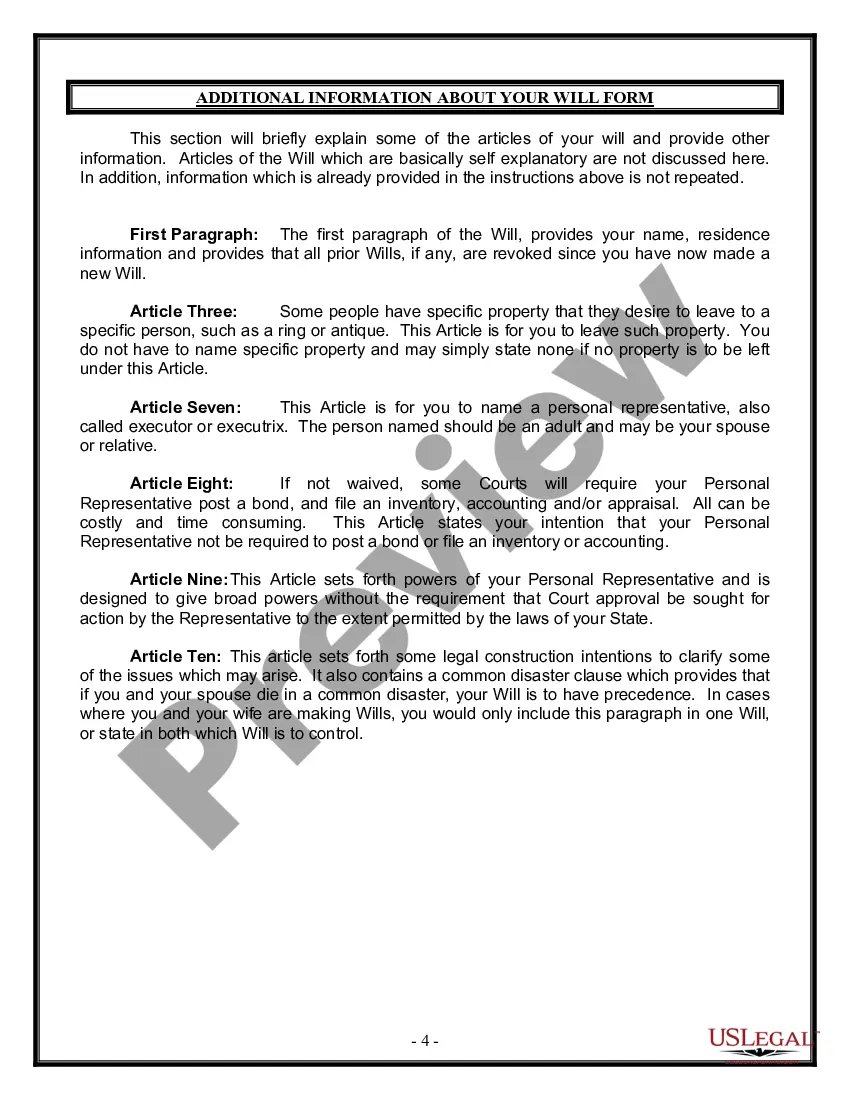

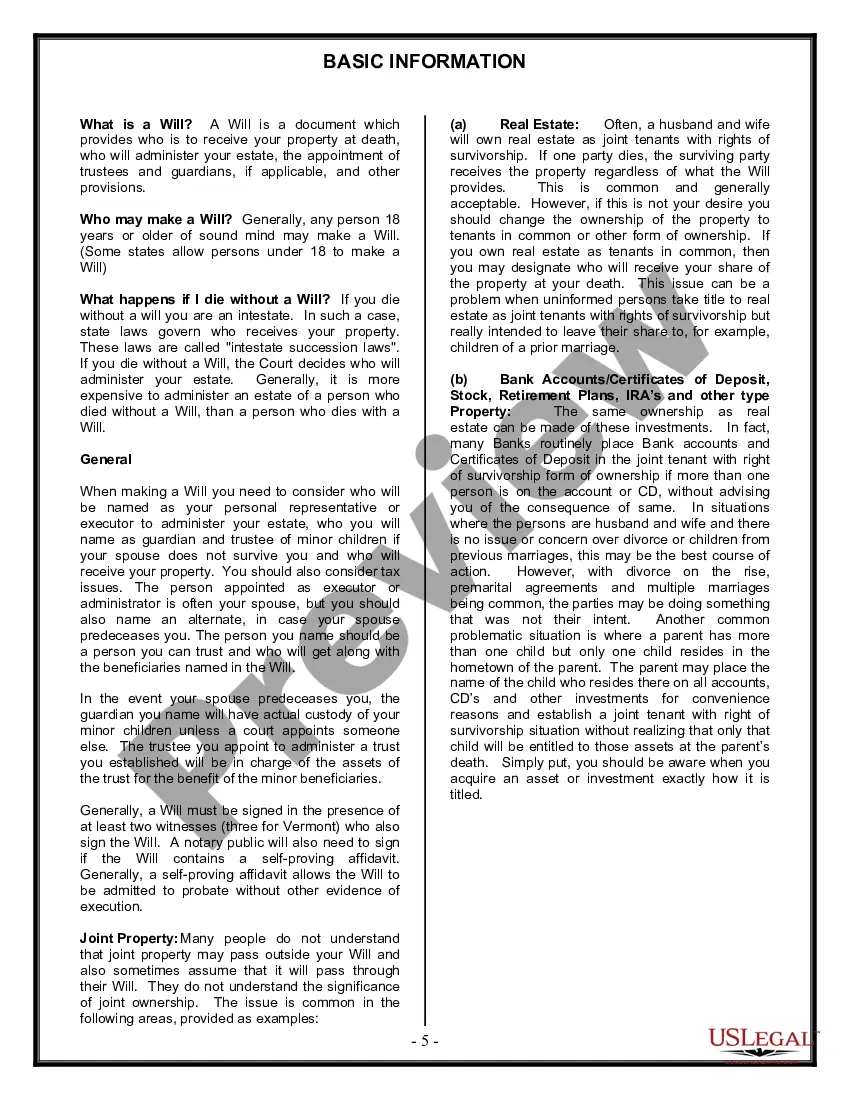

The Mesquite Texas Legal Last Will and Testament Form for Married Person with Adult Children is a legal document that allows individuals in the state of Texas to outline their final wishes regarding the distribution of their assets and the care of their children upon their death. This particular form is specifically designed for married individuals with adult children. Creating a valid Last Will and Testament is essential to ensure that your wishes are carried out after you pass away. Without a proper will, the state's intestacy laws will dictate how your assets will be distributed, which may not align with your preferences or best interests. The Mesquite Texas Legal Last Will and Testament Form for Married Person with Adult Children includes various sections such as: 1. Personal Information: This section requires the individual to provide their full legal name, address, and other relevant personal details. 2. Declaration of Marital Status: Here, the individual must indicate their marital status as married, along with their spouse's name. 3. Appointment of Executor: This section allows the individual to designate an executor, who will be responsible for administering their estate, including distributing assets, paying debts, and handling any legal procedures. 4. Guardianship: If the individual has adult children who are still dependent on them or have special needs, they can name a guardian to ensure their ongoing care and protection. 5. Asset Distribution: The individual can specify how their assets, including real estate, investments, bank accounts, and personal belongings, should be distributed among their spouse and adult children. 6. Alternate Beneficiaries: In case any of the primary beneficiaries predecease the individual, this section enables them to name alternate beneficiaries to receive their share of the estate. 7. Residue of the Estate: This part allows the individual to determine how any remaining assets or belongings should be distributed after specific bequests and debts are settled. Different types of Mesquite Texas Legal Last Will and Testament Forms for Married Person with Adult Children may include specific variations designed to cater to unique circumstances. Some specific types may include: 1. Mesquite Texas Legal Last Will and Testament Form with Trust: This type of will includes provisions for creating a trust to manage the distribution of assets, particularly for minors or individuals with special needs. 2. Mesquite Texas Legal Last Will and Testament Form with Charitable Bequests: This variation allows individuals to leave a portion of their estate or specific assets to charitable organizations or causes close to their heart. It is essential to consult with an experienced attorney or legal professional to ensure the correct form is used and that all aspects of the Last Will and Testament align with state laws and individual circumstances.The Mesquite Texas Legal Last Will and Testament Form for Married Person with Adult Children is a legal document that allows individuals in the state of Texas to outline their final wishes regarding the distribution of their assets and the care of their children upon their death. This particular form is specifically designed for married individuals with adult children. Creating a valid Last Will and Testament is essential to ensure that your wishes are carried out after you pass away. Without a proper will, the state's intestacy laws will dictate how your assets will be distributed, which may not align with your preferences or best interests. The Mesquite Texas Legal Last Will and Testament Form for Married Person with Adult Children includes various sections such as: 1. Personal Information: This section requires the individual to provide their full legal name, address, and other relevant personal details. 2. Declaration of Marital Status: Here, the individual must indicate their marital status as married, along with their spouse's name. 3. Appointment of Executor: This section allows the individual to designate an executor, who will be responsible for administering their estate, including distributing assets, paying debts, and handling any legal procedures. 4. Guardianship: If the individual has adult children who are still dependent on them or have special needs, they can name a guardian to ensure their ongoing care and protection. 5. Asset Distribution: The individual can specify how their assets, including real estate, investments, bank accounts, and personal belongings, should be distributed among their spouse and adult children. 6. Alternate Beneficiaries: In case any of the primary beneficiaries predecease the individual, this section enables them to name alternate beneficiaries to receive their share of the estate. 7. Residue of the Estate: This part allows the individual to determine how any remaining assets or belongings should be distributed after specific bequests and debts are settled. Different types of Mesquite Texas Legal Last Will and Testament Forms for Married Person with Adult Children may include specific variations designed to cater to unique circumstances. Some specific types may include: 1. Mesquite Texas Legal Last Will and Testament Form with Trust: This type of will includes provisions for creating a trust to manage the distribution of assets, particularly for minors or individuals with special needs. 2. Mesquite Texas Legal Last Will and Testament Form with Charitable Bequests: This variation allows individuals to leave a portion of their estate or specific assets to charitable organizations or causes close to their heart. It is essential to consult with an experienced attorney or legal professional to ensure the correct form is used and that all aspects of the Last Will and Testament align with state laws and individual circumstances.