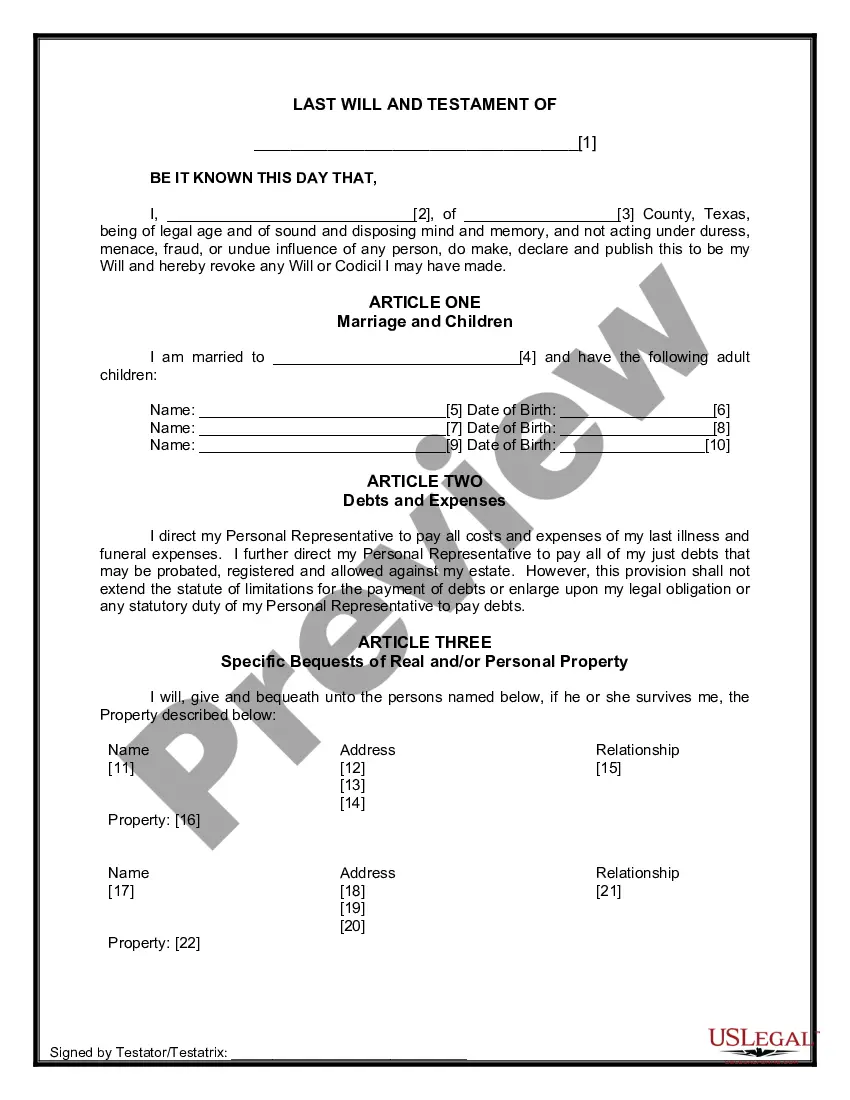

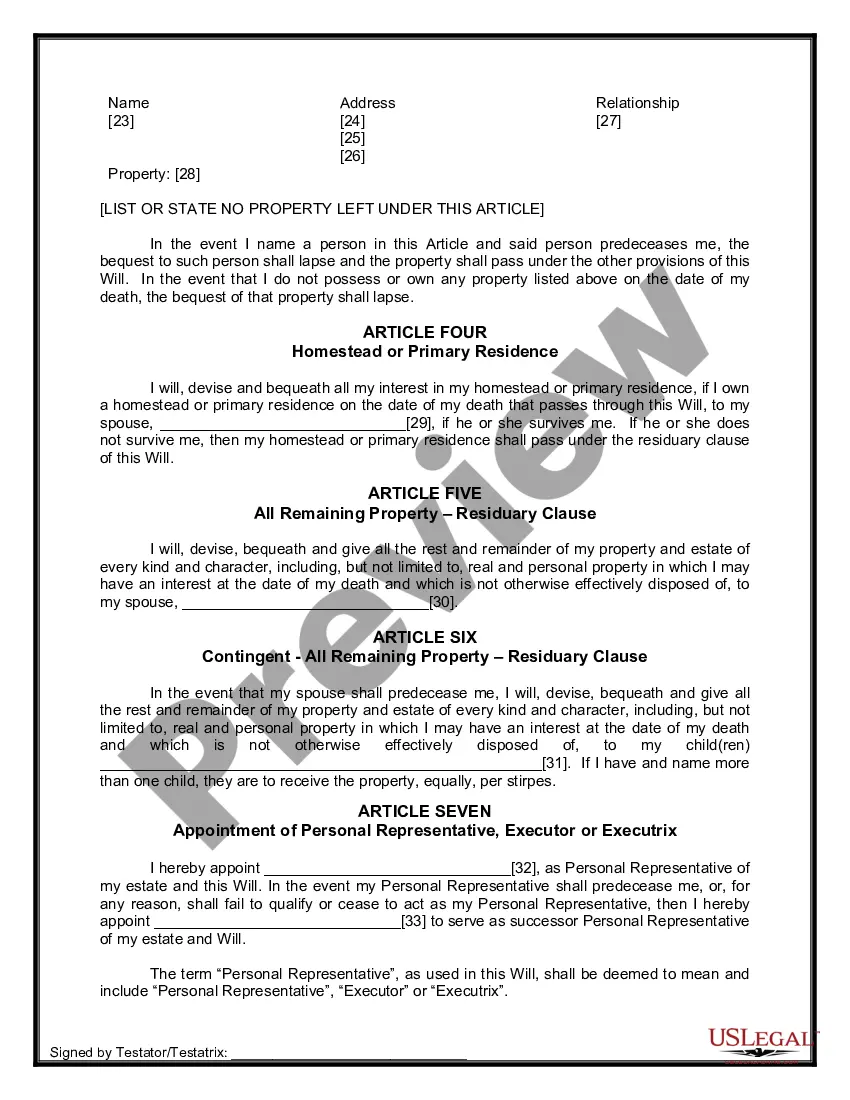

The Will you have found is for a married person with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children.

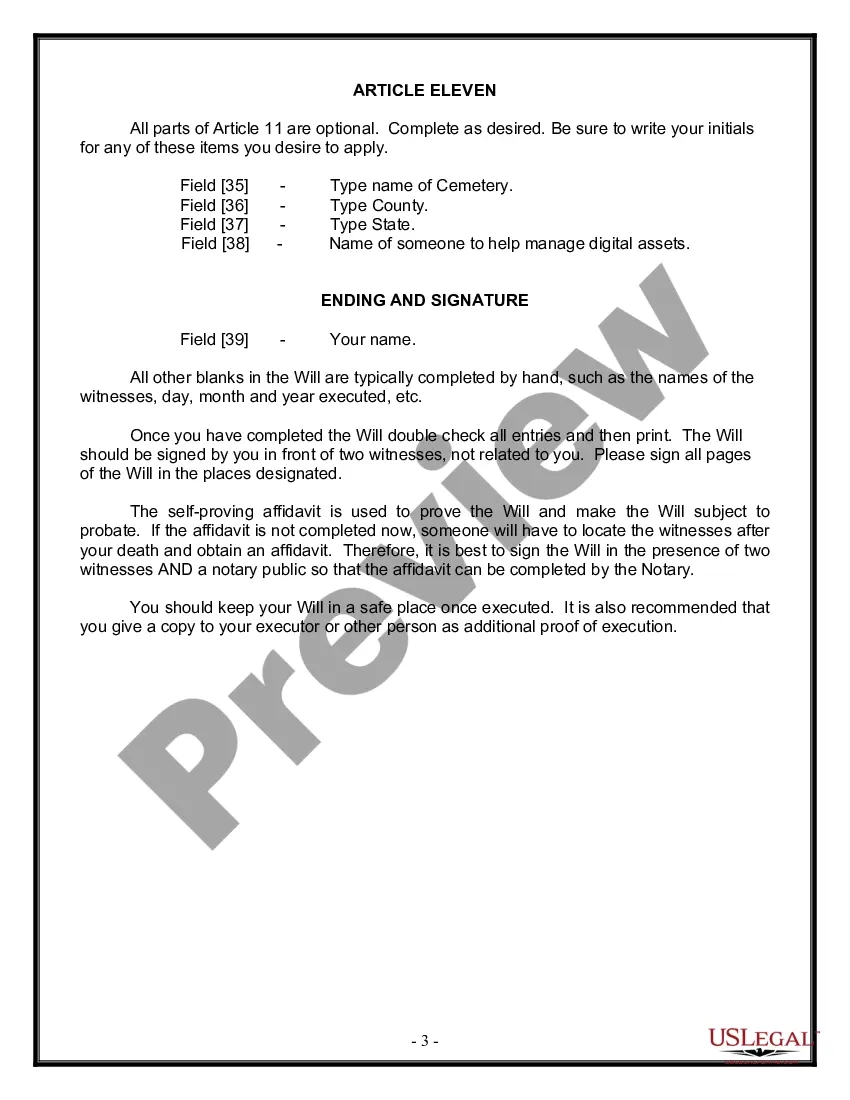

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

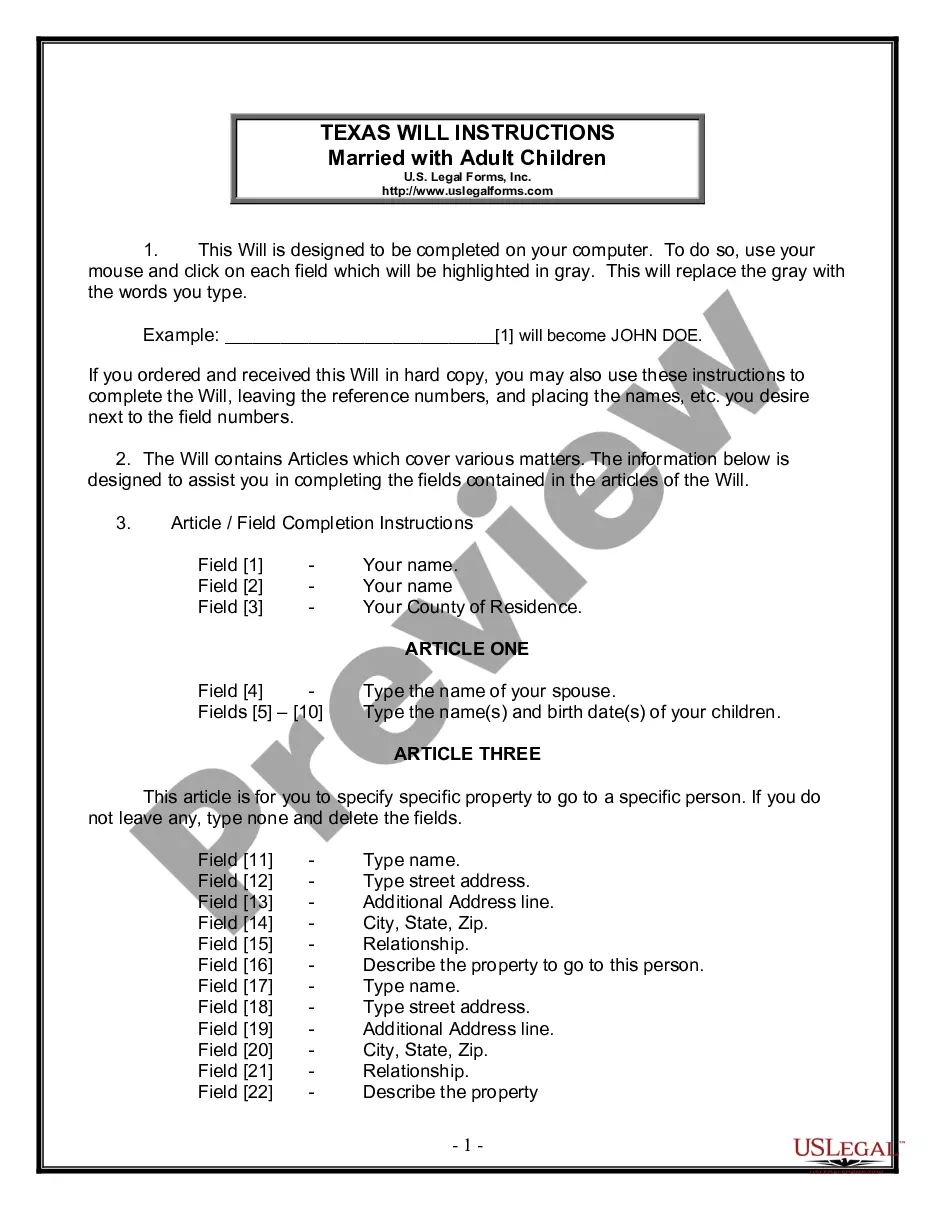

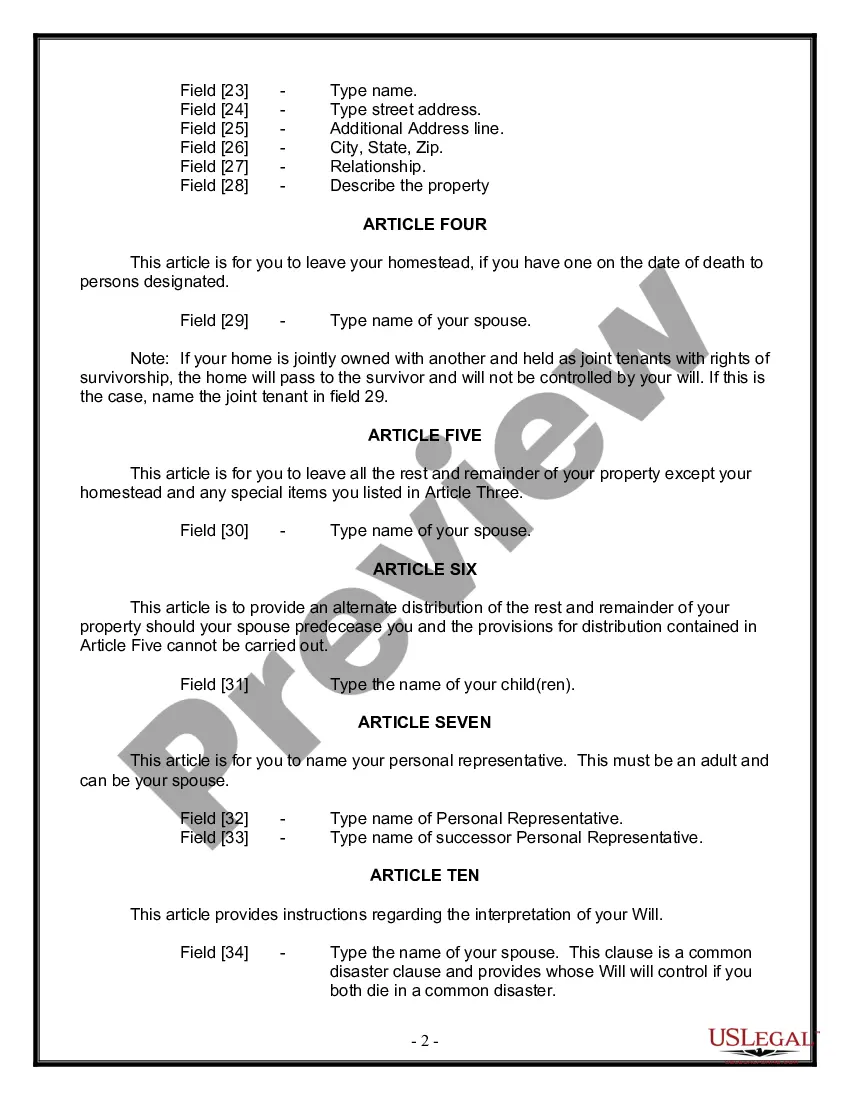

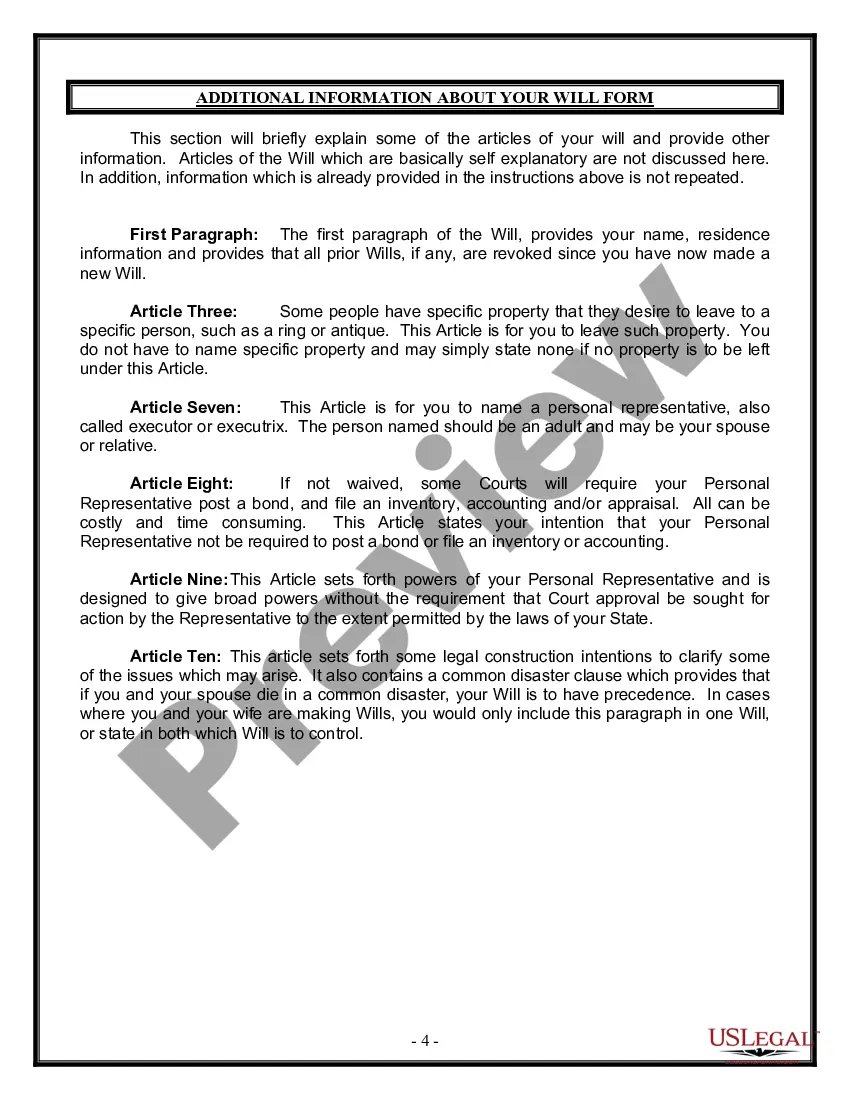

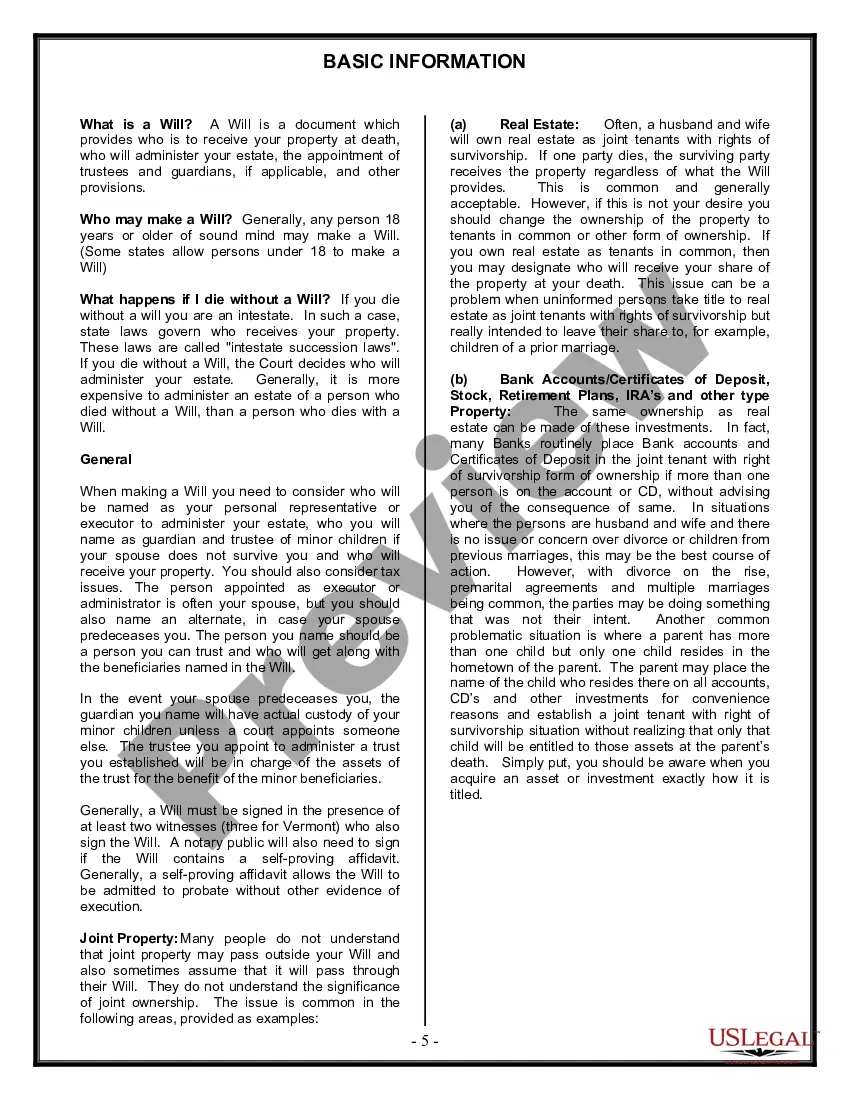

When it comes to estate planning, it is crucial for married individuals with adult children to have a Last Will and Testament in place to ensure their wishes are carried out after they pass away. In Round Rock, Texas, there are various legal forms available specifically designed for this purpose. The Round Rock Texas Legal Last Will and Testament Form for Married Person with Adult Children is a legal document that allows individuals to outline how their assets and properties should be distributed among their beneficiaries, particularly their adult children, upon their death. This comprehensive legal form provides specific instructions and guidelines to ensure a smooth and fair distribution of assets. The Round Rock Texas Legal Last Will and Testament Form for Married Person with Adult Children typically covers various important aspects, including: 1. Personal Information: It starts with gathering personal information of the testator (the person creating the will), such as their full name, address, and marital status. 2. Appointment of Executor: This form allows the testator to appoint an executor, who will be responsible for managing and distributing the estate as per the outlined instructions. 3. Distribution of Assets: The form enables the testator to specify how their assets, including real estate, bank accounts, investments, and personal belongings, should be distributed among their adult children. They can distribute assets equally or specify different shares for each beneficiary. 4. Guardianship Designation: If the testator has minor children, this form provides an opportunity to designate a legal guardian who will be responsible for their well-being in the event that both parents pass away. 5. Debts and Taxes: This form also addresses any outstanding debts, taxes, or expenses that need to be settled from the estate before the distribution of assets. 6. Residual Clause: The form often includes a residual clause that designates how any remaining or unspecified assets should be distributed after fulfilling the primary beneficiaries' share. Some variant forms of Round Rock Texas Legal Last Will and Testament specifically tailored for married individuals with adult children may focus on unique situations, such as: 1. Living Will: This additional form allows individuals to outline their medical treatment preferences, particularly regarding life-sustaining measures, in case they become incapacitated or unable to communicate their wishes. 2. Trusts: Some Last Will and Testament forms may include provisions for establishing a trust for the adult children. This trust can provide additional protection, management, and control over the assets, ensuring that they are used wisely and according to the testator's wishes. It is important to consult with an attorney well-versed in Texas estate planning laws to ensure that the Last Will and Testament form chosen is legally binding and customized to address the specific needs and goals of the testator and their family.When it comes to estate planning, it is crucial for married individuals with adult children to have a Last Will and Testament in place to ensure their wishes are carried out after they pass away. In Round Rock, Texas, there are various legal forms available specifically designed for this purpose. The Round Rock Texas Legal Last Will and Testament Form for Married Person with Adult Children is a legal document that allows individuals to outline how their assets and properties should be distributed among their beneficiaries, particularly their adult children, upon their death. This comprehensive legal form provides specific instructions and guidelines to ensure a smooth and fair distribution of assets. The Round Rock Texas Legal Last Will and Testament Form for Married Person with Adult Children typically covers various important aspects, including: 1. Personal Information: It starts with gathering personal information of the testator (the person creating the will), such as their full name, address, and marital status. 2. Appointment of Executor: This form allows the testator to appoint an executor, who will be responsible for managing and distributing the estate as per the outlined instructions. 3. Distribution of Assets: The form enables the testator to specify how their assets, including real estate, bank accounts, investments, and personal belongings, should be distributed among their adult children. They can distribute assets equally or specify different shares for each beneficiary. 4. Guardianship Designation: If the testator has minor children, this form provides an opportunity to designate a legal guardian who will be responsible for their well-being in the event that both parents pass away. 5. Debts and Taxes: This form also addresses any outstanding debts, taxes, or expenses that need to be settled from the estate before the distribution of assets. 6. Residual Clause: The form often includes a residual clause that designates how any remaining or unspecified assets should be distributed after fulfilling the primary beneficiaries' share. Some variant forms of Round Rock Texas Legal Last Will and Testament specifically tailored for married individuals with adult children may focus on unique situations, such as: 1. Living Will: This additional form allows individuals to outline their medical treatment preferences, particularly regarding life-sustaining measures, in case they become incapacitated or unable to communicate their wishes. 2. Trusts: Some Last Will and Testament forms may include provisions for establishing a trust for the adult children. This trust can provide additional protection, management, and control over the assets, ensuring that they are used wisely and according to the testator's wishes. It is important to consult with an attorney well-versed in Texas estate planning laws to ensure that the Last Will and Testament form chosen is legally binding and customized to address the specific needs and goals of the testator and their family.