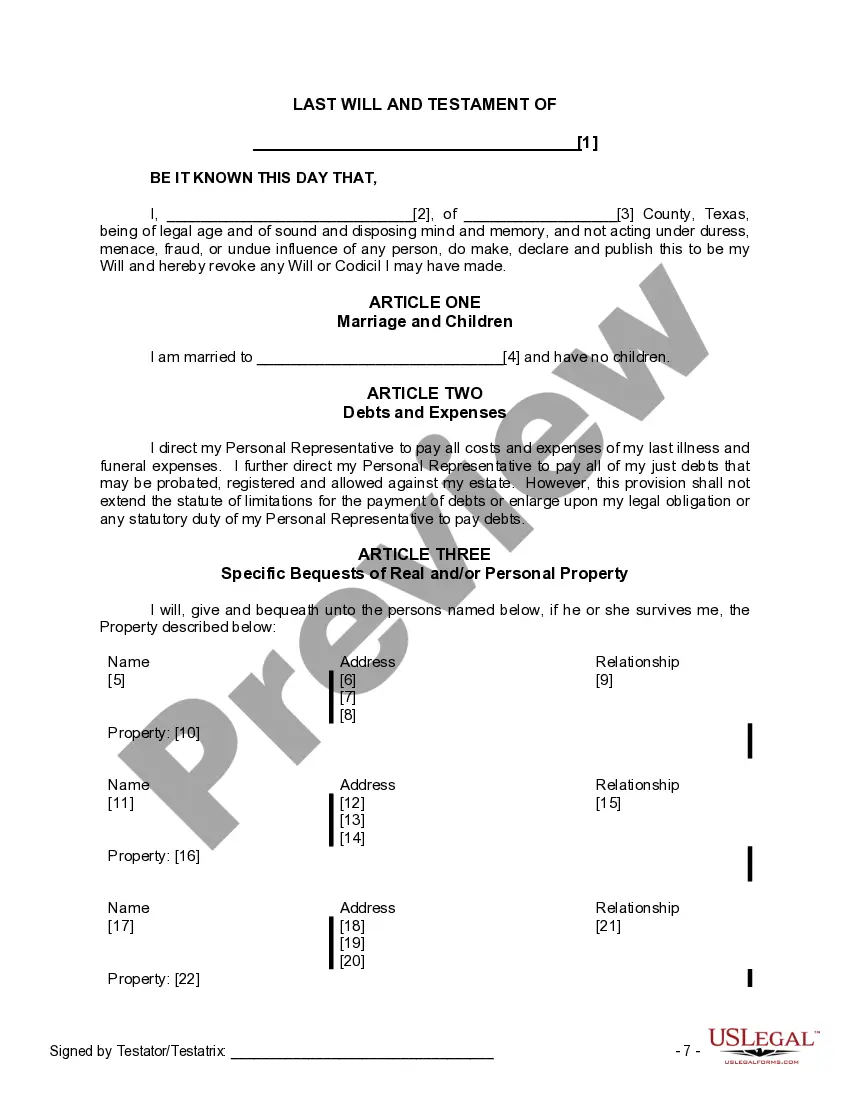

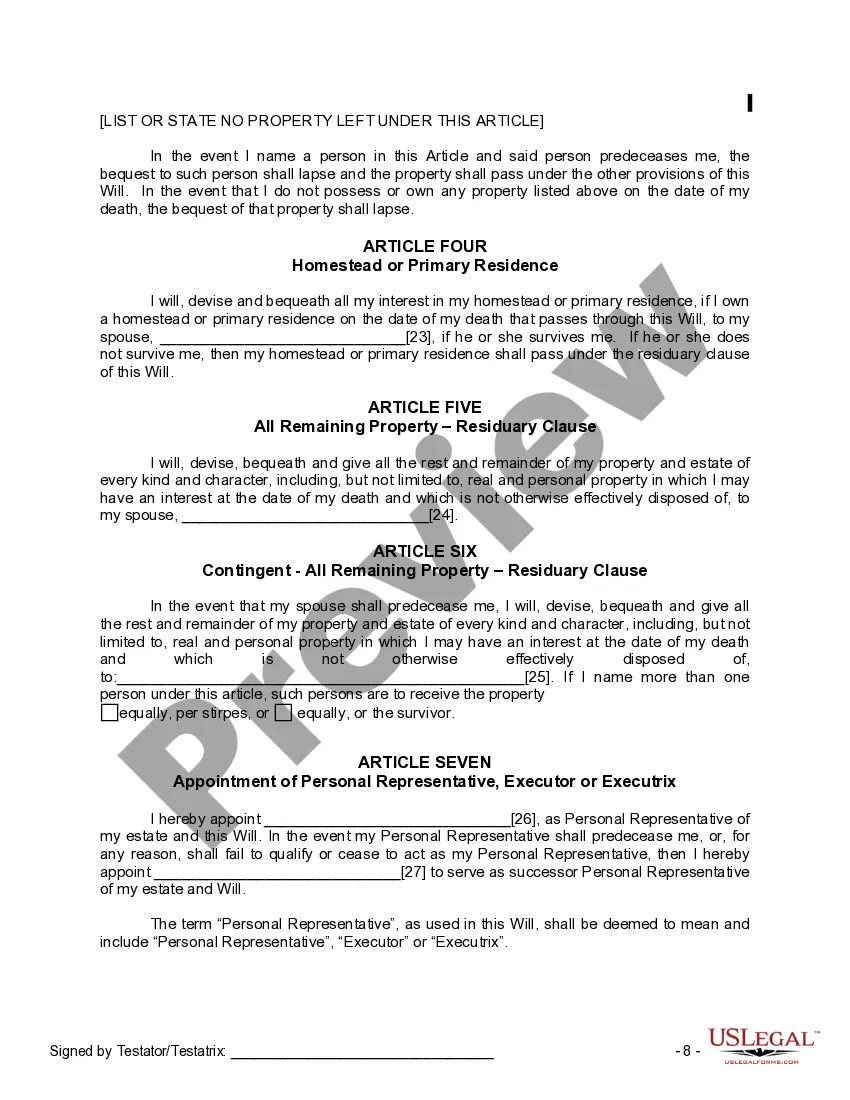

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

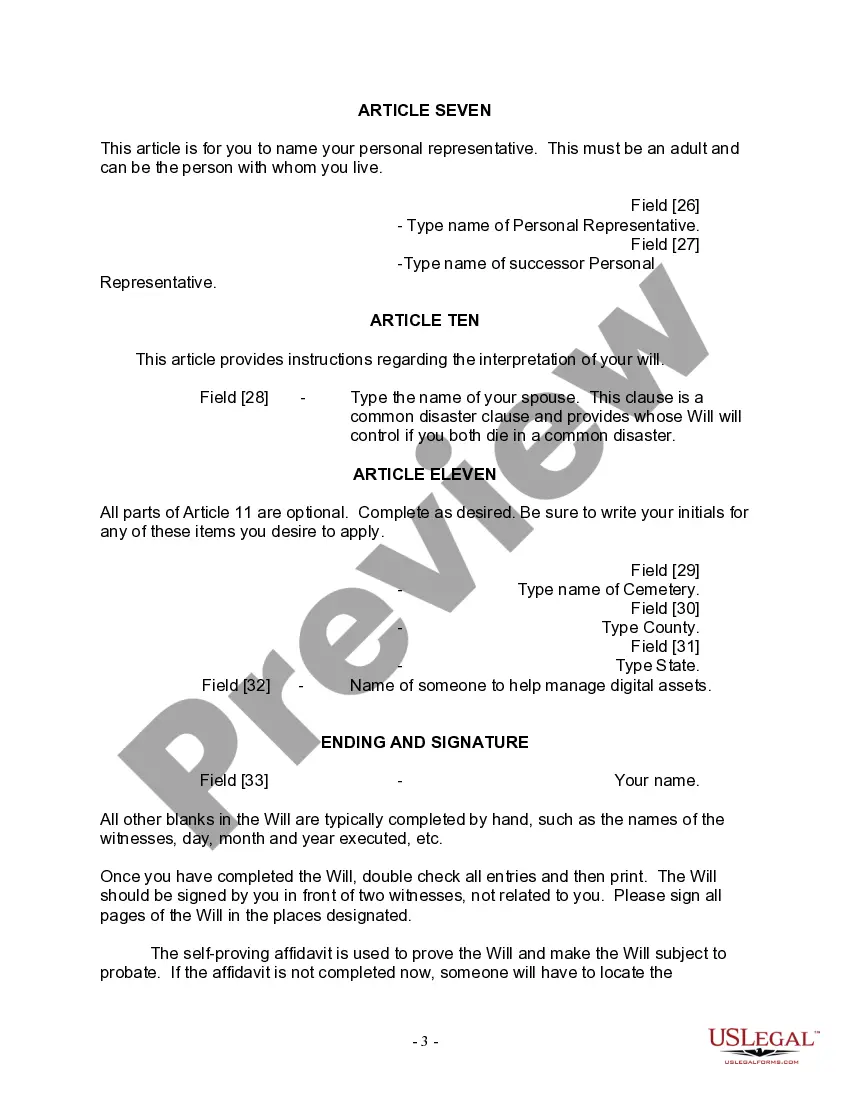

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

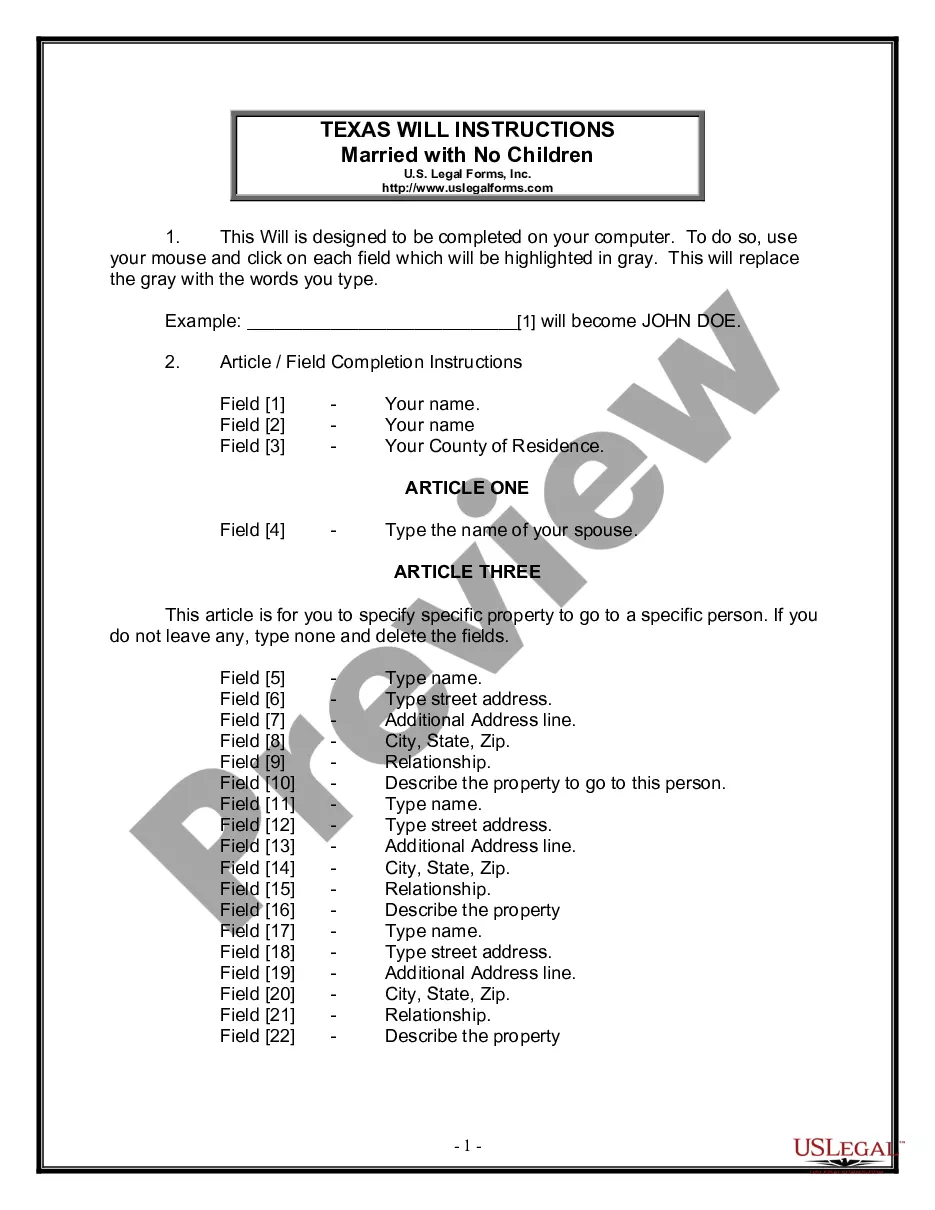

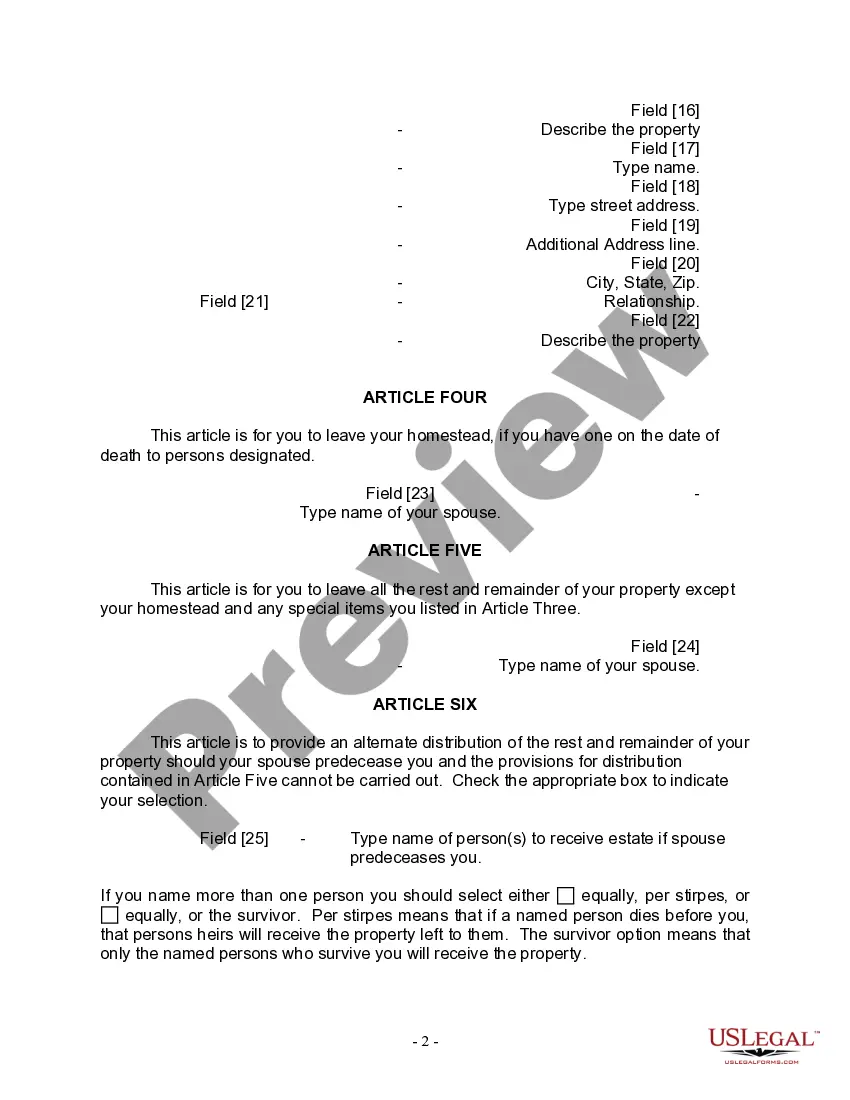

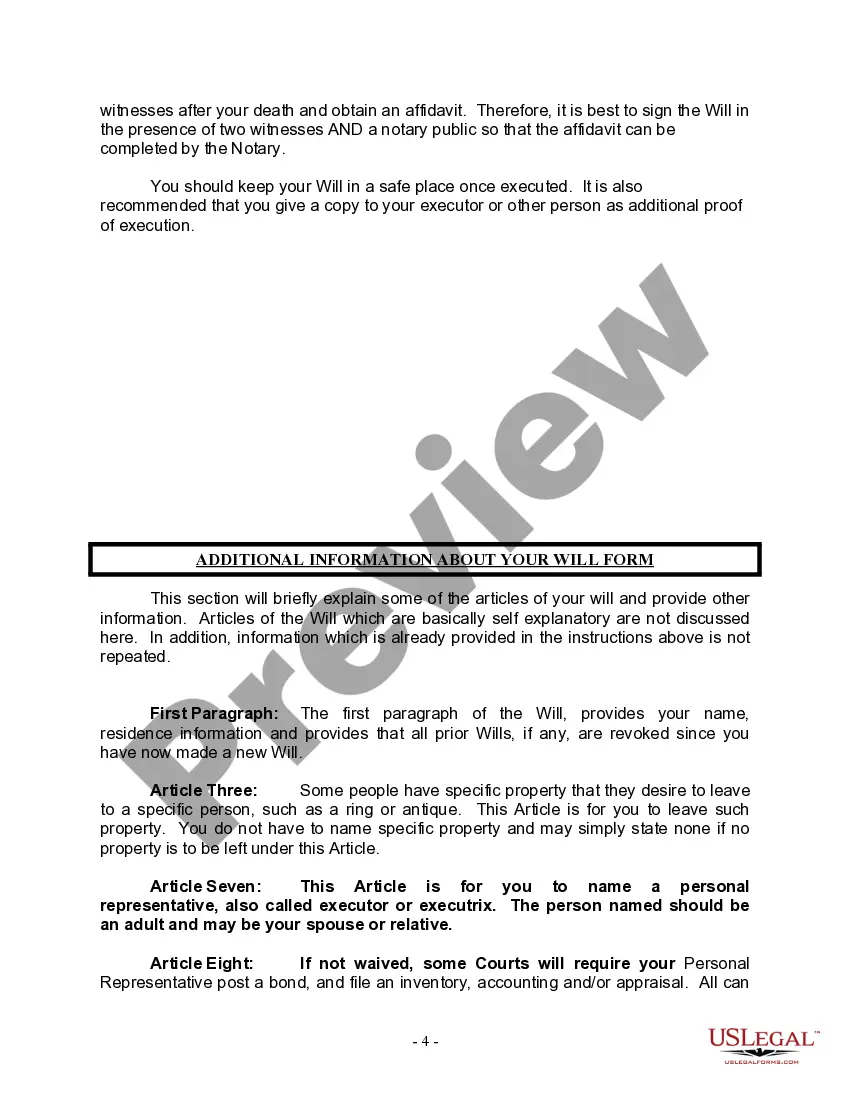

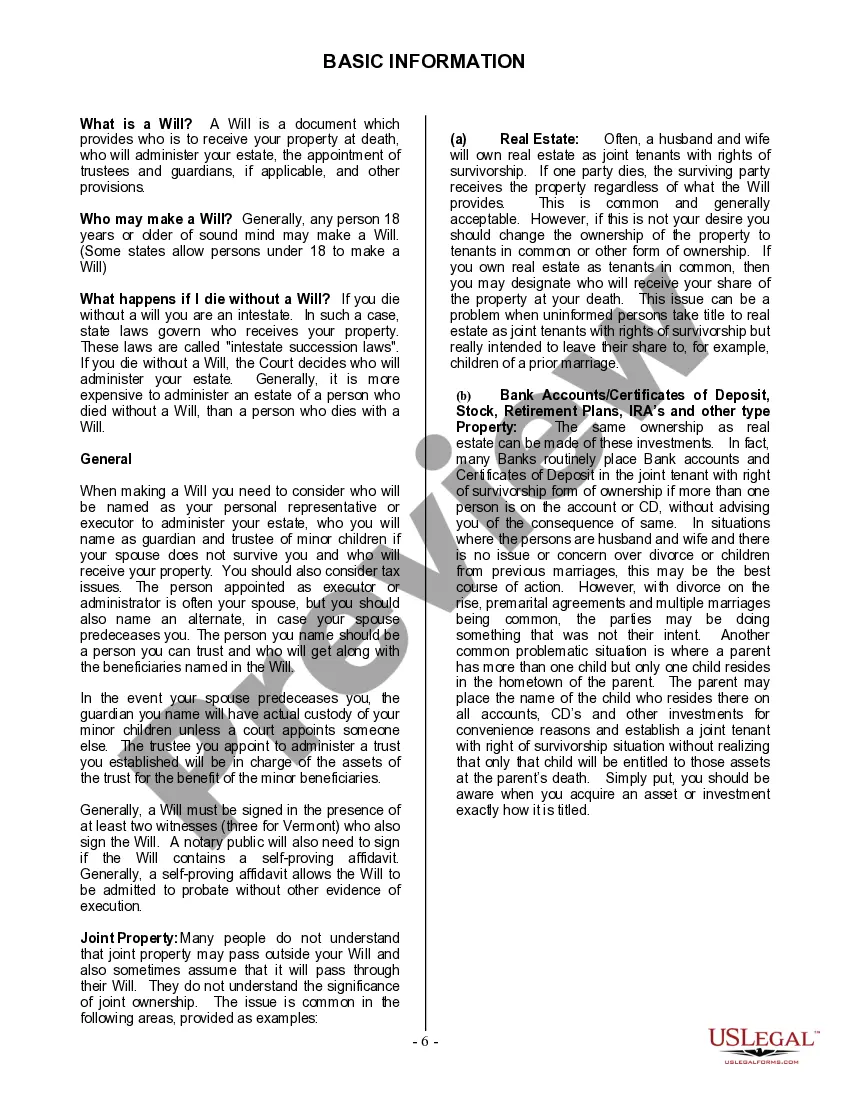

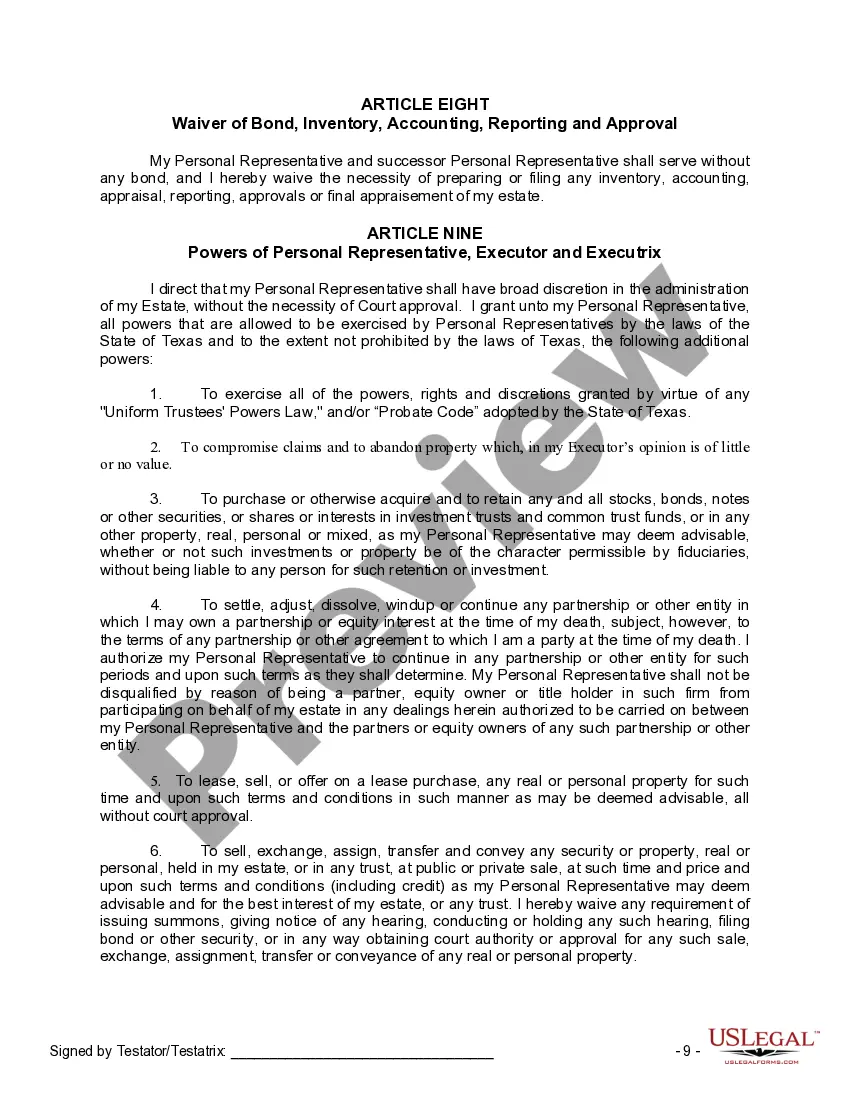

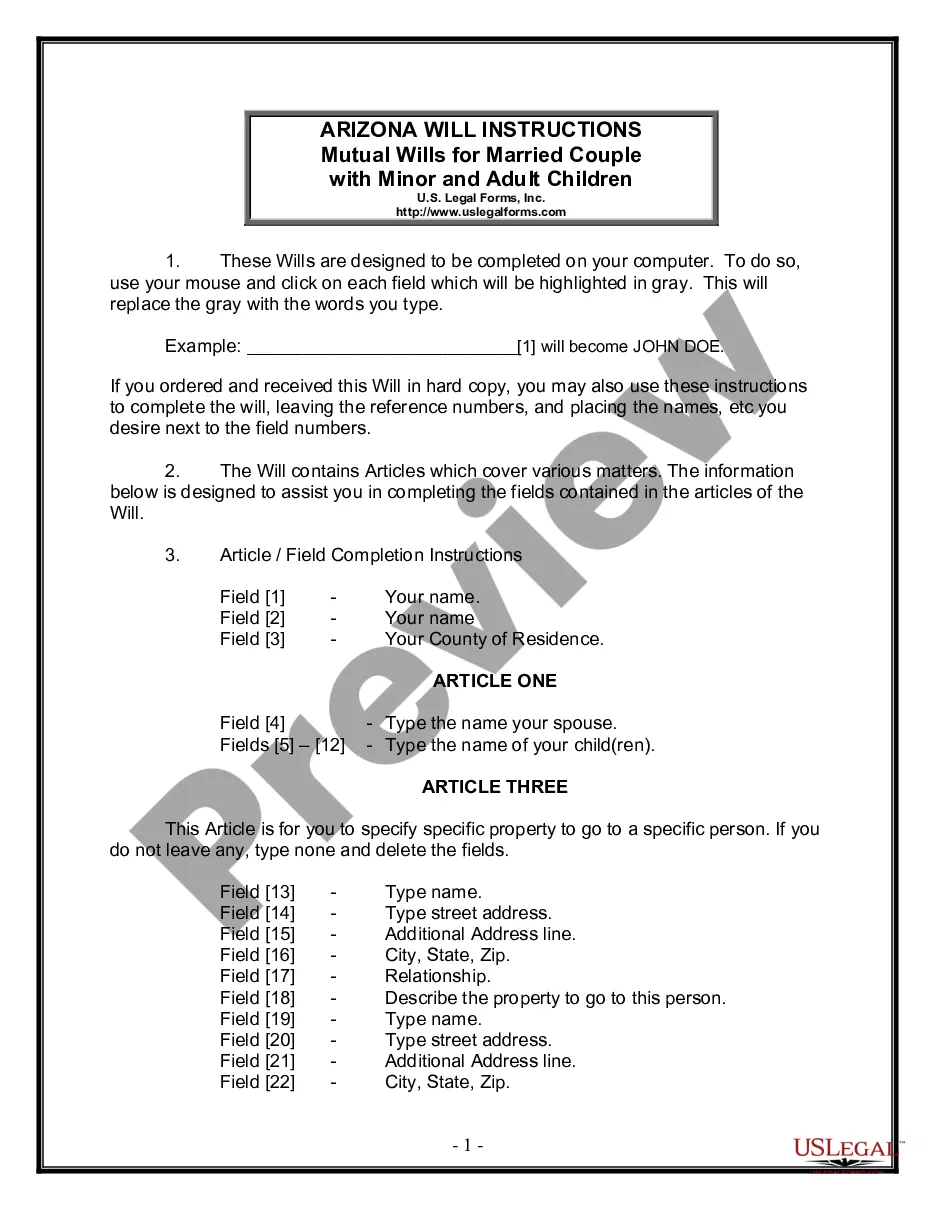

The Austin Texas Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows married individuals with no children to outline their final wishes regarding the distribution of their assets, debts, and other important matters upon their death. This form ensures that their property, finances, and personal belongings are handled according to their specific instructions and prevents any potential conflicts or disputes among family members or beneficiaries. This legal form is designed specifically for residents of Austin, Texas and is compliant with the state's laws and regulations. It is crucial to use the appropriate form for the specific jurisdiction to ensure validity and enforceability. The Austin Texas Legal Last Will and Testament Form for a Married Person with No Children typically includes several key sections: 1. Introduction: This portion of the form states that it is the Last Will and Testament of the individual, along with their full name, address, and marital status. 2. Appointment of Executor: The individual specifies who they want to appoint as the executor of their estate. The executor is responsible for carrying out the instructions outlined in the will, including distributing assets, settling debts, and handling any legal procedures. 3. Distribution of Assets: This section allows the individual to outline how they want their assets to be distributed among their surviving spouse, family members, or any other beneficiaries. It may specify specific instructions for certain items or provide a general distribution plan. 4. Disposition of Digital Assets: With the growing presence of digital assets, this section allows individuals to determine how they want their online accounts, including social media profiles, email accounts, and digital files, to be managed or transferred after their death. 5. Guardianship: If the individual has dependents, this section provides an opportunity to name a guardian who will have legal responsibility for their care and upbringing in the event that both parents pass away. 6. Funeral Arrangements: This section allows the individual to specify their preferences for their funeral or memorial service, including burial or cremation instructions, location preferences, and any desired religious or cultural traditions to be observed. 7. Revocation of Previous Wills: The individual may include a statement that revokes any previous wills or testamentary documents they may have created, ensuring the current will takes precedence. It is important to note that there may be variations or additional forms specific to Austin, Texas, such as the "Living Will" or "Medical Power of Attorney," which address healthcare decisions in case of incapacity. It is recommended to consult with an attorney specializing in estate planning or probate law to ensure that the appropriate forms are used and all legal requirements are met.The Austin Texas Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows married individuals with no children to outline their final wishes regarding the distribution of their assets, debts, and other important matters upon their death. This form ensures that their property, finances, and personal belongings are handled according to their specific instructions and prevents any potential conflicts or disputes among family members or beneficiaries. This legal form is designed specifically for residents of Austin, Texas and is compliant with the state's laws and regulations. It is crucial to use the appropriate form for the specific jurisdiction to ensure validity and enforceability. The Austin Texas Legal Last Will and Testament Form for a Married Person with No Children typically includes several key sections: 1. Introduction: This portion of the form states that it is the Last Will and Testament of the individual, along with their full name, address, and marital status. 2. Appointment of Executor: The individual specifies who they want to appoint as the executor of their estate. The executor is responsible for carrying out the instructions outlined in the will, including distributing assets, settling debts, and handling any legal procedures. 3. Distribution of Assets: This section allows the individual to outline how they want their assets to be distributed among their surviving spouse, family members, or any other beneficiaries. It may specify specific instructions for certain items or provide a general distribution plan. 4. Disposition of Digital Assets: With the growing presence of digital assets, this section allows individuals to determine how they want their online accounts, including social media profiles, email accounts, and digital files, to be managed or transferred after their death. 5. Guardianship: If the individual has dependents, this section provides an opportunity to name a guardian who will have legal responsibility for their care and upbringing in the event that both parents pass away. 6. Funeral Arrangements: This section allows the individual to specify their preferences for their funeral or memorial service, including burial or cremation instructions, location preferences, and any desired religious or cultural traditions to be observed. 7. Revocation of Previous Wills: The individual may include a statement that revokes any previous wills or testamentary documents they may have created, ensuring the current will takes precedence. It is important to note that there may be variations or additional forms specific to Austin, Texas, such as the "Living Will" or "Medical Power of Attorney," which address healthcare decisions in case of incapacity. It is recommended to consult with an attorney specializing in estate planning or probate law to ensure that the appropriate forms are used and all legal requirements are met.