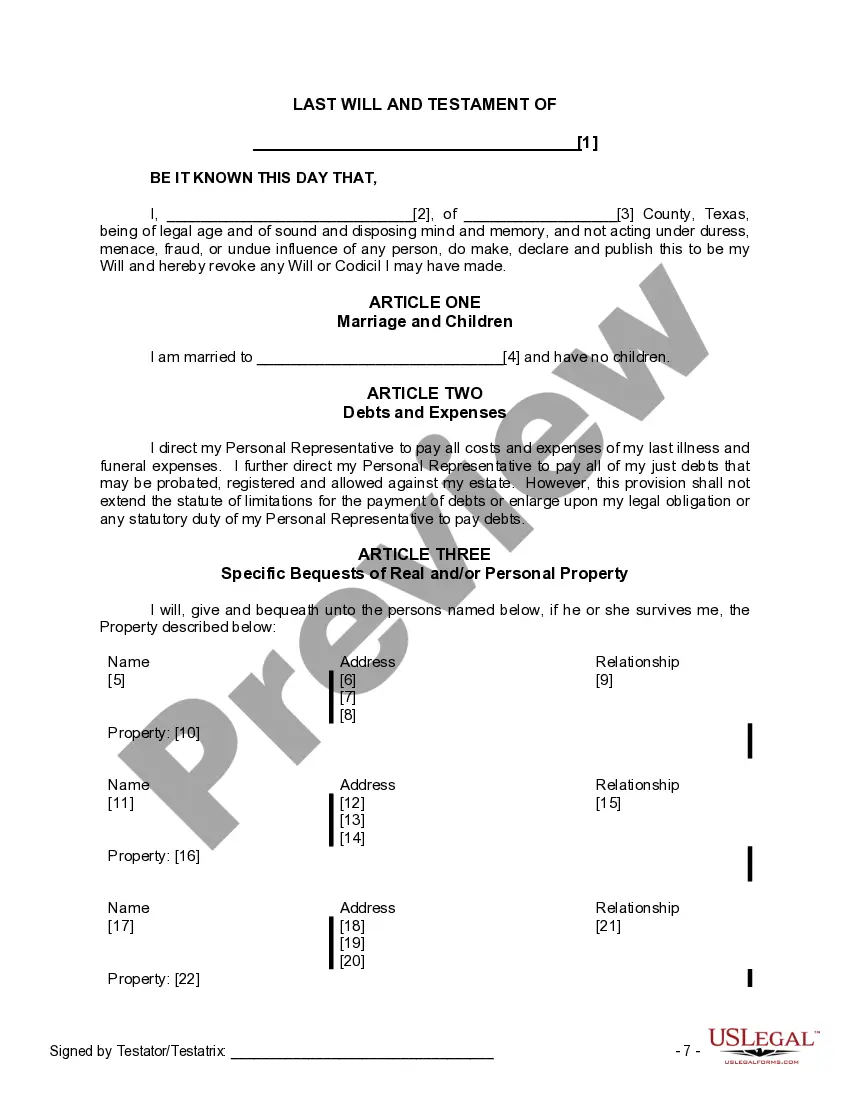

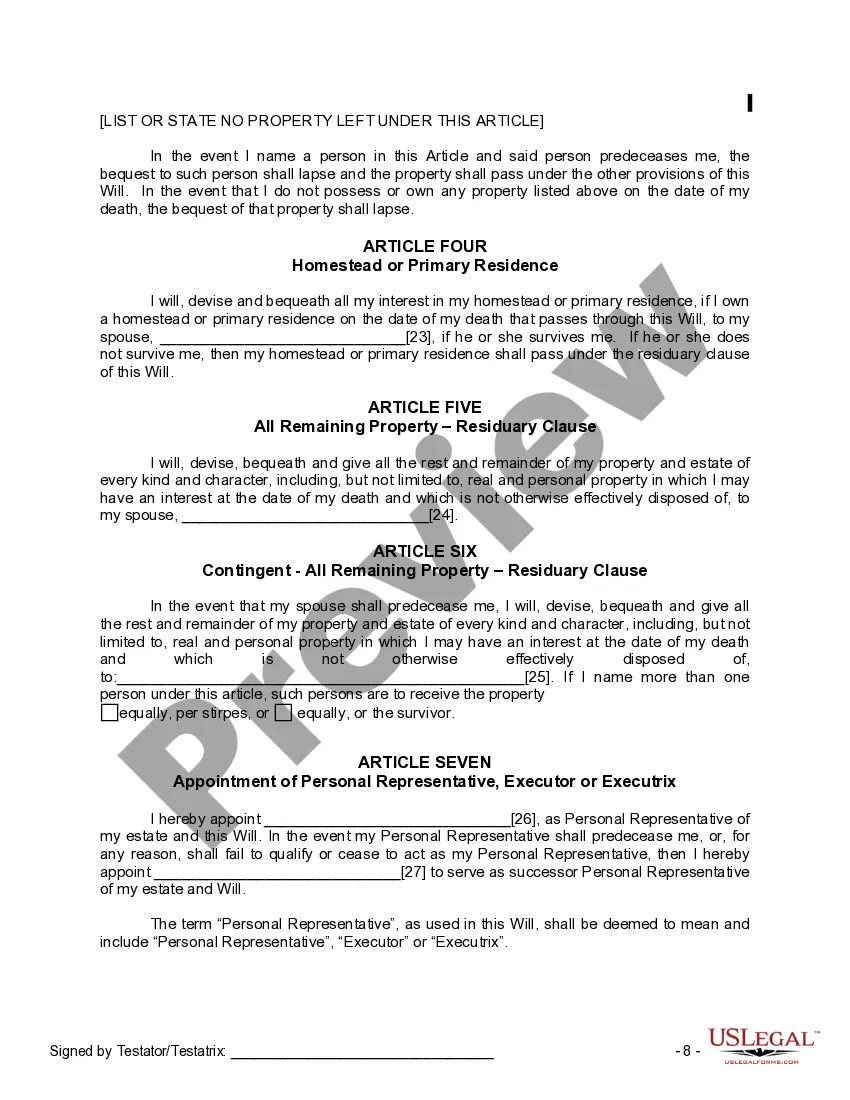

Last Will and Testament for a Married Person with No Children

This summary is not intended to be an all-inclusive

summary but does include many of the material matters dealing with Texas

Wills.

Who May Execute a Will: Every person who has attained the

age of eighteen years, or who is or has been lawfully married, or who is

a member of the armed forces of the United States or of the auxiliaries

thereof or of the maritime service at the time the will is made, being

of sound mind, shall have the right and power to make a last will and testament.

Sec 57.

Right to Disinherit:

A person who makes a last will and testament may disinherit an heir. Sec.

58.

Devises or Bequests to Trustees:

A testator may validly devise or bequeath property in a will to the trustee

of a trust established or to be established. Sec. 58a.

Devises and Bequests That

Are Void: A devise or bequest of property in a will

to an attorney who prepares or supervises the preparation of the will or

a devise or bequest of property in a will to an heir or employee of the

attorney who prepares or supervises the preparation of the will is void.

Sec. 58b.

Requisites of a Will:

A last will and testament shall be in writing and signed by the testator

in person and be attested by two or more credible witnesses above the age

of fourteen years who shall sign their names thereto in their own handwriting

in the presence of the testator. Sec. 59.

Revocation of Wills:

A will may be revoked by a subsequent will, codicil, or declaration in

writing, executed with like formalities, or by the testator destroying

or canceling the will. Sec. 63.

Deposit of Will With Court

During Testator's Lifetime: A will may be deposited

by the person making it, or by another person for him, with the county

clerk of the county of the testator's residence. Before accepting any will

for deposit, the clerk may require such proof as shall be satisfactory

to him concerning the testator's identity and residence. The clerk, on

being paid a fee of Three Dollars therefor, shall receive and keep the

will, and shall give a certificate of deposit for it. All wills so filed

shall be numbered by the clerk in consecutive order, and all certificates

of deposit shall bear like numbers respectively.

How Will Shall Be Enclosed.

Every will intended to be deposited with a county clerk shall be enclosed

in a sealed wrapper, which shall have indorsed thereon "Will of," followed

by the name, address and signature of the testator. The wrapper must also

be indorsed with the name and current address of each person who shall

be notified of the deposit of the will after the death of the testator.

Index To Be Kept of All Wills

Deposited. Each county clerk shall keep an index of all wills so deposited

with him.

To Whom Will Shall Be Delivered.

During

the lifetime of the testator, a will so deposited shall be delivered only

to the testator, or to another person authorized by him by a sworn written

order. Upon delivery of the will to the testator or to a person so authorized

by him, the certificate of deposit issued for the will shall be surrendered

by the person to whom delivery of the will is made; provided, however,

that in lieu of the surrender of such certificate, the clerk may, in his

discretion, accept and file an affidavit by the testator to the effect

that the certificate of deposit has been lost, stolen, or destroyed.

Proceedings Upon Death of

Testator. If there shall be submitted to the clerk an affidavit to

the effect that the testator of any will deposited with the clerk has died,

or if the clerk shall receive any other notice or proof of the death of

such testator which shall suffice to convince him that the testator is

deceased, the clerk shall notify by registered mail with return receipt

requested the person or persons named on the indorsement of the wrapper

of the will that the will is on deposit in his office, and, upon request,

he shall deliver the will to such person or persons, taking a receipt therefor.

If the notice by registered mail is returned undelivered, or if a clerk

has accepted a will which does not specify on the wrapper the person or

persons to whom it shall be delivered, the clerk shall open the wrapper

and inspect the will. If an executor is named in the will, he shall be

notified by registered mail, with return receipt requested, that the will

is on deposit, and, upon request, the clerk shall deliver the will to the

person so named as executor. If no executor is named in the will, or if

the person so named is deceased, or fails to take the will within thirty

days after the clerk's notice to him is mailed, or if notice to the person

so named is returned undelivered, the clerk shall give notice by registered

mail, with return receipt requested, to the devisees and legatees named

in the will that the will is on deposit, and, upon request, the clerk shall

deliver the will to any or all of such devisees and legatees.

Depositing Has No Legal Significance.

These

provisions for the depositing of a will during the lifetime of a testator

are solely for the purpose of providing a safe and convenient repository

for such a will, and no will which has been so deposited shall be treated

for purposes of probate any differently than any will which has not been

so deposited. In particular, and without limiting the generality of the

foregoing, a will which is not deposited shall be admitted to probate upon

proof that it is the last will and testament of the testator, notwithstanding

the fact that the same testator has on deposit with the court a prior will

which has been deposited in accordance with the provisions of this Code.

Depositing Does Not Constitute

Notice. The fact that a will has been deposited as provided herein

shall not constitute notice of any character, constructive or otherwise,

to any persons to the existence of such will or as to the contents thereof.

Sec. 71.

More Advanced Issues:

Bequest to Witness:

Should any person be a subscribing witness to a will, and also be a legatee

or devisee therein, if the will cannot be otherwise established, such bequest

shall be void, and such witness shall be allowed and compelled to appear

and give his testimony in like manner as if no such bequest had been made.

But, if in such case the witness would have been entitled to a share of

the estate of the testator had there been no will, he shall be entitled

to as much of such share as shall not exceed the value of the bequest to

him in the will. Sec. 61. In the situation covered by the preceding Section,

the bequest to the subscribing witness shall not be void if his testimony

proving the will is corroborated by one or more disinterested and credible

persons who testify that the testimony of the subscribing witness is true

and correct, and such subscribing witness shall not be regarded as an incompetent

or non-credible witness under Section 59 of this Code. Sec. 62.

Contracts Concerning Succession:

A contract to make a will or devise, or not to revoke a will or devise,

if executed or entered into on or after September 1, 1979, can be established

only by provisions of a will stating that a contract does exist and stating

the material provisions of the contract. The execution of a joint

will or reciprocal wills does not by itself suffice as evidence of the

existence of a contract. Sec. 59A.

Voidness Arising From Divorce:

If, after making a will, the testator is divorced or the testator's marriage

is annulled, all provisions in the will in favor of the testator's former

spouse, or appointing such spouse to any fiduciary capacity under the will

or with respect to the estate or person of the testator's children, must

be read as if the former spouse failed to survive the testator, and shall

be null and void and of no effect unless the will expressly provides otherwise.

A person who is divorced from the decedent or whose marriage to the decedent

has been annulled is not a surviving spouse unless, by virtue of a subsequent

marriage, the person is married to the decedent at the time of death. Sec.

69.

Provision in Will for Management

of Separate Property: The husband or wife may, by

last will and testament, give to the survivor of the marriage the power

to keep testator's separate property together until each of the several

distributees shall become of lawful age, and to manage and control the

same under the provisions of law relating to community property, and subject

to such other restrictions as are imposed by such will; provided,that any

child or distributee entitled to any part of said property shall, at any

time upon becoming of age, be entitled to receive his distributive portion

of said estate. Sec. 70.