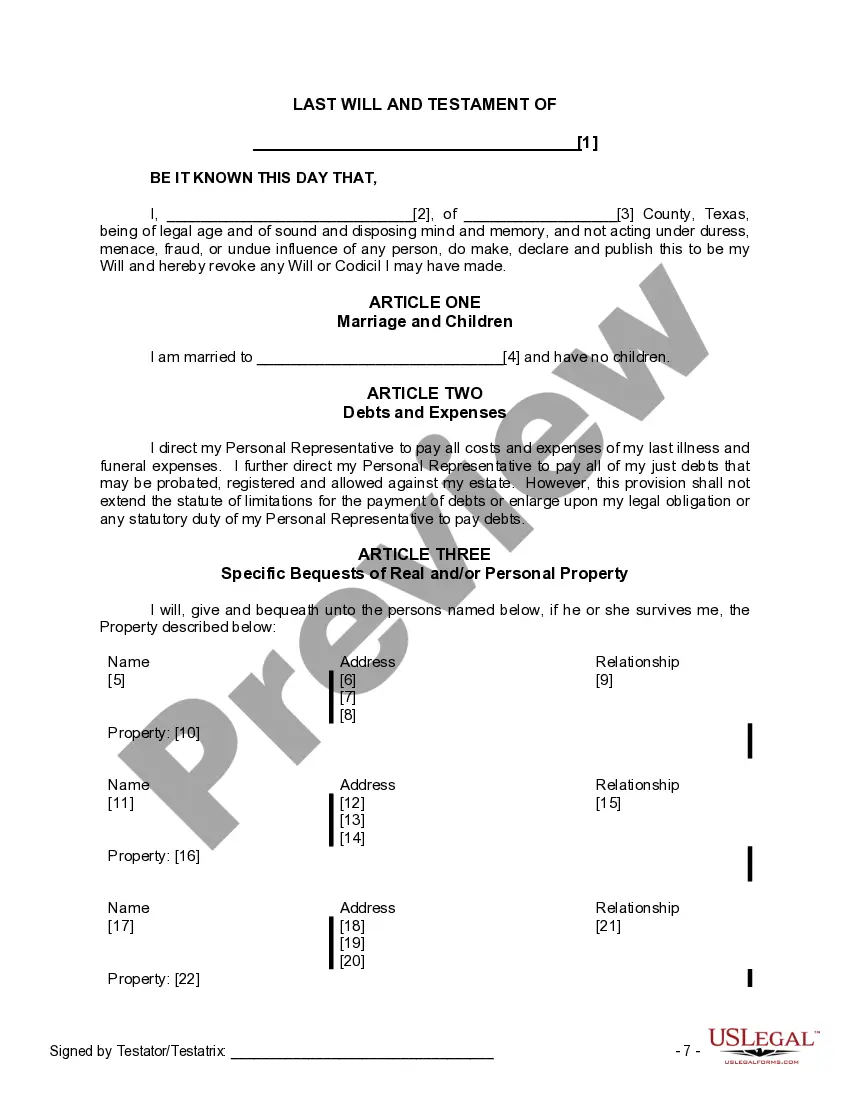

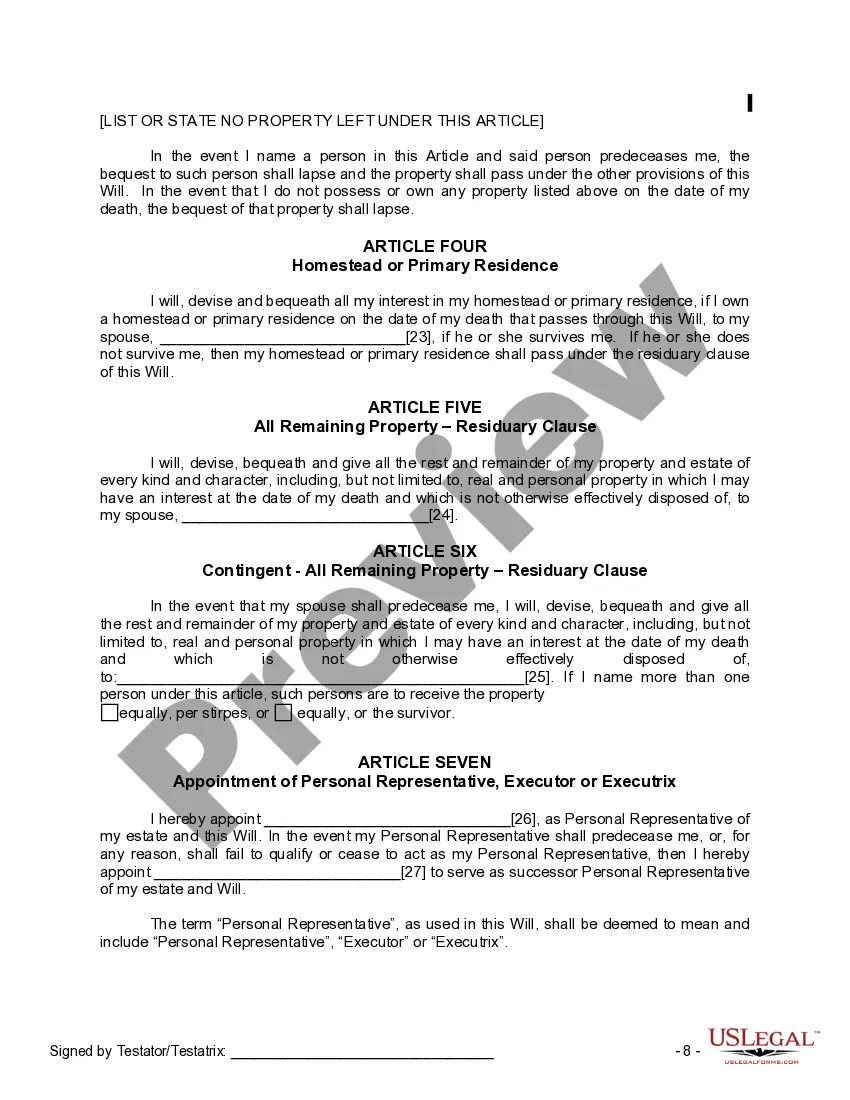

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

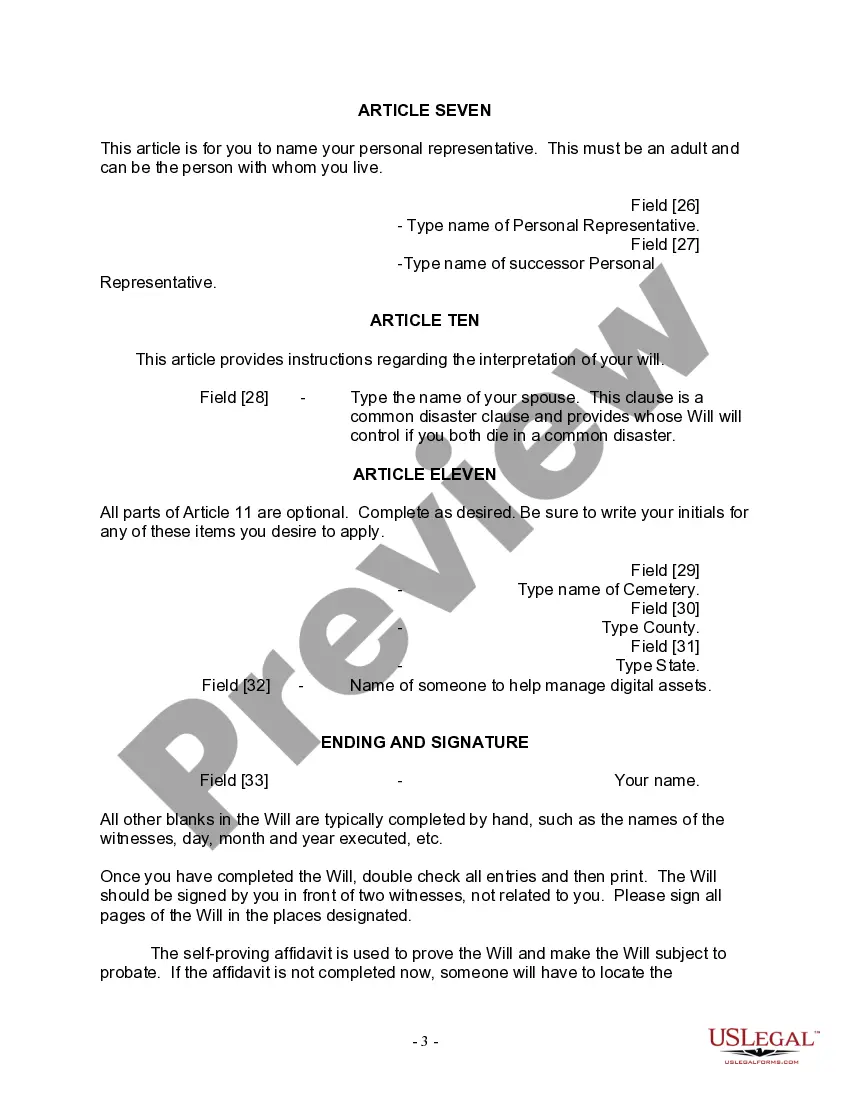

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

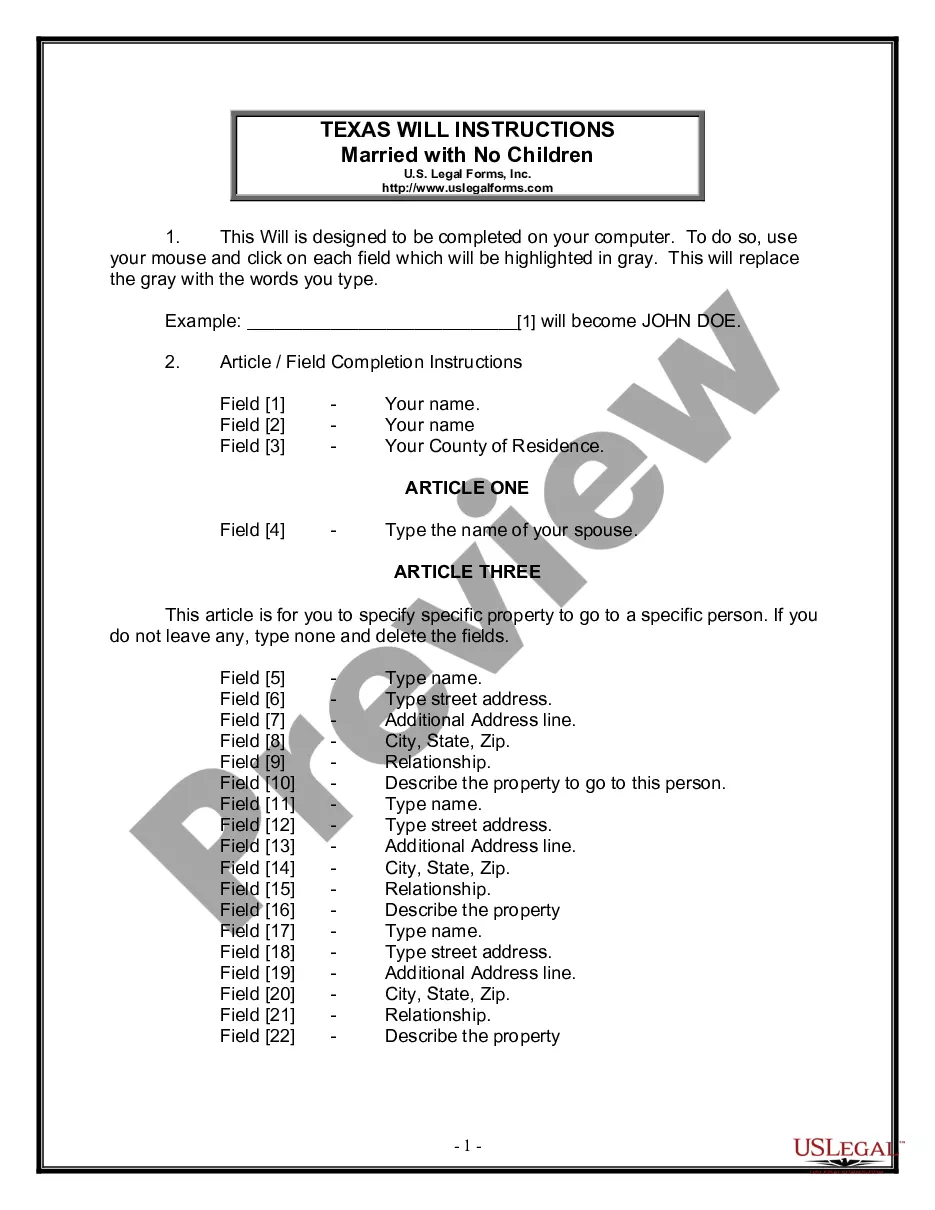

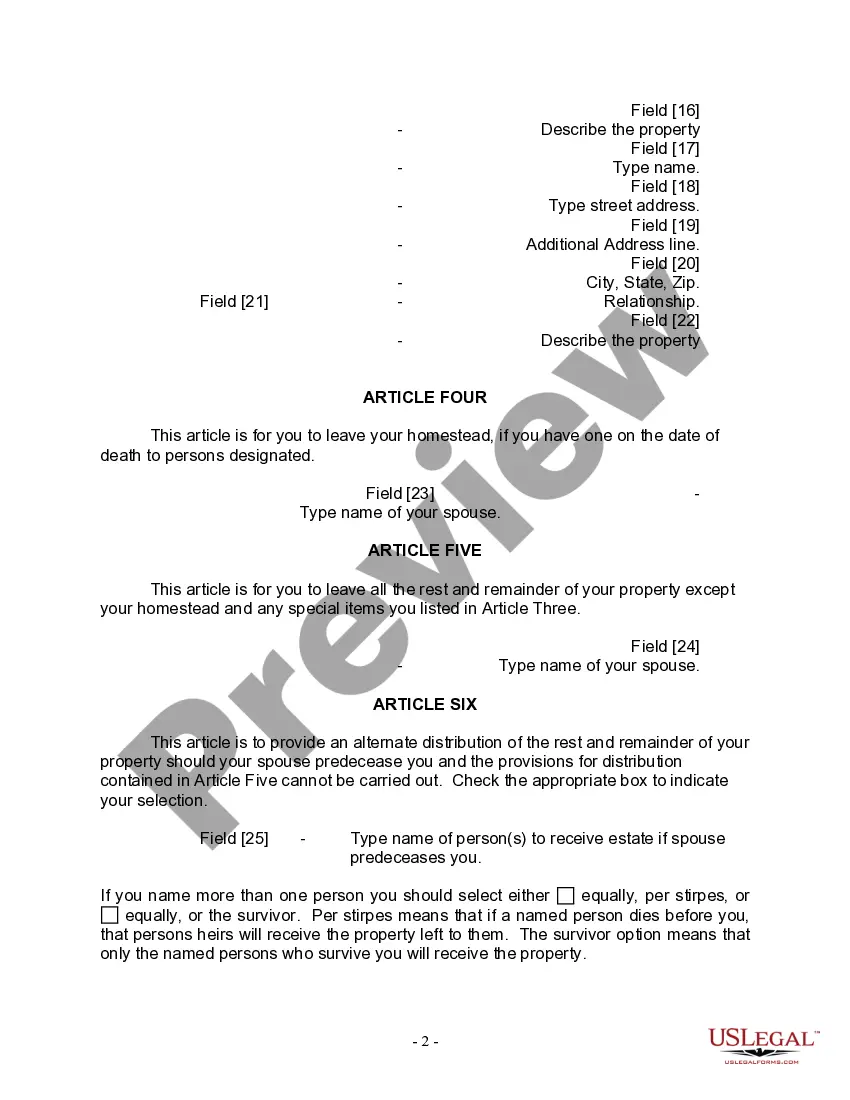

The Grand Prairie Texas Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows individuals to outline their wishes regarding the distribution of their assets, property, and other important matters after their demise. This document ensures that their wishes are carried out, providing security and peace of mind for the person creating the will, as well as their loved one's left behind. This specific type of will is tailored for married individuals without children. It caters to the unique circumstances of couples in this situation, taking into consideration their specific wishes and requirements. The Grand Prairie Texas Legal Last Will and Testament Form for a Married Person with No Children may contain various key provisions and information. These may include: 1. Identification: The will begins with the identification of the testator (the person creating the will) and their spouse. It includes their full legal names, addresses, and any other necessary personal information. 2. Appointment of an Executor: The testator can appoint an executor, who will be responsible for overseeing the administration of the estate and ensuring that the terms of the will are carried out faithfully. This can be a trusted family member, friend, or a professional executor. 3. Asset Distribution: The will clearly outlines how the testator's assets, including property, bank accounts, investments, and personal belongings, should be distributed among family, friends, or charitable organizations. It provides specific instructions to avoid any confusion or disputes after the testator's passing. 4. Debts and Expenses: The will addresses any outstanding debts, bills, or expenses that need to be settled from the estate. It ensures that these obligations are met, reducing the burden on the surviving spouse. 5. Guardianship: Since married individuals without children may still have dependents, such as elderly parents or disabled relatives, the will can designate guardianship arrangements for them. This ensures the continued care and support of these individuals in the absence of the testator. 6. Alternate Beneficiaries: The will may include provisions for alternate beneficiaries in case the primary beneficiaries predecease the testator or are unable to receive the designated assets. This ensures that no assets are left unaccounted for or go unclaimed. It is important to note that there may be different versions or variations of the Grand Prairie Texas Legal Last Will and Testament Form for a Married Person with No Children. These variations could arise due to changes in state laws, updates in legal requirements, or personal preferences of the testator. It is advisable to consult an attorney specializing in wills and estate planning to ensure that the specific form aligns with the testator's intentions and complies with current legal standards.The Grand Prairie Texas Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows individuals to outline their wishes regarding the distribution of their assets, property, and other important matters after their demise. This document ensures that their wishes are carried out, providing security and peace of mind for the person creating the will, as well as their loved one's left behind. This specific type of will is tailored for married individuals without children. It caters to the unique circumstances of couples in this situation, taking into consideration their specific wishes and requirements. The Grand Prairie Texas Legal Last Will and Testament Form for a Married Person with No Children may contain various key provisions and information. These may include: 1. Identification: The will begins with the identification of the testator (the person creating the will) and their spouse. It includes their full legal names, addresses, and any other necessary personal information. 2. Appointment of an Executor: The testator can appoint an executor, who will be responsible for overseeing the administration of the estate and ensuring that the terms of the will are carried out faithfully. This can be a trusted family member, friend, or a professional executor. 3. Asset Distribution: The will clearly outlines how the testator's assets, including property, bank accounts, investments, and personal belongings, should be distributed among family, friends, or charitable organizations. It provides specific instructions to avoid any confusion or disputes after the testator's passing. 4. Debts and Expenses: The will addresses any outstanding debts, bills, or expenses that need to be settled from the estate. It ensures that these obligations are met, reducing the burden on the surviving spouse. 5. Guardianship: Since married individuals without children may still have dependents, such as elderly parents or disabled relatives, the will can designate guardianship arrangements for them. This ensures the continued care and support of these individuals in the absence of the testator. 6. Alternate Beneficiaries: The will may include provisions for alternate beneficiaries in case the primary beneficiaries predecease the testator or are unable to receive the designated assets. This ensures that no assets are left unaccounted for or go unclaimed. It is important to note that there may be different versions or variations of the Grand Prairie Texas Legal Last Will and Testament Form for a Married Person with No Children. These variations could arise due to changes in state laws, updates in legal requirements, or personal preferences of the testator. It is advisable to consult an attorney specializing in wills and estate planning to ensure that the specific form aligns with the testator's intentions and complies with current legal standards.