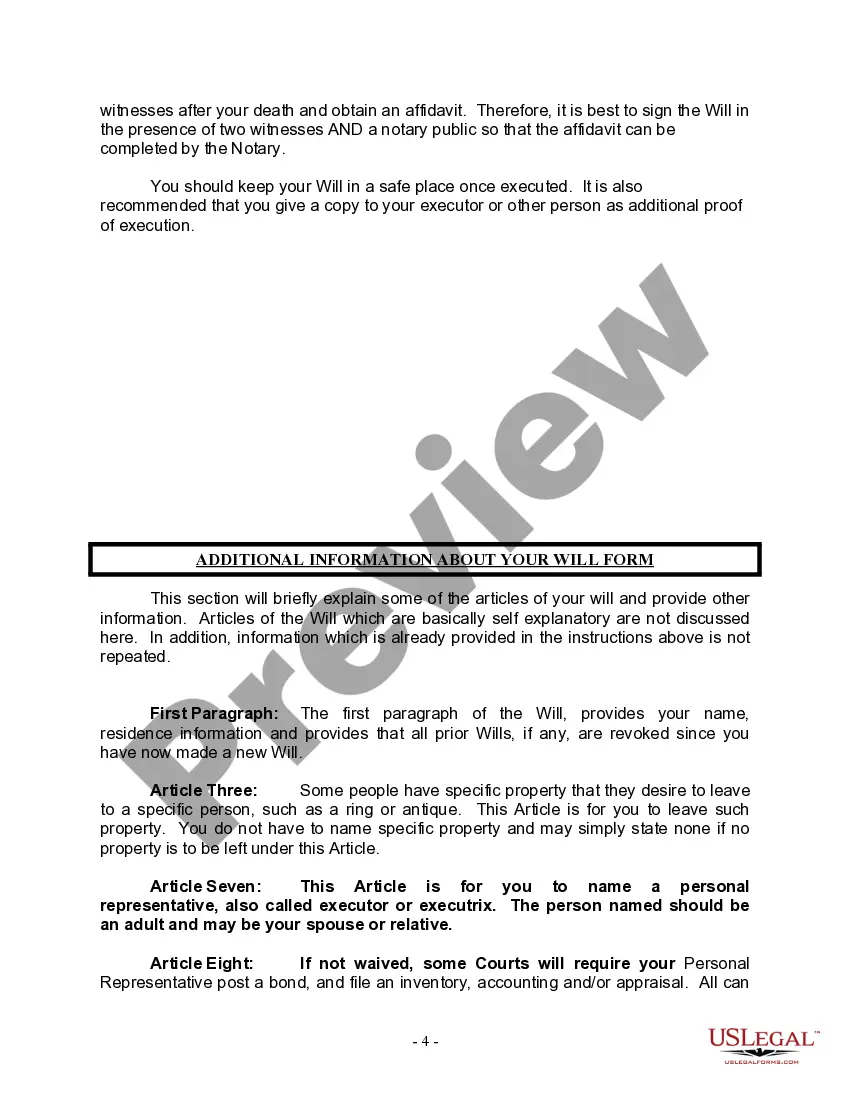

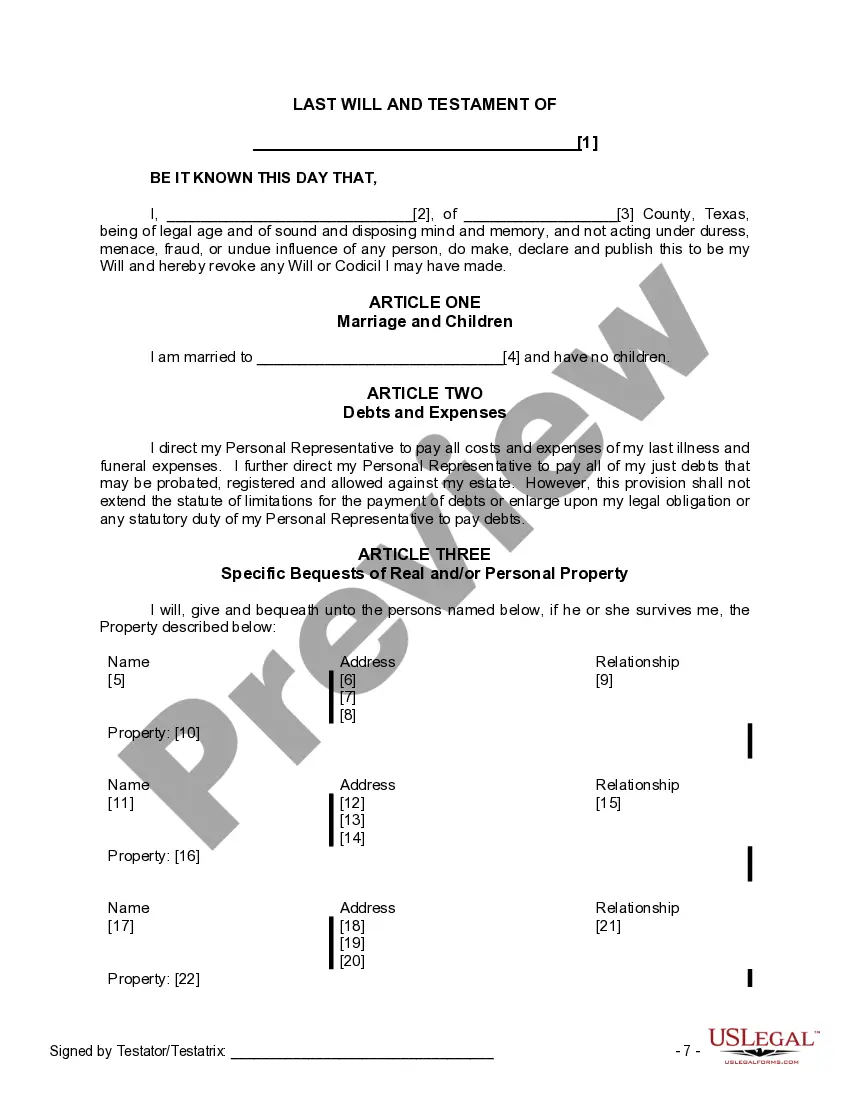

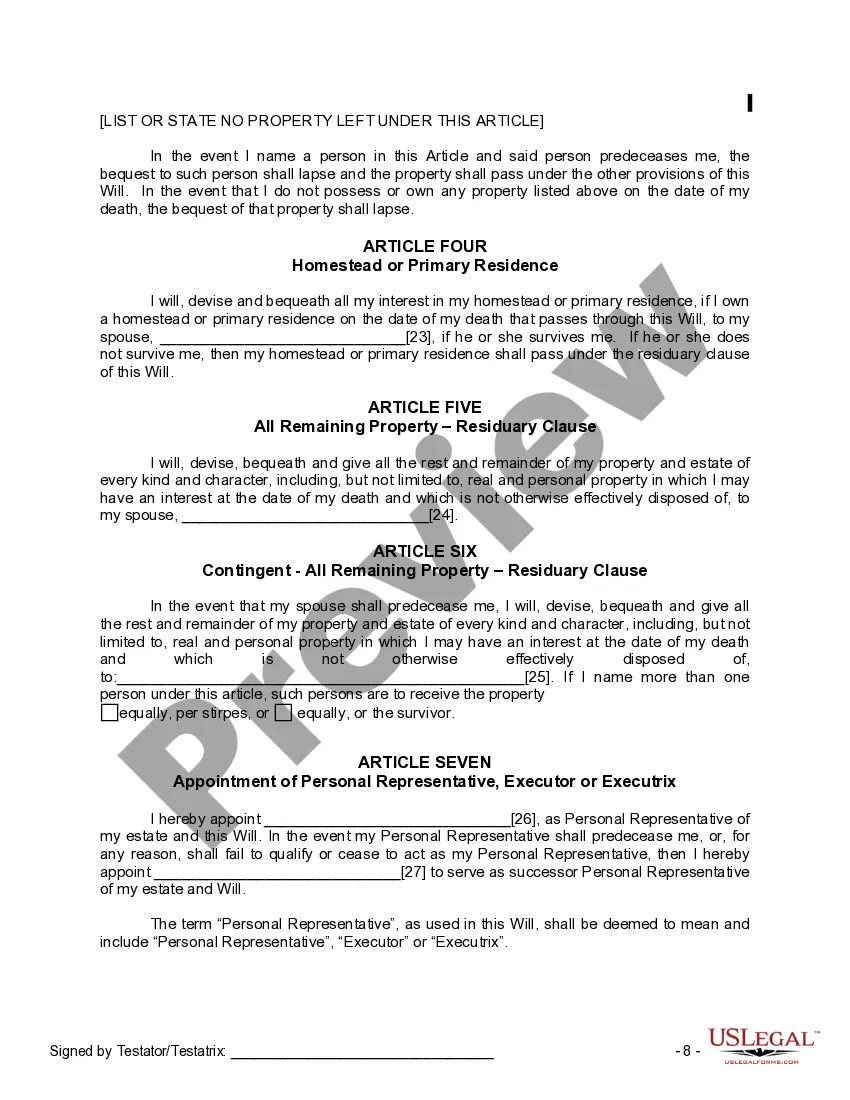

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

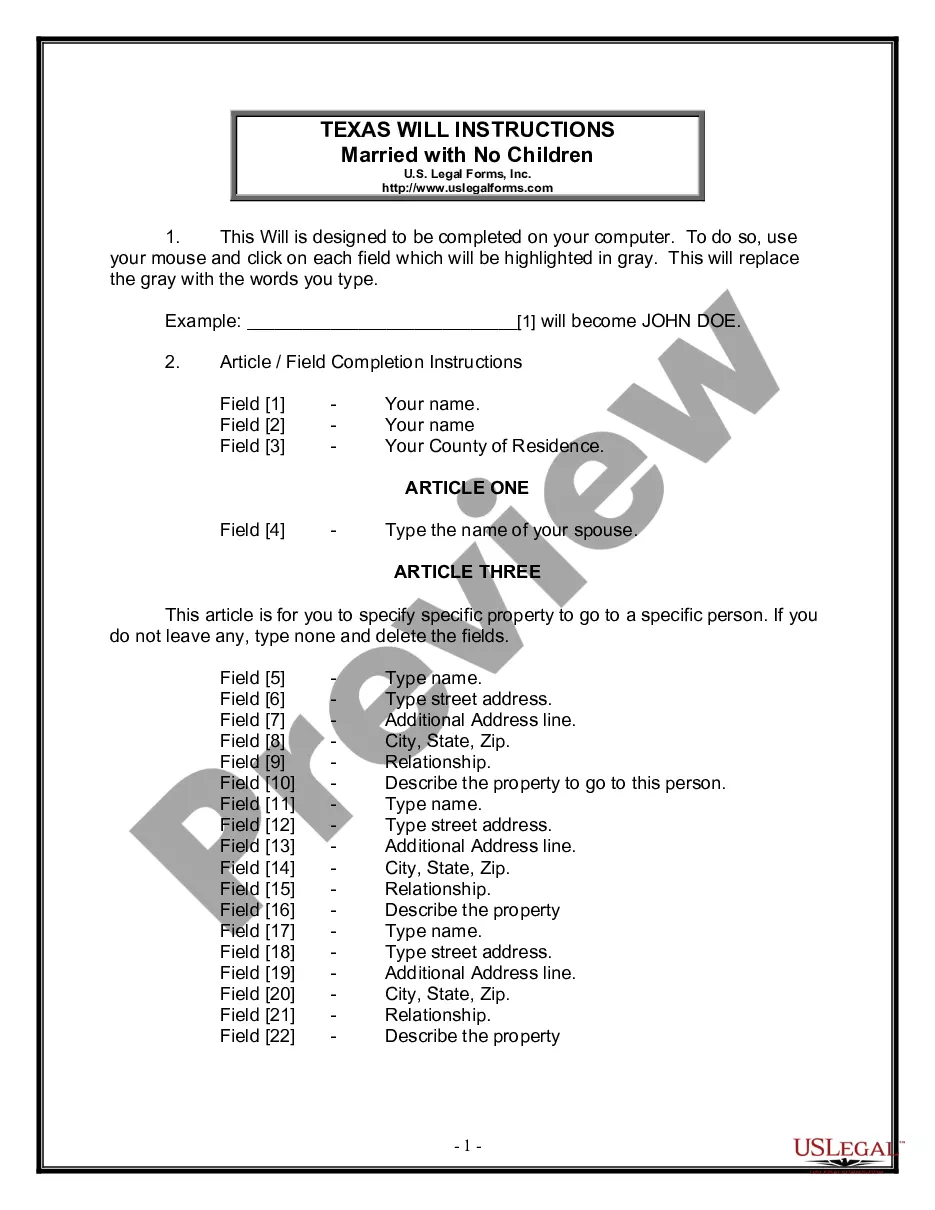

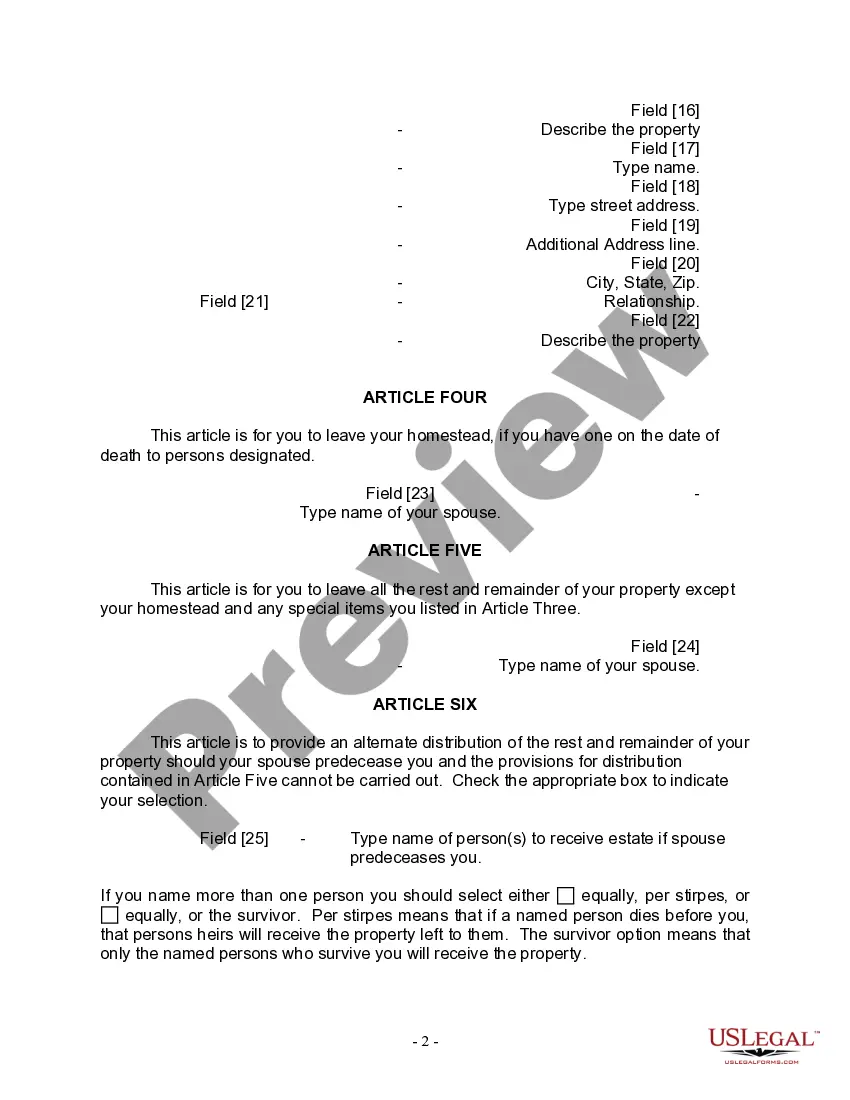

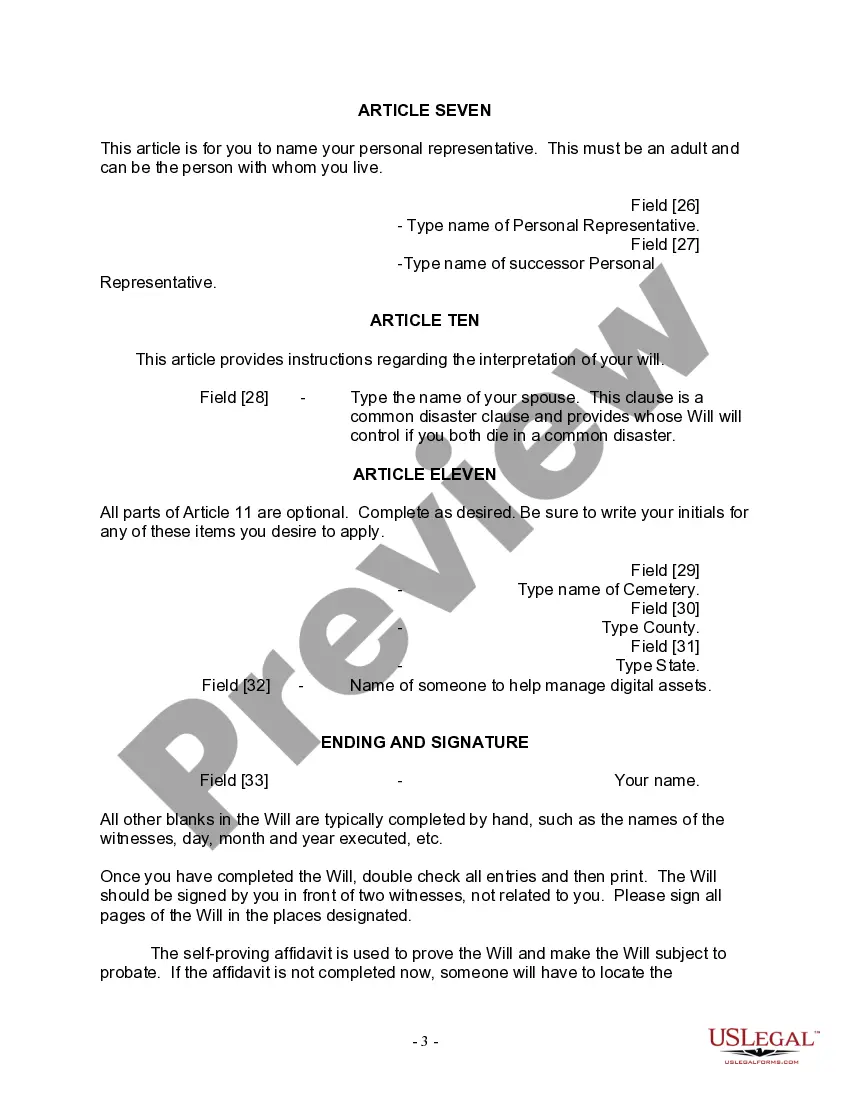

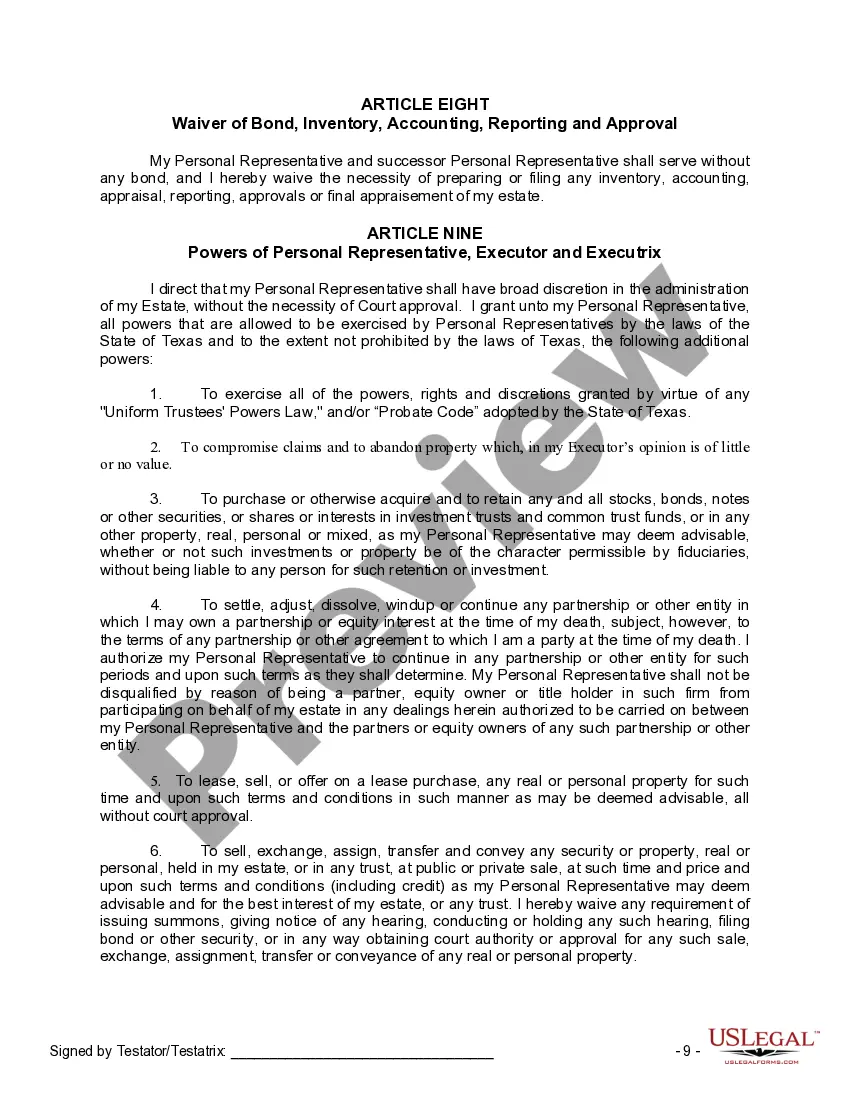

The Harris Texas Legal Last Will and Testament Form for a Married Person with No Children is a legal document that allows married individuals who do not have any children to stipulate how their assets and properties should be distributed after their death. It serves as a legally binding declaration of their wishes and ensures a smooth and fair distribution of their estate. This specific form is designed for married individuals residing in Harris, Texas, and caters to their unique circumstances. It is important to note that while there may be different versions or variations of this form, the main objective remains the same — to provide clear instructions regarding the distribution of an individual's estate in the absence of children. The Harris Texas Legal Last Will and Testament Form for a Married Person with No Children typically includes sections where individuals can designate beneficiaries, executors, and guardians, if applicable. It allows the person to distribute their assets, such as real estate, bank accounts, investments, and personal belongings, among their chosen recipients. This legal document offers married individuals the opportunity to express their specific intentions, such as making specific bequests, establishing trusts for beneficiaries, creating charitable donations, or assigning digital assets. It provides flexibility for married individuals to tailor their will according to their unique circumstances and preferences. By completing the Harris Texas Legal Last Will and Testament Form for a Married Person with No Children, individuals can ensure that their estate is handled according to their wishes, avoid potential disputes or conflicts among family members, and provide clarity and peace of mind for their surviving spouse. It is always advisable to consult with a qualified attorney when preparing a last will and testament to ensure compliance with Harris, Texas laws and to address any concerns specific to the individual's circumstances.The Harris Texas Legal Last Will and Testament Form for a Married Person with No Children is a legal document that allows married individuals who do not have any children to stipulate how their assets and properties should be distributed after their death. It serves as a legally binding declaration of their wishes and ensures a smooth and fair distribution of their estate. This specific form is designed for married individuals residing in Harris, Texas, and caters to their unique circumstances. It is important to note that while there may be different versions or variations of this form, the main objective remains the same — to provide clear instructions regarding the distribution of an individual's estate in the absence of children. The Harris Texas Legal Last Will and Testament Form for a Married Person with No Children typically includes sections where individuals can designate beneficiaries, executors, and guardians, if applicable. It allows the person to distribute their assets, such as real estate, bank accounts, investments, and personal belongings, among their chosen recipients. This legal document offers married individuals the opportunity to express their specific intentions, such as making specific bequests, establishing trusts for beneficiaries, creating charitable donations, or assigning digital assets. It provides flexibility for married individuals to tailor their will according to their unique circumstances and preferences. By completing the Harris Texas Legal Last Will and Testament Form for a Married Person with No Children, individuals can ensure that their estate is handled according to their wishes, avoid potential disputes or conflicts among family members, and provide clarity and peace of mind for their surviving spouse. It is always advisable to consult with a qualified attorney when preparing a last will and testament to ensure compliance with Harris, Texas laws and to address any concerns specific to the individual's circumstances.