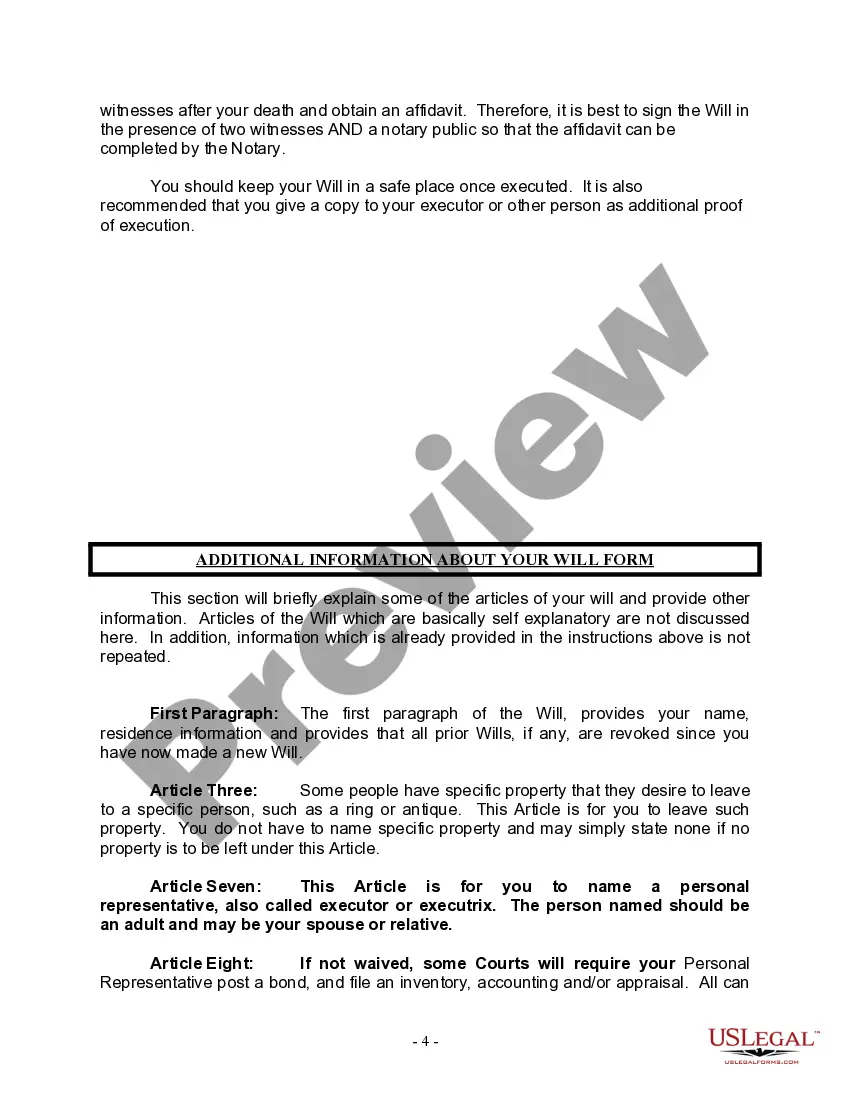

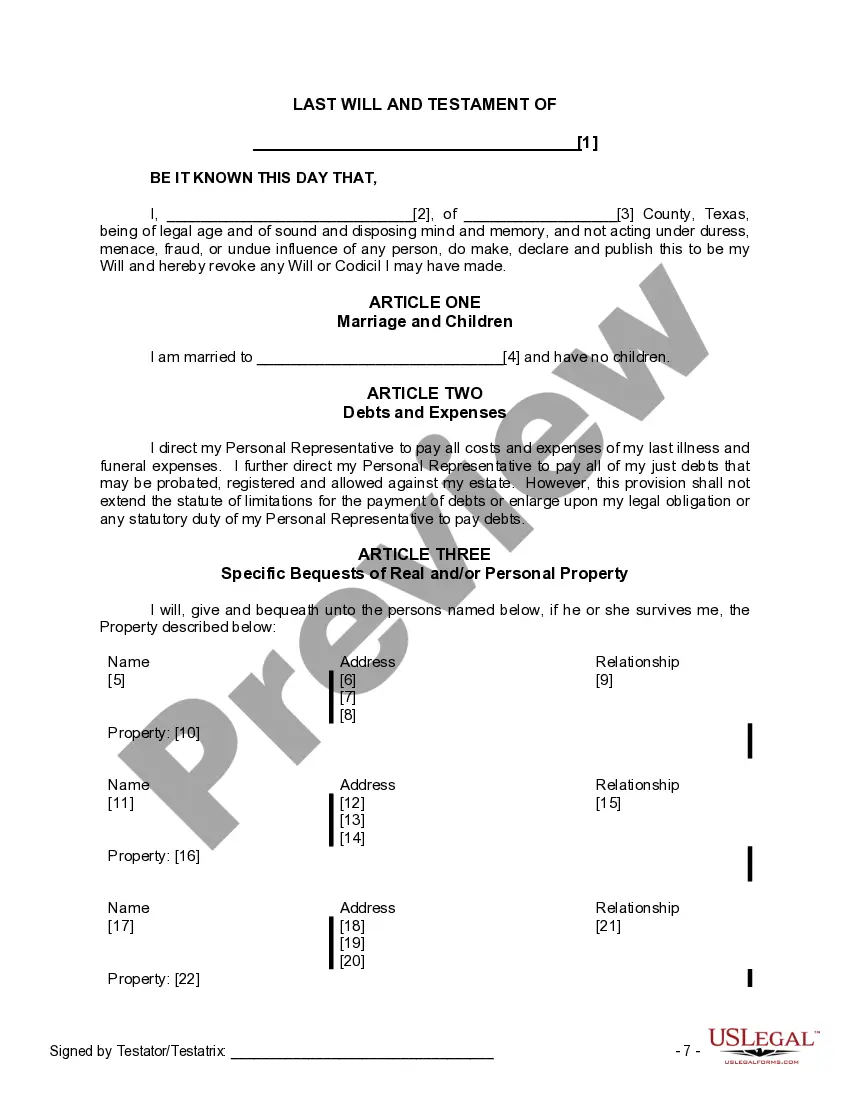

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

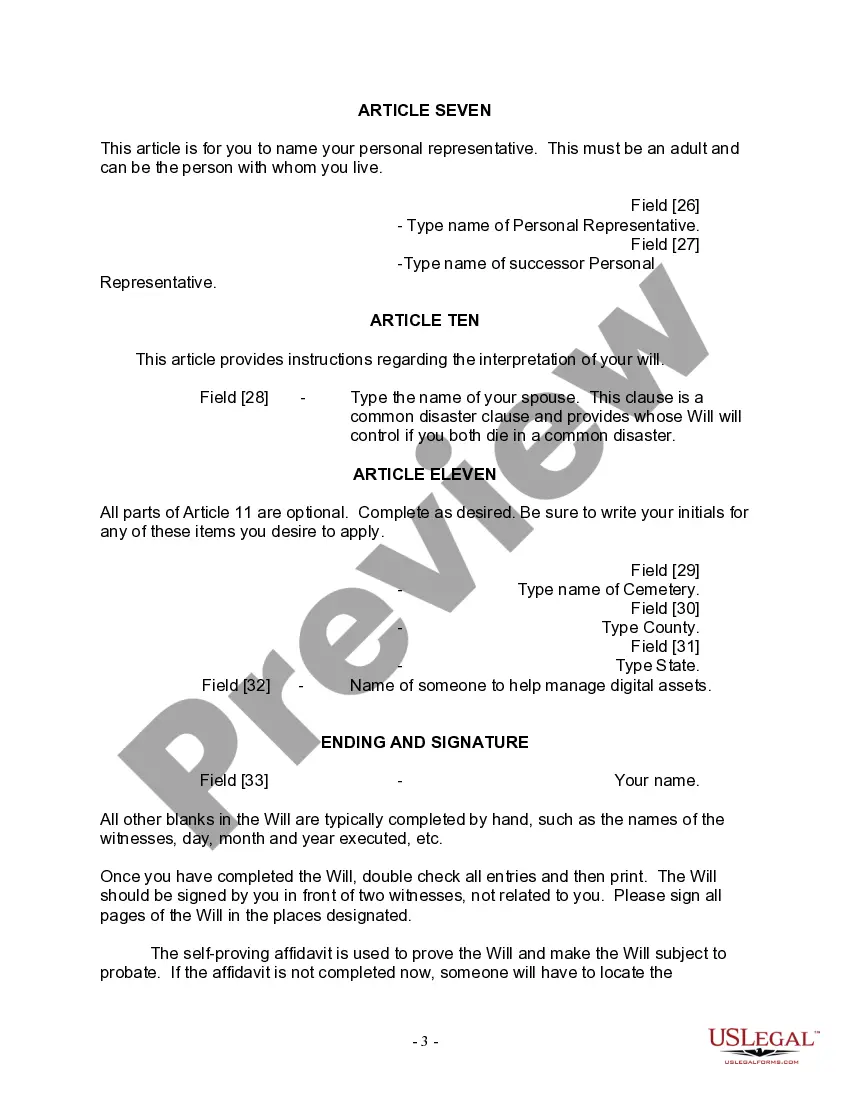

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

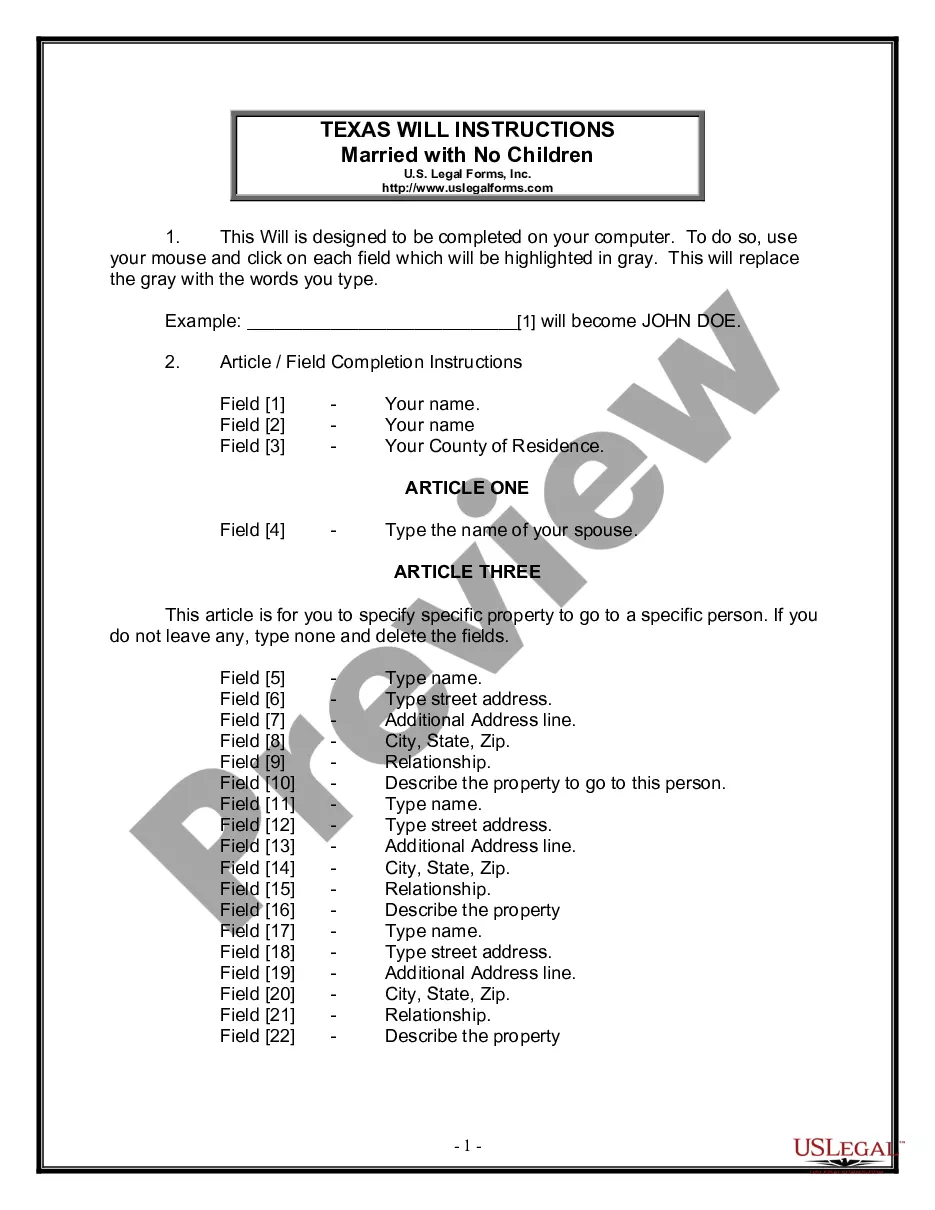

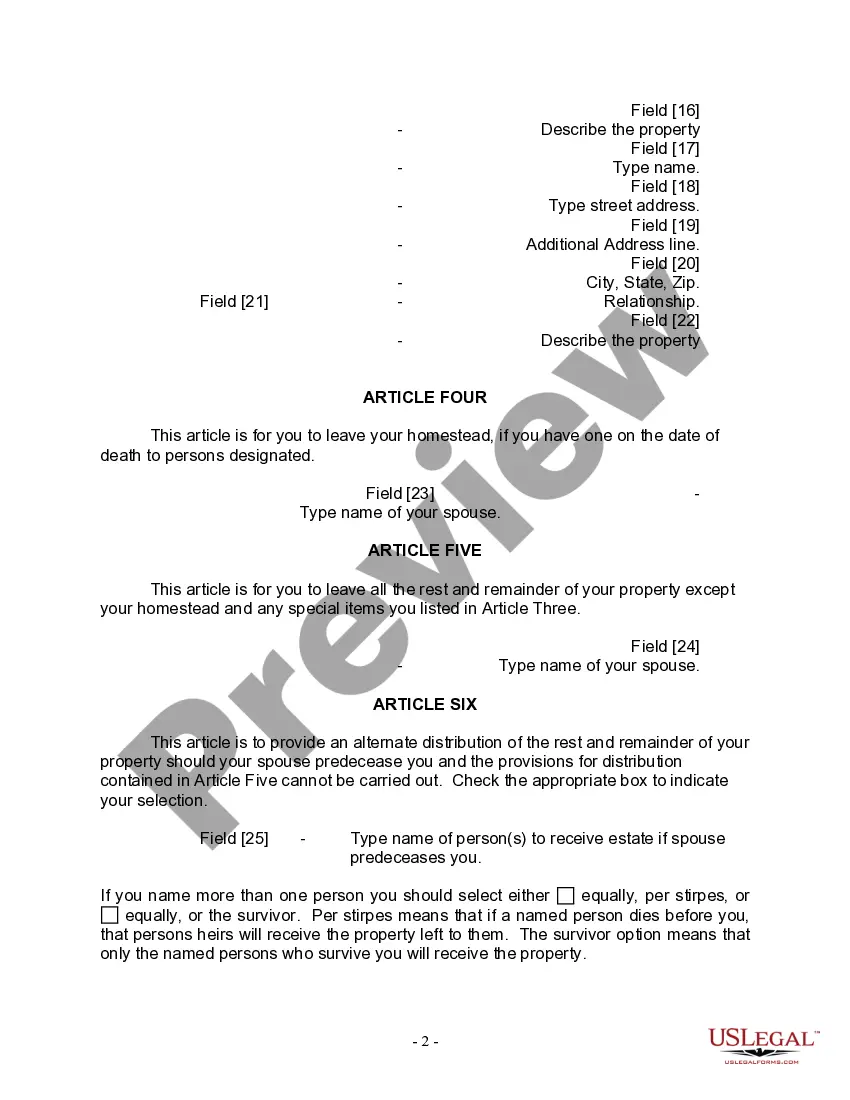

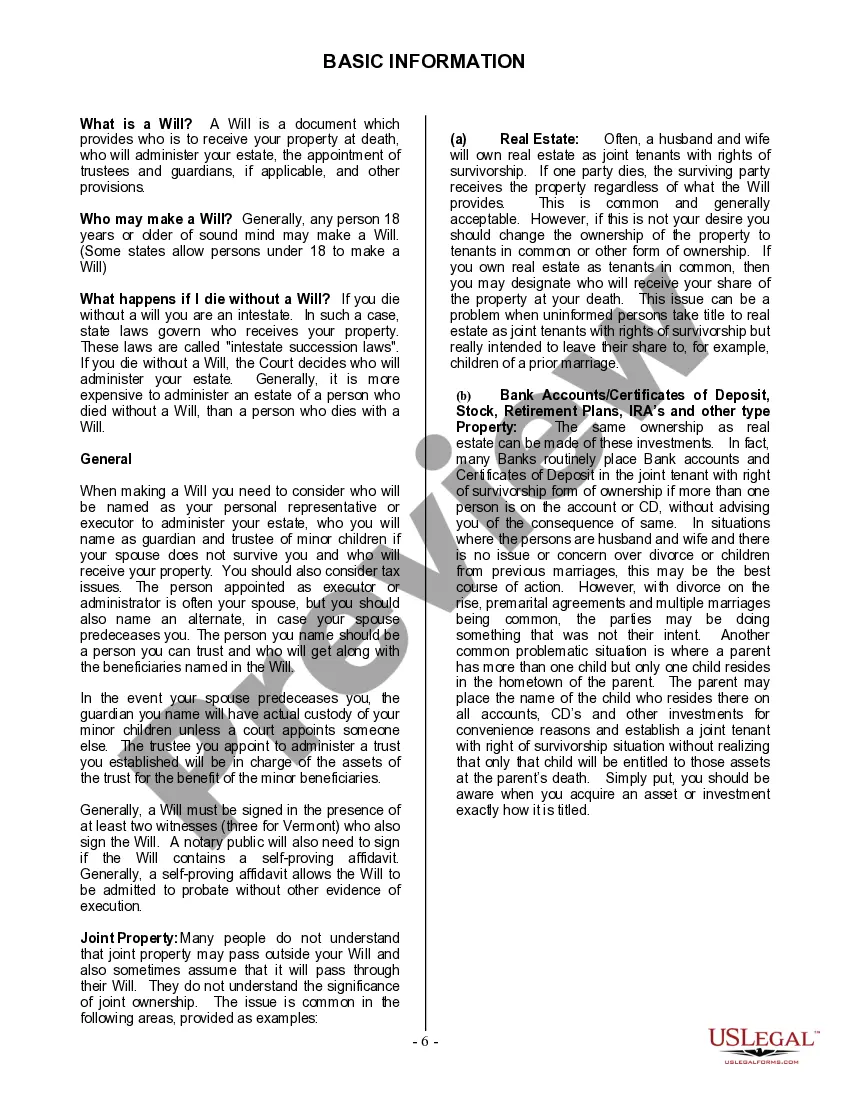

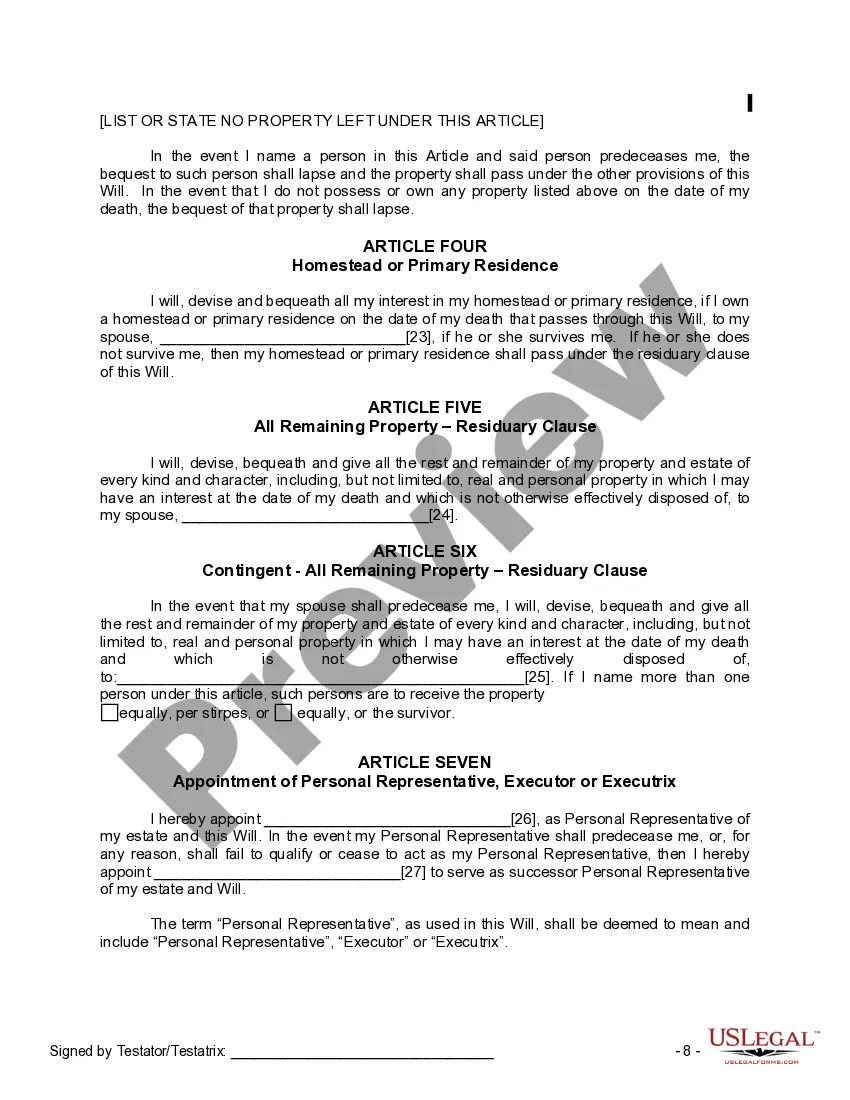

The Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that outlines the final wishes and distribution of assets for individuals residing in Odessa, Texas, who are married and do not have children. This comprehensive form is a crucial tool in ensuring that the wishes of the testator (the person creating the will) are upheld after their passing. The Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children typically includes the following key elements: 1. Identification of the Testator: The form begins by collecting essential information about the testator, including their full legal name, address, and marital status. 2. Appointment of Executor: This section allows the testator to select an executor, who will be responsible for carrying out the instructions detailed in the will, such as asset distribution and fulfilling other legal obligations. 3. Asset Distribution: The form provides a systematic structure for the testator to distribute their assets among their surviving spouse, family members, friends, or charitable organizations. It mentions specific assets, such as real estate, vehicles, bank accounts, investments, personal belongings, and more. 4. Gifts and Bequests: In this section, the testator can make specific bequests or gifts to individuals or organizations, such as sentimental items, financial contributions, or personal property. 5. Alternative Beneficiaries: The Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children may include contingency plans, allowing the testator to designate alternative beneficiaries if the primary beneficiaries are unable to receive their allocation. 6. Appointment of Guardian: If the testator has minor children, this section allows them to appoint a guardian who will be responsible for the care and upbringing of the children in the event of the testator's death. 7. Powers and Authorities: Here, the testator can grant powers and authorities to the executor or any other designated individual to undertake specific responsibilities, such as settling debts, managing business affairs, selling properties, or making legal decisions on their behalf. 8. Residual Estate: This section addresses the distribution of the testator's remaining assets not covered through specific bequests or gifts. It stipulates how the residual estate should be divided among the beneficiaries. Additionally, there might be variations of the Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children tailored to specific needs, such as: 1. Living Will: This variant allows the testator to outline their preferences regarding medical treatment, end-of-life care, and organ donation in the event they become incapacitated. 2. Mutual Will: This type of will is commonly used by married couples without children. It ensures that both spouses' estates are distributed according to their mutual agreement, often leaving assets to each other or other family members. 3. Testamentary Trust: This form includes provisions for establishing a trust upon the testator's death, which can provide ongoing financial support for beneficiaries who may be minors or have special needs. It is important to consult with legal professionals or estate planning attorneys to fully comprehend the specific legal requirements and nuances of the Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children, as well as to ensure that it complies with the laws of Texas.The Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that outlines the final wishes and distribution of assets for individuals residing in Odessa, Texas, who are married and do not have children. This comprehensive form is a crucial tool in ensuring that the wishes of the testator (the person creating the will) are upheld after their passing. The Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children typically includes the following key elements: 1. Identification of the Testator: The form begins by collecting essential information about the testator, including their full legal name, address, and marital status. 2. Appointment of Executor: This section allows the testator to select an executor, who will be responsible for carrying out the instructions detailed in the will, such as asset distribution and fulfilling other legal obligations. 3. Asset Distribution: The form provides a systematic structure for the testator to distribute their assets among their surviving spouse, family members, friends, or charitable organizations. It mentions specific assets, such as real estate, vehicles, bank accounts, investments, personal belongings, and more. 4. Gifts and Bequests: In this section, the testator can make specific bequests or gifts to individuals or organizations, such as sentimental items, financial contributions, or personal property. 5. Alternative Beneficiaries: The Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children may include contingency plans, allowing the testator to designate alternative beneficiaries if the primary beneficiaries are unable to receive their allocation. 6. Appointment of Guardian: If the testator has minor children, this section allows them to appoint a guardian who will be responsible for the care and upbringing of the children in the event of the testator's death. 7. Powers and Authorities: Here, the testator can grant powers and authorities to the executor or any other designated individual to undertake specific responsibilities, such as settling debts, managing business affairs, selling properties, or making legal decisions on their behalf. 8. Residual Estate: This section addresses the distribution of the testator's remaining assets not covered through specific bequests or gifts. It stipulates how the residual estate should be divided among the beneficiaries. Additionally, there might be variations of the Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children tailored to specific needs, such as: 1. Living Will: This variant allows the testator to outline their preferences regarding medical treatment, end-of-life care, and organ donation in the event they become incapacitated. 2. Mutual Will: This type of will is commonly used by married couples without children. It ensures that both spouses' estates are distributed according to their mutual agreement, often leaving assets to each other or other family members. 3. Testamentary Trust: This form includes provisions for establishing a trust upon the testator's death, which can provide ongoing financial support for beneficiaries who may be minors or have special needs. It is important to consult with legal professionals or estate planning attorneys to fully comprehend the specific legal requirements and nuances of the Odessa Texas Legal Last Will and Testament Form for a Married Person with No Children, as well as to ensure that it complies with the laws of Texas.