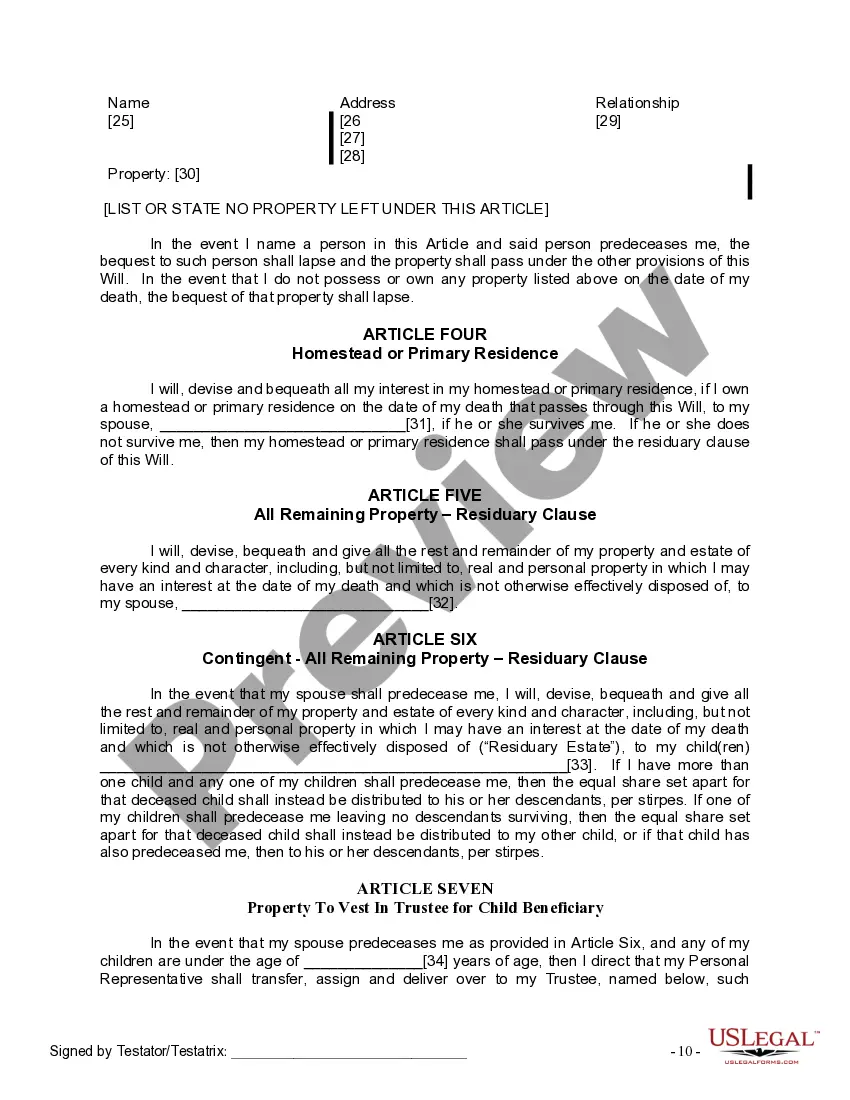

The Mutual Wills with Last Wills and Testaments Package you have found, is for a married couple with both minor and adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children. It also establishes a trust and provides for the appointment of a trustee for the estate of the minor children. This package contains two wills, one for each spouse. It also includes instructions.

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills.

College Station Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult and Minor Children If you are a married couple residing in College Station, Texas, who wants to secure the future of your family and ensure that your assets are distributed according to your wishes, the College Station Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult and Minor Children is the solution you need. This comprehensive package offers a legally binding arrangement that provides peace of mind and protects your loved ones. By opting for the College Station Texas Mutual Wills Package, you can customize your Last Wills and Testaments to suit your unique circumstances. It is designed specifically for married couples with both adult and minor children, taking into consideration their different needs and legal requirements. With this package, you can outline your preferences regarding property, financial assets, and the guardianship of your minor children. The College Stations Texas Mutual Wills Package offers two variations to cater to different scenarios: 1. Mutual Will with Testamentary Trust: This type of mutual will allows you to establish a testamentary trust within your wills. A testamentary trust is created upon your passing, ensuring that your assets are managed and distributed to your minor children according to your specified instructions. This option allows for greater control and protection of the children's inheritance until they reach adulthood or a predetermined age. 2. Mutual Will without Testamentary Trust: If you already have a designated trust or do not wish to establish one, this option provides a straightforward mutual will arrangement. It enables you to designate your spouse as the primary beneficiary of your assets, and subsequently, your children as secondary beneficiaries upon both spouses' passing. This option ensures that your adult and minor children receive their rightful inheritance. The College Stations Texas Mutual Wills Package eliminates any ambiguity or uncertainty that may arise in the absence of a will. By explicitly stating your intentions, you can prevent potential disputes and legal complications among family members. This package is specifically tailored to meet the legal requirements in College Station, Texas, and ensures that your Last Wills and Testaments are legally binding and enforceable. Secure your family's future by availing of the College Station Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult and Minor Children. Make informed decisions about your assets, guardianship, and beneficiaries to provide your loved ones with financial stability and protect their interests.College Station Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult and Minor Children If you are a married couple residing in College Station, Texas, who wants to secure the future of your family and ensure that your assets are distributed according to your wishes, the College Station Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult and Minor Children is the solution you need. This comprehensive package offers a legally binding arrangement that provides peace of mind and protects your loved ones. By opting for the College Station Texas Mutual Wills Package, you can customize your Last Wills and Testaments to suit your unique circumstances. It is designed specifically for married couples with both adult and minor children, taking into consideration their different needs and legal requirements. With this package, you can outline your preferences regarding property, financial assets, and the guardianship of your minor children. The College Stations Texas Mutual Wills Package offers two variations to cater to different scenarios: 1. Mutual Will with Testamentary Trust: This type of mutual will allows you to establish a testamentary trust within your wills. A testamentary trust is created upon your passing, ensuring that your assets are managed and distributed to your minor children according to your specified instructions. This option allows for greater control and protection of the children's inheritance until they reach adulthood or a predetermined age. 2. Mutual Will without Testamentary Trust: If you already have a designated trust or do not wish to establish one, this option provides a straightforward mutual will arrangement. It enables you to designate your spouse as the primary beneficiary of your assets, and subsequently, your children as secondary beneficiaries upon both spouses' passing. This option ensures that your adult and minor children receive their rightful inheritance. The College Stations Texas Mutual Wills Package eliminates any ambiguity or uncertainty that may arise in the absence of a will. By explicitly stating your intentions, you can prevent potential disputes and legal complications among family members. This package is specifically tailored to meet the legal requirements in College Station, Texas, and ensures that your Last Wills and Testaments are legally binding and enforceable. Secure your family's future by availing of the College Station Texas Mutual Wills Package with Last Wills and Testaments for Married Couple with Adult and Minor Children. Make informed decisions about your assets, guardianship, and beneficiaries to provide your loved ones with financial stability and protect their interests.