The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

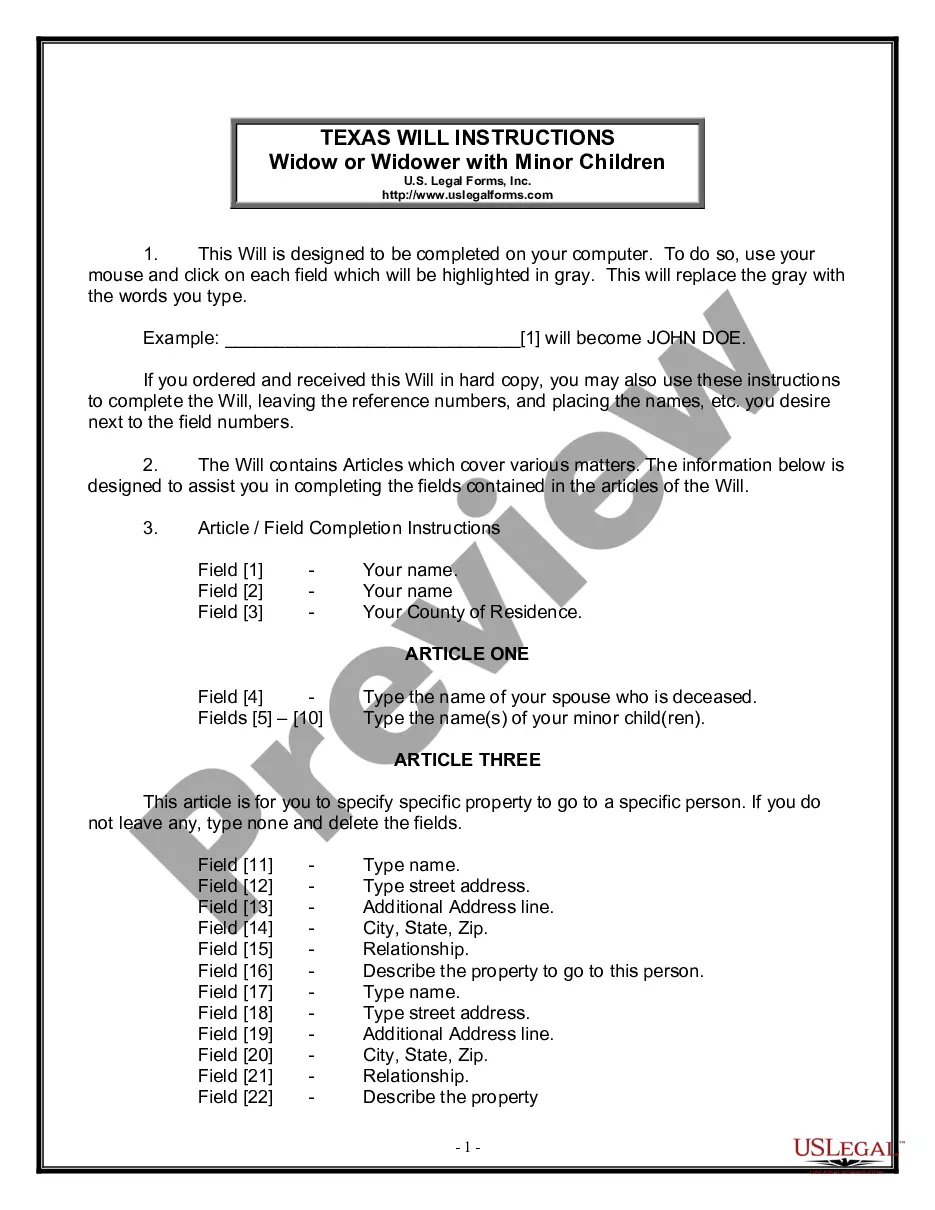

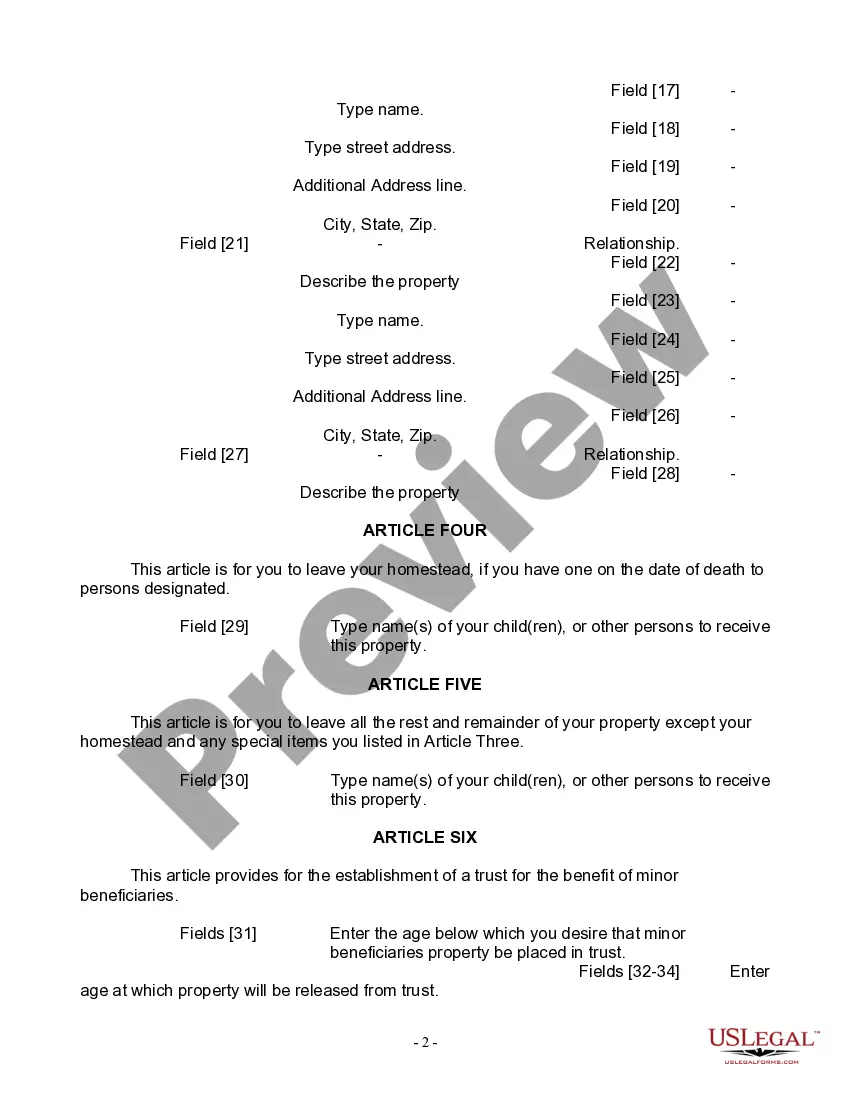

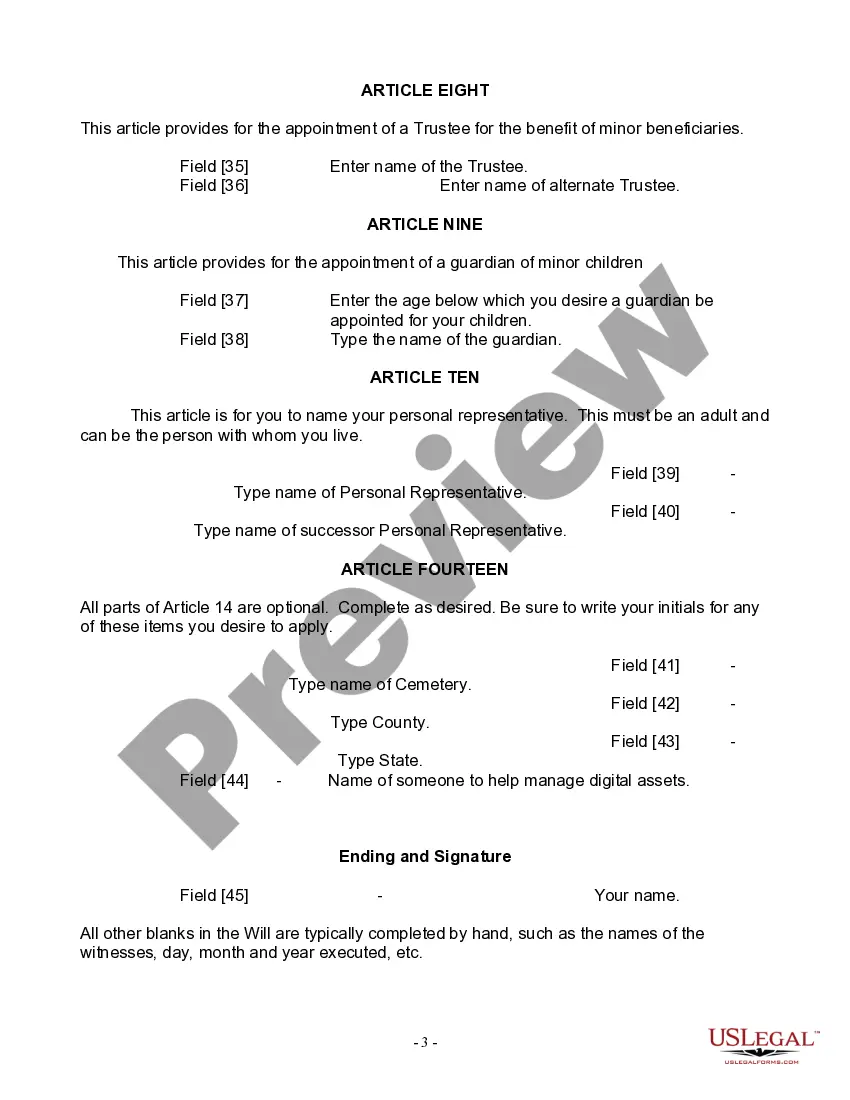

Sugar Land Texas Legal Last Will and Testament Form for Widow or Widower with Minor Children is a crucial legal document that allows individuals to provide clear instructions on how their assets and guardianship of their minor children should be handled after their passing. It is important for widows or widowers with minor children to have a comprehensive Last Will and Testament to ensure the well-being of their children and the proper distribution of their estate. The Sugar Land Texas Legal Last Will and Testament Form for Widow or Widower with Minor Children is specifically designed to cater to the unique needs of individuals in this situation. It may include various sections, such as: 1. Declarations: This section provides the necessary information about the person creating the will, including their full name, address, and marital status. It also confirms their intention to create a legally valid will and revoke any previous wills or codicils. 2. Appointment of Executor: The executor is responsible for managing the estate, distributing assets, and ensuring the terms of the will are executed. In this section, the widow or widower appoints a trusted individual to act as the executor of their will. 3. Guardianship of Minor Children: This is a crucial element for widows or widowers with minor children. It allows them to name a guardian who will take care of their children in the event of their passing. The chosen guardian should be someone trustworthy and capable of providing a safe and nurturing environment for the children. 4. Distribution of Assets: In this section, the widow or widower specifies how their assets, including property, investments, and personal belongings, should be distributed among their beneficiaries. They can divide their assets equally or assign specific items to different beneficiaries. 5. Trusts: Depending on the complexities of the estate or the specific needs of the minor children, the will may establish trusts to manage and protect the inheritances until the children reach a certain age or milestone. 6. Residuary Clause: This clause ensures that any remaining assets which were not specifically mentioned in the will are distributed according to the widow or widower's wishes. It is important to note that there may be variations of the Sugar Land Texas Legal Last Will and Testament Form for Widow or Widower with Minor Children, depending on the specific requirements and preferences of individuals. It is always recommended consulting with an experienced attorney who specializes in estate planning to ensure the will accurately reflects one's wishes and is legally binding. Remember, estate planning is a deeply personal matter, and careful consideration should be given to every detail to protect the future of your minor children and the distribution of your assets.Sugar Land Texas Legal Last Will and Testament Form for Widow or Widower with Minor Children is a crucial legal document that allows individuals to provide clear instructions on how their assets and guardianship of their minor children should be handled after their passing. It is important for widows or widowers with minor children to have a comprehensive Last Will and Testament to ensure the well-being of their children and the proper distribution of their estate. The Sugar Land Texas Legal Last Will and Testament Form for Widow or Widower with Minor Children is specifically designed to cater to the unique needs of individuals in this situation. It may include various sections, such as: 1. Declarations: This section provides the necessary information about the person creating the will, including their full name, address, and marital status. It also confirms their intention to create a legally valid will and revoke any previous wills or codicils. 2. Appointment of Executor: The executor is responsible for managing the estate, distributing assets, and ensuring the terms of the will are executed. In this section, the widow or widower appoints a trusted individual to act as the executor of their will. 3. Guardianship of Minor Children: This is a crucial element for widows or widowers with minor children. It allows them to name a guardian who will take care of their children in the event of their passing. The chosen guardian should be someone trustworthy and capable of providing a safe and nurturing environment for the children. 4. Distribution of Assets: In this section, the widow or widower specifies how their assets, including property, investments, and personal belongings, should be distributed among their beneficiaries. They can divide their assets equally or assign specific items to different beneficiaries. 5. Trusts: Depending on the complexities of the estate or the specific needs of the minor children, the will may establish trusts to manage and protect the inheritances until the children reach a certain age or milestone. 6. Residuary Clause: This clause ensures that any remaining assets which were not specifically mentioned in the will are distributed according to the widow or widower's wishes. It is important to note that there may be variations of the Sugar Land Texas Legal Last Will and Testament Form for Widow or Widower with Minor Children, depending on the specific requirements and preferences of individuals. It is always recommended consulting with an experienced attorney who specializes in estate planning to ensure the will accurately reflects one's wishes and is legally binding. Remember, estate planning is a deeply personal matter, and careful consideration should be given to every detail to protect the future of your minor children and the distribution of your assets.