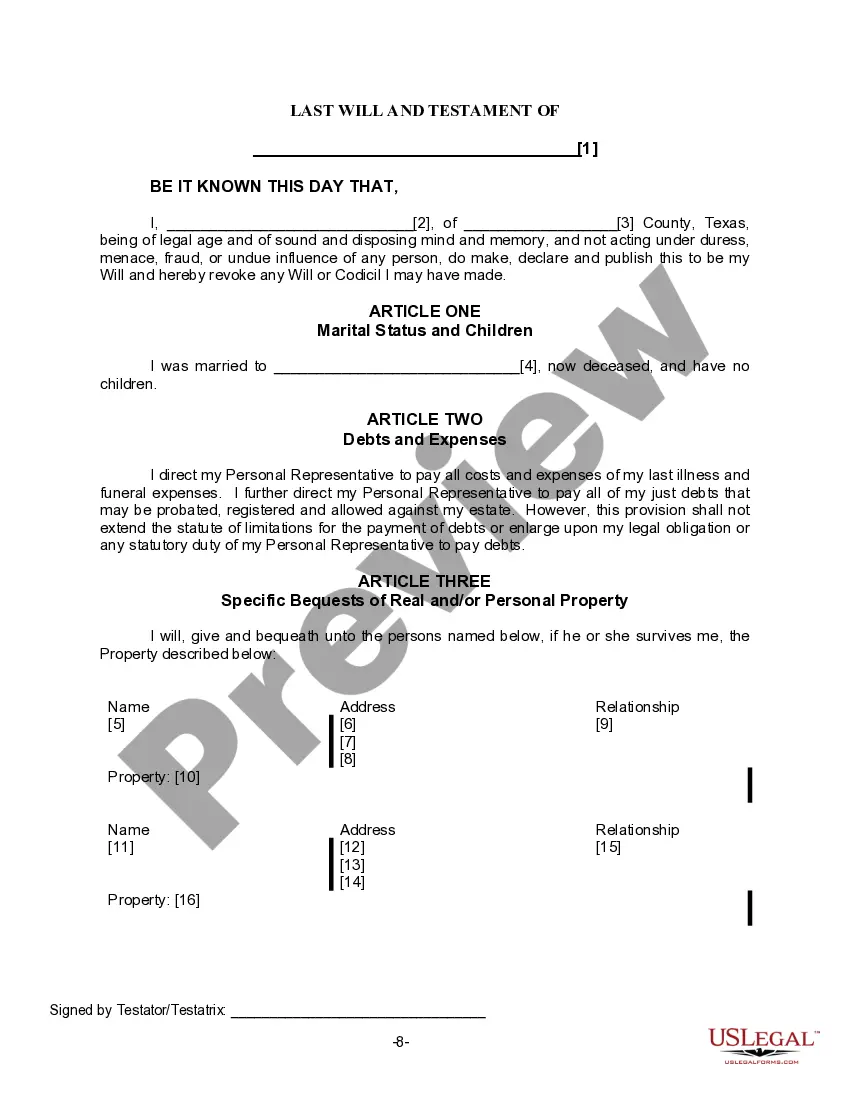

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

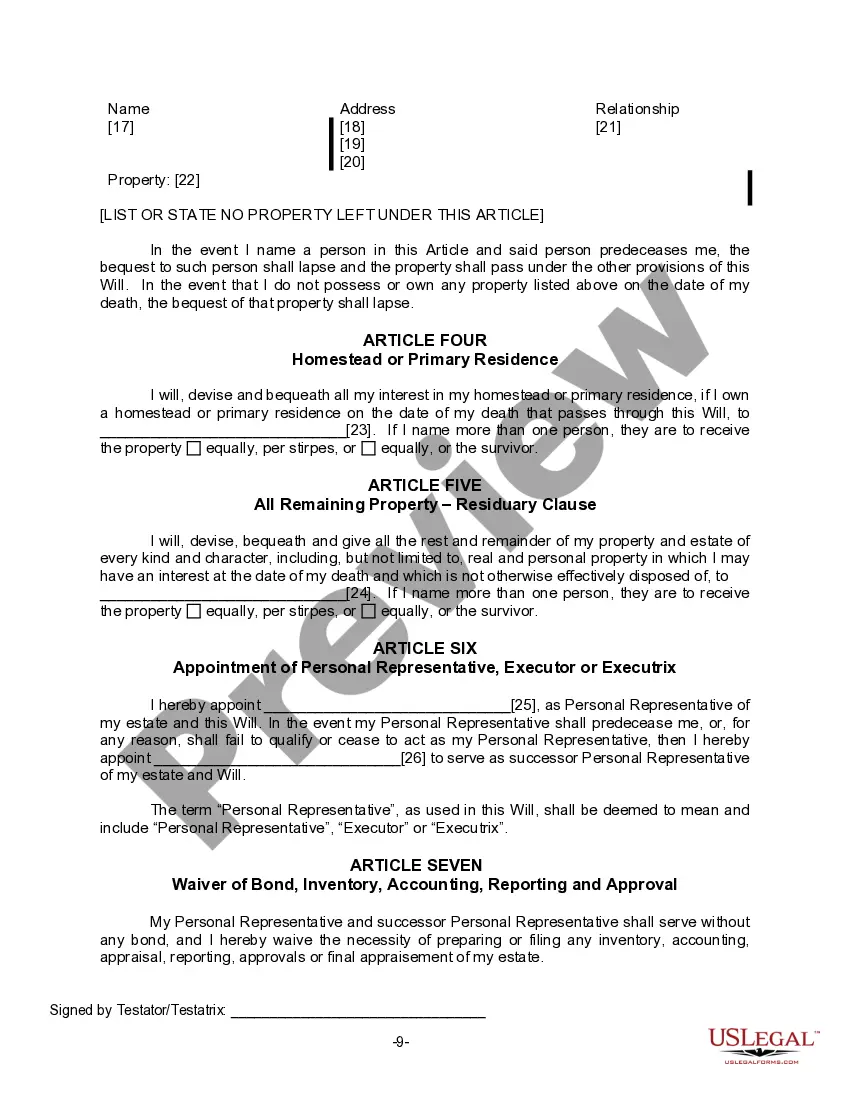

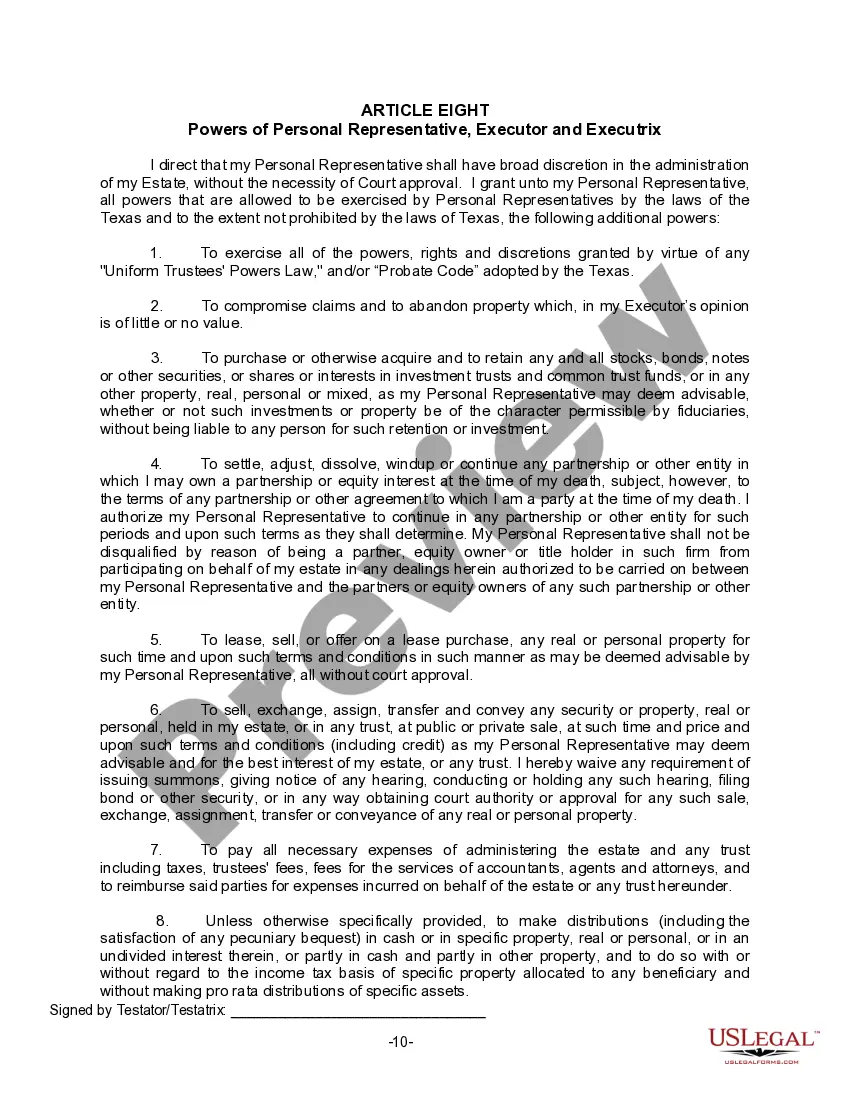

The Carrollton Texas Legal Last Will Form for a Widow or Widower with no Children is a legal document that outlines the wishes and distribution of assets for individuals who have lost their spouse and do not have any children. This form enables the widow or widower to specify how their property, finances, and possessions should be distributed upon their passing. This specific type of last will form recognizes the unique circumstances of individuals without children, allowing them to allocate their estate to desired beneficiaries such as other family members, close friends, or charitable organizations. It also serves as an opportunity to appoint someone as the executor of the will, responsible for executing the stated wishes and managing the estate's affairs. While there may not be different "types" of Carrollton Texas Legal Last Will Forms for a Widow or Widower with no Children, variations may exist based on specific preferences, circumstances, or estate complexities. Some key points to consider when drafting such a last will form include: 1. Naming beneficiaries: The widower or widow can specify the beneficiaries of the estate, considering family members, relatives, close friends, or charitable organizations. 2. Appointment of executor: This form allows the individual to name an executor, the person responsible for managing and distributing the estate according to the specified instructions. 3. Distribution of assets: The widow or widower can define how their assets, including property, investments, bank accounts, personal belongings, and any other valuable possessions, should be distributed among the designated beneficiaries. 4. Funeral arrangements: In this form, the individual may detail their preferred funeral arrangements, such as burial or cremation, and any specific wishes regarding memorial services. 5. Legal formalities: The Carrollton Last Will Form for a Widow or Widower with no Children must adhere to the legal requirements of the state of Texas to ensure its validity. This includes the presence of witnesses and notarization. Consulting an attorney with expertise in estate planning or probate matters can provide necessary guidance and ensure that the Last Will Form reflects the individual's intentions accurately. Note: It is crucial to review and update the Last Will Form periodically to account for any changes in personal circumstances, relationships, or asset ownership.The Carrollton Texas Legal Last Will Form for a Widow or Widower with no Children is a legal document that outlines the wishes and distribution of assets for individuals who have lost their spouse and do not have any children. This form enables the widow or widower to specify how their property, finances, and possessions should be distributed upon their passing. This specific type of last will form recognizes the unique circumstances of individuals without children, allowing them to allocate their estate to desired beneficiaries such as other family members, close friends, or charitable organizations. It also serves as an opportunity to appoint someone as the executor of the will, responsible for executing the stated wishes and managing the estate's affairs. While there may not be different "types" of Carrollton Texas Legal Last Will Forms for a Widow or Widower with no Children, variations may exist based on specific preferences, circumstances, or estate complexities. Some key points to consider when drafting such a last will form include: 1. Naming beneficiaries: The widower or widow can specify the beneficiaries of the estate, considering family members, relatives, close friends, or charitable organizations. 2. Appointment of executor: This form allows the individual to name an executor, the person responsible for managing and distributing the estate according to the specified instructions. 3. Distribution of assets: The widow or widower can define how their assets, including property, investments, bank accounts, personal belongings, and any other valuable possessions, should be distributed among the designated beneficiaries. 4. Funeral arrangements: In this form, the individual may detail their preferred funeral arrangements, such as burial or cremation, and any specific wishes regarding memorial services. 5. Legal formalities: The Carrollton Last Will Form for a Widow or Widower with no Children must adhere to the legal requirements of the state of Texas to ensure its validity. This includes the presence of witnesses and notarization. Consulting an attorney with expertise in estate planning or probate matters can provide necessary guidance and ensure that the Last Will Form reflects the individual's intentions accurately. Note: It is crucial to review and update the Last Will Form periodically to account for any changes in personal circumstances, relationships, or asset ownership.