The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

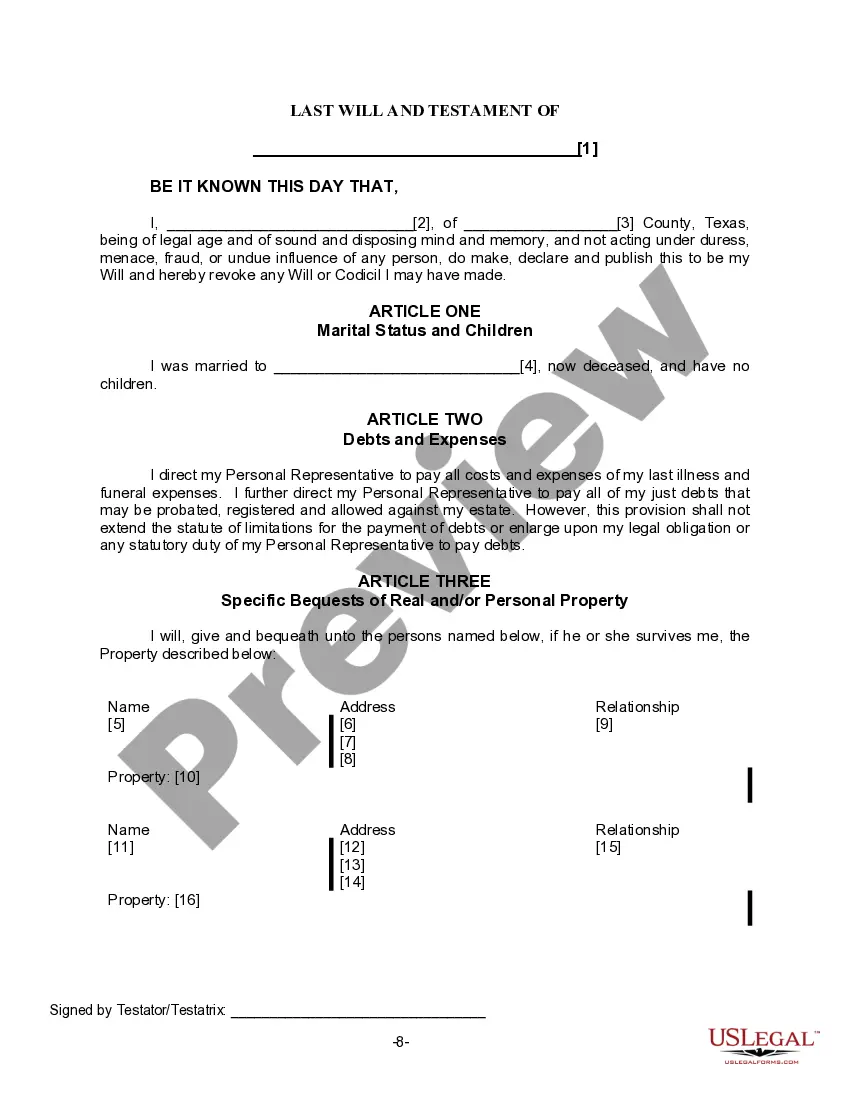

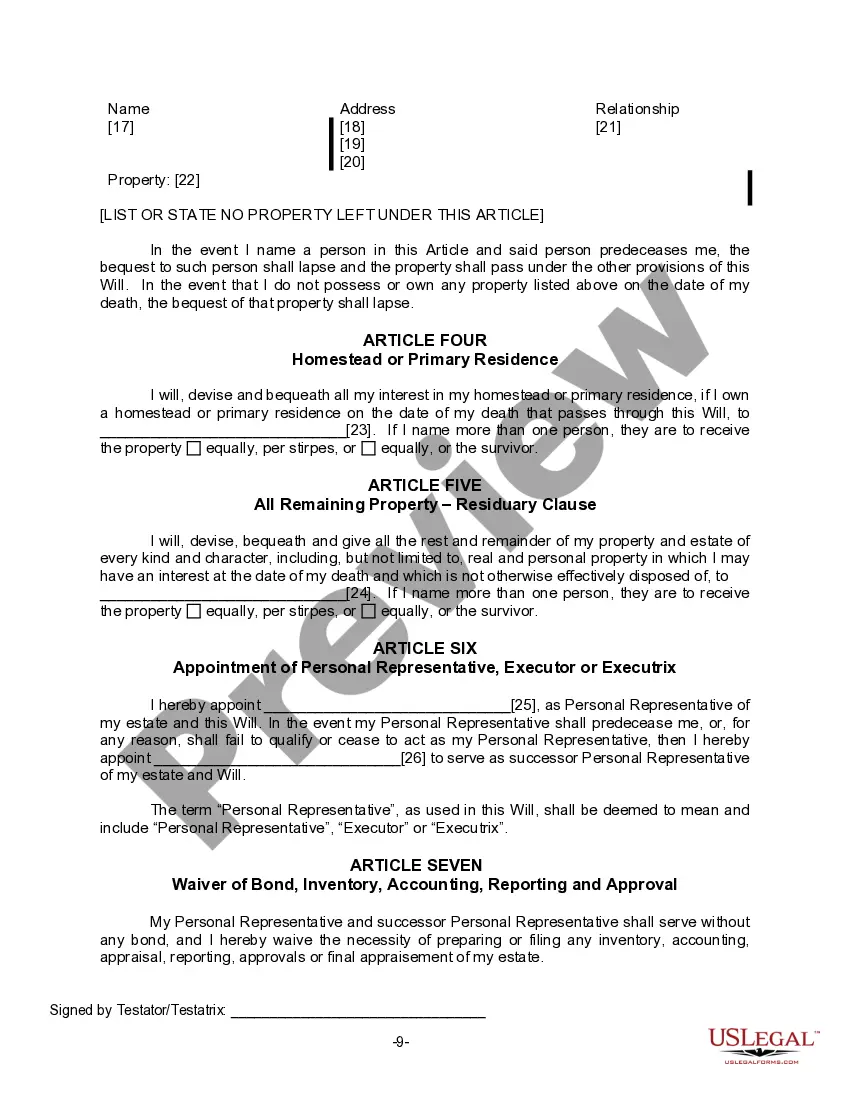

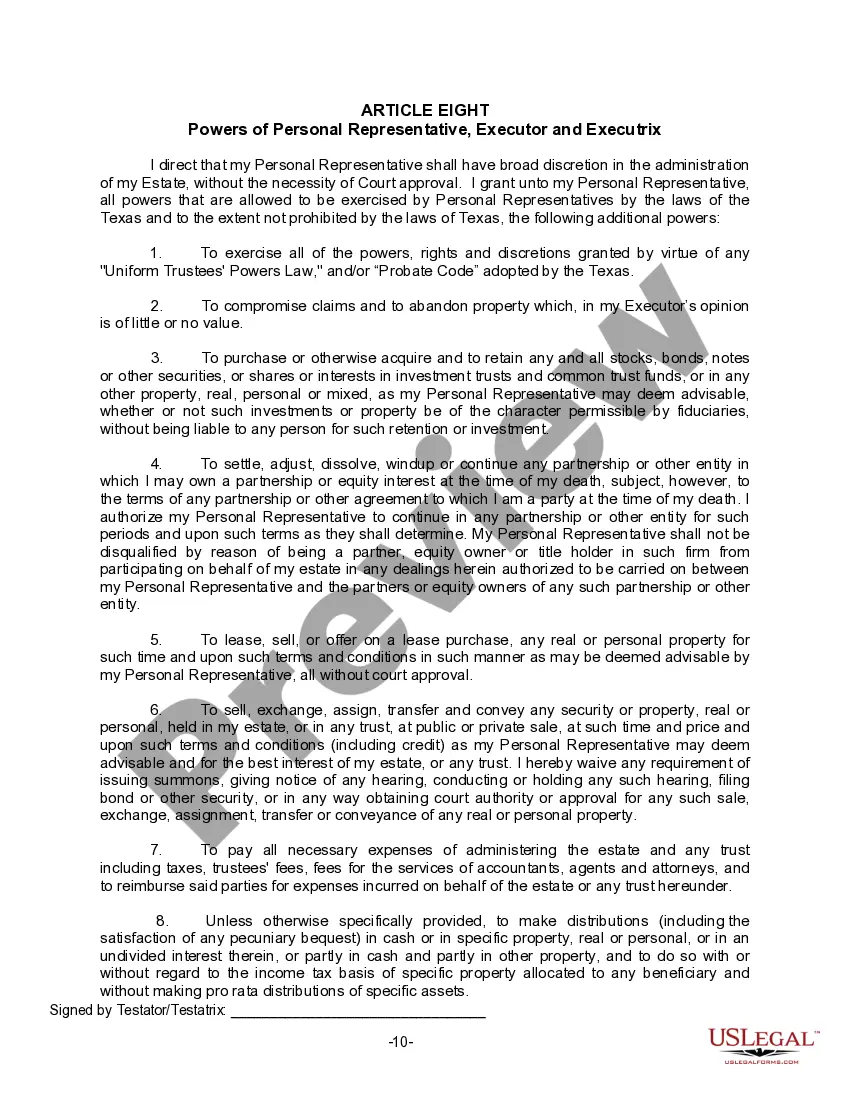

Harris Texas Legal Last Will Form for Widow or Widower with no Children A Harris Texas Legal Last Will Form for a Widow or Widower with no Children is specifically designed to address the unique circumstances of individuals who have lost their spouse without having any children. This legal document enables widows or widowers to outline their final wishes, ensuring that their assets and properties are distributed according to their preferences after their passing. The Last Will Form allows individuals to appoint an executor, who will be responsible for administering the estate and ensuring that the wishes detailed in the will are carried out. Executors may be a trusted family member, friend, or a legal professional. In the Harris Texas Legal Last Will Form for a Widow or Widower with no Children, several key elements are typically included: 1. Personal Information: This section collects the basic details of the person creating the will, including their full name, address, and contact information. 2. Appointment of Executor: The document provides a space for the widow or widower to name the chosen executor, who will handle the necessary tasks related to the distribution of assets and settling of the estate. 3. Asset Distribution: This portion allows the testator (the person creating the will) to specify how their assets should be distributed after their death. It includes provisions to name specific beneficiaries, allocate certain assets to individuals or organizations, and outline any specific conditions or instructions regarding property distribution. 4. Debts and Taxes: This section addresses any outstanding debts or taxes the testator may have. It may include instructions on how these liabilities should be settled using the assets from the estate. 5. Funeral and Burial Wishes: The Last Will Form often includes a provision for the testator to express their desires regarding funeral arrangements, the type of funeral service, and their preferred burial location. It is important to note that different organizations or websites may offer variations of the Harris Texas Legal Last Will Form for a Widow or Widower with no Children. Some variations may focus on specific aspects or provide additional clauses that can be tailored to best suit an individual's needs. Other possible names for Harris Texas Legal Last Will Forms related to widows or widowers with no children might include: — Harris County Widow/Widower Last Will Form — Texas Widow/Widower Last Will Template — Harris County Last Will Form for Spouses without Children — Texas Legal Will Form for Widows or Widowers without Children.Harris Texas Legal Last Will Form for Widow or Widower with no Children A Harris Texas Legal Last Will Form for a Widow or Widower with no Children is specifically designed to address the unique circumstances of individuals who have lost their spouse without having any children. This legal document enables widows or widowers to outline their final wishes, ensuring that their assets and properties are distributed according to their preferences after their passing. The Last Will Form allows individuals to appoint an executor, who will be responsible for administering the estate and ensuring that the wishes detailed in the will are carried out. Executors may be a trusted family member, friend, or a legal professional. In the Harris Texas Legal Last Will Form for a Widow or Widower with no Children, several key elements are typically included: 1. Personal Information: This section collects the basic details of the person creating the will, including their full name, address, and contact information. 2. Appointment of Executor: The document provides a space for the widow or widower to name the chosen executor, who will handle the necessary tasks related to the distribution of assets and settling of the estate. 3. Asset Distribution: This portion allows the testator (the person creating the will) to specify how their assets should be distributed after their death. It includes provisions to name specific beneficiaries, allocate certain assets to individuals or organizations, and outline any specific conditions or instructions regarding property distribution. 4. Debts and Taxes: This section addresses any outstanding debts or taxes the testator may have. It may include instructions on how these liabilities should be settled using the assets from the estate. 5. Funeral and Burial Wishes: The Last Will Form often includes a provision for the testator to express their desires regarding funeral arrangements, the type of funeral service, and their preferred burial location. It is important to note that different organizations or websites may offer variations of the Harris Texas Legal Last Will Form for a Widow or Widower with no Children. Some variations may focus on specific aspects or provide additional clauses that can be tailored to best suit an individual's needs. Other possible names for Harris Texas Legal Last Will Forms related to widows or widowers with no children might include: — Harris County Widow/Widower Last Will Form — Texas Widow/Widower Last Will Template — Harris County Last Will Form for Spouses without Children — Texas Legal Will Form for Widows or Widowers without Children.