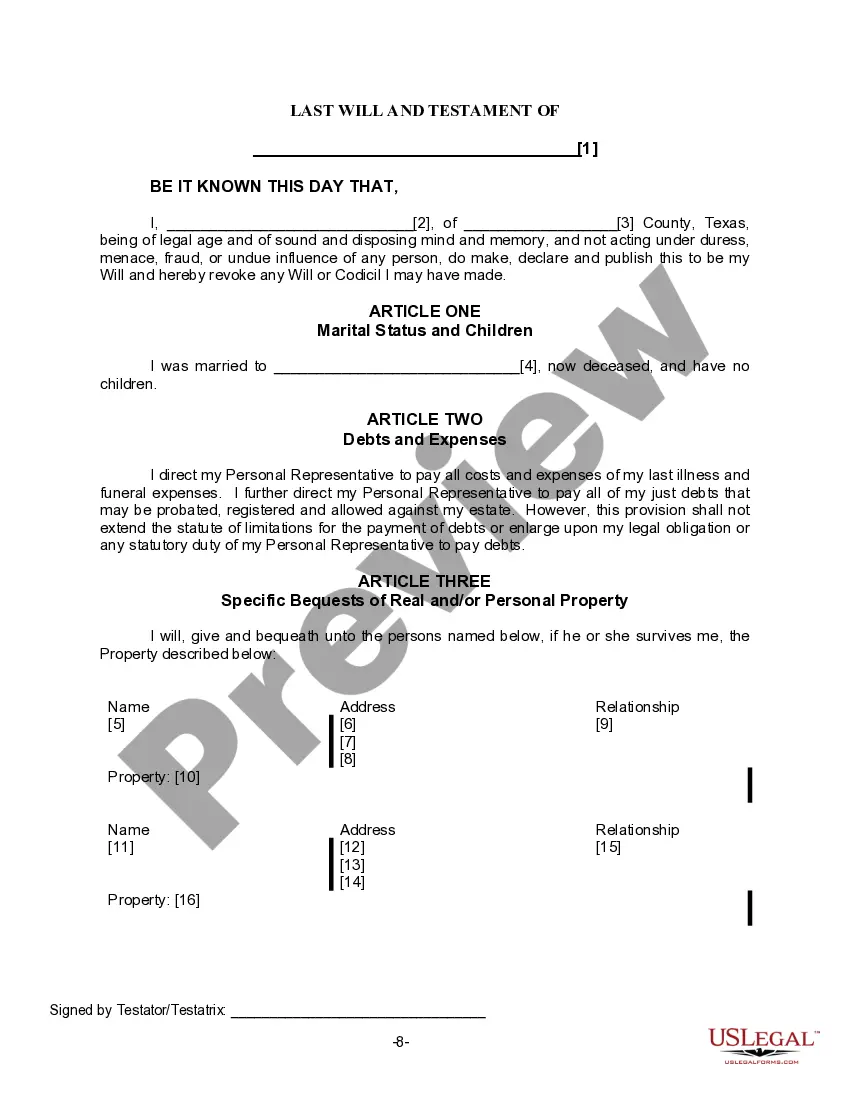

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

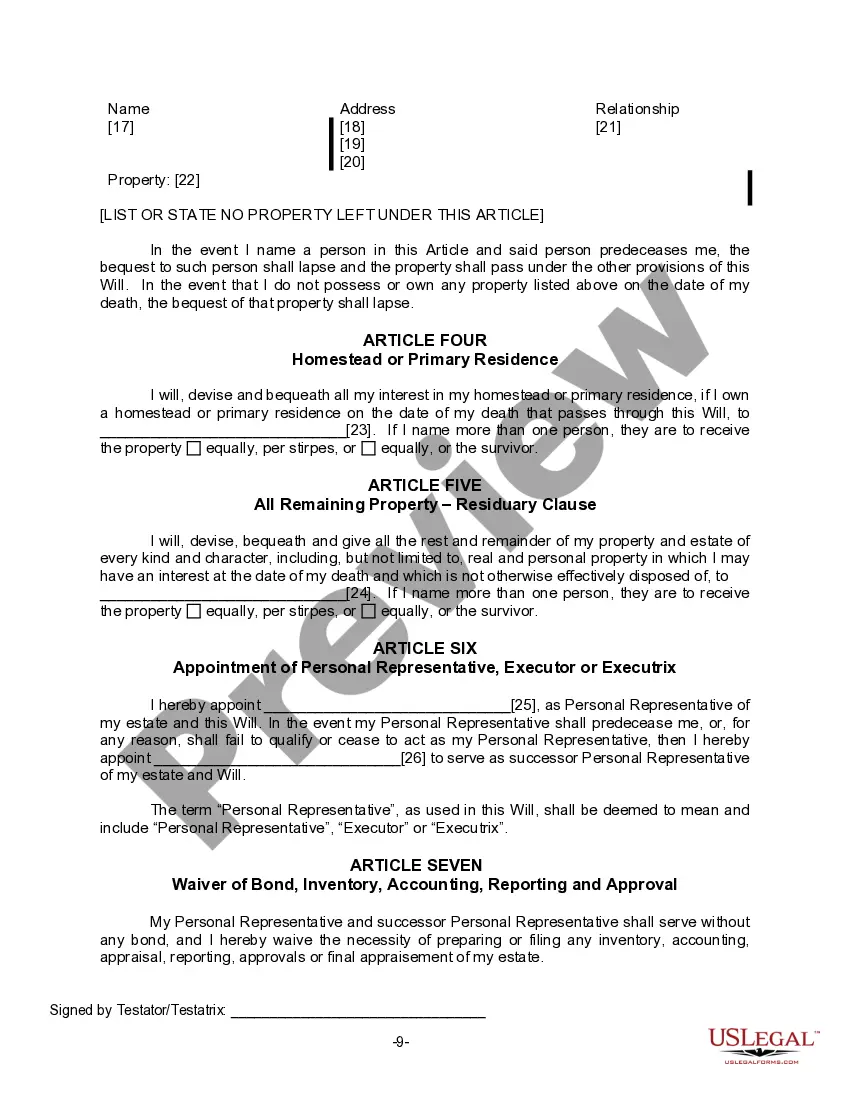

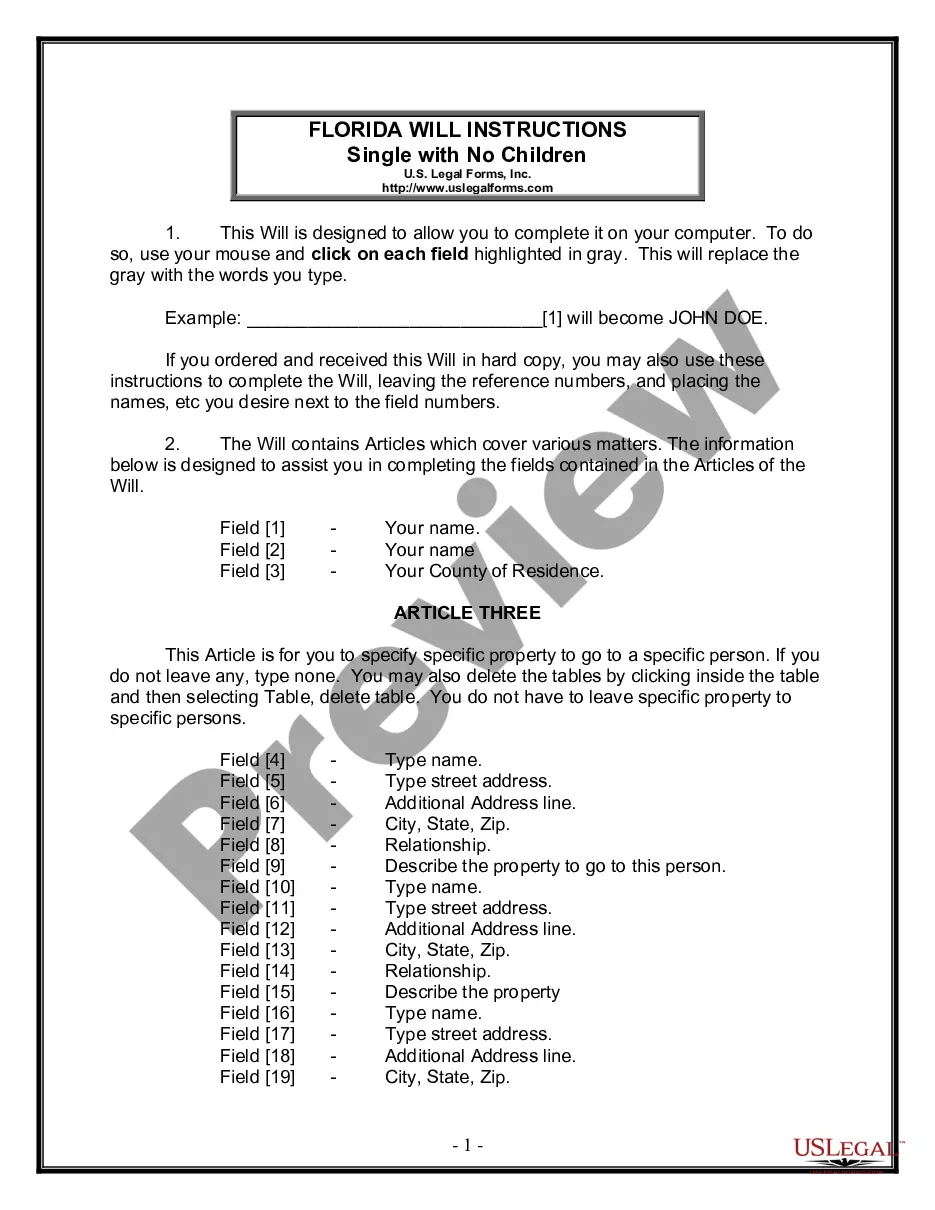

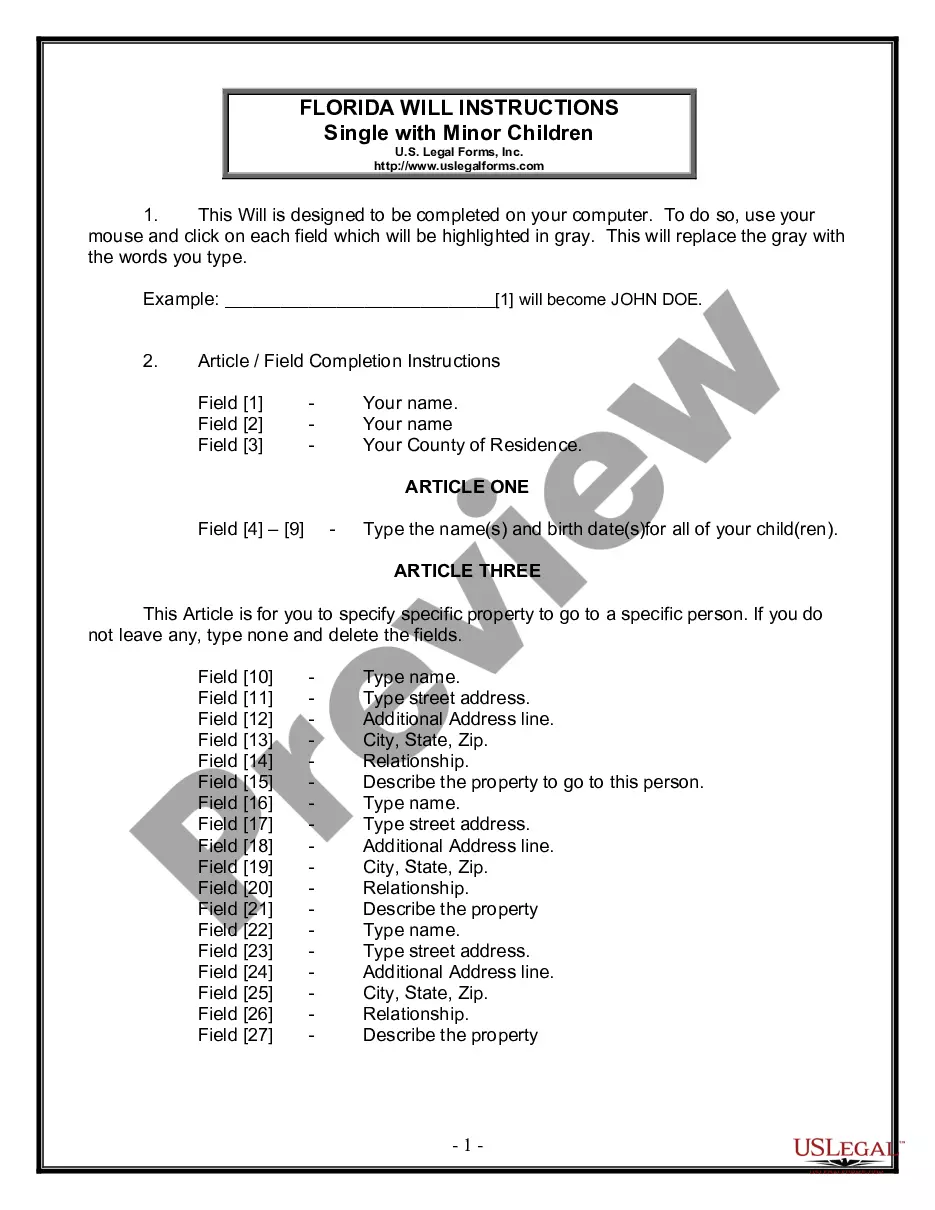

Laredo Texas Legal Last Will Form for a Widow or Widower with No Children: A Comprehensive Guide In Laredo, Texas, creating a legal Last Will and Testament is crucial for individuals who want to ensure that their assets and estate are distributed according to their wishes after their passing. For widows or widowers without children, it becomes even more important to have a will in place to determine how their estate will be distributed and to whom. This detailed description will explore the specifics of the Laredo Texas Legal Last Will Form designed specifically for a widow or widower with no children, answering any questions or concerns one may have. The Laredo Texas Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals to express their wishes regarding the distribution of their estate, assets, and properties upon their death. It provides clarity and avoids potential disputes among family members and other interested parties. Some essential components covered in this specific Last Will Form include: 1. Personal Information: — Full legal name of the widow or widower — Current address and contact information Catbirdsrt— - Social Security number 2. Executor Designation: — Naming an executor is crucial as this person will be responsible for overseeing the administration of the estate and ensuring that all instructions are carried out accordingly. — The widow or widower can identify a trusted family member, friend, or professional executor, such as an attorney or a financial advisor. — It's important to have a backup executor listed in case the primary executor is unable or unwilling to fulfill their duties. 3. Assets and Property Distribution: — This section allows the widow or widower to specify how they want their assets, properties, and personal belongings to be distributed after their passing. — It might include real estate properties, financial accounts, vehicles, valuable possessions, sentimental items, and more. — Specific instructions can be given, such as gifting certain items to specific individuals, donating to charitable organizations, or setting up trusts for beneficiaries. 4. Debts, Taxes, and Expenses: — The Last Will Form should address how any outstanding debts, taxes, and final expenses will be handled. — It is essential to ensure that these obligations are properly settled to prevent any encumbrances on the assets intended for distribution. Different Types of Laredo Texas Legal Last Will Forms for a Widow or Widower with no Children: 1. Simple Last Will Form: — This type of form provides a straightforward template for individuals with simpler estate distribution requirements. — It is suited for those with relatively fewer assets and a straightforward distribution plan. 2. Complex Last Will Form: — For individuals with complex financial holdings, extensive property ownership, or unique distribution requirements, a complex Last Will Form might be necessary. — It enables the widow or widower to provide more detailed instructions regarding various types of assets, conditions or restrictions on distributions, and special considerations. In conclusion, the Laredo Texas Legal Last Will Form for a Widow or Widower with no Children is a legally-binding document that allows individuals in this specific situation to ensure their estate is handled according to their wishes. By addressing personal information, executor designation, assets distribution, and financial obligations, this form provides a comprehensive framework for creating an effective Last Will. Depending on the complexity of one's estate, one can opt for either a Simple or Complex Last Will Form.Laredo Texas Legal Last Will Form for a Widow or Widower with No Children: A Comprehensive Guide In Laredo, Texas, creating a legal Last Will and Testament is crucial for individuals who want to ensure that their assets and estate are distributed according to their wishes after their passing. For widows or widowers without children, it becomes even more important to have a will in place to determine how their estate will be distributed and to whom. This detailed description will explore the specifics of the Laredo Texas Legal Last Will Form designed specifically for a widow or widower with no children, answering any questions or concerns one may have. The Laredo Texas Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals to express their wishes regarding the distribution of their estate, assets, and properties upon their death. It provides clarity and avoids potential disputes among family members and other interested parties. Some essential components covered in this specific Last Will Form include: 1. Personal Information: — Full legal name of the widow or widower — Current address and contact information Catbirdsrt— - Social Security number 2. Executor Designation: — Naming an executor is crucial as this person will be responsible for overseeing the administration of the estate and ensuring that all instructions are carried out accordingly. — The widow or widower can identify a trusted family member, friend, or professional executor, such as an attorney or a financial advisor. — It's important to have a backup executor listed in case the primary executor is unable or unwilling to fulfill their duties. 3. Assets and Property Distribution: — This section allows the widow or widower to specify how they want their assets, properties, and personal belongings to be distributed after their passing. — It might include real estate properties, financial accounts, vehicles, valuable possessions, sentimental items, and more. — Specific instructions can be given, such as gifting certain items to specific individuals, donating to charitable organizations, or setting up trusts for beneficiaries. 4. Debts, Taxes, and Expenses: — The Last Will Form should address how any outstanding debts, taxes, and final expenses will be handled. — It is essential to ensure that these obligations are properly settled to prevent any encumbrances on the assets intended for distribution. Different Types of Laredo Texas Legal Last Will Forms for a Widow or Widower with no Children: 1. Simple Last Will Form: — This type of form provides a straightforward template for individuals with simpler estate distribution requirements. — It is suited for those with relatively fewer assets and a straightforward distribution plan. 2. Complex Last Will Form: — For individuals with complex financial holdings, extensive property ownership, or unique distribution requirements, a complex Last Will Form might be necessary. — It enables the widow or widower to provide more detailed instructions regarding various types of assets, conditions or restrictions on distributions, and special considerations. In conclusion, the Laredo Texas Legal Last Will Form for a Widow or Widower with no Children is a legally-binding document that allows individuals in this specific situation to ensure their estate is handled according to their wishes. By addressing personal information, executor designation, assets distribution, and financial obligations, this form provides a comprehensive framework for creating an effective Last Will. Depending on the complexity of one's estate, one can opt for either a Simple or Complex Last Will Form.