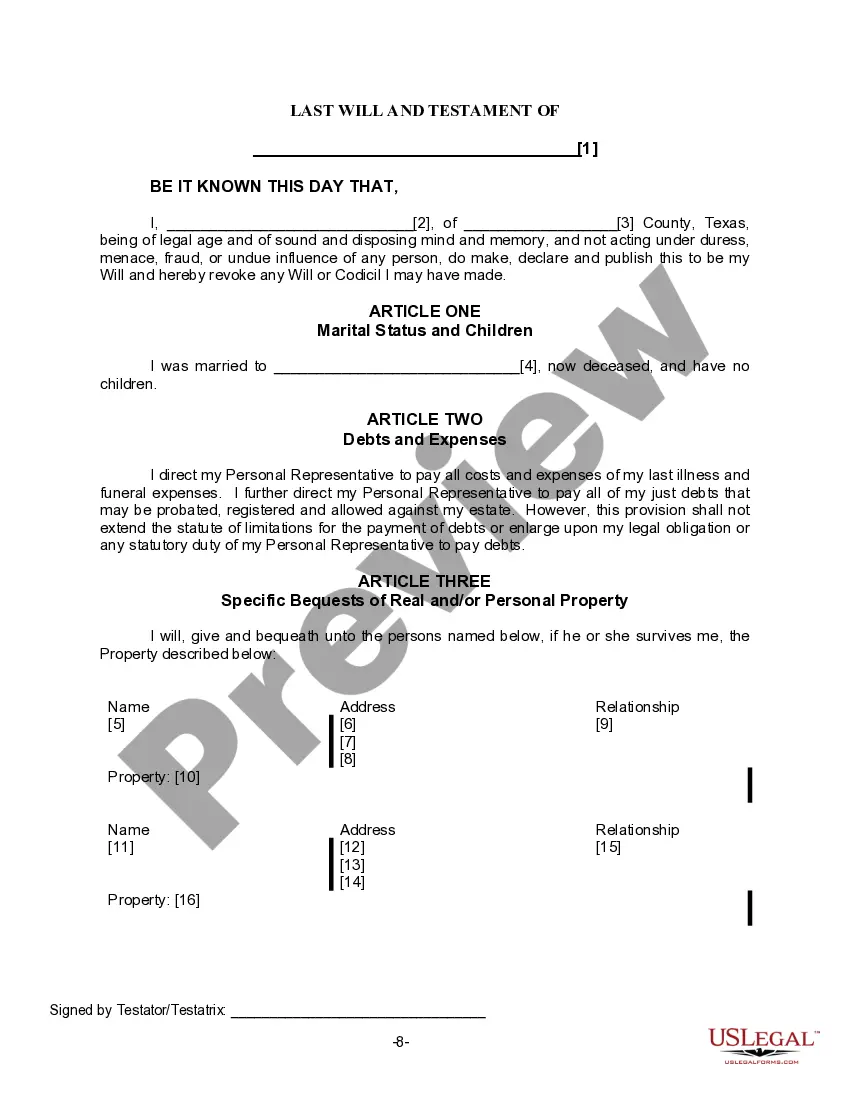

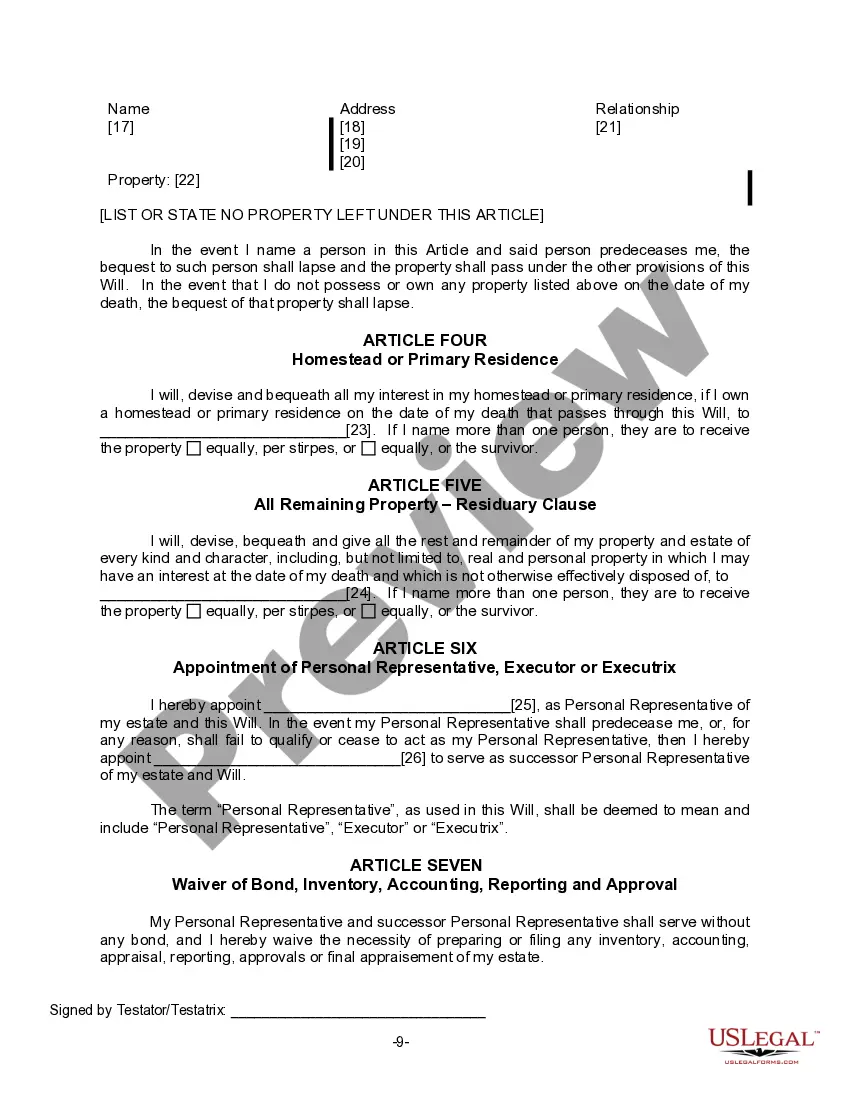

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children: A Comprehensive Guide When it comes to estate planning, a legal last will form is an essential document that enables individuals to dictate their wishes regarding the distribution of their assets after their passing. For widows or widowers residing in Lewisville, Texas, it becomes particularly important to establish their final wishes through a legally binding will to ensure their estate is handled according to their desires. This comprehensive guide will provide an in-depth description of the Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children, covering key elements, relevant keywords, and other important information. Key Elements of a Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children: 1. Testator Information: They will form includes a section to provide personal details such as the widow or widower's full legal name, address, and contact information. 2. Executor Appointment: The testator can designate an executor, also referred to as a personal representative, who will be responsible for managing the estate and ensuring the will's instructions are carried out. The executor will handle tasks such as filing court documents, paying debts, and distributing assets. 3. Asset Distribution: This is the core element of they will form. The widowed individual can outline how their assets, including property, bank accounts, investments, and personal belongings, should be distributed among beneficiaries. In the absence of children, the testator may choose relatives, close friends, or charitable organizations as beneficiaries. 4. Alternate Beneficiaries: It is prudent to include alternate beneficiaries in case the primary beneficiaries predecease the testator or are unable to inherit the assets for any reason. This ensures that assets are distributed as desired even if circumstances change. 5. Specific Bequests: The testator may make specific bequests, providing detailed instructions for the distribution of certain items, such as family heirlooms, sentimental possessions, or charitable donations. 6. Guardianship Designation: While this may not apply to widows or widowers with no children, if they have dependents or minor siblings, they can designate a guardian who will assume care and custody of them in the event of the testator's death. Different Types of Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children: 1. Simple Last Will: This straightforward will form is suitable for individuals with uncomplicated estates and straightforward distribution instructions. It is ideal for widows or widowers with limited assets and a clear vision of their intended beneficiaries. 2. Living Will: While not directly applicable to the distribution of assets, a living will allows individuals to specify their wishes regarding healthcare decisions if they become incapacitated. This is an additional document that can complement the Last Will. 3. Testamentary Trust Will: For widows or widowers with substantial assets, a testamentary trust will enable the creation of trusts within the will itself. This allows for asset management on behalf of beneficiaries, providing flexibility and potentially mitigating tax implications. By utilizing the appropriate Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children, individuals can ensure that their final wishes are respected and their estate is distributed according to their intentions. It is always advisable to consult with an experienced attorney specializing in estate planning to ensure the will complies with all legal requirements and is tailored to one's specific circumstances.Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children: A Comprehensive Guide When it comes to estate planning, a legal last will form is an essential document that enables individuals to dictate their wishes regarding the distribution of their assets after their passing. For widows or widowers residing in Lewisville, Texas, it becomes particularly important to establish their final wishes through a legally binding will to ensure their estate is handled according to their desires. This comprehensive guide will provide an in-depth description of the Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children, covering key elements, relevant keywords, and other important information. Key Elements of a Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children: 1. Testator Information: They will form includes a section to provide personal details such as the widow or widower's full legal name, address, and contact information. 2. Executor Appointment: The testator can designate an executor, also referred to as a personal representative, who will be responsible for managing the estate and ensuring the will's instructions are carried out. The executor will handle tasks such as filing court documents, paying debts, and distributing assets. 3. Asset Distribution: This is the core element of they will form. The widowed individual can outline how their assets, including property, bank accounts, investments, and personal belongings, should be distributed among beneficiaries. In the absence of children, the testator may choose relatives, close friends, or charitable organizations as beneficiaries. 4. Alternate Beneficiaries: It is prudent to include alternate beneficiaries in case the primary beneficiaries predecease the testator or are unable to inherit the assets for any reason. This ensures that assets are distributed as desired even if circumstances change. 5. Specific Bequests: The testator may make specific bequests, providing detailed instructions for the distribution of certain items, such as family heirlooms, sentimental possessions, or charitable donations. 6. Guardianship Designation: While this may not apply to widows or widowers with no children, if they have dependents or minor siblings, they can designate a guardian who will assume care and custody of them in the event of the testator's death. Different Types of Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children: 1. Simple Last Will: This straightforward will form is suitable for individuals with uncomplicated estates and straightforward distribution instructions. It is ideal for widows or widowers with limited assets and a clear vision of their intended beneficiaries. 2. Living Will: While not directly applicable to the distribution of assets, a living will allows individuals to specify their wishes regarding healthcare decisions if they become incapacitated. This is an additional document that can complement the Last Will. 3. Testamentary Trust Will: For widows or widowers with substantial assets, a testamentary trust will enable the creation of trusts within the will itself. This allows for asset management on behalf of beneficiaries, providing flexibility and potentially mitigating tax implications. By utilizing the appropriate Lewisville Texas Legal Last Will Form for a Widow or Widower with no Children, individuals can ensure that their final wishes are respected and their estate is distributed according to their intentions. It is always advisable to consult with an experienced attorney specializing in estate planning to ensure the will complies with all legal requirements and is tailored to one's specific circumstances.