The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

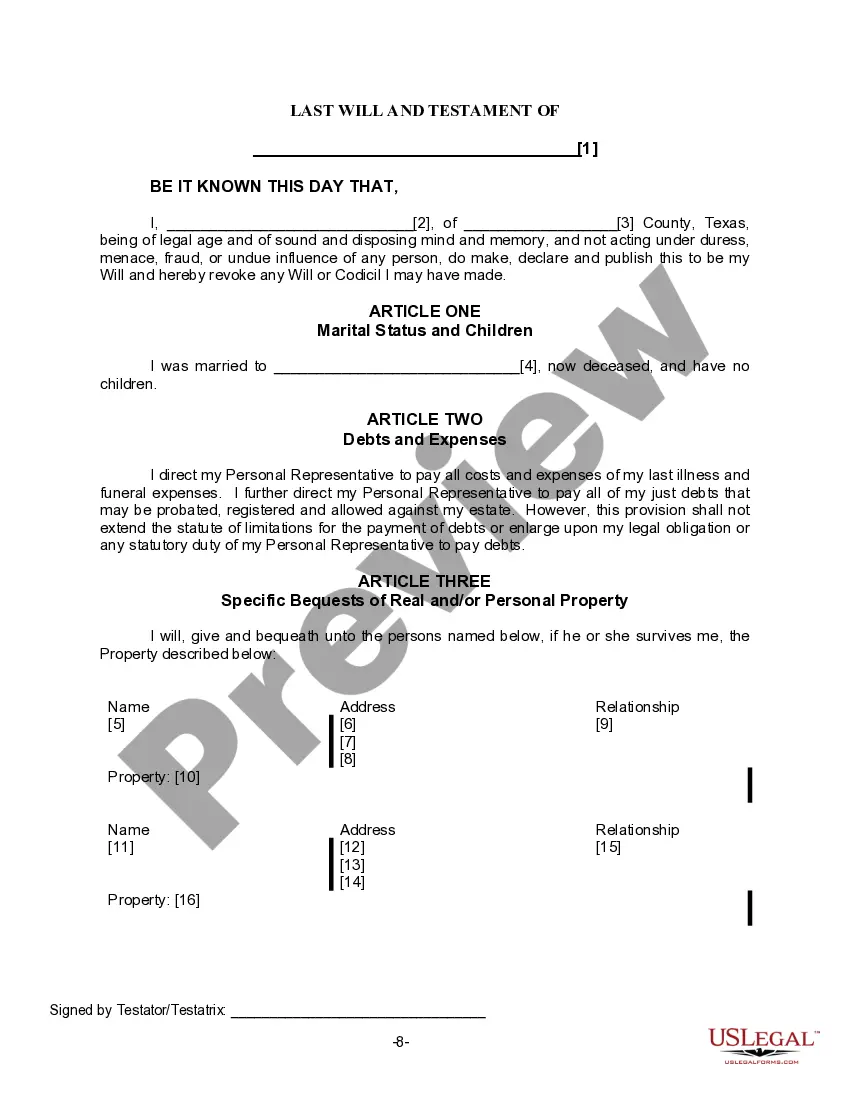

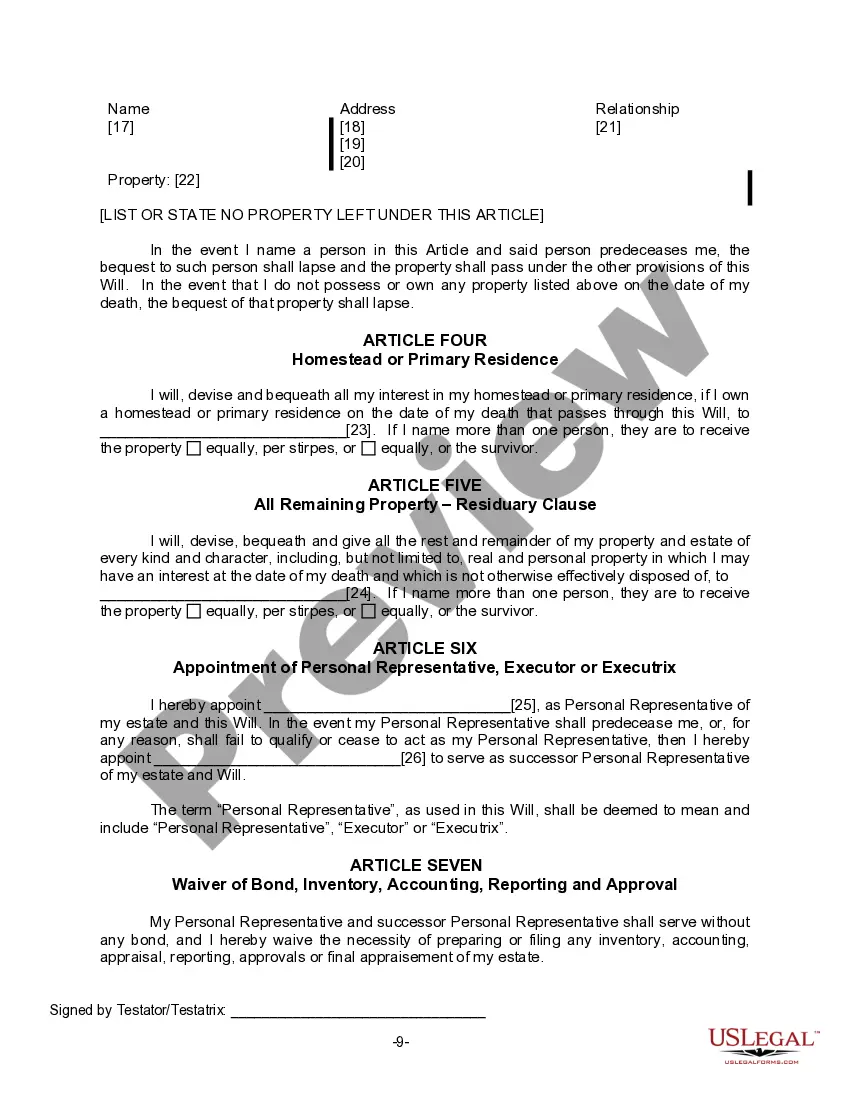

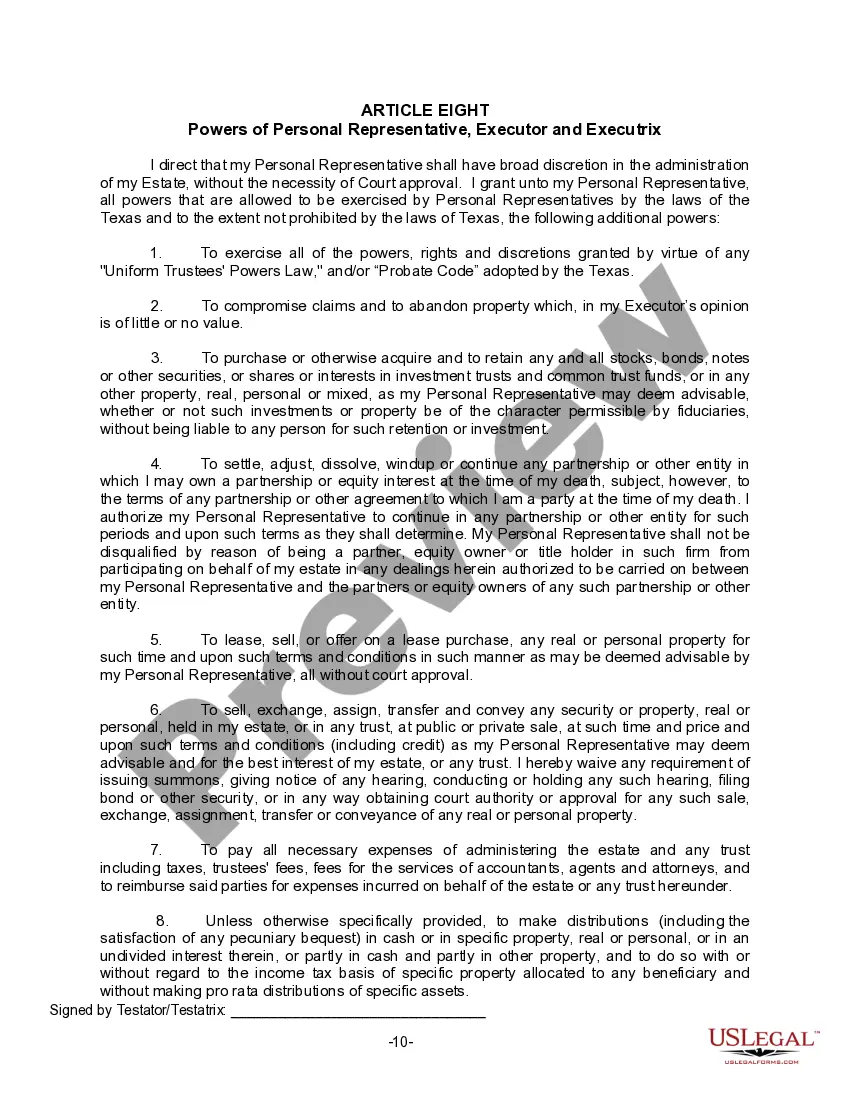

The Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals in Pasadena, Texas, who are widowed and have no children, to outline their wishes for the distribution of their assets and designate beneficiaries. This form is designed specifically for those who do not have any surviving children and need to create a comprehensive estate plan. The Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children is essential for ensuring that your property, assets, and belongings are distributed according to your wishes after your passing. By completing this legal document, individuals can have peace of mind knowing that their estate will be handled exactly as desired. Some key elements included in the Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children are: 1. Testator's Personal Information: Begin the form by providing the individual's full name, address, and other contact details. This information helps to establish the identity of the testator — the person creating the will – and ensure its validity. 2. Appointment of Executor: Appointing an executor is a crucial aspect of the will. The executor is responsible for managing the administration of the estate, ensuring that debts and taxes are paid, and handling the distribution of assets as specified in the will. It is advisable to choose a trusted family member, close friend, or a professional executor for this role. 3. Specific Distribution of Assets: In this section, the testator can detail the specific distribution of their assets. This may include properties, bank accounts, investments, personal belongings, and any other valuable possessions. It is recommended to be as detailed as possible to avoid any ambiguity or disputes among beneficiaries. 4. Alternate Beneficiaries: In the event that the primary beneficiaries are unable or unwilling to accept their inheritance, providing alternate beneficiaries is essential. This ensures that the estate does not go unclaimed or become subject to probate court. 5. Residual Estate: After specific bequests have been made, any remaining assets or property constitute the residual estate. The testator can designate who will inherit this residual estate. 6. Guardianship Appointment: In case the testator has any dependents, such as pets or individuals requiring special care, the will form allows for the appointment of a guardian to ensure their well-being. Some variations of the Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children may include specific provisions for charitable donations, establishment of testamentary trusts, or instructions for funeral arrangements. Creating a will is an important step in safeguarding your assets and ensuring that your wishes are respected after your passing. Consider consulting with an experienced attorney to guide you through the process and ensure compliance with applicable state laws and regulations.The Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals in Pasadena, Texas, who are widowed and have no children, to outline their wishes for the distribution of their assets and designate beneficiaries. This form is designed specifically for those who do not have any surviving children and need to create a comprehensive estate plan. The Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children is essential for ensuring that your property, assets, and belongings are distributed according to your wishes after your passing. By completing this legal document, individuals can have peace of mind knowing that their estate will be handled exactly as desired. Some key elements included in the Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children are: 1. Testator's Personal Information: Begin the form by providing the individual's full name, address, and other contact details. This information helps to establish the identity of the testator — the person creating the will – and ensure its validity. 2. Appointment of Executor: Appointing an executor is a crucial aspect of the will. The executor is responsible for managing the administration of the estate, ensuring that debts and taxes are paid, and handling the distribution of assets as specified in the will. It is advisable to choose a trusted family member, close friend, or a professional executor for this role. 3. Specific Distribution of Assets: In this section, the testator can detail the specific distribution of their assets. This may include properties, bank accounts, investments, personal belongings, and any other valuable possessions. It is recommended to be as detailed as possible to avoid any ambiguity or disputes among beneficiaries. 4. Alternate Beneficiaries: In the event that the primary beneficiaries are unable or unwilling to accept their inheritance, providing alternate beneficiaries is essential. This ensures that the estate does not go unclaimed or become subject to probate court. 5. Residual Estate: After specific bequests have been made, any remaining assets or property constitute the residual estate. The testator can designate who will inherit this residual estate. 6. Guardianship Appointment: In case the testator has any dependents, such as pets or individuals requiring special care, the will form allows for the appointment of a guardian to ensure their well-being. Some variations of the Pasadena Texas Legal Last Will Form for a Widow or Widower with no Children may include specific provisions for charitable donations, establishment of testamentary trusts, or instructions for funeral arrangements. Creating a will is an important step in safeguarding your assets and ensuring that your wishes are respected after your passing. Consider consulting with an experienced attorney to guide you through the process and ensure compliance with applicable state laws and regulations.