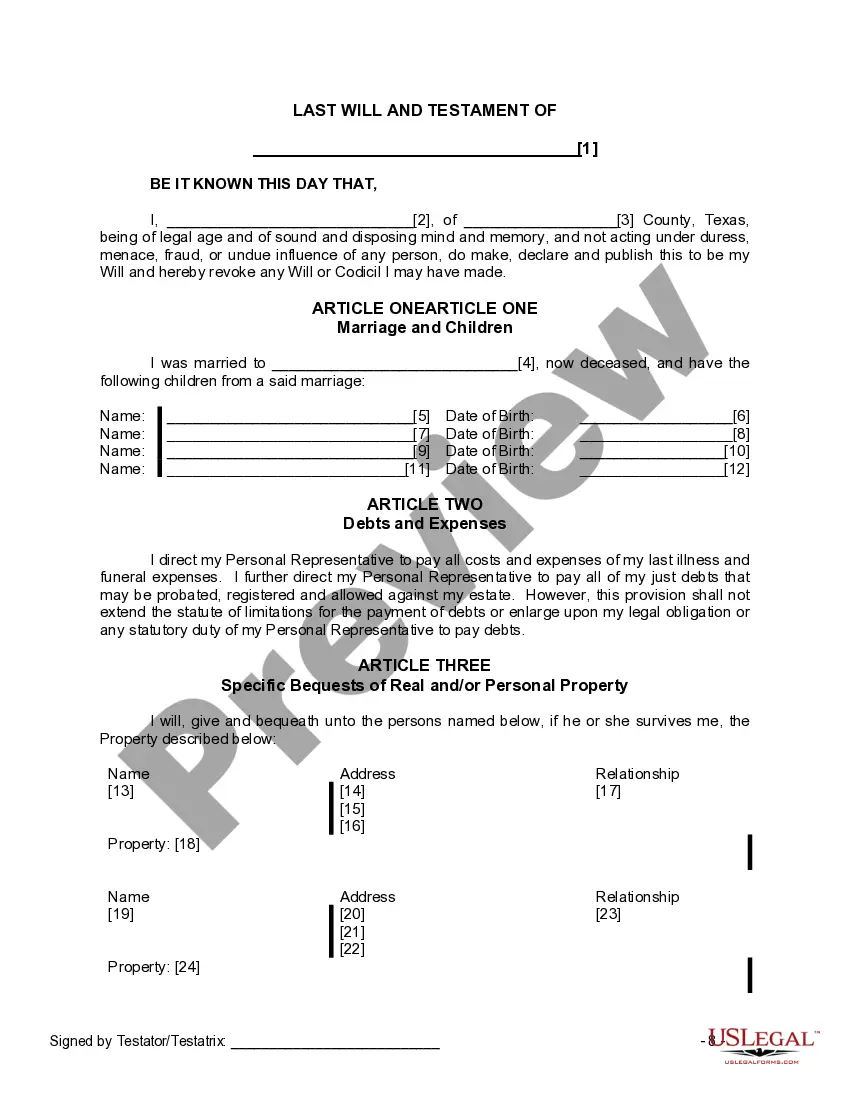

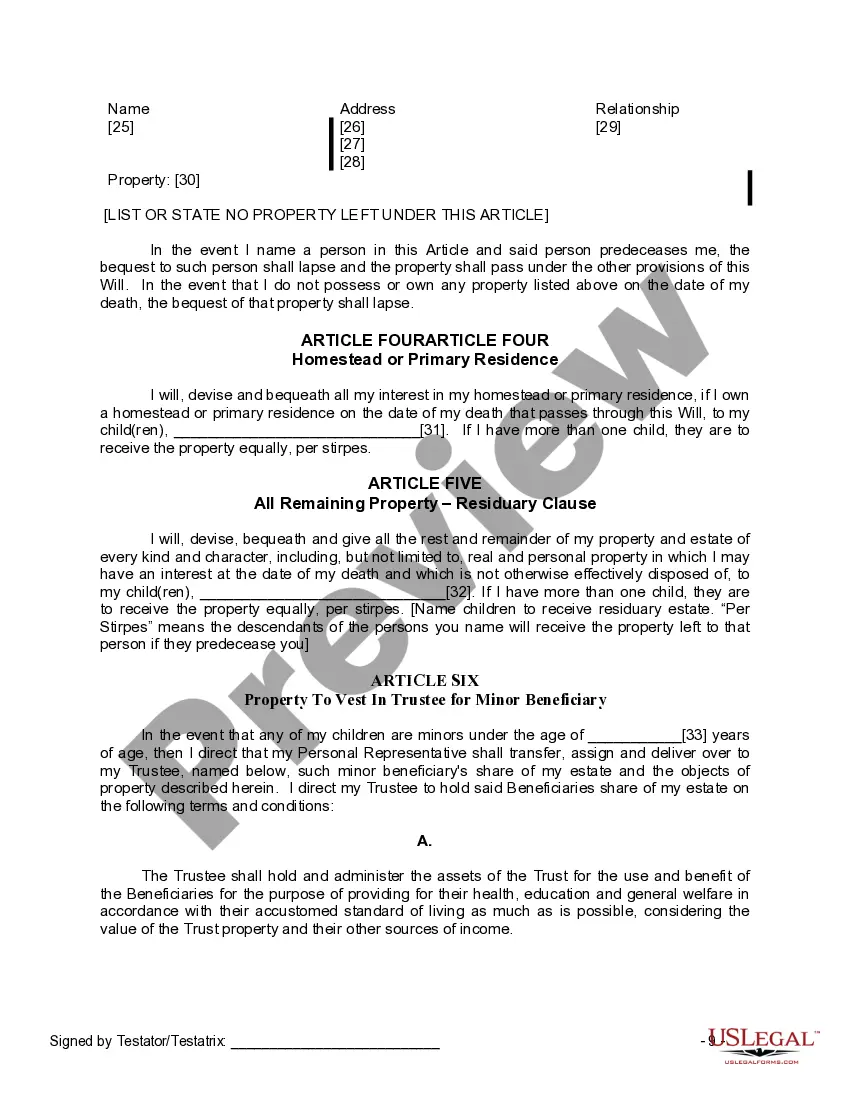

This Legal Last Will and Testament Form with Instructions for a Widow or Widower with Adult and Minor Children is for a widow or widower with minor and adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

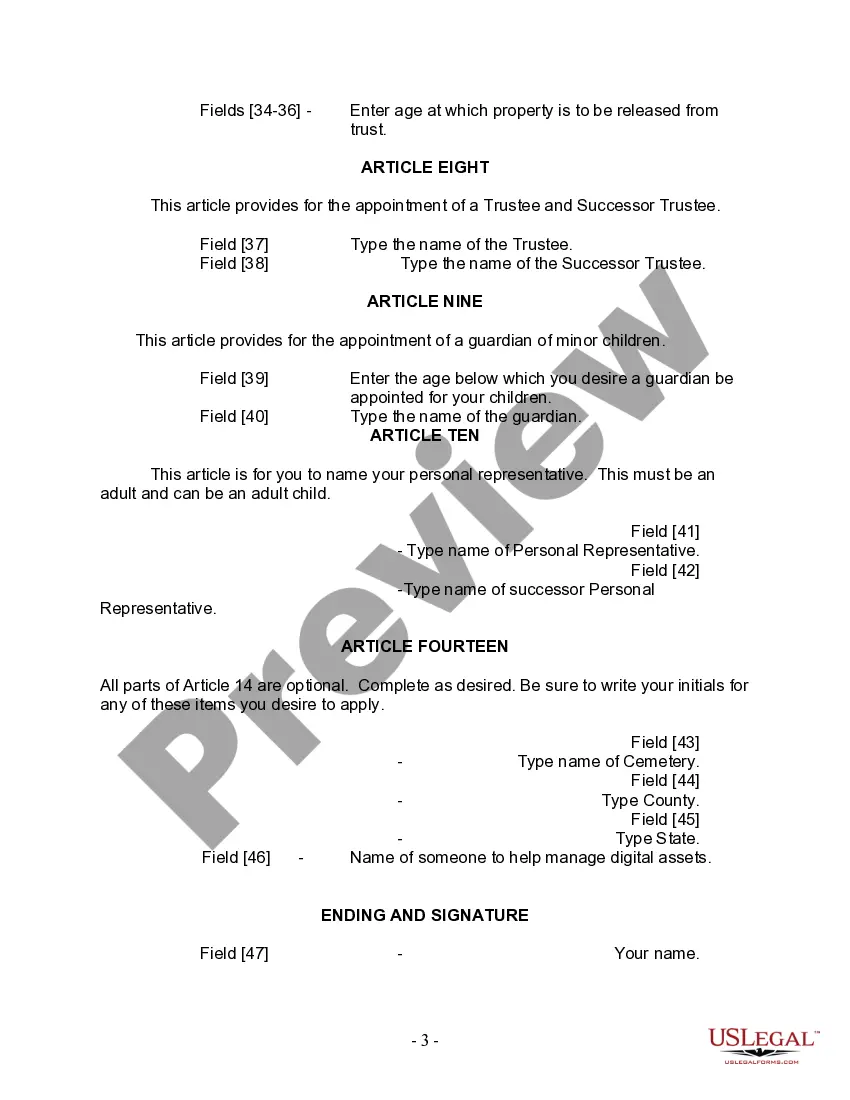

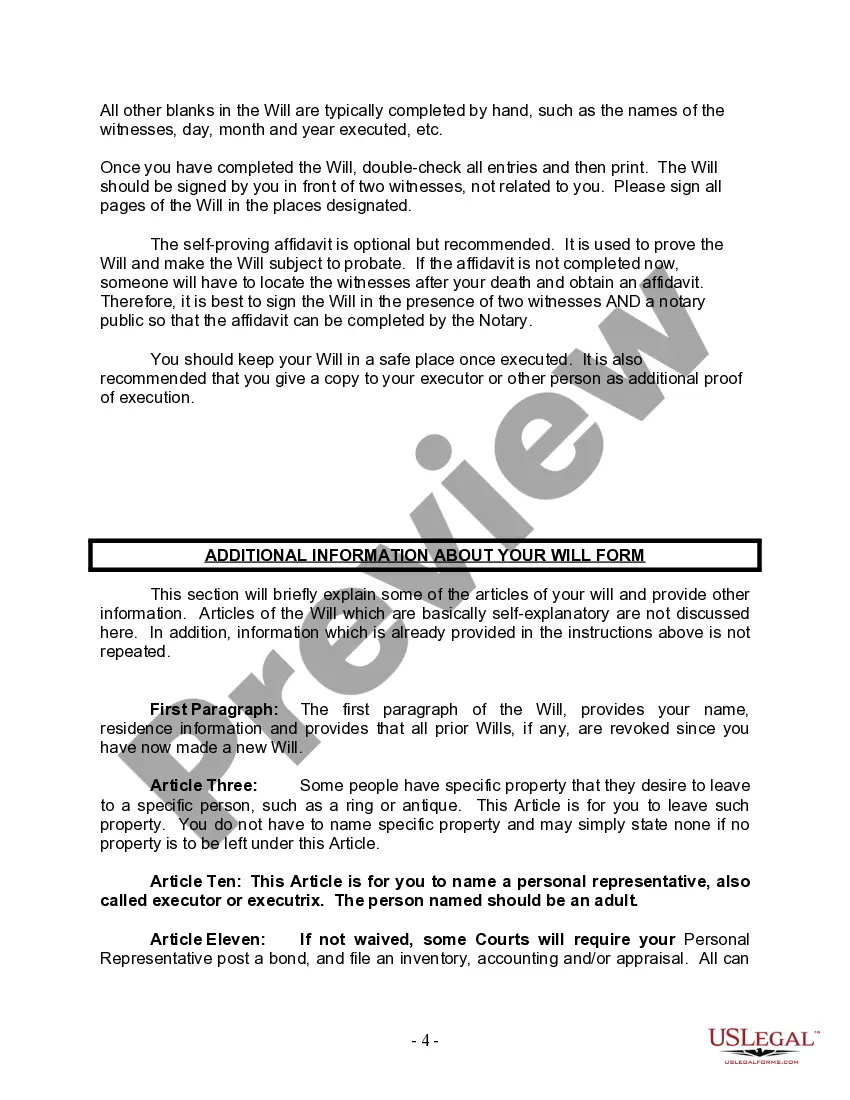

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

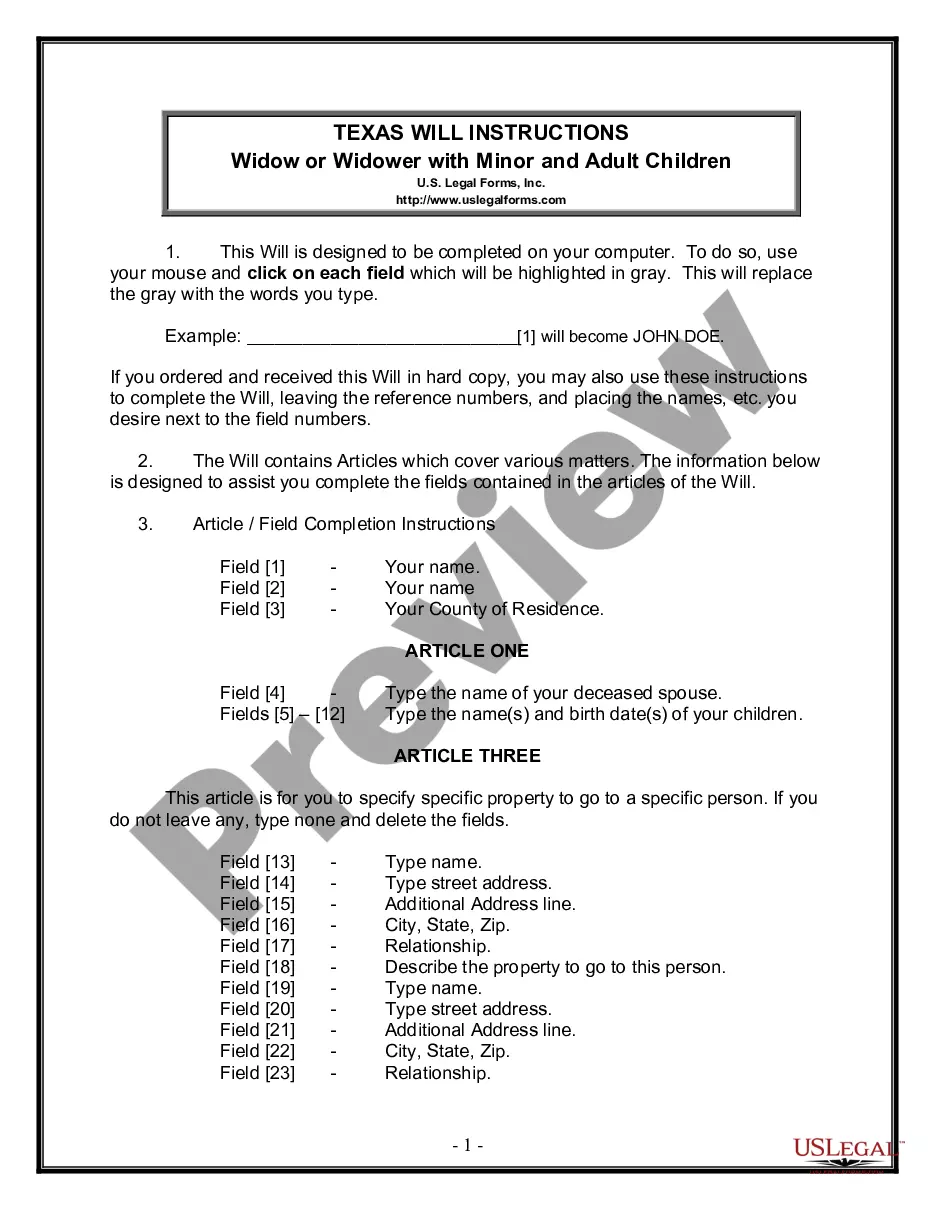

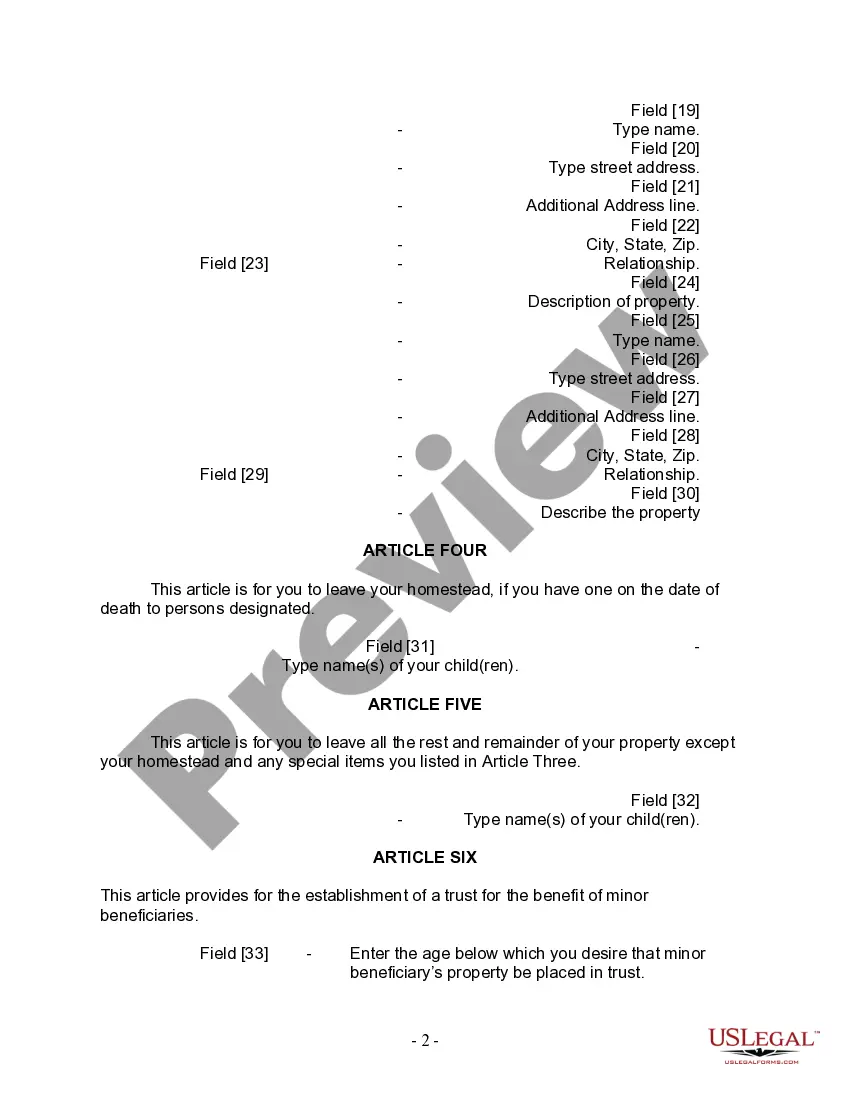

When it comes to ensuring the well-being and security of your loved ones, having a comprehensive and legally binding Last Will and Testament is essential. In Lewisville, Texas, there are various types of Legal Last Will and Testament Forms designed specifically for widows or widowers with both adult and minor children. One of the common forms available is the Lewisville Texas Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children. This document serves as a detailed blueprint for distributing your assets and addressing important matters such as guardianship of your minor children, allocation of property, and naming an executor to carry out your wishes. The Lewisville Texas Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children typically consists of several key sections: 1. Introduction: This section provides an overview of the document, stating that it is your Last Will and Testament, and revokes any previous wills or codicils. It also confirms your legal capacity and intention to create a valid will. 2. Executor Appointment: Here, you can designate an executor who will be responsible for managing your estate and ensuring that your wishes are carried out. This individual should be trustworthy, diligent, and capable of handling legal and financial matters. 3. Guardian Appointment: If you have minor children, this section allows you to appoint a guardian who will be responsible for their care, custody, and education in the event of your passing. You can also specify any preferences or conditions regarding their upbringing. 4. Asset Distribution: In this section, you can outline how your assets, including real estate, bank accounts, investments, and personal belongings, should be distributed. You can specify who should receive what, either by naming individuals, percentages, or through a trust arrangement. 5. Trusts and Special Provisions: If you want to establish a trust for the benefit of your minor children or for any other purposes, you can include the necessary provisions in this section. Trusts can provide added protection and control over assets, especially when dealing with minor beneficiaries. 6. Residuary Estate: This section deals with any assets not specifically mentioned in earlier sections. It allows you to determine how any remaining property or unidentified assets should be distributed. By utilizing the Lewisville Texas Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children, you can ensure that your wishes are legally documented and adhered to. Other variations of this form may exist, tailored to specific circumstances, such as the presence of step-children or unique asset distribution preferences. It is always advisable to consult with an attorney to determine which form suits your specific needs and to ensure compliance with Texas state laws.When it comes to ensuring the well-being and security of your loved ones, having a comprehensive and legally binding Last Will and Testament is essential. In Lewisville, Texas, there are various types of Legal Last Will and Testament Forms designed specifically for widows or widowers with both adult and minor children. One of the common forms available is the Lewisville Texas Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children. This document serves as a detailed blueprint for distributing your assets and addressing important matters such as guardianship of your minor children, allocation of property, and naming an executor to carry out your wishes. The Lewisville Texas Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children typically consists of several key sections: 1. Introduction: This section provides an overview of the document, stating that it is your Last Will and Testament, and revokes any previous wills or codicils. It also confirms your legal capacity and intention to create a valid will. 2. Executor Appointment: Here, you can designate an executor who will be responsible for managing your estate and ensuring that your wishes are carried out. This individual should be trustworthy, diligent, and capable of handling legal and financial matters. 3. Guardian Appointment: If you have minor children, this section allows you to appoint a guardian who will be responsible for their care, custody, and education in the event of your passing. You can also specify any preferences or conditions regarding their upbringing. 4. Asset Distribution: In this section, you can outline how your assets, including real estate, bank accounts, investments, and personal belongings, should be distributed. You can specify who should receive what, either by naming individuals, percentages, or through a trust arrangement. 5. Trusts and Special Provisions: If you want to establish a trust for the benefit of your minor children or for any other purposes, you can include the necessary provisions in this section. Trusts can provide added protection and control over assets, especially when dealing with minor beneficiaries. 6. Residuary Estate: This section deals with any assets not specifically mentioned in earlier sections. It allows you to determine how any remaining property or unidentified assets should be distributed. By utilizing the Lewisville Texas Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children, you can ensure that your wishes are legally documented and adhered to. Other variations of this form may exist, tailored to specific circumstances, such as the presence of step-children or unique asset distribution preferences. It is always advisable to consult with an attorney to determine which form suits your specific needs and to ensure compliance with Texas state laws.