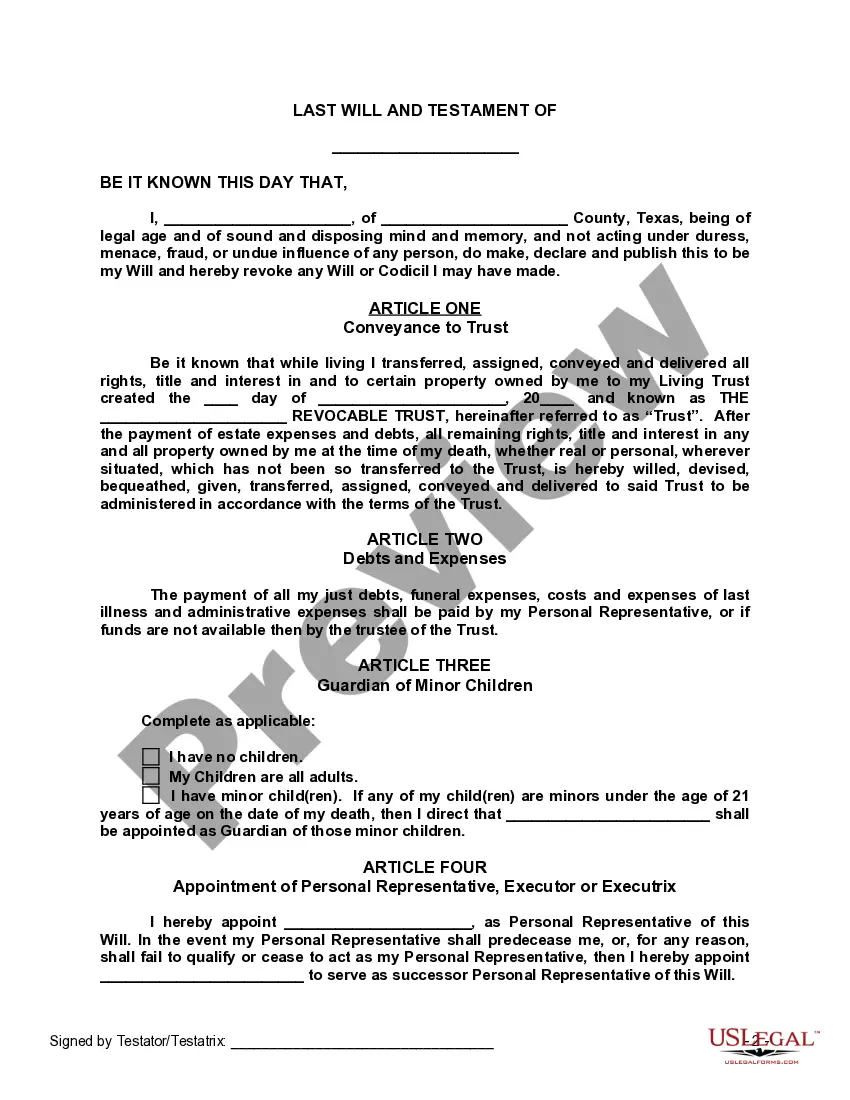

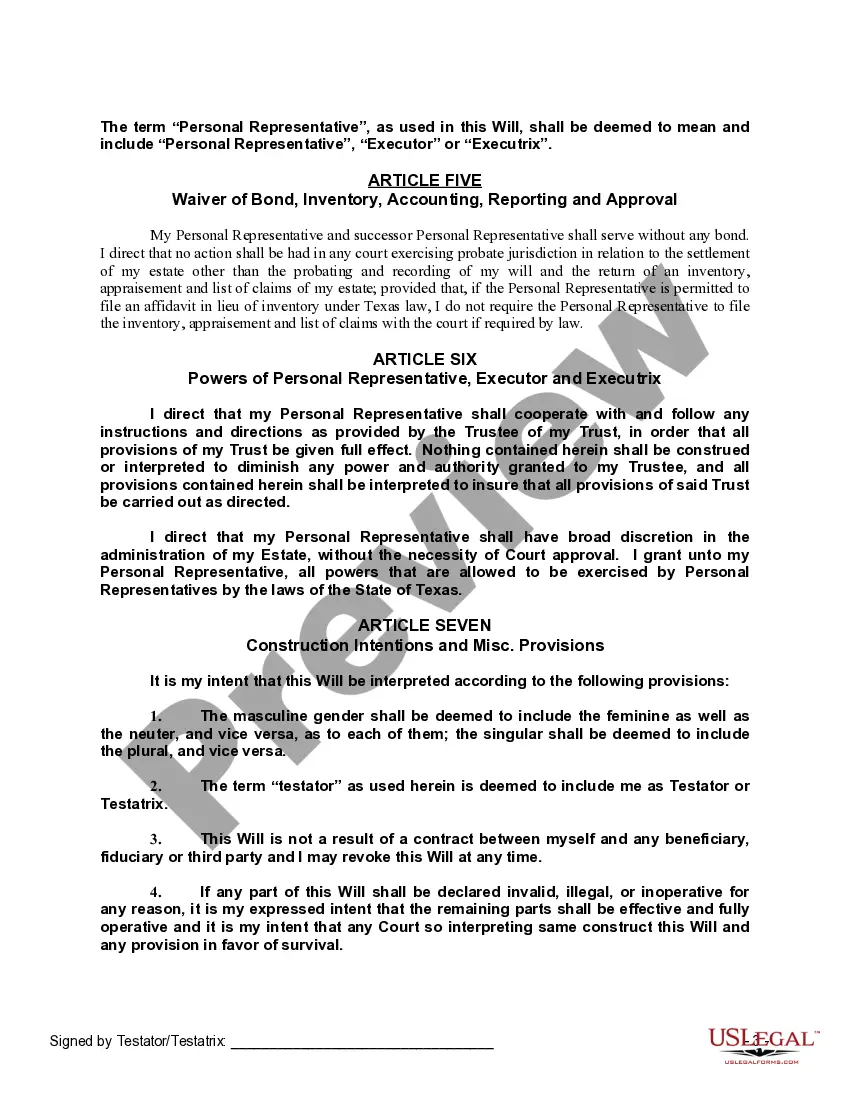

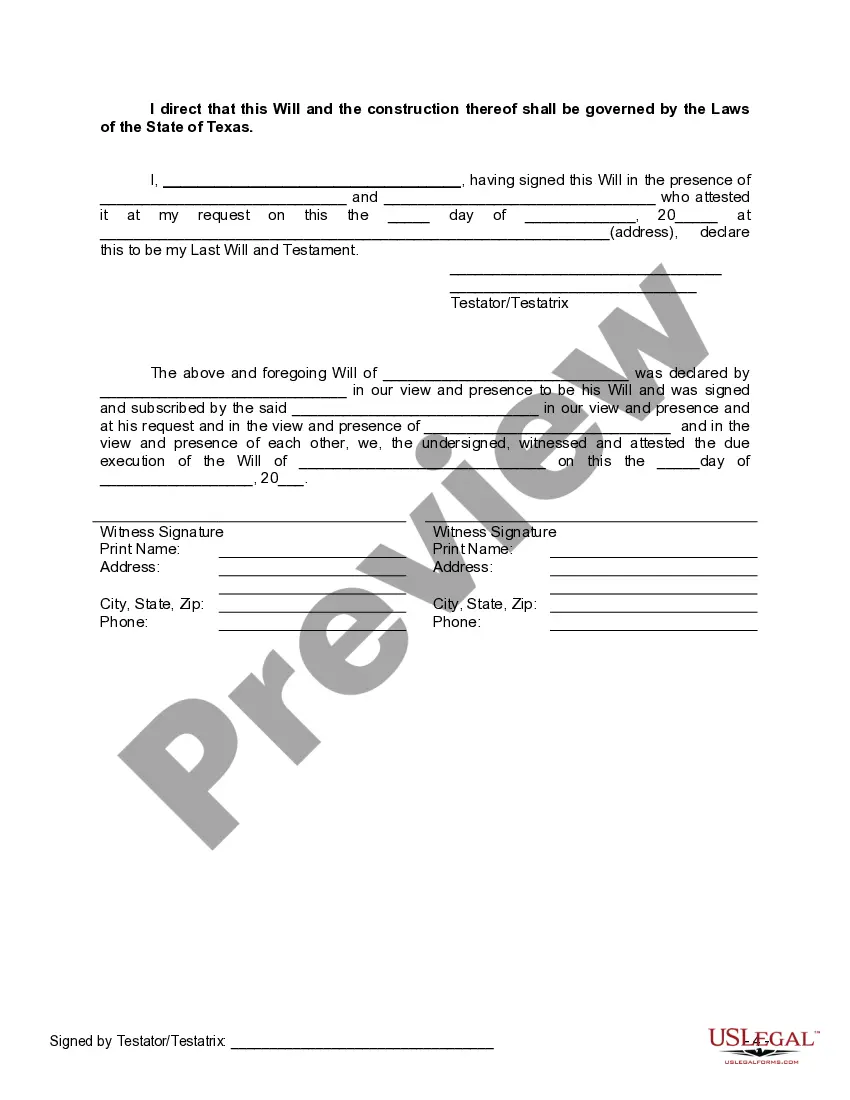

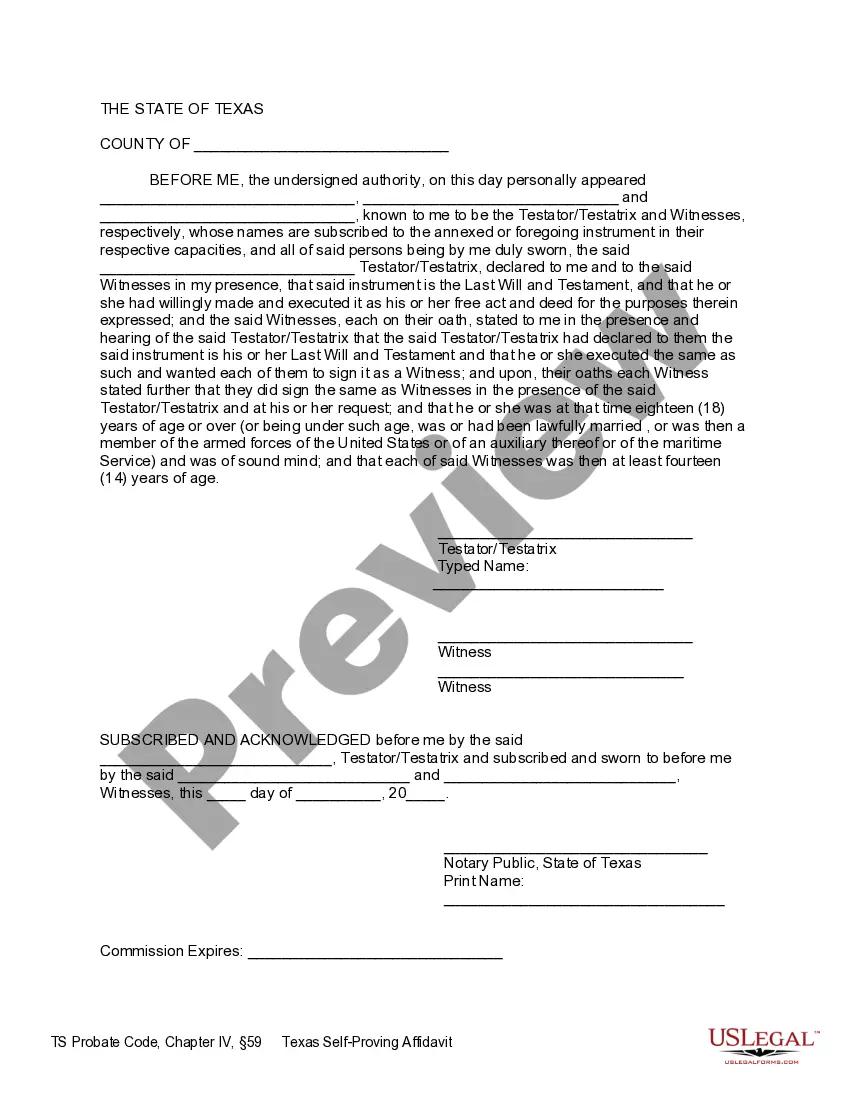

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Texas Last Will And Testament With All Property To Trust Called A Pour Over Will?

Irrespective of societal or occupational standing, finalizing legal documents is an undesirable requirement in the current professional landscape.

Frequently, it is nearly unfeasible for an individual lacking any legal expertise to create this type of paperwork from scratch, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms proves to be invaluable.

Confirm that the template you’ve located is relevant to your location since the laws of one state or county do not apply to another.

Preview the document and read a brief description (if available) of scenarios the form can be employed for.

- Our service provides an extensive library of over 85,000 ready-to-use state-specific forms suitable for nearly any legal predicament.

- US Legal Forms is also an excellent asset for associates or legal advisors aiming to enhance efficiency by utilizing our DIY documents.

- Whether you require the Dallas Texas Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will or other documentation applicable in your state or county, US Legal Forms places everything at your disposal.

- Here’s how you can acquire the Dallas Texas Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will in moments using our reliable service.

- If you are already a member, you may proceed to Log In to your account to retrieve the required form.

- Conversely, if you are new to our platform, ensure you follow these instructions before downloading the Dallas Texas Legal Last Will and Testament Form with All Property to Trust identified as a Pour Over Will.

Form popularity

FAQ

One disadvantage of a will compared to a trust is that a will typically goes through probate, which can be a lengthy and public process. This means that the distribution of assets may take time and may be visible to the public. In contrast, a trust allows for immediate transfer of assets upon death, which can be more private and efficient, making the Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will a valuable option.

A will does not override a trust; they serve different purposes. While a will directs how assets are distributed upon death, a trust manages assets during your lifetime and after. In a Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will, the trust may take precedence for assets placed within it, providing an organized strategy for beneficiaries.

Distributing trust property to beneficiaries typically occurs according to the terms outlined in the trust document. When you create a trust, you specify how and when beneficiaries will receive their share of the assets. Utilizing a Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will can simplify this process, as any unspecified assets will automatically be directed to the trust for distribution.

over will functions by funneling any assets not directly transferred to your trust during your lifetime into it after your death. This means that if you acquire new assets or fail to include something in the trust, those items will automatically be transferred to the trust, allowing for consistent management and distribution according to your wishes. This mechanism ensures that your Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will works effectively with your trust.

Generally, a trust does not override a last will and testament; rather, it complements it. In a situation where both documents exist, the trust governs the distribution of assets placed within it. However, assets that are solely governed by the last will and testament will follow its instructions, which is why having a Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will is beneficial.

Yes, a pour-over will connects your last will and testament to your trust. When you create a pour-over will, it directs that any remaining assets go directly into your trust upon your death. This ensures that all property, including those not included in the trust during your lifetime, becomes part of the trust, providing a seamless transition for your beneficiaries.

In Texas, it is not mandatory for a last will and testament to be notarized to be valid, including a Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will. However, having your will notarized can provide additional security and help reduce the risk of disputes after your passing. Notarization can also streamline the probate process by verifying the authenticity of your signature. To ensure your will meets all legal requirements, consider utilizing resources from uslegalforms.

To put your property in a trust in Texas, start by creating a revocable living trust. This involves drafting a trust document, which outlines how you want your property managed and distributed. Once the trust is established, transfer your ownership of any assets into the trust by re-titling them in the name of the trust. By doing this, you ensure that your assets are efficiently managed according to your wishes, and they will flow into your Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will upon your passing.

Typically, a will does not avoid probate in Texas. When a will is presented, it must go through the probate process to be validated and executed. This process can sometimes be lengthy and may lead to additional legal fees. For individuals looking to streamline their estate planning, a Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will might offer better options, though probate is still involved.

over will does not avoid probate in Texas. Your assets must go through the probate process before they can be transferred to your trust. This means that any properties or funds listed in your pourover will may take time to distribute to your heirs. Understanding this aspect is crucial when considering a Dallas Texas Last Will and Testament with All Property to Trust called a Pour Over Will.