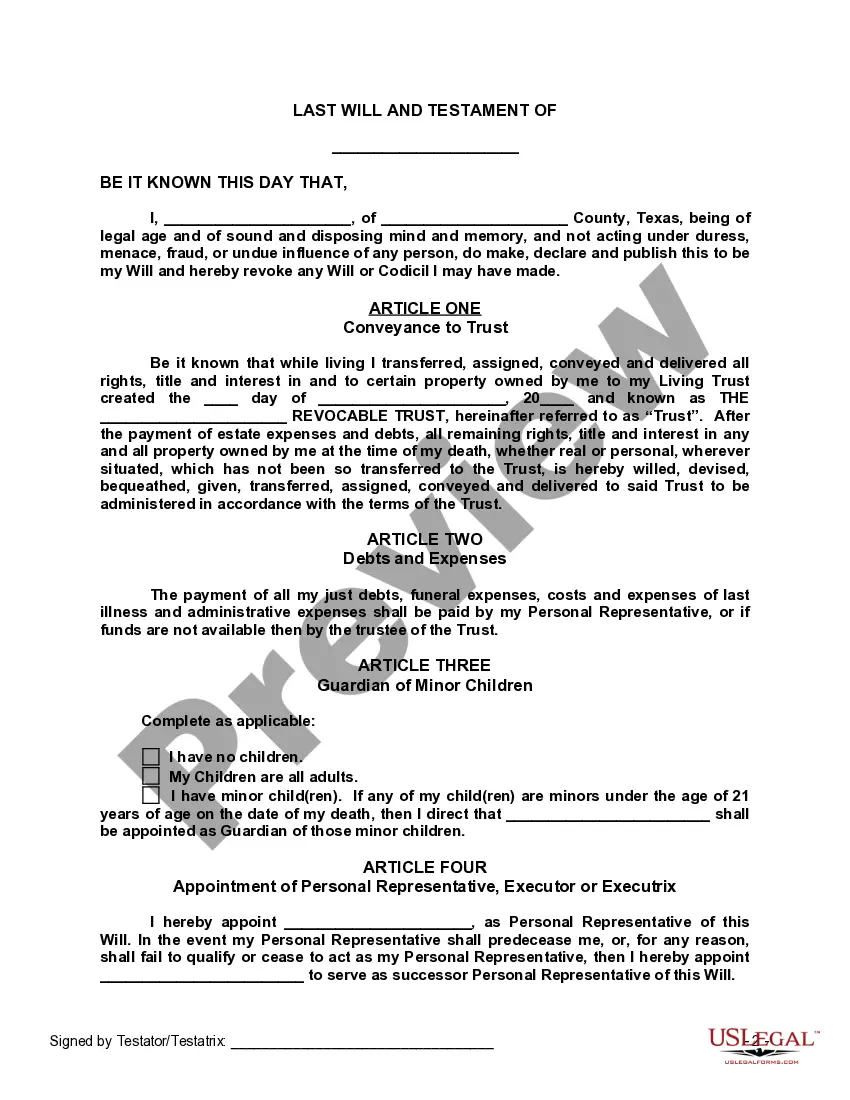

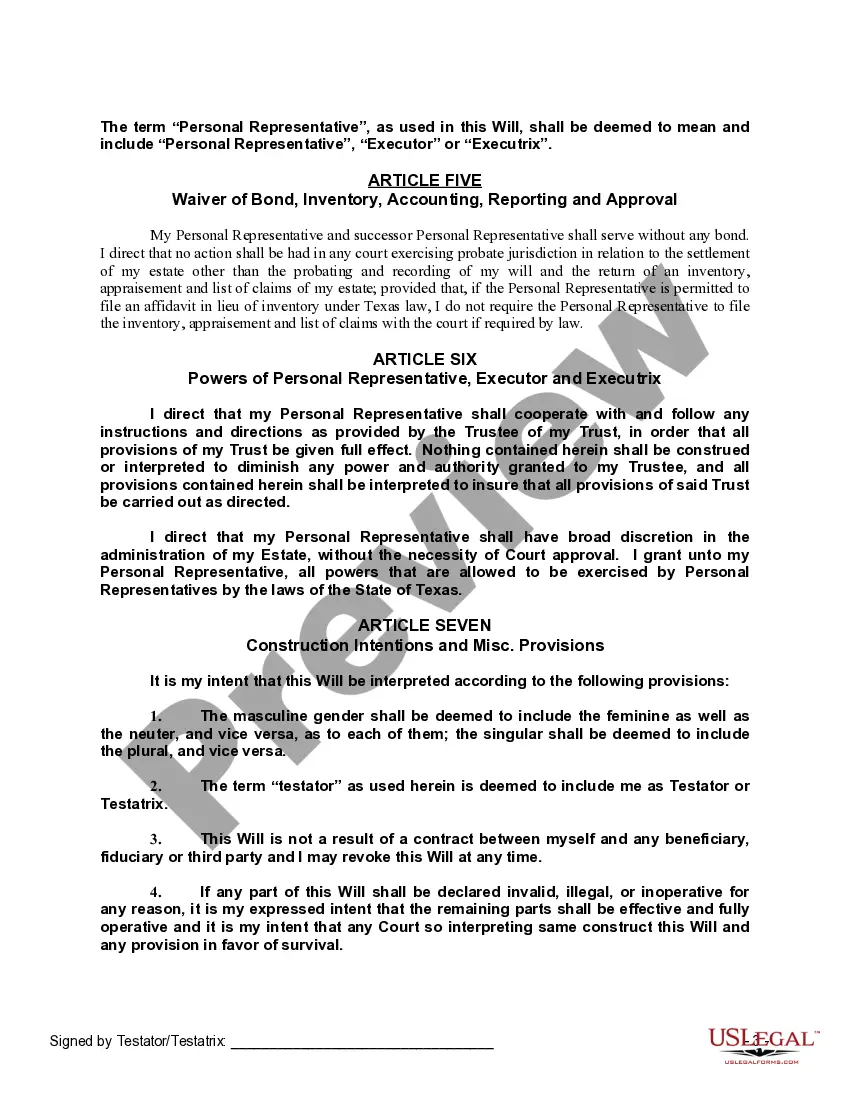

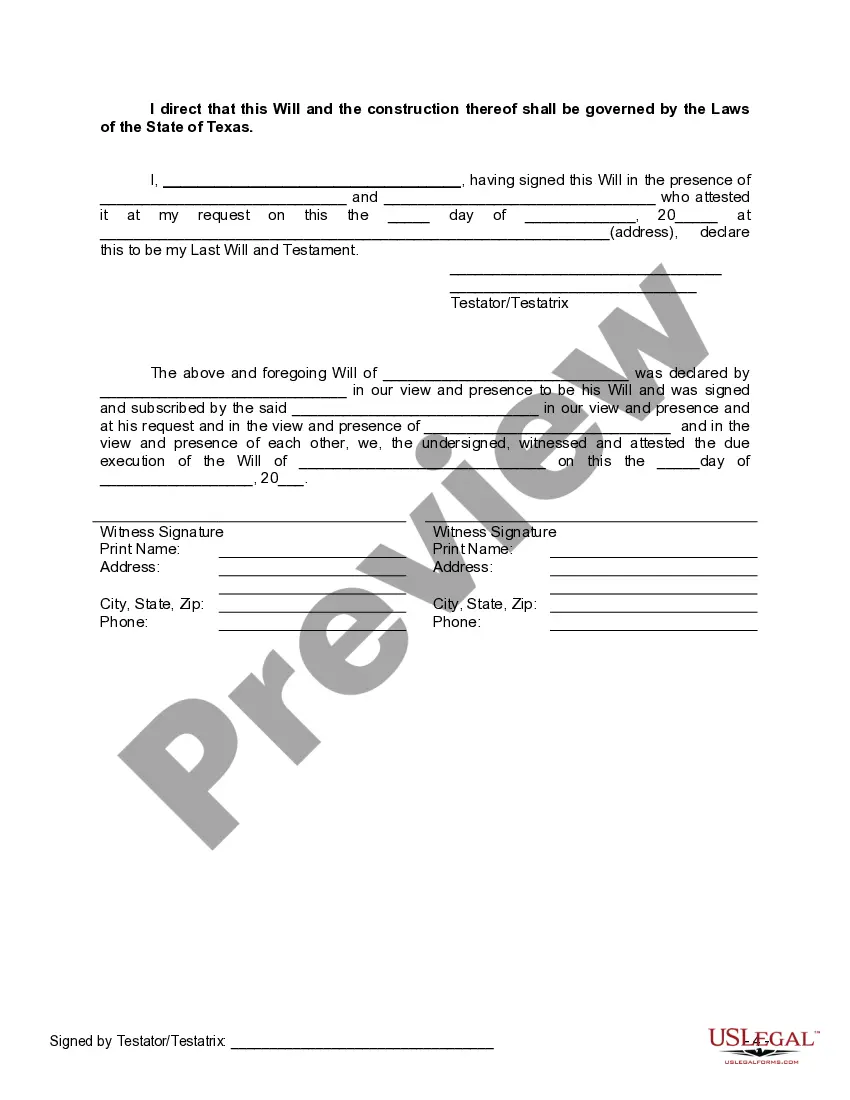

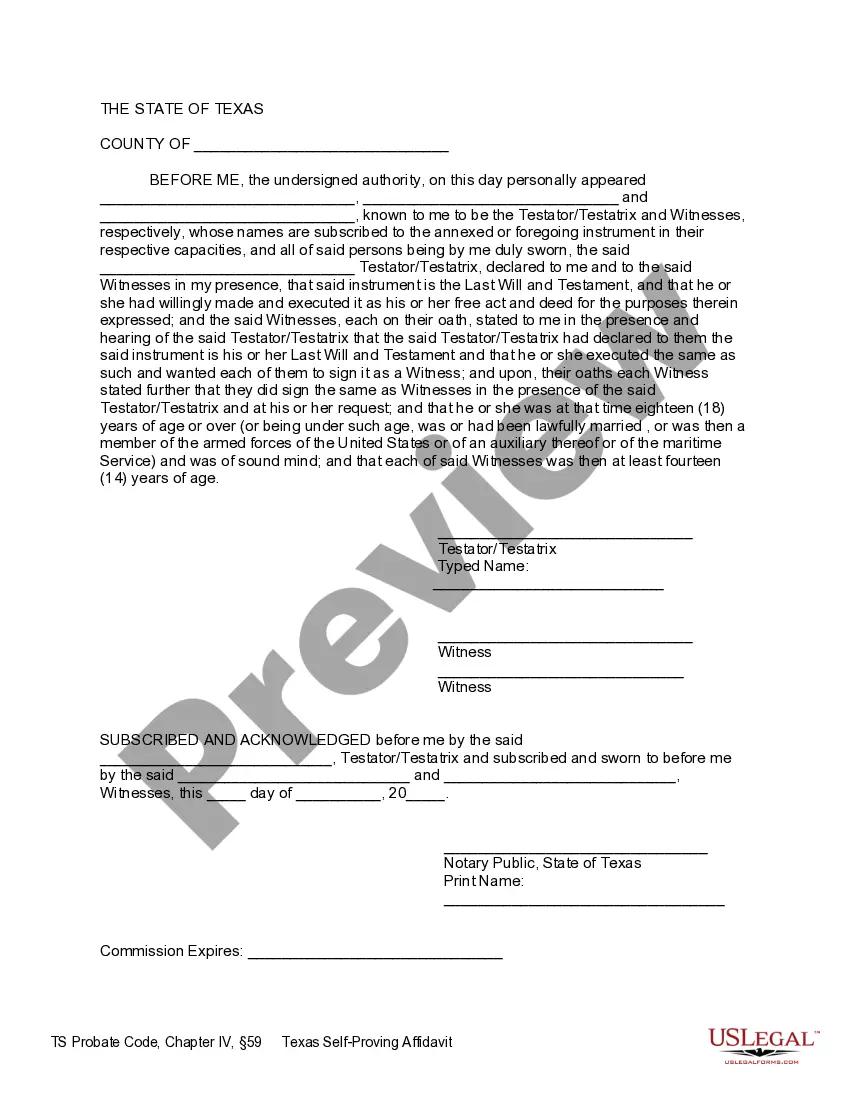

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

A Fort Worth Texas Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, is a legal document that ensures your assets are passed down according to your wishes. This form serves as an essential part of estate planning, specifically designed for individuals who have created a living trust. The Pour Over Will works in conjunction with a living trust, acting as a safety net to capture any assets or property that were not explicitly included in the trust. In most cases, individuals may unintentionally leave out certain assets, such as newly acquired properties or investments, from their trust. The purpose of the Pour Over Will is to ensure that these leftover assets are automatically transferred into the trust upon the testator's death. By utilizing this form, individuals can streamline their estate planning process and ensure that their entire estate will be distributed as per the instructions provided in the living trust. It effectively avoids the lengthy and costly probate process for any property or assets inadvertently omitted from the trust. Different types of Fort Worth Texas Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will may include variations based on the specific circumstances of the individual. Some common variants may include: 1. Simple Pour Over Will: This type of Pour Over Will is commonly used when the testator's estate consists of relatively few assets or property. It captures any omitted assets and transfers them into the living trust. 2. Complex Pour Over Will: If the testator's estate is more diverse and involves various types of assets, such as real estate, investments, or business interests, a complex Pour Over Will may be necessary. This document is specifically crafted to address the complexities of capturing and directing these diverse assets into the living trust. 3. Testamentary Pour Over Will: This type of Pour Over Will is created alongside a traditional will and is only activated upon the testator's death. It ensures that any assets left out of the will are promptly transferred to the living trust. Overall, a Fort Worth Texas Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will is a crucial component of estate planning for individuals who have established a living trust. It provides peace of mind by guaranteeing that any remaining assets or property not included in the trust will still be properly managed and distributed according to the testator's intentions.A Fort Worth Texas Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, is a legal document that ensures your assets are passed down according to your wishes. This form serves as an essential part of estate planning, specifically designed for individuals who have created a living trust. The Pour Over Will works in conjunction with a living trust, acting as a safety net to capture any assets or property that were not explicitly included in the trust. In most cases, individuals may unintentionally leave out certain assets, such as newly acquired properties or investments, from their trust. The purpose of the Pour Over Will is to ensure that these leftover assets are automatically transferred into the trust upon the testator's death. By utilizing this form, individuals can streamline their estate planning process and ensure that their entire estate will be distributed as per the instructions provided in the living trust. It effectively avoids the lengthy and costly probate process for any property or assets inadvertently omitted from the trust. Different types of Fort Worth Texas Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will may include variations based on the specific circumstances of the individual. Some common variants may include: 1. Simple Pour Over Will: This type of Pour Over Will is commonly used when the testator's estate consists of relatively few assets or property. It captures any omitted assets and transfers them into the living trust. 2. Complex Pour Over Will: If the testator's estate is more diverse and involves various types of assets, such as real estate, investments, or business interests, a complex Pour Over Will may be necessary. This document is specifically crafted to address the complexities of capturing and directing these diverse assets into the living trust. 3. Testamentary Pour Over Will: This type of Pour Over Will is created alongside a traditional will and is only activated upon the testator's death. It ensures that any assets left out of the will are promptly transferred to the living trust. Overall, a Fort Worth Texas Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will is a crucial component of estate planning for individuals who have established a living trust. It provides peace of mind by guaranteeing that any remaining assets or property not included in the trust will still be properly managed and distributed according to the testator's intentions.