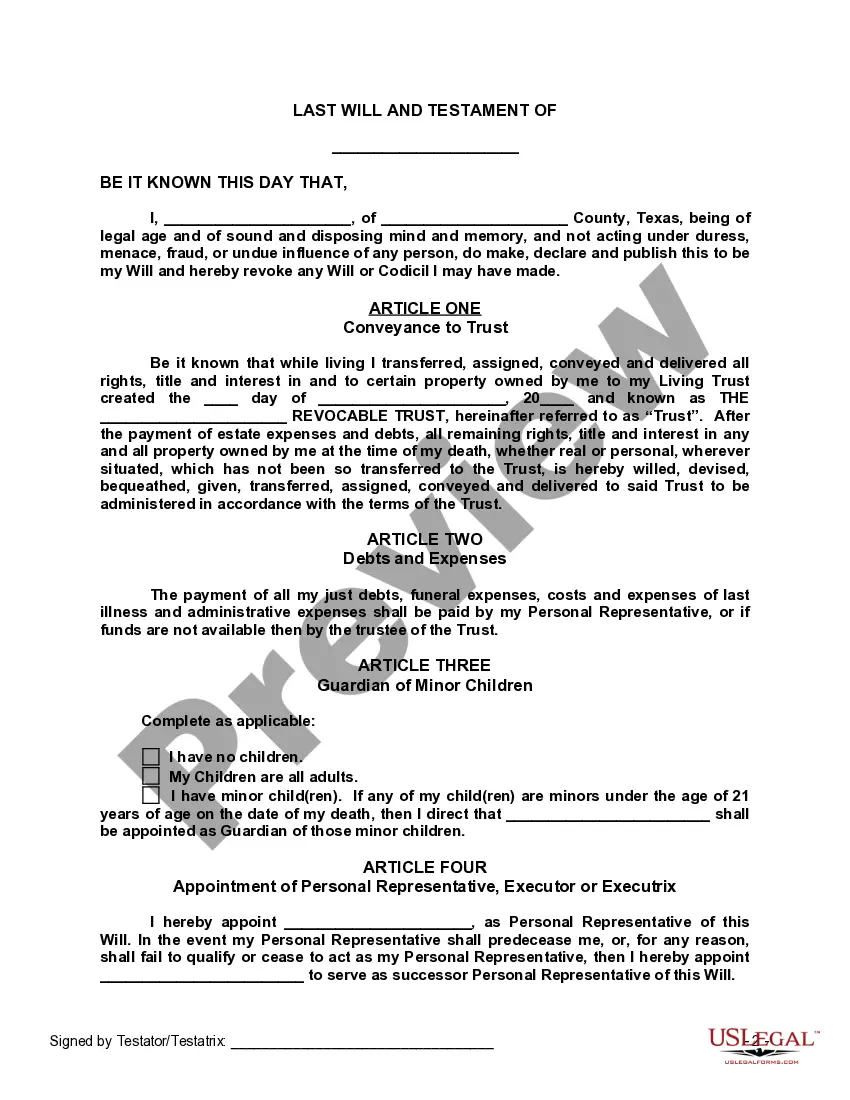

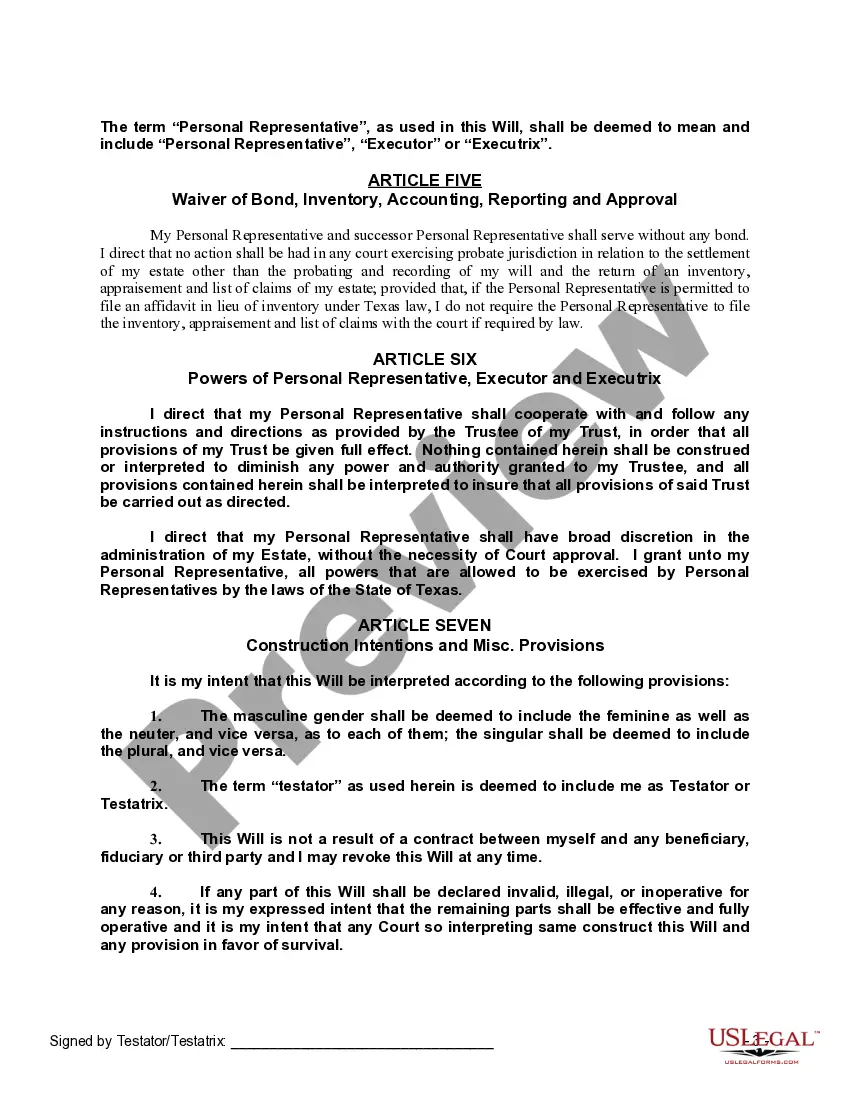

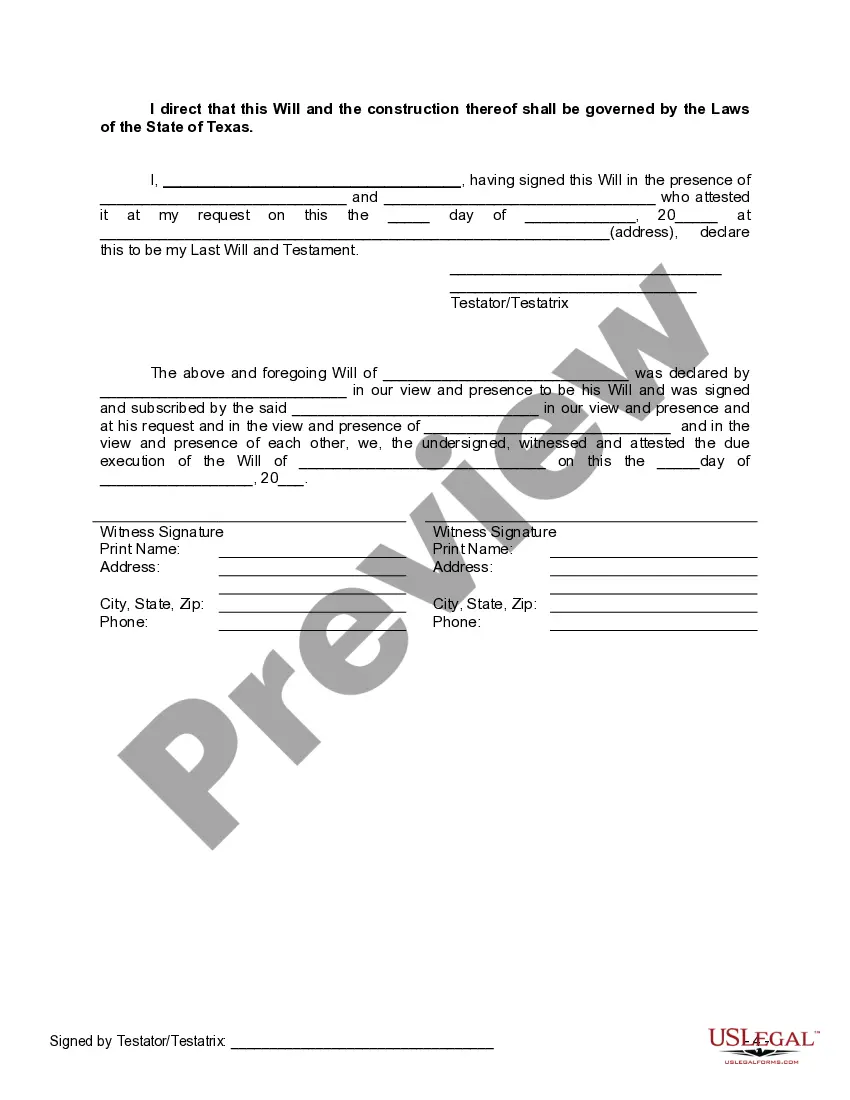

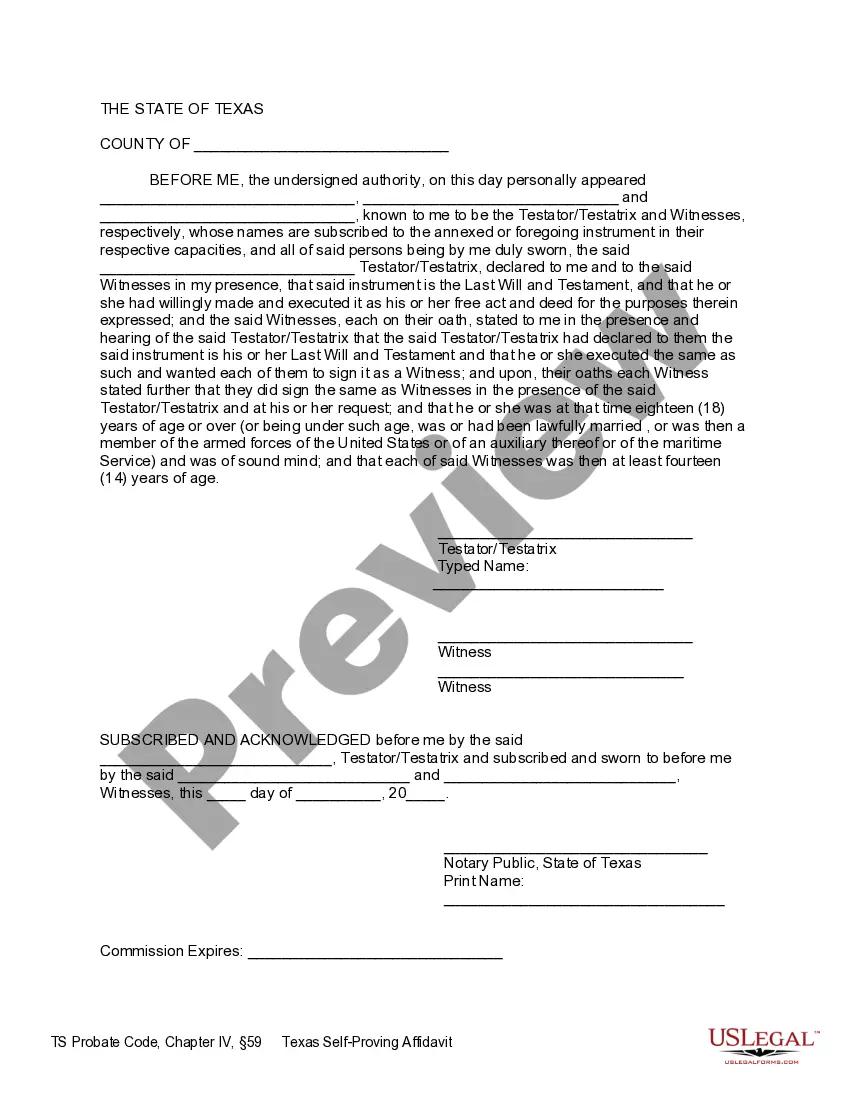

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

A Houston Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a legal document that allows an individual to ensure that all of their assets, including property, investments, and personal belongings, will be transferred to a specific trust upon their death. This type of will is ideal for individuals who have set up a living trust and intend to transfer all of their property into the trust. The pour over will act as a safety net to guarantee that any assets not specifically transferred to the trust during the person's lifetime will be automatically poured over into the trust upon their death. This ensures that the assets will be distributed according to the terms and conditions set forth in the trust agreement. By using a pour over will, an individual can simplify their estate planning process and potentially avoid the probate process for the transferred assets. Probate is the legal process by which a deceased person's assets are distributed according to their will or applicable state laws. However, if all assets are properly transferred to the trust, they can bypass the probate process and the associated costs and delays. In Houston, Texas, there are various types of Legal Last Will and Testament Forms with All Property to Trust called Pour Over Wills. Some common variations include: 1. Simple Pour Over Will: This is the most basic type of pour over will, which includes straightforward provisions transferring all the individual's property to their designated trust. 2. Testamentary Pour Over Will: This type of will is created in conjunction with a revocable living trust and provides for the transfer of assets into the trust upon the person's death. It may also contain additional provisions, such as appointment of a guardian for any minor children. 3. Joint Pour Over Will: A joint pour over will allow spouses or partners to create a single will that pours over assets into a shared trust upon the death of both individuals. This type of will ensures that both parties' assets are transferred to the trust, simplifying the distribution process. It is essential to consult with an experienced estate planning attorney to ensure that the pour over will accurately reflect your intentions, complies with the relevant laws in Houston, Texas, and works seamlessly with your existing trust. This will help provide peace of mind and ensure that your assets are distributed according to your wishes, while minimizing potential complications and legal issues.A Houston Texas Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a legal document that allows an individual to ensure that all of their assets, including property, investments, and personal belongings, will be transferred to a specific trust upon their death. This type of will is ideal for individuals who have set up a living trust and intend to transfer all of their property into the trust. The pour over will act as a safety net to guarantee that any assets not specifically transferred to the trust during the person's lifetime will be automatically poured over into the trust upon their death. This ensures that the assets will be distributed according to the terms and conditions set forth in the trust agreement. By using a pour over will, an individual can simplify their estate planning process and potentially avoid the probate process for the transferred assets. Probate is the legal process by which a deceased person's assets are distributed according to their will or applicable state laws. However, if all assets are properly transferred to the trust, they can bypass the probate process and the associated costs and delays. In Houston, Texas, there are various types of Legal Last Will and Testament Forms with All Property to Trust called Pour Over Wills. Some common variations include: 1. Simple Pour Over Will: This is the most basic type of pour over will, which includes straightforward provisions transferring all the individual's property to their designated trust. 2. Testamentary Pour Over Will: This type of will is created in conjunction with a revocable living trust and provides for the transfer of assets into the trust upon the person's death. It may also contain additional provisions, such as appointment of a guardian for any minor children. 3. Joint Pour Over Will: A joint pour over will allow spouses or partners to create a single will that pours over assets into a shared trust upon the death of both individuals. This type of will ensures that both parties' assets are transferred to the trust, simplifying the distribution process. It is essential to consult with an experienced estate planning attorney to ensure that the pour over will accurately reflect your intentions, complies with the relevant laws in Houston, Texas, and works seamlessly with your existing trust. This will help provide peace of mind and ensure that your assets are distributed according to your wishes, while minimizing potential complications and legal issues.