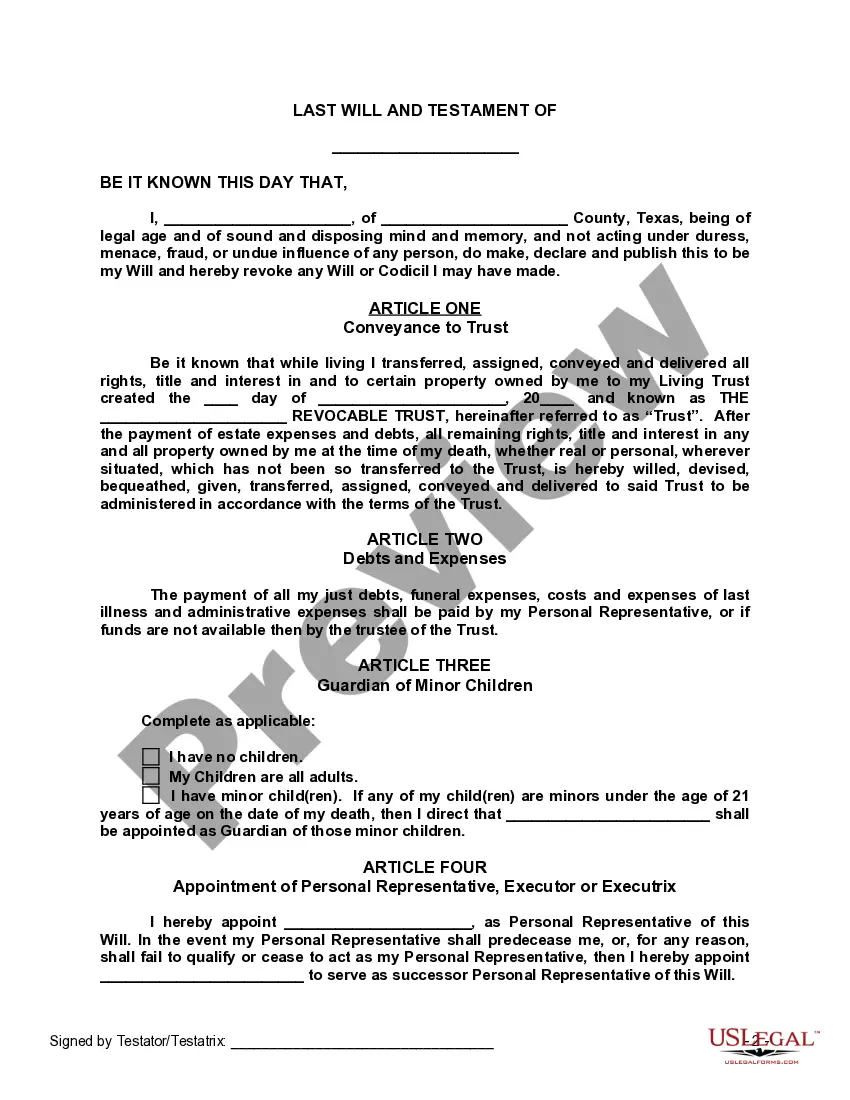

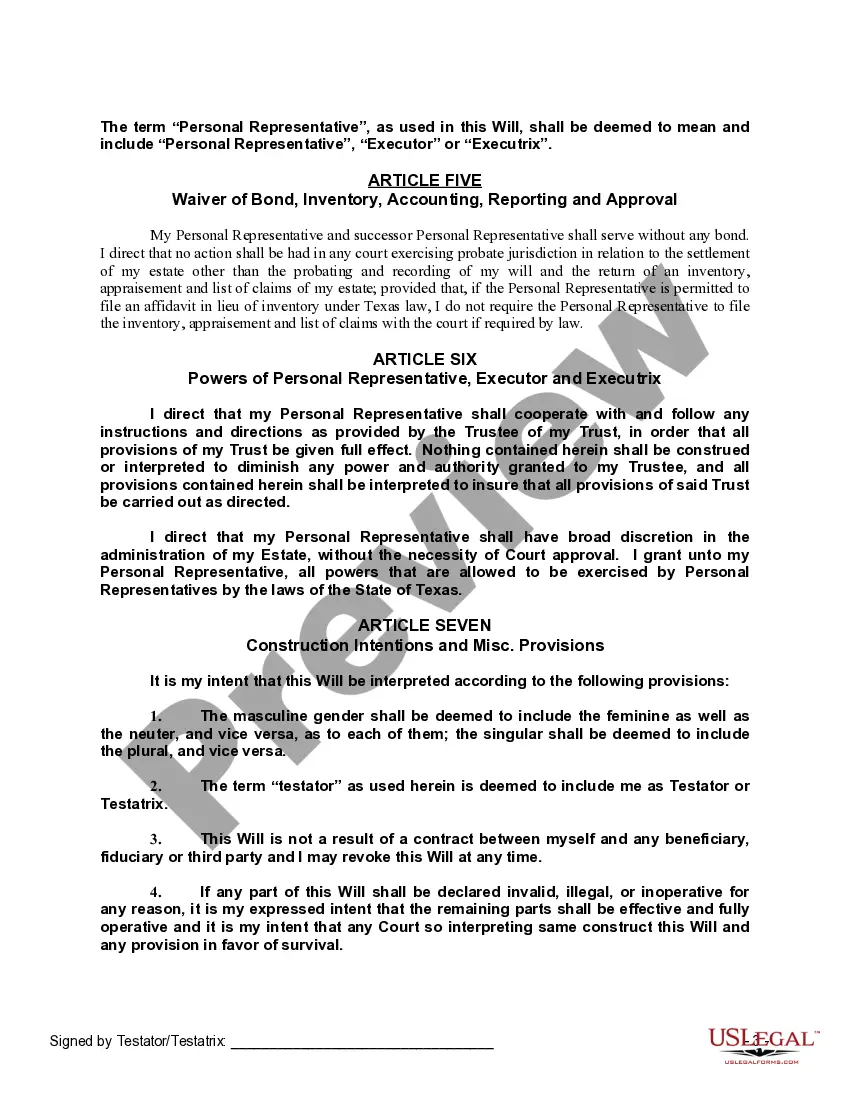

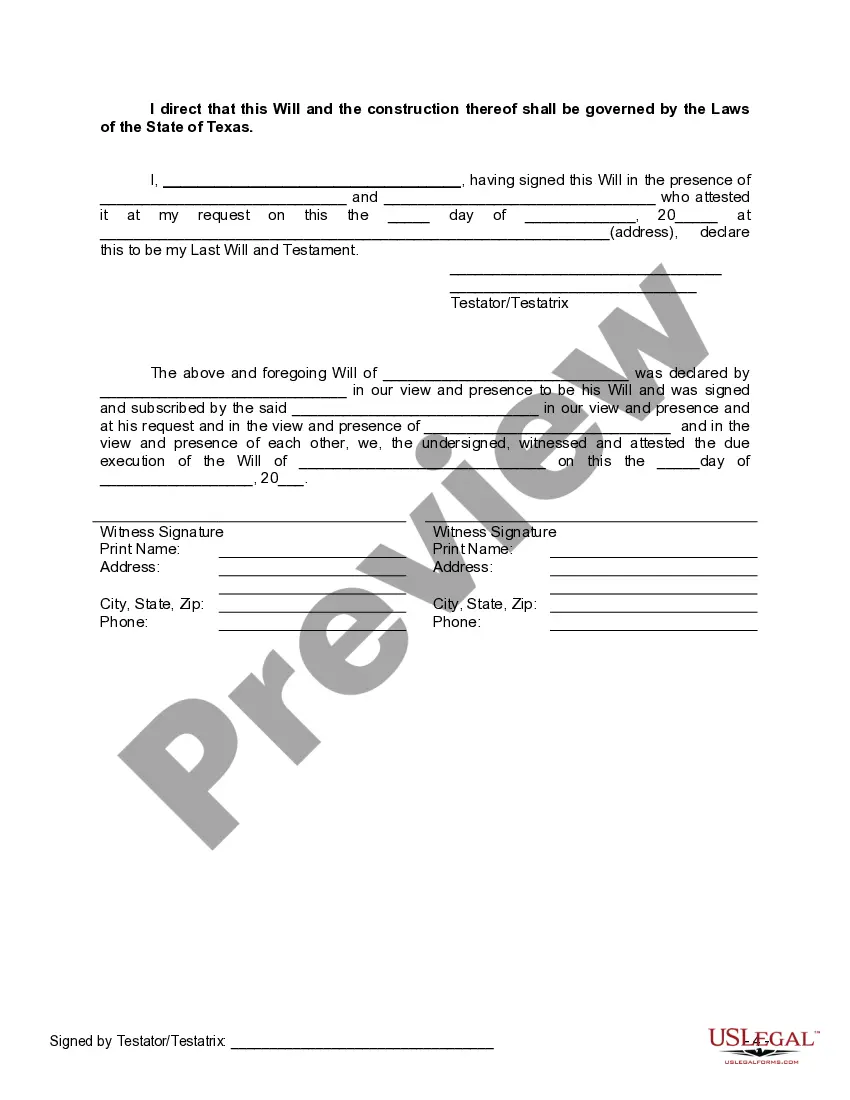

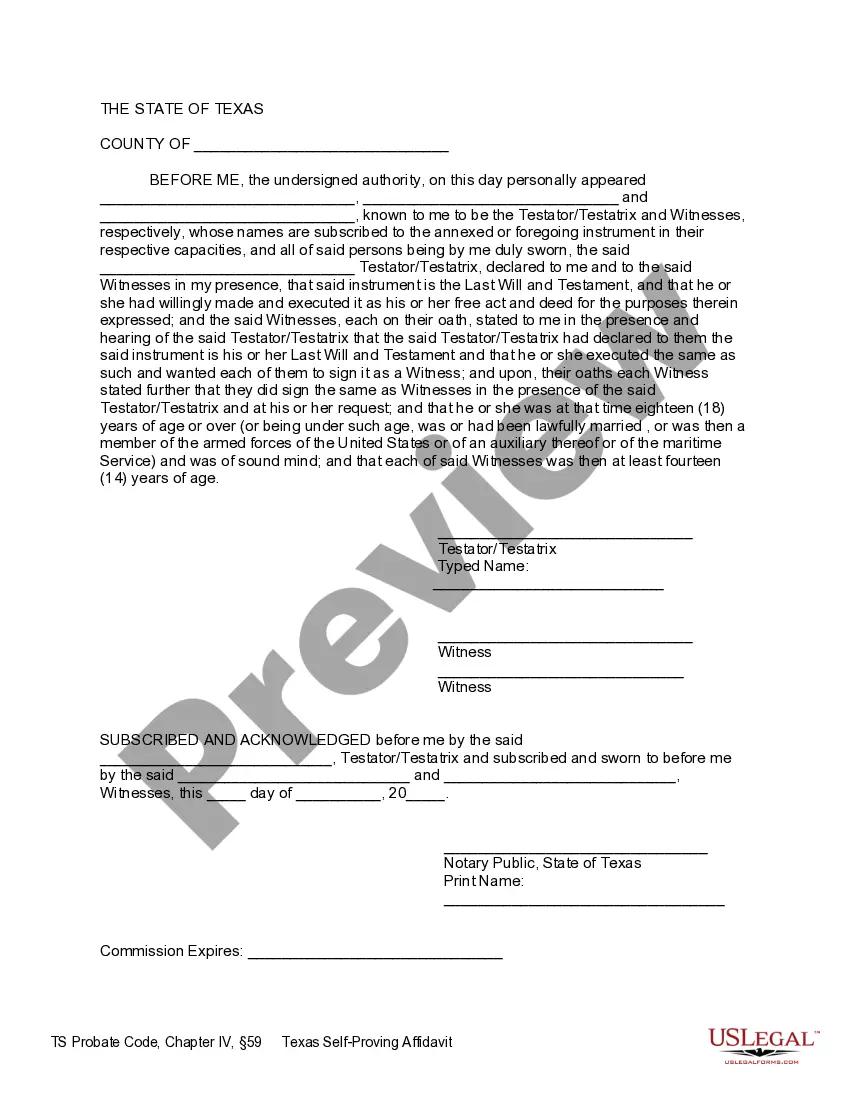

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Tarrant Texas Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, is a crucial legal document that ensures your assets are protected and distributed according to your wishes after your demise. This comprehensive legal form allows you to safeguard your estate by designating a trust as the beneficiary of all your property. A Pour Over Will functions as a safety net that guarantees any assets not previously transferred to the trust during your lifetime will be "poured over" into the trust upon your death. By using this legal document, individuals can simplify the process of estate planning and enhance asset protection by creating a comprehensive estate plan. There are various types and variations of Tarrant Texas Legal Last Will and Testament Form with All Property to Trust, known as Pour Over Wills, each tailored to meet specific circumstances and preferences. Some common types include: 1. Simple Pour Over Will: This represents the standard version, allowing individuals to transfer all their property, assets, and personal belongings to a designated trust upon their passing. It ensures a smooth transition of assets to the trust. 2. Testamentary Pour Over Will: This type of Pour Over Will is created in conjunction with a separate Last Will and Testament document. It stipulates that, upon the testator's demise, any assets not specifically mentioned in the will should be transferred to the designated trust. 3. Married Couple Pour Over Will: This tailored version is designed for married couples who wish to create a joint Pour Over Will to transfer their assets to a shared trust upon their deaths. It ensures seamless asset management and distribution for couples. 4. Living Trust Pour Over Will: In this case, a Living Trust is created during the individual's lifetime, and the Pour Over Will acts as a complementary document. It transfers any remaining assets to this established trust upon death, facilitating efficient administration and distribution. It is important to consult with a qualified estate planning attorney specialized in Tarrant Texas laws to determine which type of Pour Over Will best suits your specific needs and objectives. This legal document provides peace of mind, ensuring that your assets are protected, your loved ones are provided for, and your wishes are even upheld after you are no longer here.Tarrant Texas Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, is a crucial legal document that ensures your assets are protected and distributed according to your wishes after your demise. This comprehensive legal form allows you to safeguard your estate by designating a trust as the beneficiary of all your property. A Pour Over Will functions as a safety net that guarantees any assets not previously transferred to the trust during your lifetime will be "poured over" into the trust upon your death. By using this legal document, individuals can simplify the process of estate planning and enhance asset protection by creating a comprehensive estate plan. There are various types and variations of Tarrant Texas Legal Last Will and Testament Form with All Property to Trust, known as Pour Over Wills, each tailored to meet specific circumstances and preferences. Some common types include: 1. Simple Pour Over Will: This represents the standard version, allowing individuals to transfer all their property, assets, and personal belongings to a designated trust upon their passing. It ensures a smooth transition of assets to the trust. 2. Testamentary Pour Over Will: This type of Pour Over Will is created in conjunction with a separate Last Will and Testament document. It stipulates that, upon the testator's demise, any assets not specifically mentioned in the will should be transferred to the designated trust. 3. Married Couple Pour Over Will: This tailored version is designed for married couples who wish to create a joint Pour Over Will to transfer their assets to a shared trust upon their deaths. It ensures seamless asset management and distribution for couples. 4. Living Trust Pour Over Will: In this case, a Living Trust is created during the individual's lifetime, and the Pour Over Will acts as a complementary document. It transfers any remaining assets to this established trust upon death, facilitating efficient administration and distribution. It is important to consult with a qualified estate planning attorney specialized in Tarrant Texas laws to determine which type of Pour Over Will best suits your specific needs and objectives. This legal document provides peace of mind, ensuring that your assets are protected, your loved ones are provided for, and your wishes are even upheld after you are no longer here.