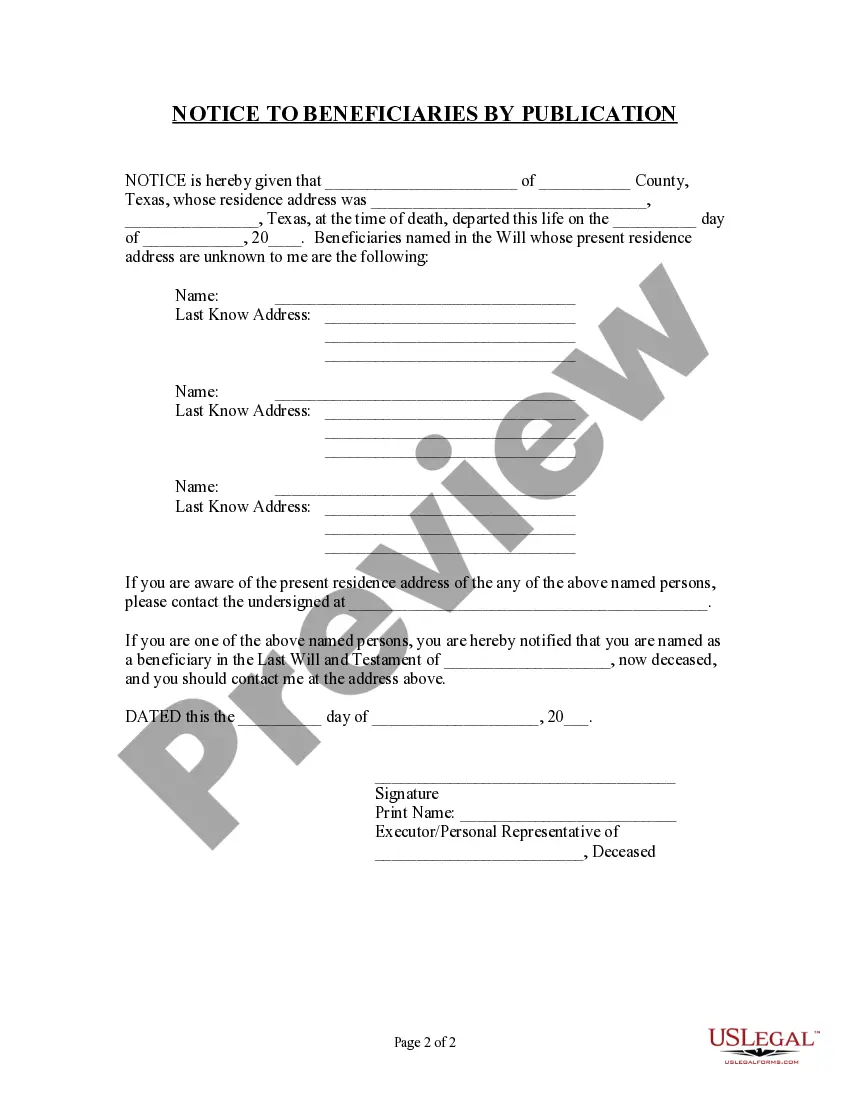

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

A Fort Worth Texas Notice to Beneficiaries of being Named in Will is a legal document that serves as formal notification to individuals who have been designated as beneficiaries in a last will and testament. It provides crucial information regarding their inclusion as beneficiaries and outlines their entitlements as stated in the will. This notice acts as an official communication to ensure that beneficiaries receive proper notification of their involvement in the deceased individual's estate distribution process. It aims to inform beneficiaries of their legal rights, responsibilities, and the steps they must take to claim their inheritance. There are different types of Fort Worth Texas Notice to Beneficiaries depending on the specific circumstances and legal requirements. These variations may include: 1. General Notice to Beneficiaries: This type of notice is typically used when the deceased individual named several beneficiaries in their will and all beneficiaries need to be informed simultaneously about their designation. It contains essential details such as the deceased's name, date of death, and a summary of the assets allocated to each beneficiary. 2. Individual Notice to Beneficiaries: In some cases, there may be certain beneficiaries or groups of beneficiaries who need to be notified individually due to specific instructions in the will. This type of notice is tailored to suit individual circumstances, outlining their unique entitlements and obligations. Regardless of the specific type, a Fort Worth Texas Notice to Beneficiaries includes key information such as the name of the deceased individual, their date of death, the court where the will is being probated, and the assigned executor or personal representative responsible for administering the estate. Additionally, the notice may specify important instructions and deadlines that beneficiaries must follow to claim their inheritance. Such instructions might include providing identification documents, contacting the executor, attending court hearings if required, or submitting any necessary paperwork. It's important to note that the format and requirements for a Notice to Beneficiaries may vary from state to state and can be influenced by local probate laws. Therefore, it is essential to consult with a legal professional or an estate attorney familiar with Texas law to ensure compliance with all necessary regulations.