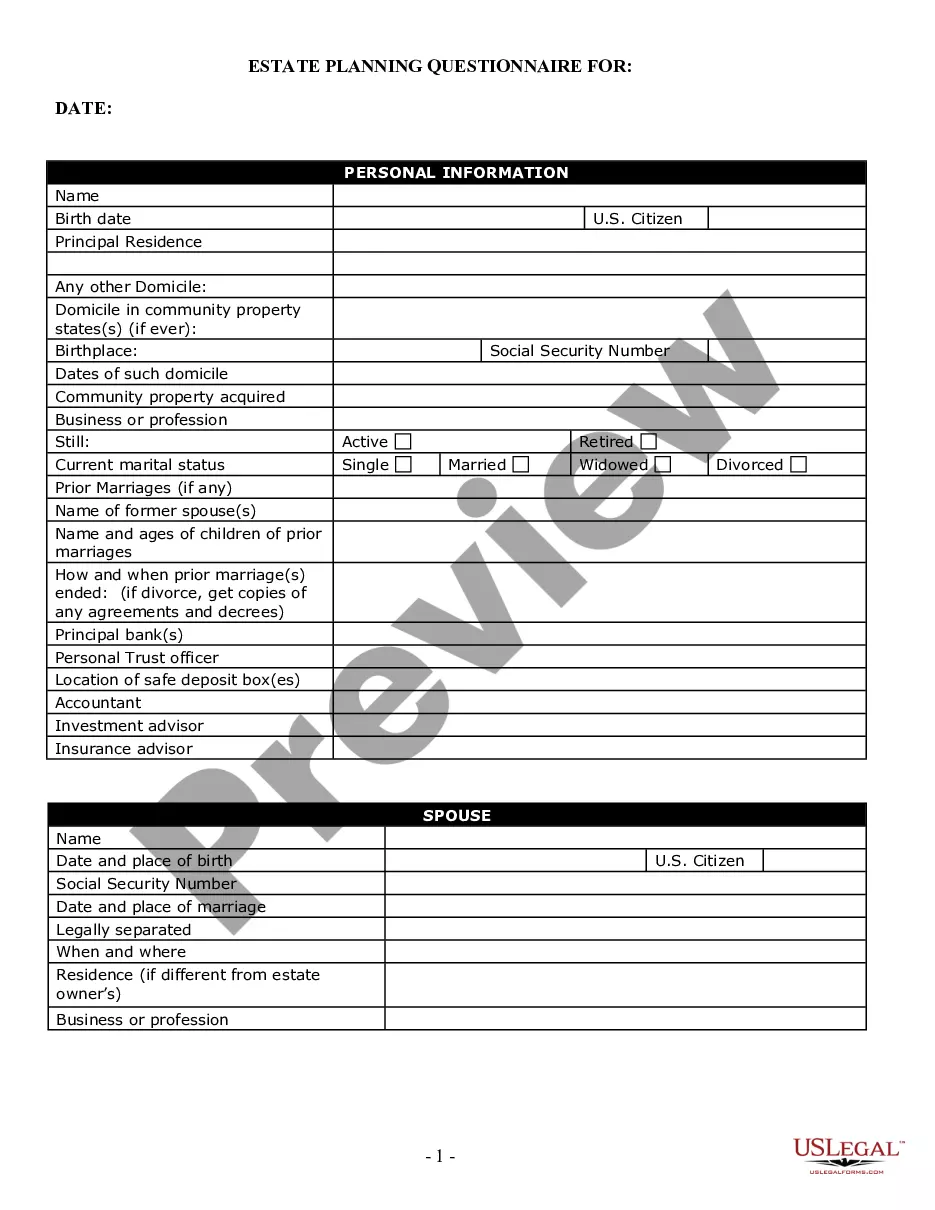

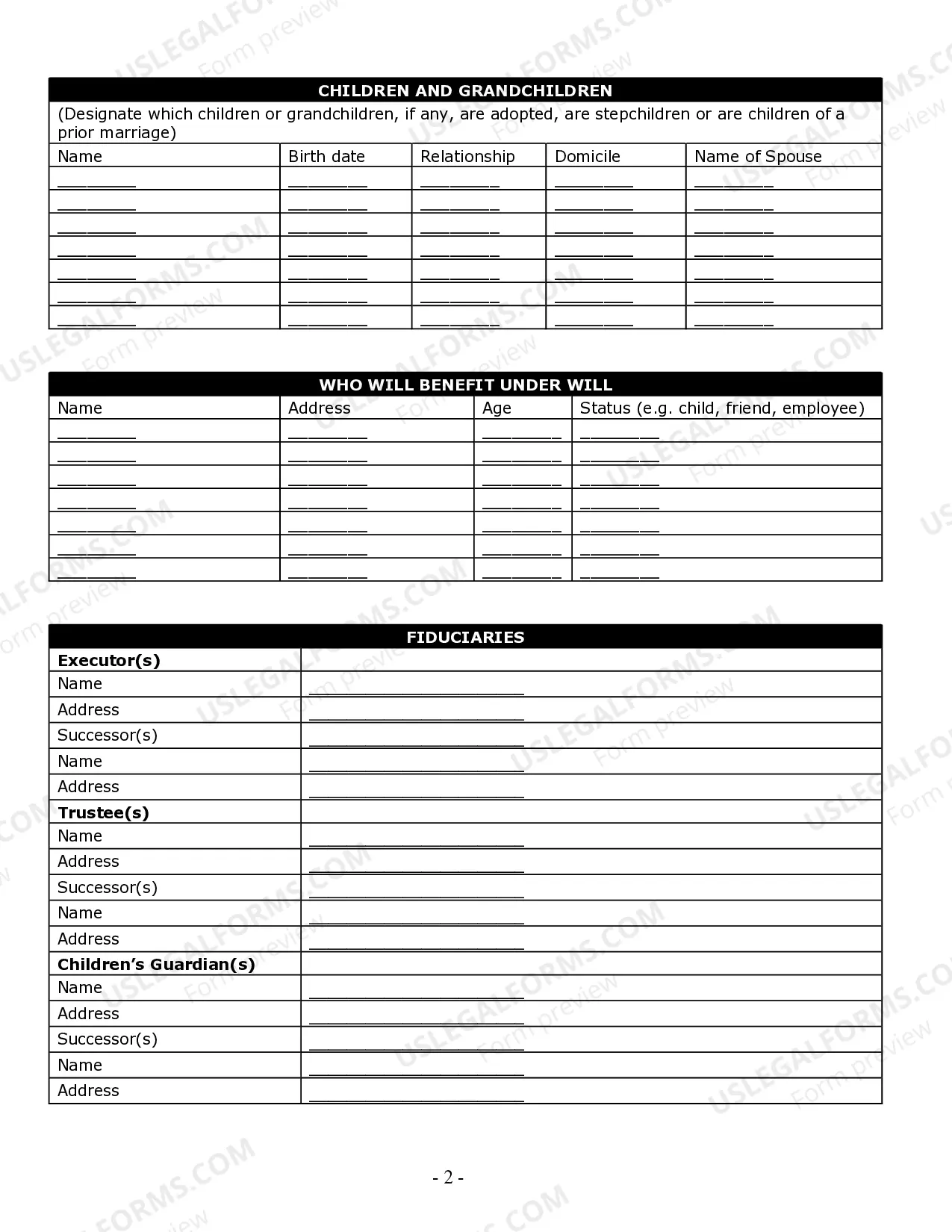

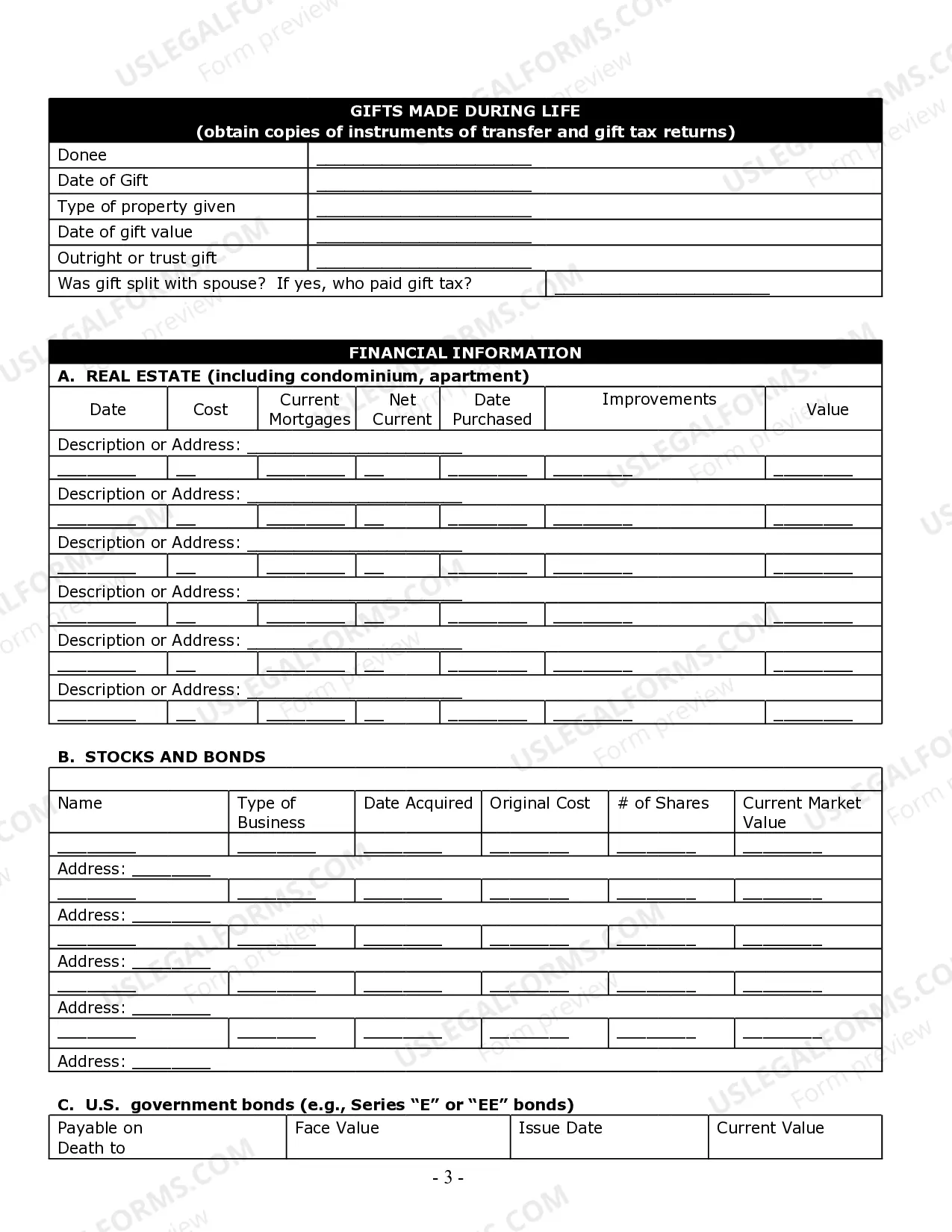

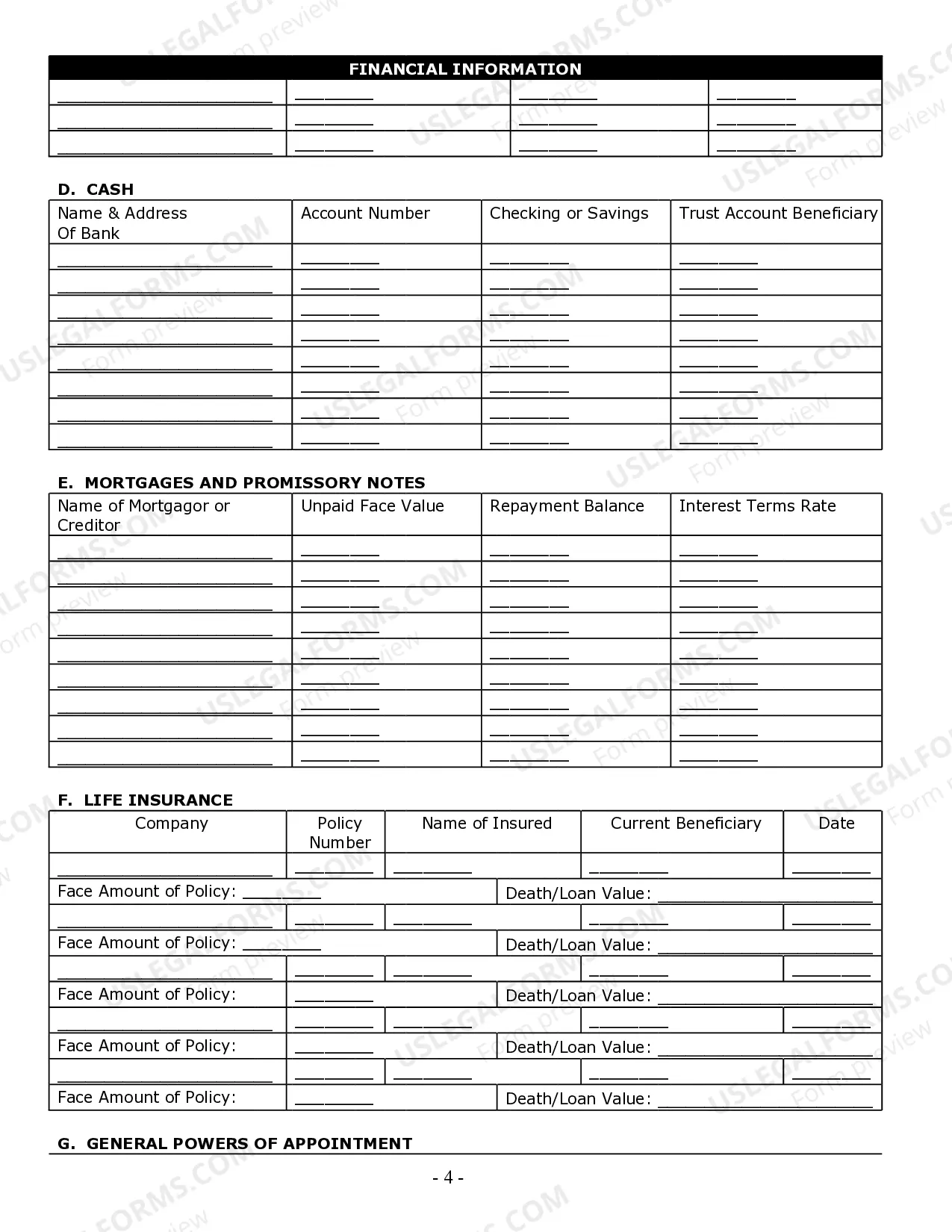

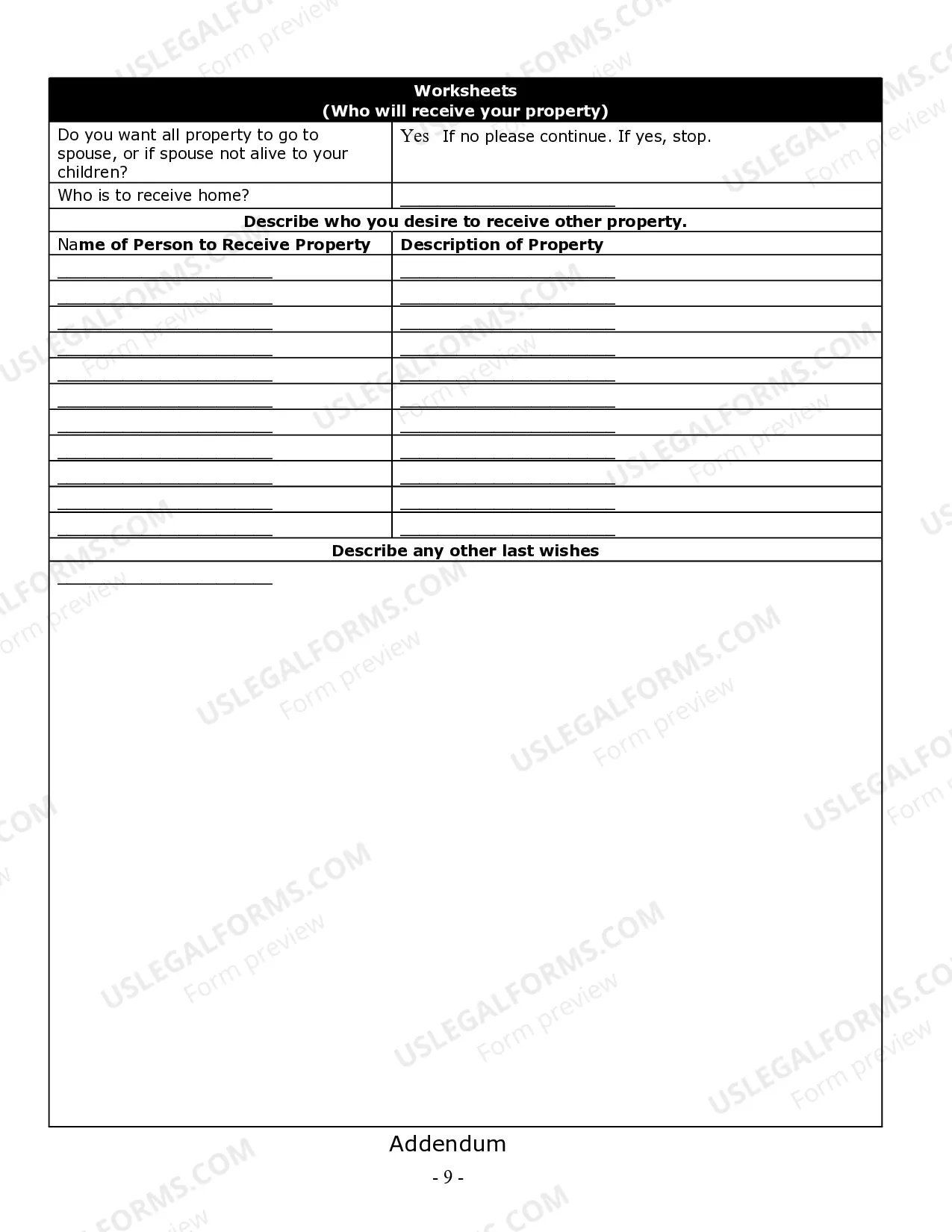

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

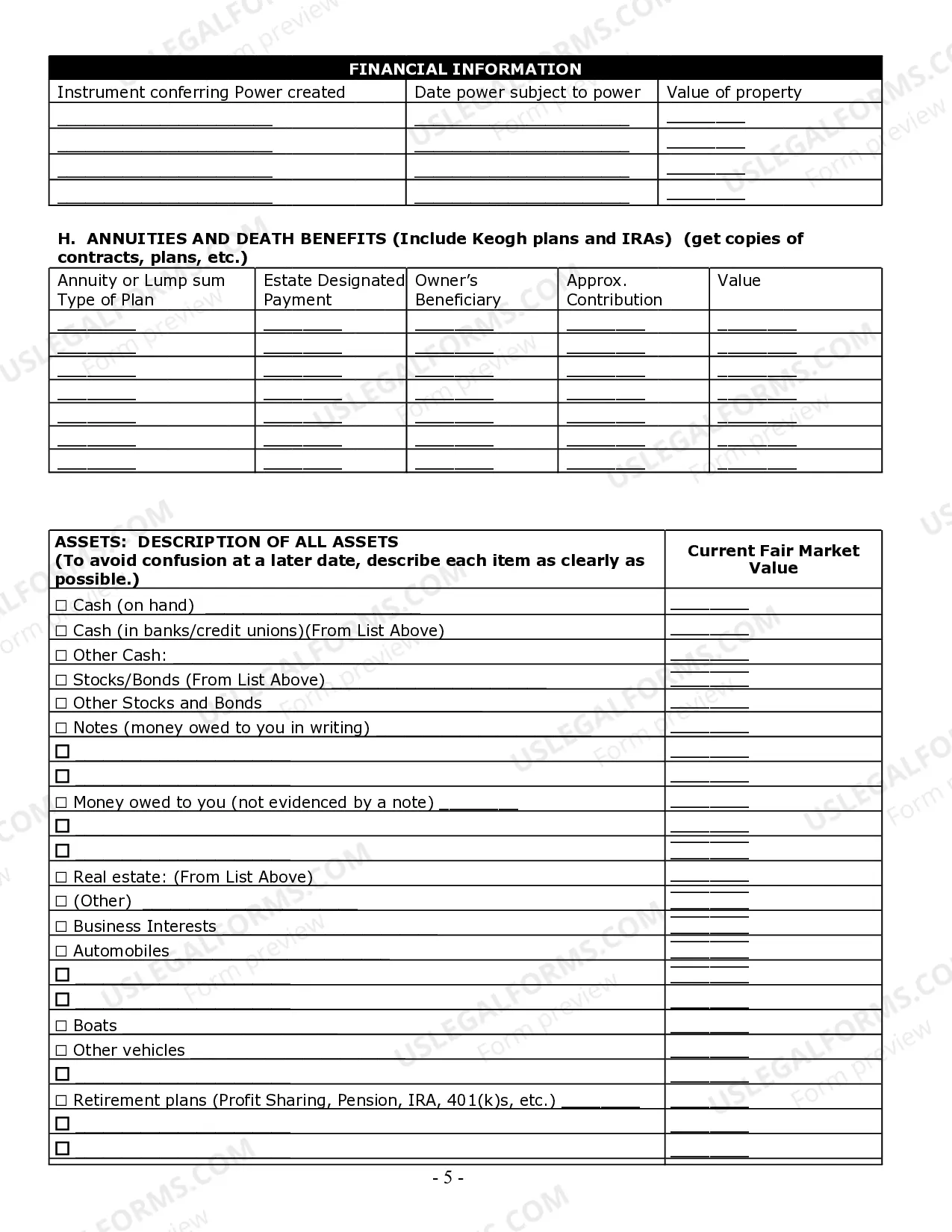

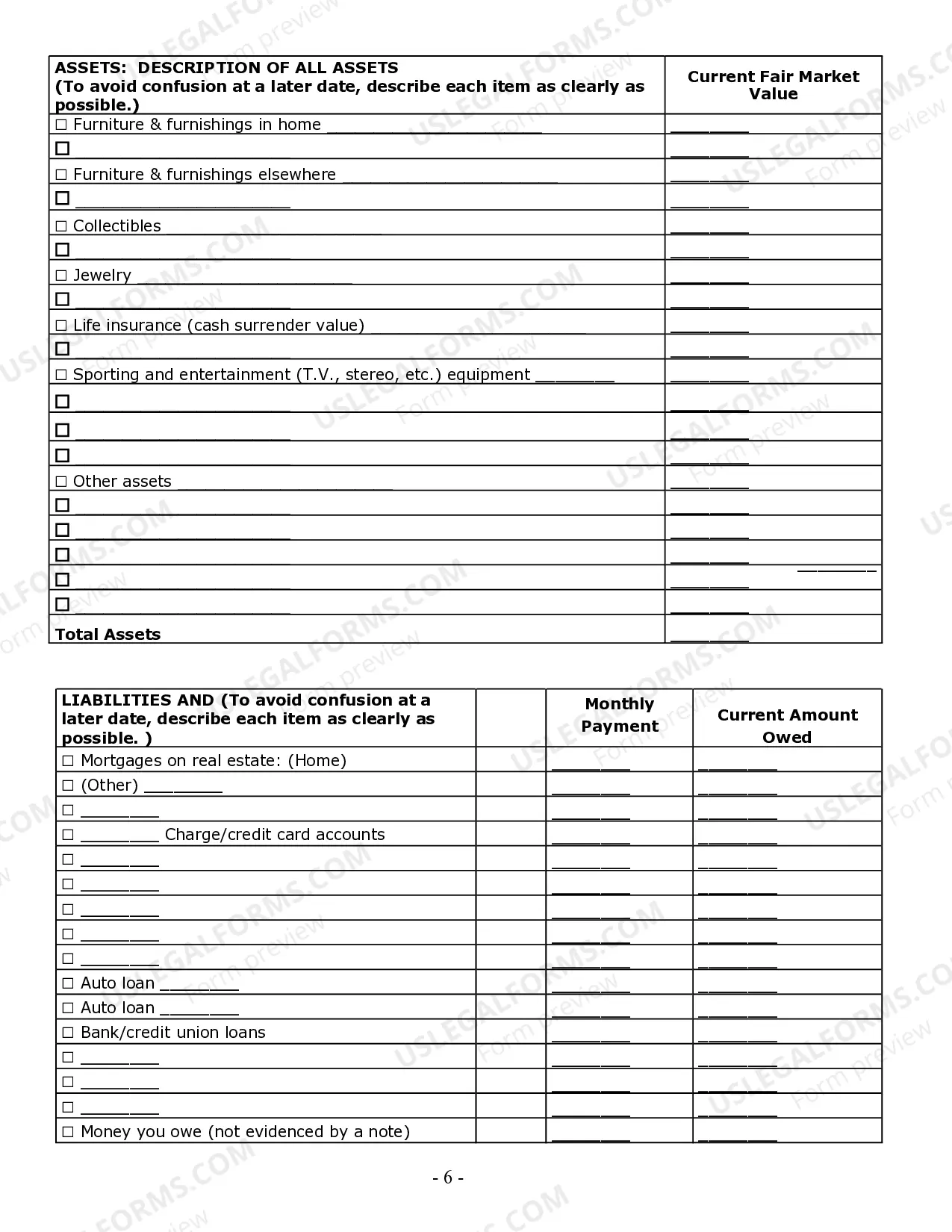

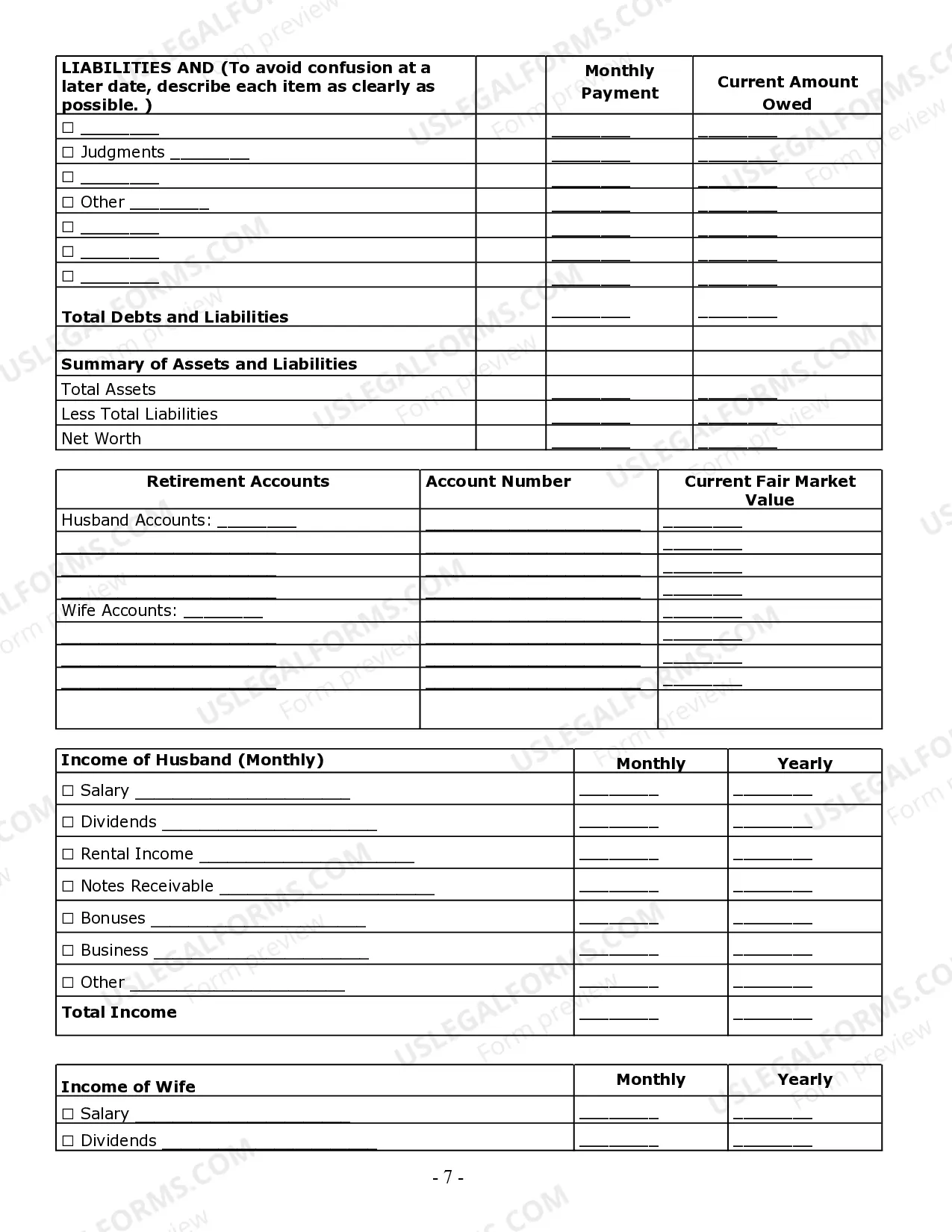

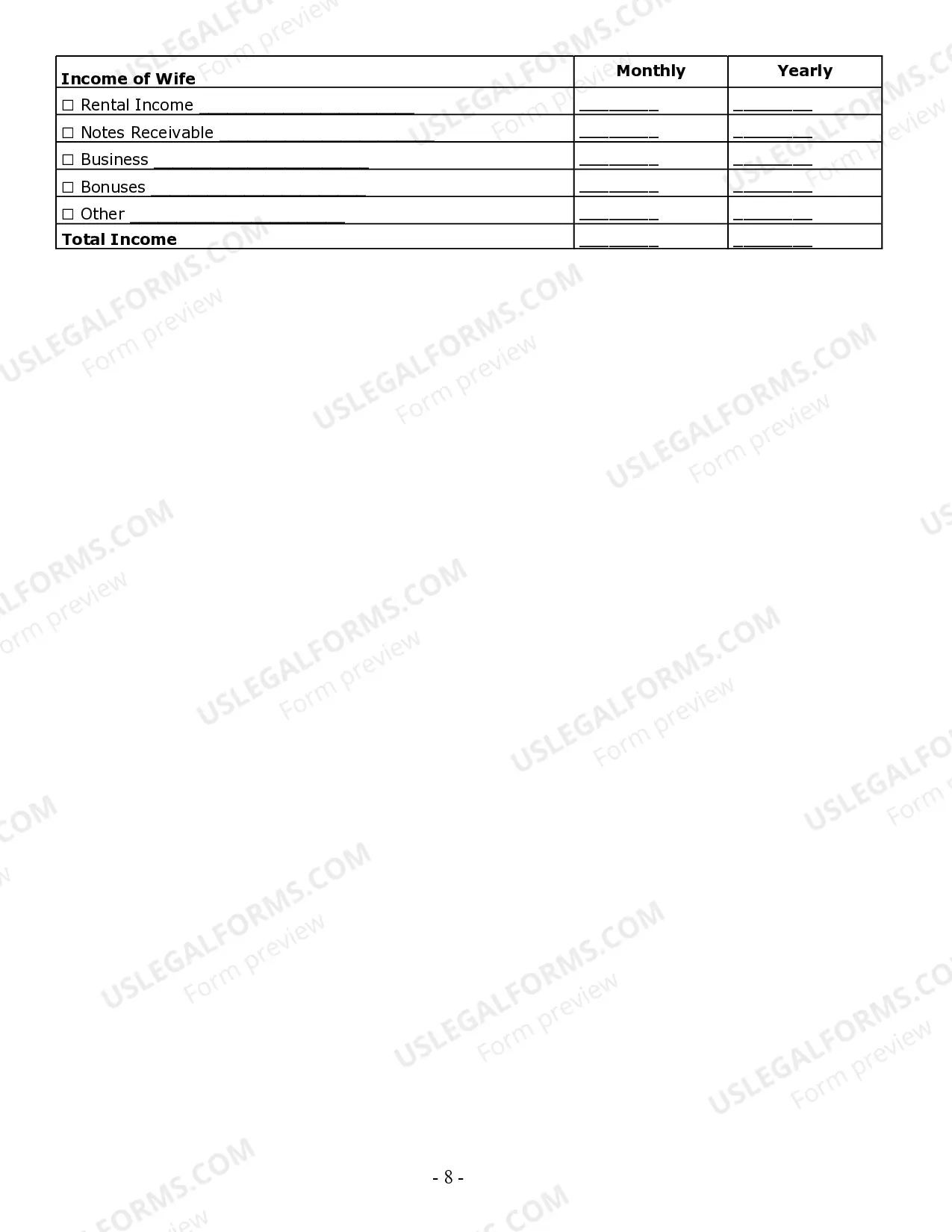

The Austin Texas Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals in organizing and preparing their estate plans in Austin, Texas. These documents involve a series of questions and statements covering various aspects of an individual's personal and financial information, ensuring that all necessary details are accounted for when creating an estate plan. The questionnaire and worksheets typically consist of different sections and categories, each focusing on a specific area of estate planning. These may include sections related to personal information, family details, assets and liabilities, healthcare wishes, financial accounts, charitable contributions, power of attorney appointments, and executor selections, among others. One type of questionnaire and worksheets may concentrate on the basic information required for estate planning, such as the individual's full name, contact details, marital status, and the names of family members and beneficiaries. It may also gather information regarding any specific healthcare instructions or preferences, such as desires for life-sustaining treatments or end-of-life care. Another type of questionnaire and worksheets may delve deeper into an individual's financial and legal affairs. This could involve identifying and documenting all the individual's assets, including real estate, bank accounts, investments, insurance policies, retirement plans, and business interests. Additionally, it may inquire about any outstanding debts, mortgages, or loans, as well as any existing estate planning documents or arrangements. The Austin Texas Estate Planning Questionnaire and Worksheets may also cover topics related to estate tax planning and charitable giving. Individuals may be asked to provide details about their intentions for distributing their assets and designating beneficiaries, as well as any philanthropic endeavors they wish to incorporate into their estate plans. By meticulously filling out these questionnaires and worksheets, individuals can provide their estate planning attorney with a comprehensive overview of their desires and financial situation. This information serves as a foundation for the attorney to create and customize estate planning documents, such as wills, trusts, powers of attorney, and advance healthcare directives, to align with the individual's specific goals and needs. Overall, the Austin Texas Estate Planning Questionnaire and Worksheets aim to simplify the estate planning process and ensure that individuals have thoroughly considered all necessary elements to protect their assets, provide for loved ones, and establish their final wishes in accordance with Texas laws.The Austin Texas Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals in organizing and preparing their estate plans in Austin, Texas. These documents involve a series of questions and statements covering various aspects of an individual's personal and financial information, ensuring that all necessary details are accounted for when creating an estate plan. The questionnaire and worksheets typically consist of different sections and categories, each focusing on a specific area of estate planning. These may include sections related to personal information, family details, assets and liabilities, healthcare wishes, financial accounts, charitable contributions, power of attorney appointments, and executor selections, among others. One type of questionnaire and worksheets may concentrate on the basic information required for estate planning, such as the individual's full name, contact details, marital status, and the names of family members and beneficiaries. It may also gather information regarding any specific healthcare instructions or preferences, such as desires for life-sustaining treatments or end-of-life care. Another type of questionnaire and worksheets may delve deeper into an individual's financial and legal affairs. This could involve identifying and documenting all the individual's assets, including real estate, bank accounts, investments, insurance policies, retirement plans, and business interests. Additionally, it may inquire about any outstanding debts, mortgages, or loans, as well as any existing estate planning documents or arrangements. The Austin Texas Estate Planning Questionnaire and Worksheets may also cover topics related to estate tax planning and charitable giving. Individuals may be asked to provide details about their intentions for distributing their assets and designating beneficiaries, as well as any philanthropic endeavors they wish to incorporate into their estate plans. By meticulously filling out these questionnaires and worksheets, individuals can provide their estate planning attorney with a comprehensive overview of their desires and financial situation. This information serves as a foundation for the attorney to create and customize estate planning documents, such as wills, trusts, powers of attorney, and advance healthcare directives, to align with the individual's specific goals and needs. Overall, the Austin Texas Estate Planning Questionnaire and Worksheets aim to simplify the estate planning process and ensure that individuals have thoroughly considered all necessary elements to protect their assets, provide for loved ones, and establish their final wishes in accordance with Texas laws.