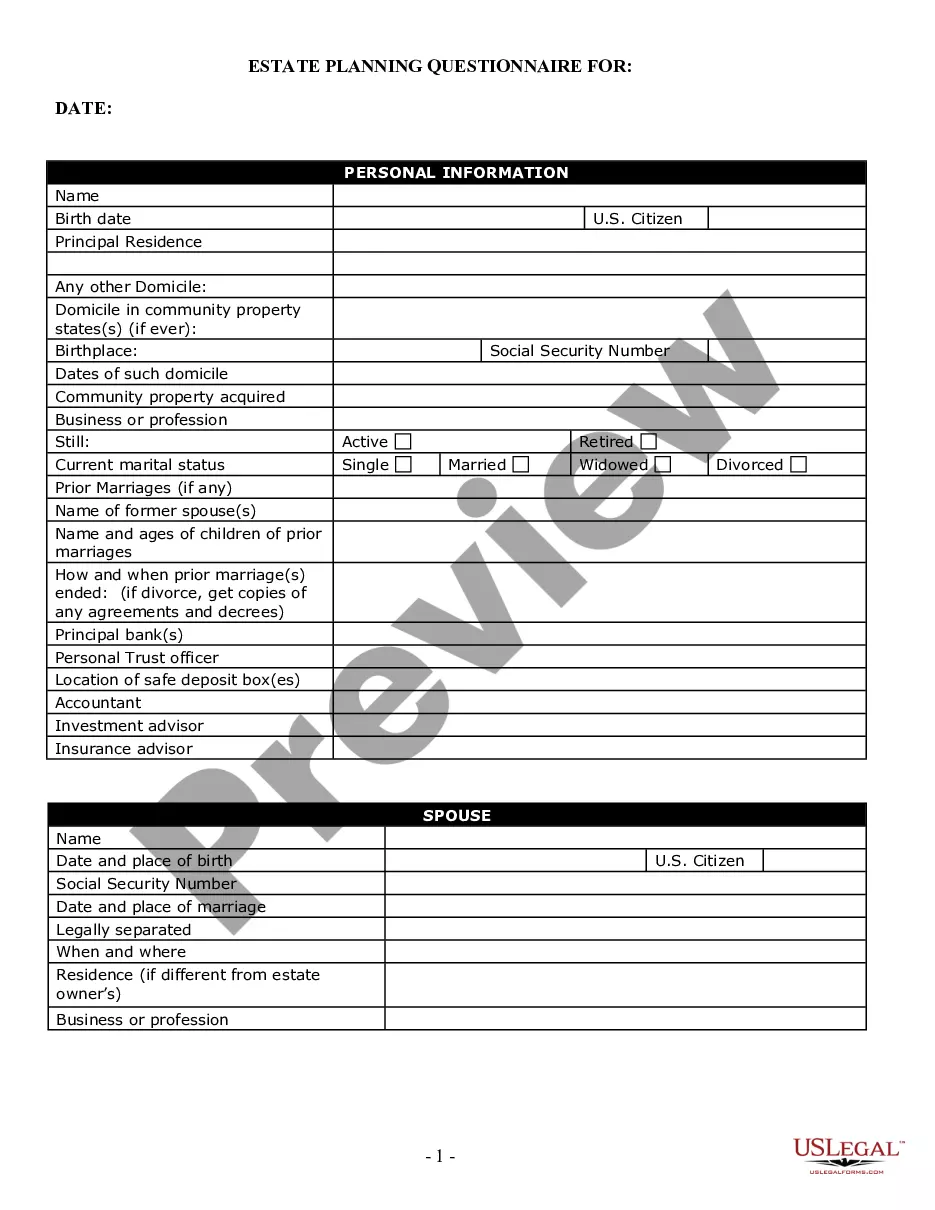

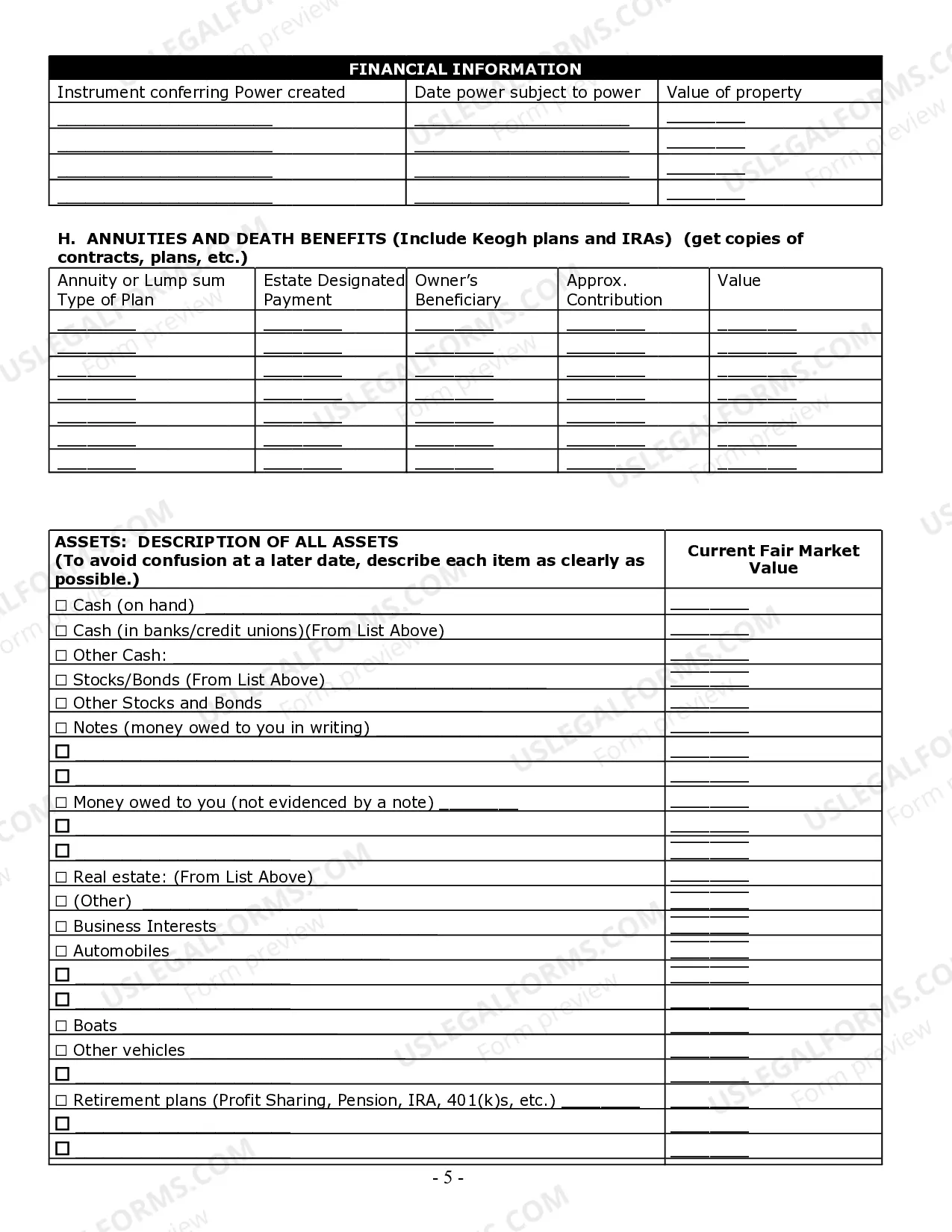

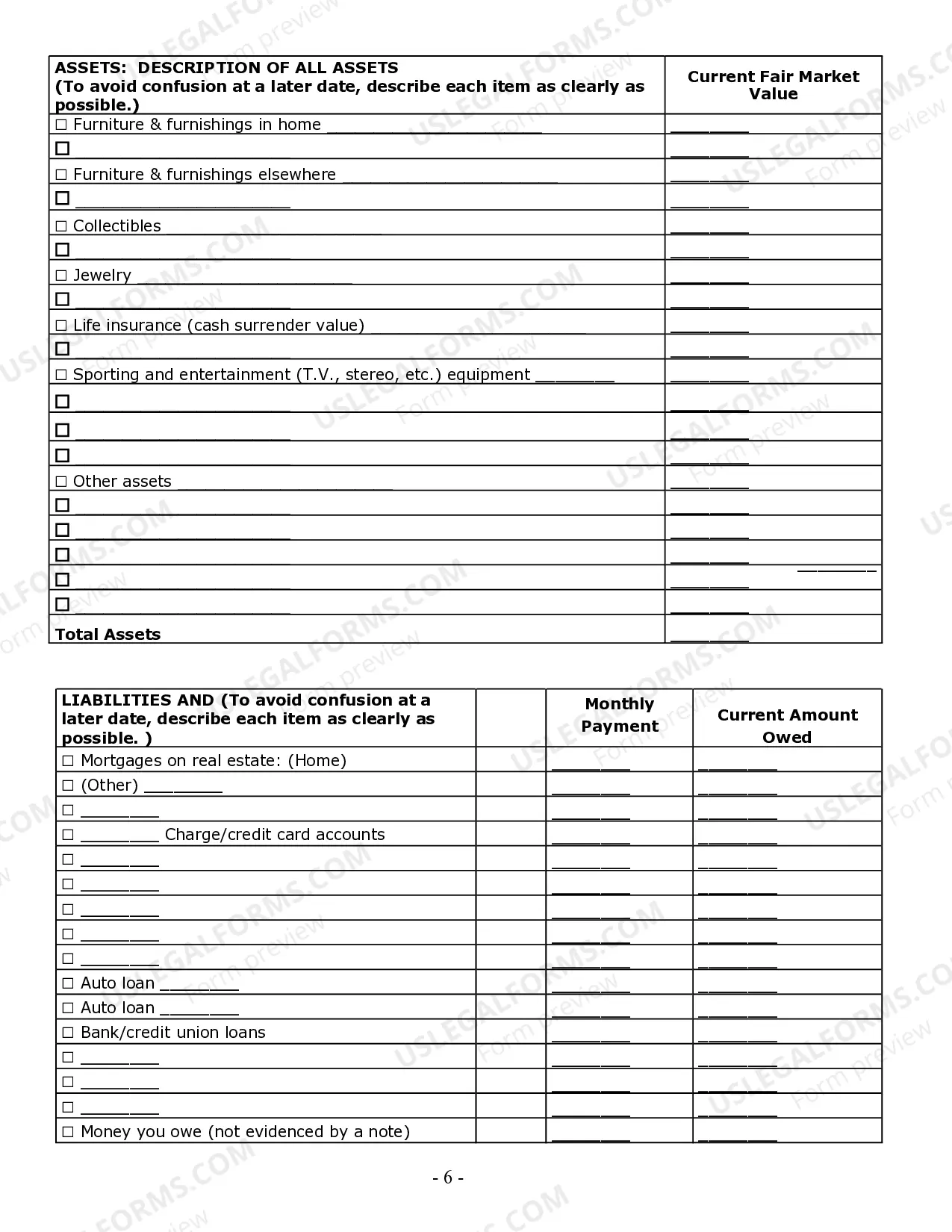

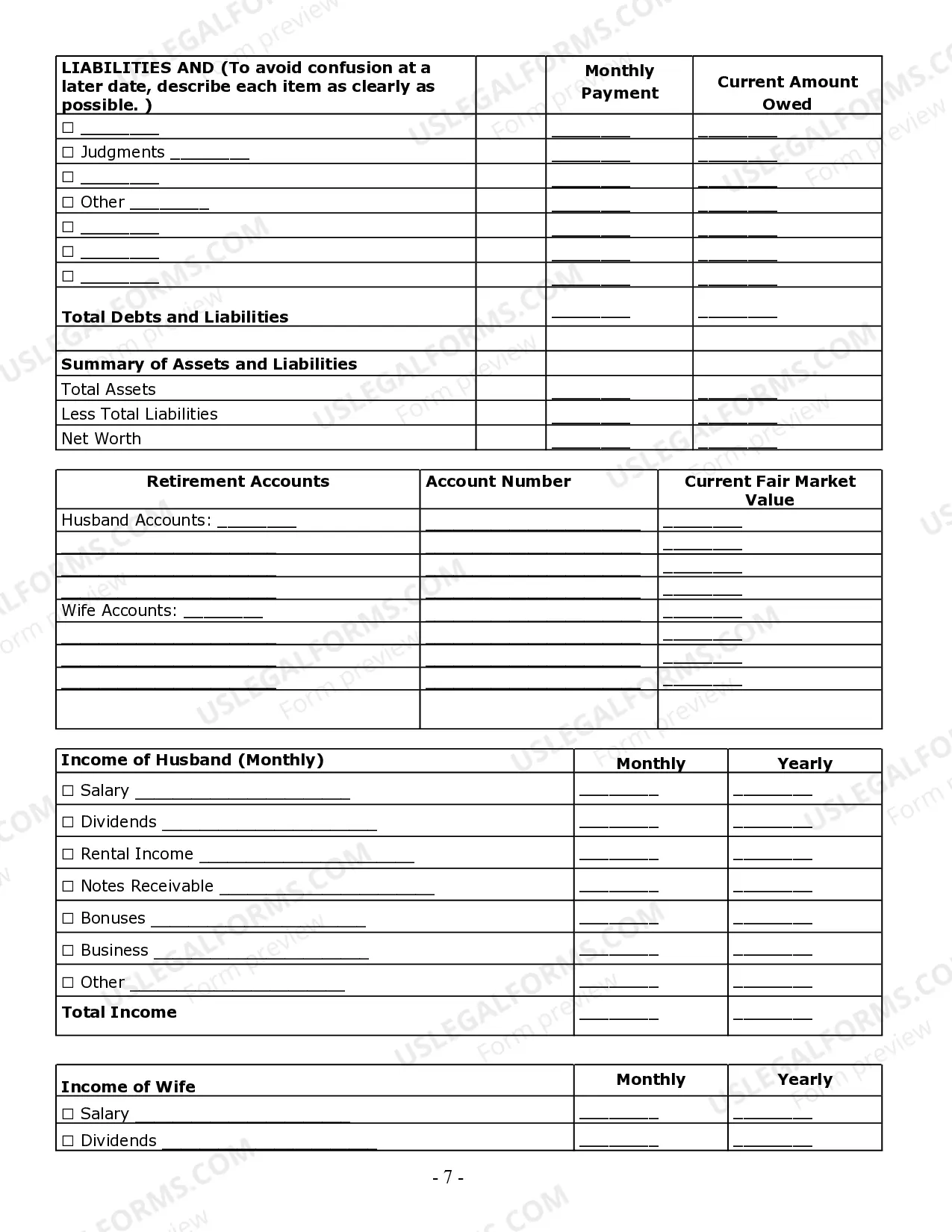

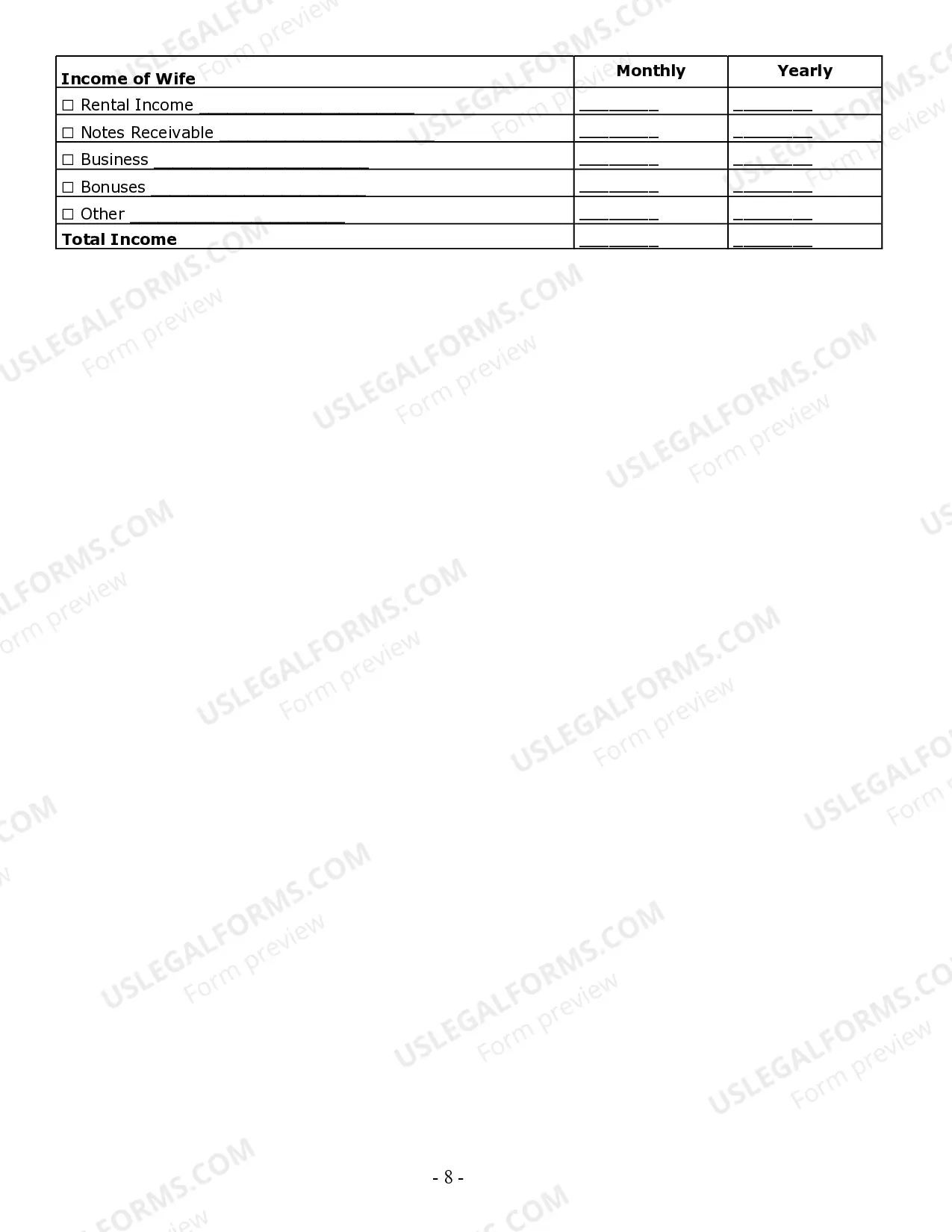

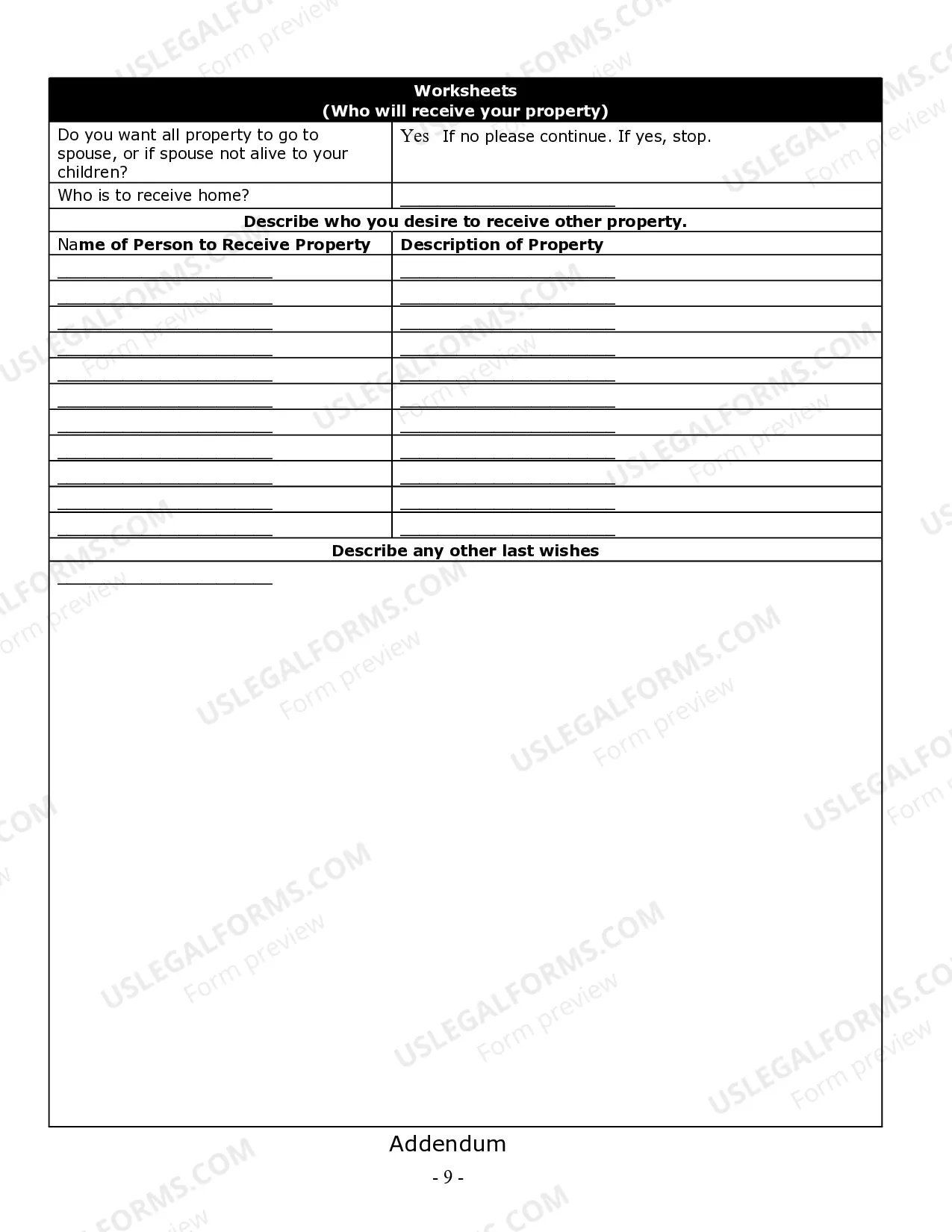

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

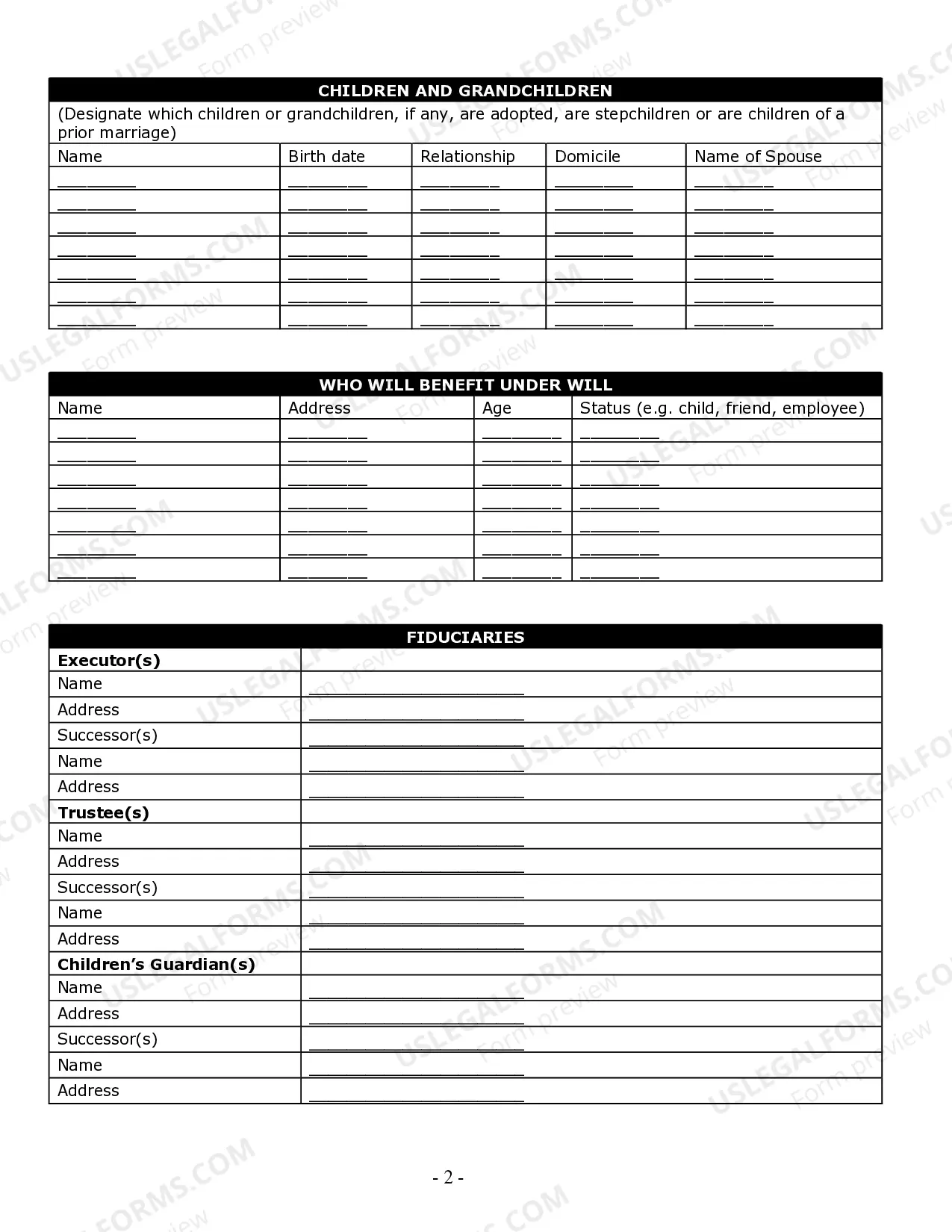

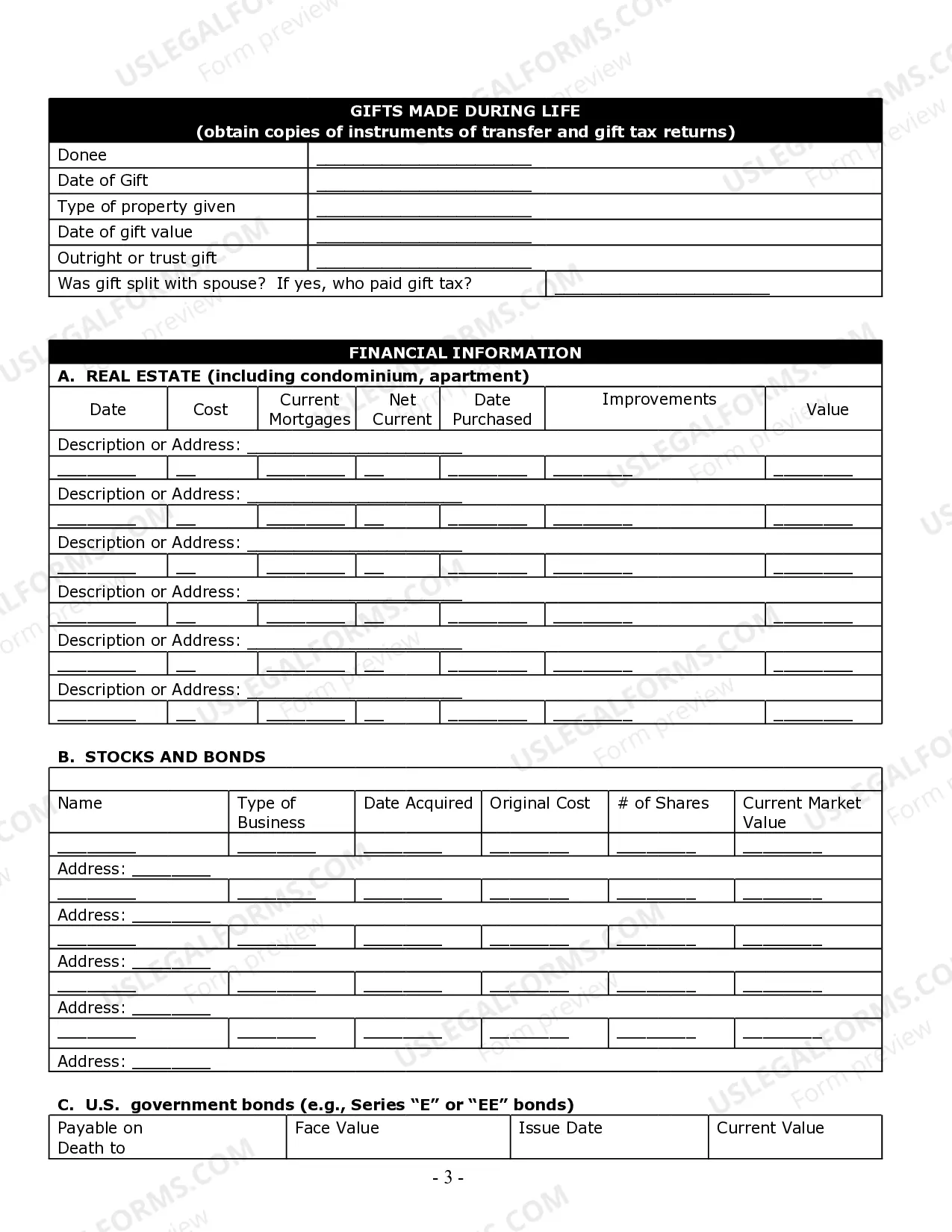

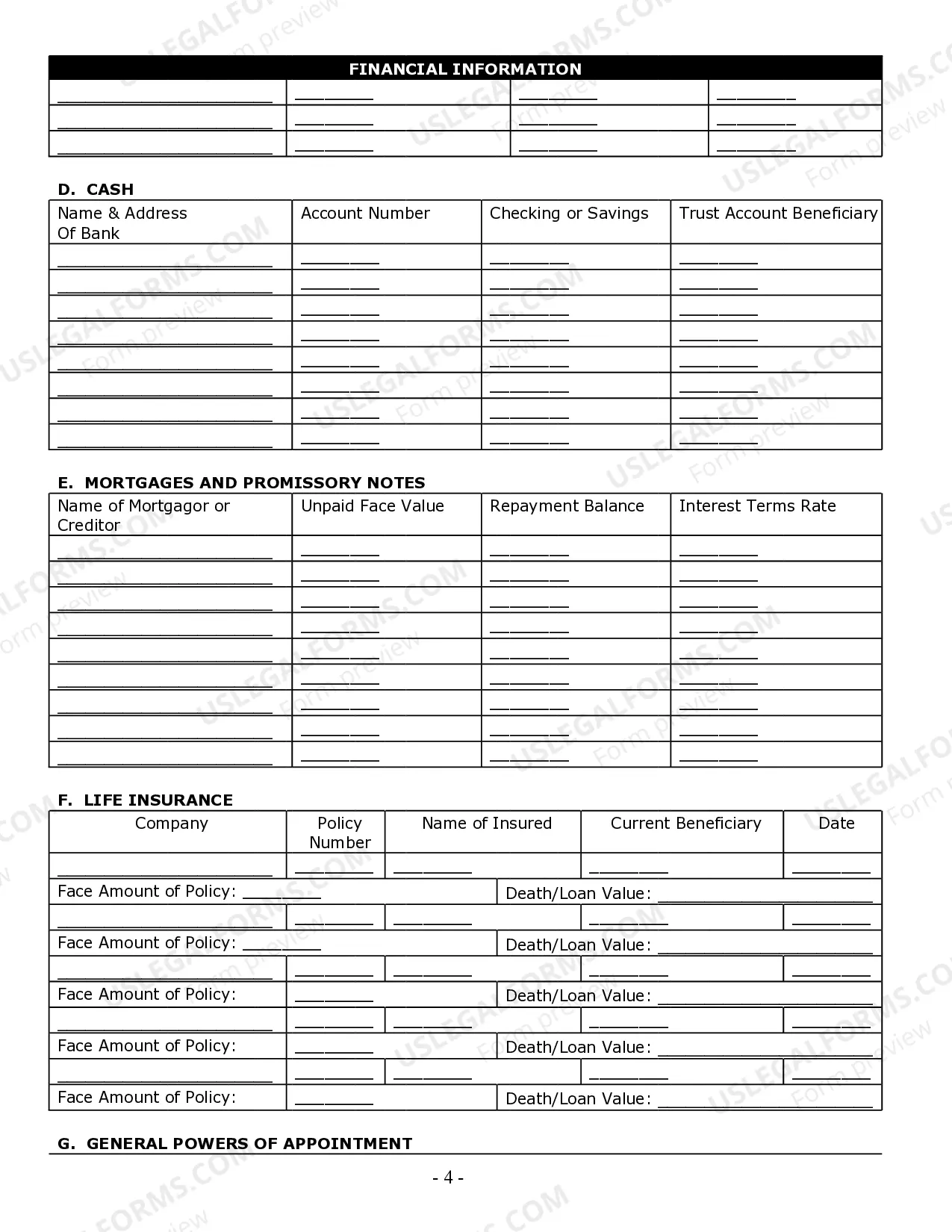

Travis Texas Estate Planning Questionnaire and Worksheets serve as comprehensive tools to gather essential information and assist individuals in the estate planning process in Travis County, Texas. These documents aim to help clients organize their assets, finances, and estate planning goals, ensuring a smooth and effective estate plan. The Travis Texas Estate Planning Questionnaire serves as a primary document that prompts individuals to provide crucial details about their personal information, such as full name, contact information, marital status, and family members. It also includes sections to outline the client's current assets, such as real estate properties, bank accounts, investments, retirement accounts, and business interests. Furthermore, the questionnaire dives into estate planning objectives, including guardianship nominations for minor children, distribution of assets among beneficiaries, and preferences regarding healthcare decisions. It covers crucial topics like the appointment of executors, trustees, and power of attorneys, as well as the establishment of trust funds or charitable contributions. Additionally, the Travis Texas Estate Planning Worksheets complement the questionnaires by offering more in-depth sections to address specific estate planning concerns. These worksheets can comprise sections regarding business succession planning, tax strategies, asset protection, and the identification of potential beneficiaries. They can also include advanced directives, healthcare directives, and living wills, allowing individuals to express their wishes in case of incapacitation or end-of-life decisions. Ranging from basic to complex, Travis Texas Estate Planning Questionnaire and Worksheets can cater to different client needs. Some variations may include single individuals or married couples, high-net-worth individuals, small business owners, or families with special needs children. By tailoring the documents to specific circumstances, these variations ensure that estate planning instruments accurately reflect the client's intentions and requirements. Overall, the Travis Texas Estate Planning Questionnaire and Worksheets provide a comprehensive framework to guide individuals through the estate planning process, ensuring that crucial details are not overlooked. By utilizing these tools, individuals can collaborate effectively with an estate planning attorney, working together to create a personalized and legally sound estate plan that meets their specific needs and protects their assets for the future.Travis Texas Estate Planning Questionnaire and Worksheets serve as comprehensive tools to gather essential information and assist individuals in the estate planning process in Travis County, Texas. These documents aim to help clients organize their assets, finances, and estate planning goals, ensuring a smooth and effective estate plan. The Travis Texas Estate Planning Questionnaire serves as a primary document that prompts individuals to provide crucial details about their personal information, such as full name, contact information, marital status, and family members. It also includes sections to outline the client's current assets, such as real estate properties, bank accounts, investments, retirement accounts, and business interests. Furthermore, the questionnaire dives into estate planning objectives, including guardianship nominations for minor children, distribution of assets among beneficiaries, and preferences regarding healthcare decisions. It covers crucial topics like the appointment of executors, trustees, and power of attorneys, as well as the establishment of trust funds or charitable contributions. Additionally, the Travis Texas Estate Planning Worksheets complement the questionnaires by offering more in-depth sections to address specific estate planning concerns. These worksheets can comprise sections regarding business succession planning, tax strategies, asset protection, and the identification of potential beneficiaries. They can also include advanced directives, healthcare directives, and living wills, allowing individuals to express their wishes in case of incapacitation or end-of-life decisions. Ranging from basic to complex, Travis Texas Estate Planning Questionnaire and Worksheets can cater to different client needs. Some variations may include single individuals or married couples, high-net-worth individuals, small business owners, or families with special needs children. By tailoring the documents to specific circumstances, these variations ensure that estate planning instruments accurately reflect the client's intentions and requirements. Overall, the Travis Texas Estate Planning Questionnaire and Worksheets provide a comprehensive framework to guide individuals through the estate planning process, ensuring that crucial details are not overlooked. By utilizing these tools, individuals can collaborate effectively with an estate planning attorney, working together to create a personalized and legally sound estate plan that meets their specific needs and protects their assets for the future.