The Travis Texas contract for the International Sale of Goods with Purchase Money Security Interest is a legal agreement that outlines the terms and conditions for the sale of goods between parties involved in an international transaction. This contract specifically addresses the inclusion of a purchase money security interest, which provides the seller with additional security should the buyer fail to make the required payments. Keywords: Travis Texas, contract, International Sale of Goods, purchase money security interest, legal agreement, terms and conditions, sale of goods, international transaction, parties, seller, buyer, payments, security. There are various types of Travis Texas contracts for the International Sale of Goods with Purchase Money Security Interest, including: 1. Comprehensive contract: This type of contract provides a detailed and comprehensive framework for the sale of goods, covering all relevant terms and conditions, payment schedules, delivery methods, and dispute resolution mechanisms. 2. Installment sales contract: In an installment sales contract, the buyer agrees to make payments in installments over a specified period. The seller retains a purchase money security interest in the goods until the full payment is made, ensuring that the seller has a right to repossess the goods in case of default. 3. Conditional sales contract: A conditional sales contract stipulates that the ownership of the goods will only transfer to the buyer once certain conditions, such as full payment, are met. The seller retains a security interest in the goods until the conditions are fulfilled. 4. Secured party contract: This type of contract establishes a security interest in the goods sold, allowing the seller to secure the buyer's payment obligations by retaining an interest in the goods until the purchase price is paid in full. 5. Consignment contract: In a consignment contract, the seller (consignor) transfers goods to a buyer (consignee) for sale. The seller retains a security interest in the consigned goods until they are sold, ensuring that the seller can repossess any unsold goods. 6. Factoring contract: A factoring contract involves the sale of accounts receivable (unpaid invoices) by the seller to a third-party (factor) at a discounted rate. The seller assigns its purchase money security interest in the goods associated with the accounts receivable to the factor as collateral. These various types of Travis Texas contracts for the International Sale of Goods with Purchase Money Security Interest cater to different scenarios and provide legal protection and clarity for both buyers and sellers engaged in international transactions.

Travis Texas Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Travis Texas Contract For The International Sale Of Goods With Purchase Money Security Interest?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Travis Contract for the International Sale of Goods with Purchase Money Security Interest without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Travis Contract for the International Sale of Goods with Purchase Money Security Interest by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Travis Contract for the International Sale of Goods with Purchase Money Security Interest:

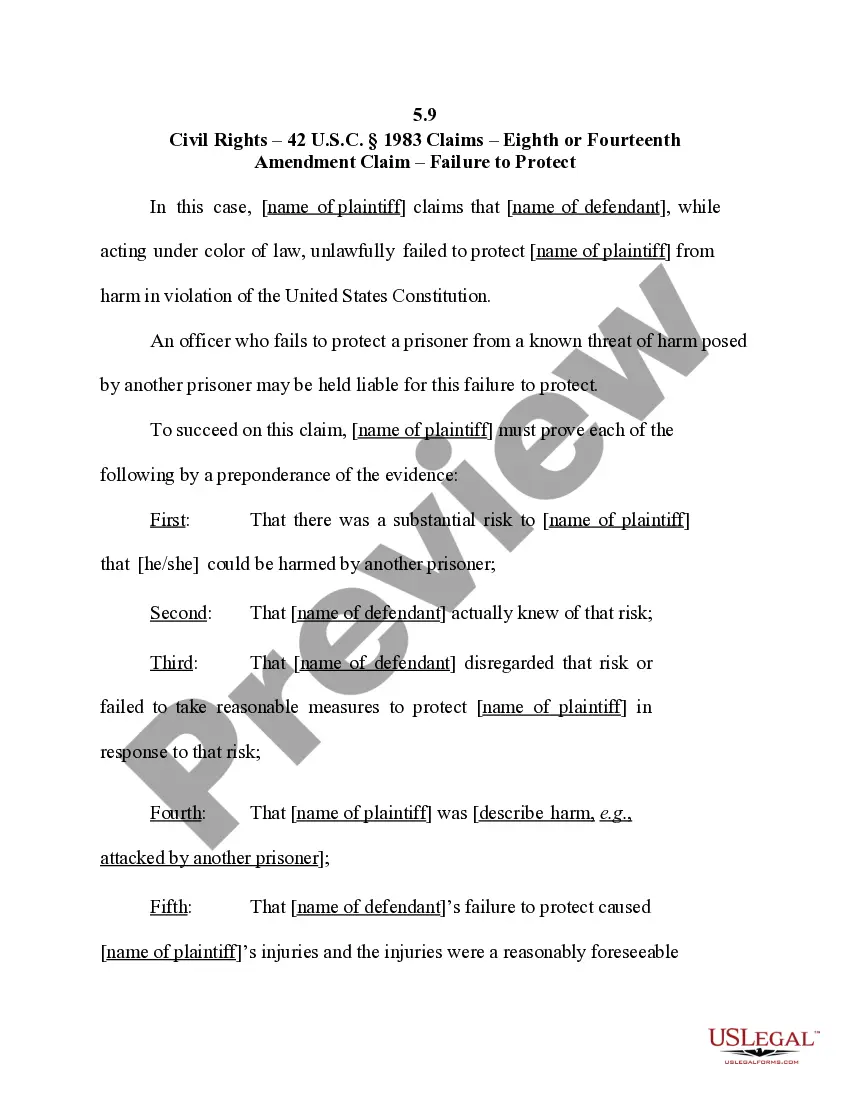

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!