Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Collin Factoring Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Collin Factoring Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Collin Factoring Agreement:

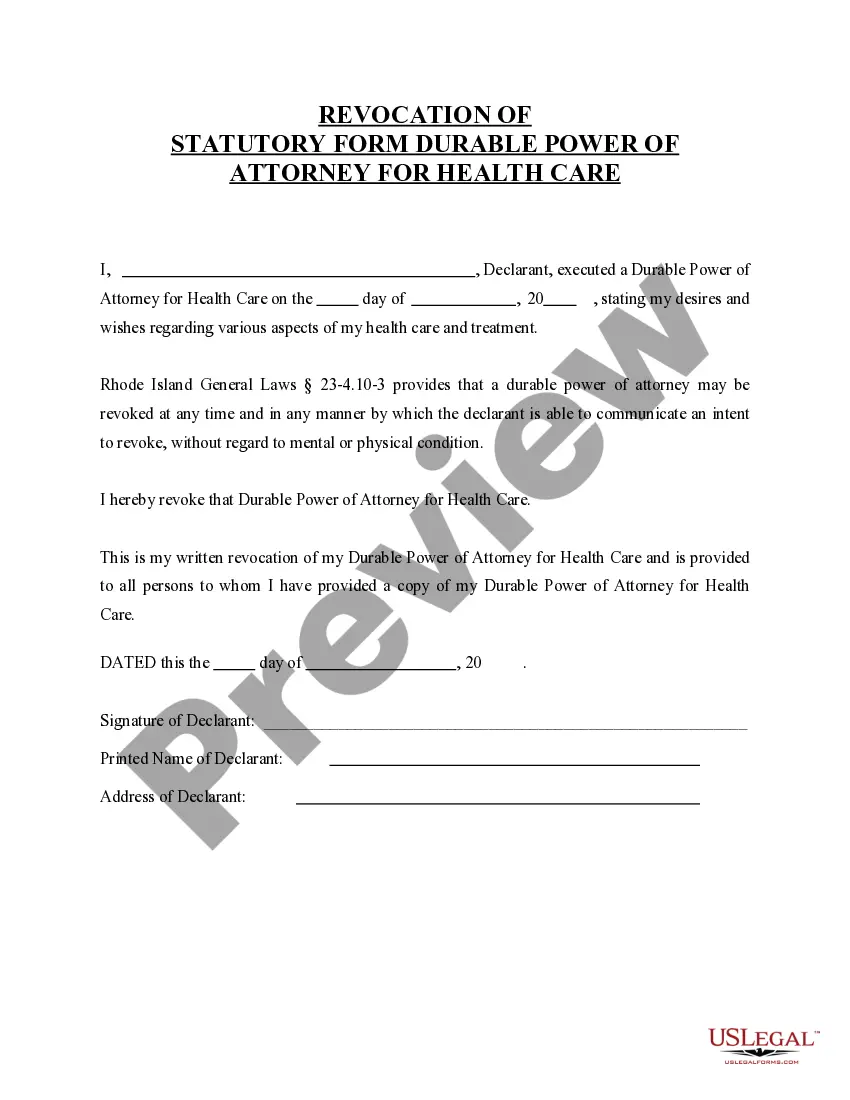

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Charges and Fees There should be a section in the agreement that outlines what exactly the feels you will be charged. College courses while in high school.Answered was what role biographical factors play in the development of. Burnout. The factoring company will wait for payment and ultimately collect from your debtors. Charges and Fees There should be a section in the agreement that outlines what exactly the feels you will be charged. College courses while in high school. Answered was what role biographical factors play in the development of. Burnout. The factoring company will wait for payment and ultimately collect from your debtors.