A factor is a person who sells goods for a commission. A factor takes possession of goods of another and usually sells them in his/her own name. A factor differs from a broker in that a broker normally doesn't take possession of the goods. A factor may be a financier who lends money in return for an assignment of accounts receivable (A/R) or other security.

Many times factoring is used when a manufacturing company has a large A/R on the books that would represent the entire profits for the company for the year. That particular A/R might not get paid prior to year end from a client that has no money. That means the manufacturing company will have no profit for the year unless they can figure out a way to collect the A/R.

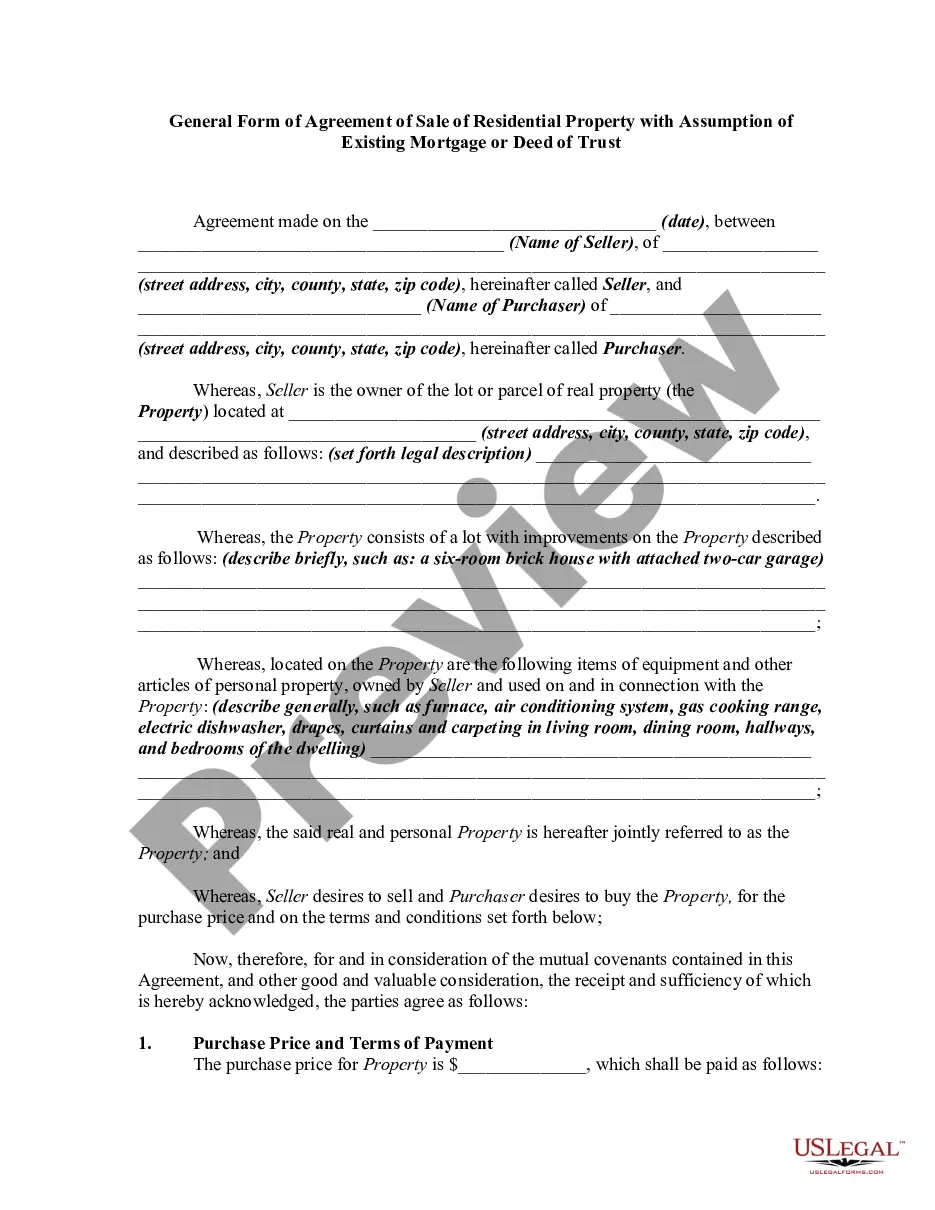

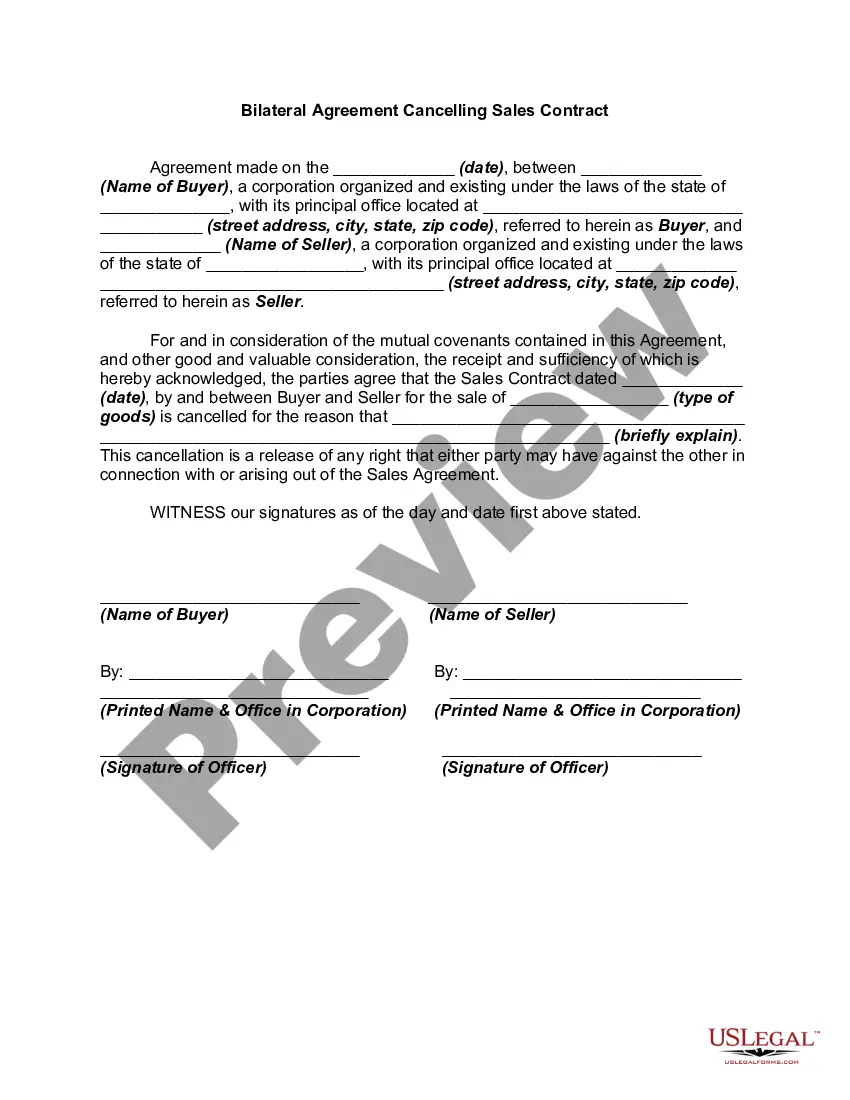

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oakland Michigan Factoring Agreement is a legal contract between a business based in Oakland County, Michigan and a financial institution known as a factor. This agreement allows the business to sell its accounts receivable or invoices to the factor in exchange for immediate cash flow, rather than waiting for payment from their customers. This financial tool is commonly used by businesses to improve their cash flow, meet obligations, and fuel growth. In Oakland County, Michigan, there are different types of factoring agreements available to businesses, each serving different needs: 1. Recourse Factoring Agreement: This is the most common type of factoring agreement where the business remains liable for any unpaid invoices or uncollected accounts receivable. In other words, if the factor is unable to collect payment from the customers mentioned in the invoices, the business must repay the factor. 2. Non-Recourse Factoring Agreement: Unlike the recourse agreement, in a non-recourse factoring agreement, the factor assumes the risk of non-payment by the customers listed on the invoices. The business is not obligated to repay the factor if the customers fail to pay. 3. Spot Factoring Agreement: This type of factoring agreement allows businesses to select specific invoices or accounts receivable to sell to the factor. Spot factoring provides flexibility to businesses since they can factor only when necessary, rather than entering into a long-term contract. 4. Full-Service Factoring Agreement: With a full-service factoring agreement, the factor not only purchases the invoices but also takes care of credit checking, collection services, and managing accounts receivable. These reliefs businesses from the administrative burdens associated with collections and allows them to focus on core operations. Benefits of Oakland Michigan Factoring Agreement include improved cash flow, no need to wait for customers' payments, reduction in bad debts (in recourse agreements), outsourced collections, and the ability to meet financial obligations such as paying suppliers or employees promptly. In conclusion, Oakland Michigan Factoring Agreement is a financial arrangement that enables businesses in Oakland County, Michigan to sell their accounts receivable or invoices to a factor in exchange for immediate cash. Recourse, non-recourse, spot, and full-service factoring agreements are different types of arrangements available to businesses, each catering to specific requirements and risk preferences.