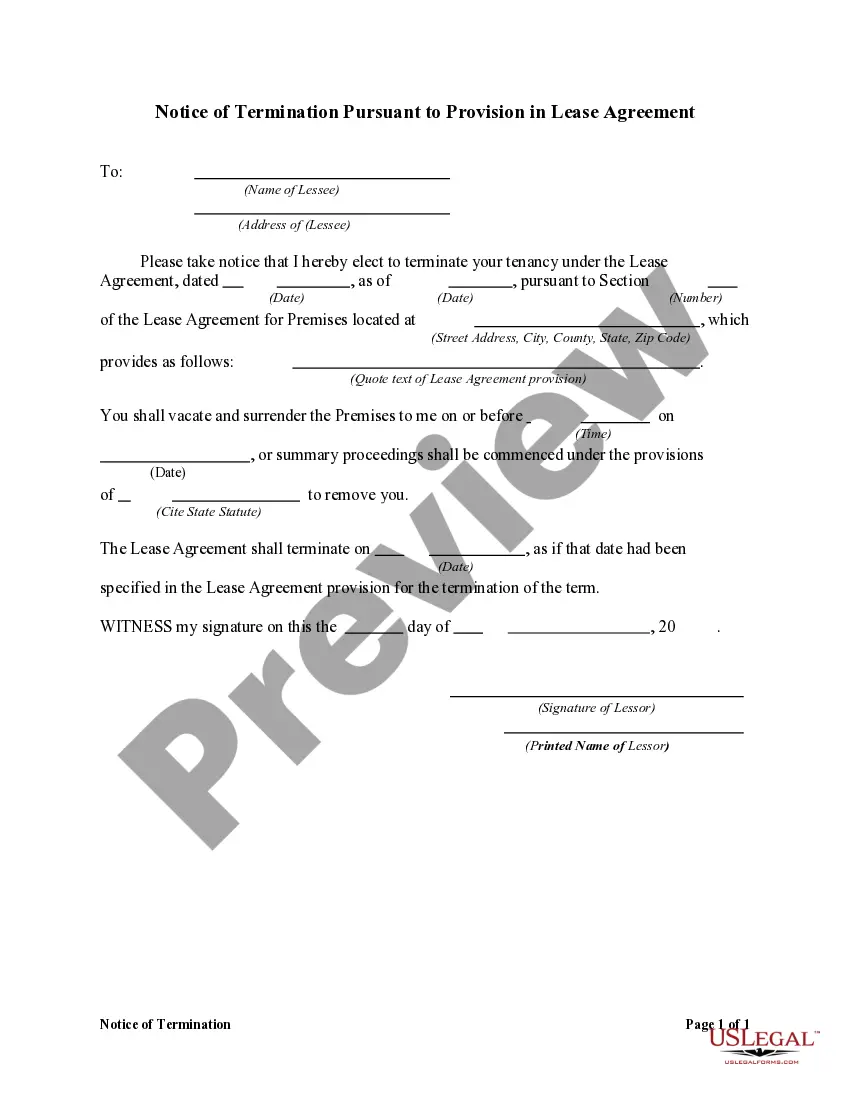

This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Title: San Jose, California: Application for Release of Right to Redeem Property from IRS After Foreclosure Introduction: In San Jose, California, individuals who have experienced foreclosure on their property may find themselves in a situation where they need to apply for the release of their right to redeem the property from the Internal Revenue Service (IRS). This application process allows property owners to regain control of their foreclosed property by satisfying any outstanding tax liabilities. This comprehensive guide will outline the necessary steps, requirements, and key information related to the San Jose, California Application for Release of Right to Redeem Property from IRS After Foreclosure. 1. Understanding the Application Process: The San Jose, California Application for Release of Right to Redeem Property from IRS After Foreclosure is a formal procedure aimed at settling outstanding tax debts associated with foreclosure proceedings. This application must be completed and filed correctly to initiate the process of regaining ownership and control of the foreclosed property. 2. Key Components of the Application: a. Property Information: Provide detailed information about the foreclosed property, such as the address, property identification number, and any relevant legal documents relating to the foreclosure proceedings. b. Tax Liability Documentation: Accurately disclose the tax liabilities associated with the foreclosed property, including federal taxes, penalties, and interest due. c. Current Financial Situation: Clearly outline your current financial circumstances, including income, expenses, and assets, in order to evaluate your ability to satisfy the outstanding tax debts. d. Repayment Proposal: Develop a repayment proposal outlining how you intend to settle the outstanding tax debts. This may involve one-time payment or installment arrangements based on your financial capacity. 3. Supporting Documentation: In order to strengthen your application for the release of right to redeem property, it is crucial to gather and include the following supporting documents: a. Foreclosure documents: Provide copies of all relevant foreclosure documents, such as the Notice of Default, Trustee's Sale Notice, or Certificate of Sale. b. Tax Returns: Submit recent federal tax returns to provide a comprehensive understanding of your financial situation. c. Financial Statements: Include financial statements such as bank statements, pay stubs, and asset valuations to support your claims about your financial standing and ability to repay the tax debts. d. Proof of Repayment Ability: If you propose an installment plan, provide documentation that demonstrates your capacity to meet the proposed monthly payments. Types of San Jose, California Applications for Release of Right to Redeem Property from IRS After Foreclosure: 1. Individual Property Owner Application: This application is specifically designed for individual property owners who have experienced foreclosure and seek to redeem ownership from the IRS. 2. Joint Property Owner Application: In cases where multiple individuals co-owned a foreclosed property, this application is used to initiate the process of releasing the right to redeem the property from the IRS. 3. Business Entity Application: If a business entity, such as a corporation or partnership, owned the foreclosed property, this specialized application is required to address the unique circumstances of the foreclosure and tax liabilities. Conclusion: The San Jose, California Application for Release of Right to Redeem Property from IRS After Foreclosure serves as a vital tool for individuals and entities seeking to regain ownership and control of their foreclosed property. By completing the application accurately and providing supporting documentation, applicants demonstrate their commitment to resolving outstanding tax liabilities. Understanding the process, requirements, and various types of applications ensures a smoother application process, increasing the chances of reclaiming the foreclosed property.Title: San Jose, California: Application for Release of Right to Redeem Property from IRS After Foreclosure Introduction: In San Jose, California, individuals who have experienced foreclosure on their property may find themselves in a situation where they need to apply for the release of their right to redeem the property from the Internal Revenue Service (IRS). This application process allows property owners to regain control of their foreclosed property by satisfying any outstanding tax liabilities. This comprehensive guide will outline the necessary steps, requirements, and key information related to the San Jose, California Application for Release of Right to Redeem Property from IRS After Foreclosure. 1. Understanding the Application Process: The San Jose, California Application for Release of Right to Redeem Property from IRS After Foreclosure is a formal procedure aimed at settling outstanding tax debts associated with foreclosure proceedings. This application must be completed and filed correctly to initiate the process of regaining ownership and control of the foreclosed property. 2. Key Components of the Application: a. Property Information: Provide detailed information about the foreclosed property, such as the address, property identification number, and any relevant legal documents relating to the foreclosure proceedings. b. Tax Liability Documentation: Accurately disclose the tax liabilities associated with the foreclosed property, including federal taxes, penalties, and interest due. c. Current Financial Situation: Clearly outline your current financial circumstances, including income, expenses, and assets, in order to evaluate your ability to satisfy the outstanding tax debts. d. Repayment Proposal: Develop a repayment proposal outlining how you intend to settle the outstanding tax debts. This may involve one-time payment or installment arrangements based on your financial capacity. 3. Supporting Documentation: In order to strengthen your application for the release of right to redeem property, it is crucial to gather and include the following supporting documents: a. Foreclosure documents: Provide copies of all relevant foreclosure documents, such as the Notice of Default, Trustee's Sale Notice, or Certificate of Sale. b. Tax Returns: Submit recent federal tax returns to provide a comprehensive understanding of your financial situation. c. Financial Statements: Include financial statements such as bank statements, pay stubs, and asset valuations to support your claims about your financial standing and ability to repay the tax debts. d. Proof of Repayment Ability: If you propose an installment plan, provide documentation that demonstrates your capacity to meet the proposed monthly payments. Types of San Jose, California Applications for Release of Right to Redeem Property from IRS After Foreclosure: 1. Individual Property Owner Application: This application is specifically designed for individual property owners who have experienced foreclosure and seek to redeem ownership from the IRS. 2. Joint Property Owner Application: In cases where multiple individuals co-owned a foreclosed property, this application is used to initiate the process of releasing the right to redeem the property from the IRS. 3. Business Entity Application: If a business entity, such as a corporation or partnership, owned the foreclosed property, this specialized application is required to address the unique circumstances of the foreclosure and tax liabilities. Conclusion: The San Jose, California Application for Release of Right to Redeem Property from IRS After Foreclosure serves as a vital tool for individuals and entities seeking to regain ownership and control of their foreclosed property. By completing the application accurately and providing supporting documentation, applicants demonstrate their commitment to resolving outstanding tax liabilities. Understanding the process, requirements, and various types of applications ensures a smoother application process, increasing the chances of reclaiming the foreclosed property.