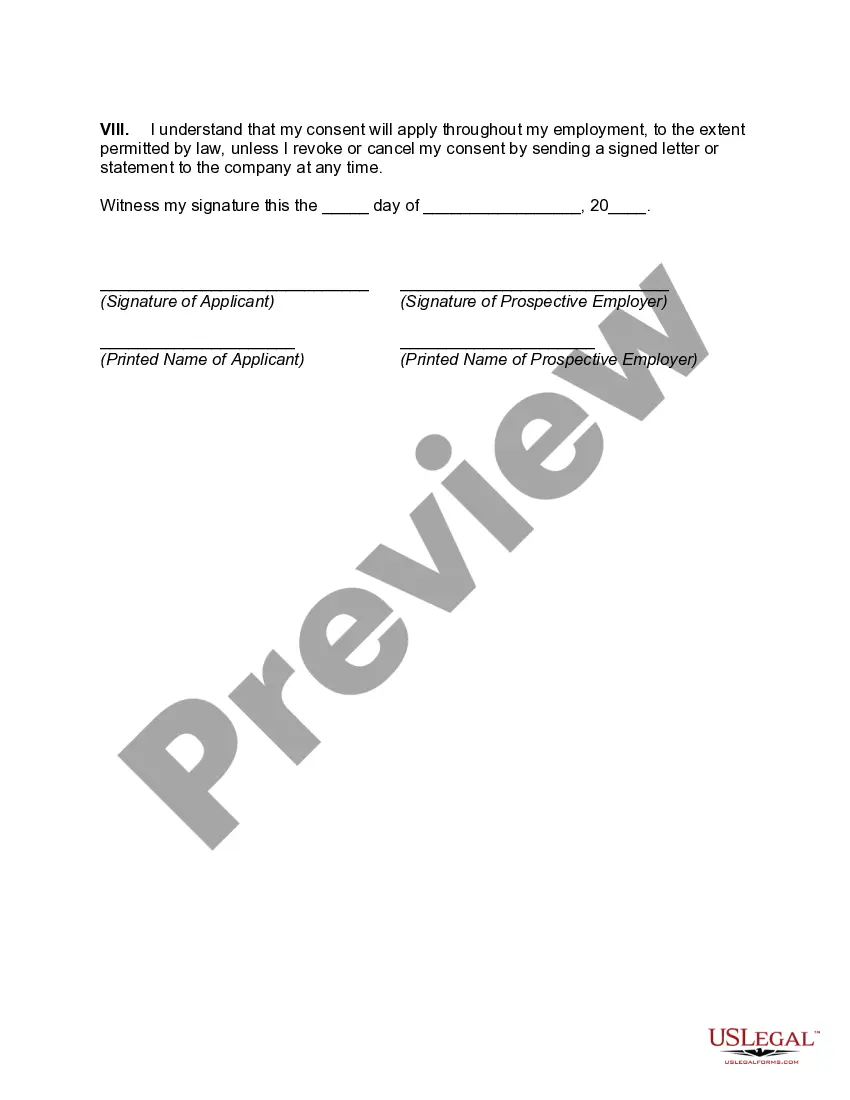

Chicago Illinois Disclosure and Consent for a Consumer and Investigative Report and Release Authorization is a legal document used in various situations where an individual's consumer or investigative report needs to be obtained and shared with concerned parties. It ensures that the person providing the information is willing and aware of its implications, granting consent for the release of personal data. This process is crucial for companies, employers, landlords, or any entity that needs to conduct background checks, credit reports, or gather private information on an individual. There are different types of Chicago Illinois Disclosure and Consent for a Consumer and Investigative Report and Release Authorizations, depending on the specific purpose or industry they pertain to. Below are some common variations: 1. Employment Background Check Authorization: This type is used by potential employers to gather information about a job applicant's past employment history, educational background, criminal records, and creditworthiness before making a hiring decision. It ensures that the employer has received informed consent from the applicant for conducting the background check. 2. Tenant Screening Authorization: Landlords often require prospective tenants to provide consent for conducting a rental background check. This authorization allows the landlord to access the applicant's credit score, eviction history, criminal records, and other relevant information to assess their eligibility to lease a property. 3. Financial Institution Consent: Banks and financial institutions may require customers to sign a Disclosure and Consent form when applying for loans, mortgages, or credit cards. This document permits the institution to retrieve the applicant's credit report and financial information, ensuring they are aware and have consented to the investigation. 4. Insurance Application Authorization: When individuals apply for insurance coverage, such as life, health, or auto insurance, they may be required to sign a Disclosure and Consent form. This authorization ensures that insurance companies can obtain the needed consumer and investigative reports to evaluate the applicant's insurability and determine appropriate rates. It is important to note that each type of Chicago Illinois Disclosure and Consent for a Consumer and Investigative Report and Release Authorization may vary slightly in terms of specific information being accessed, the duration for which consent is granted, and the limitations placed on its use. However, the overall purpose remains constant—to obtain the necessary information with informed consent from the individual involved.

Chicago Illinois Disclosure and Consent for a Consumer Investigative Report and Release Authorization

Description

How to fill out Chicago Illinois Disclosure And Consent For A Consumer Investigative Report And Release Authorization?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Chicago Disclosure and Consent for a Consumer and Investigative Report and Release Authorization, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to locate and download Chicago Disclosure and Consent for a Consumer and Investigative Report and Release Authorization.

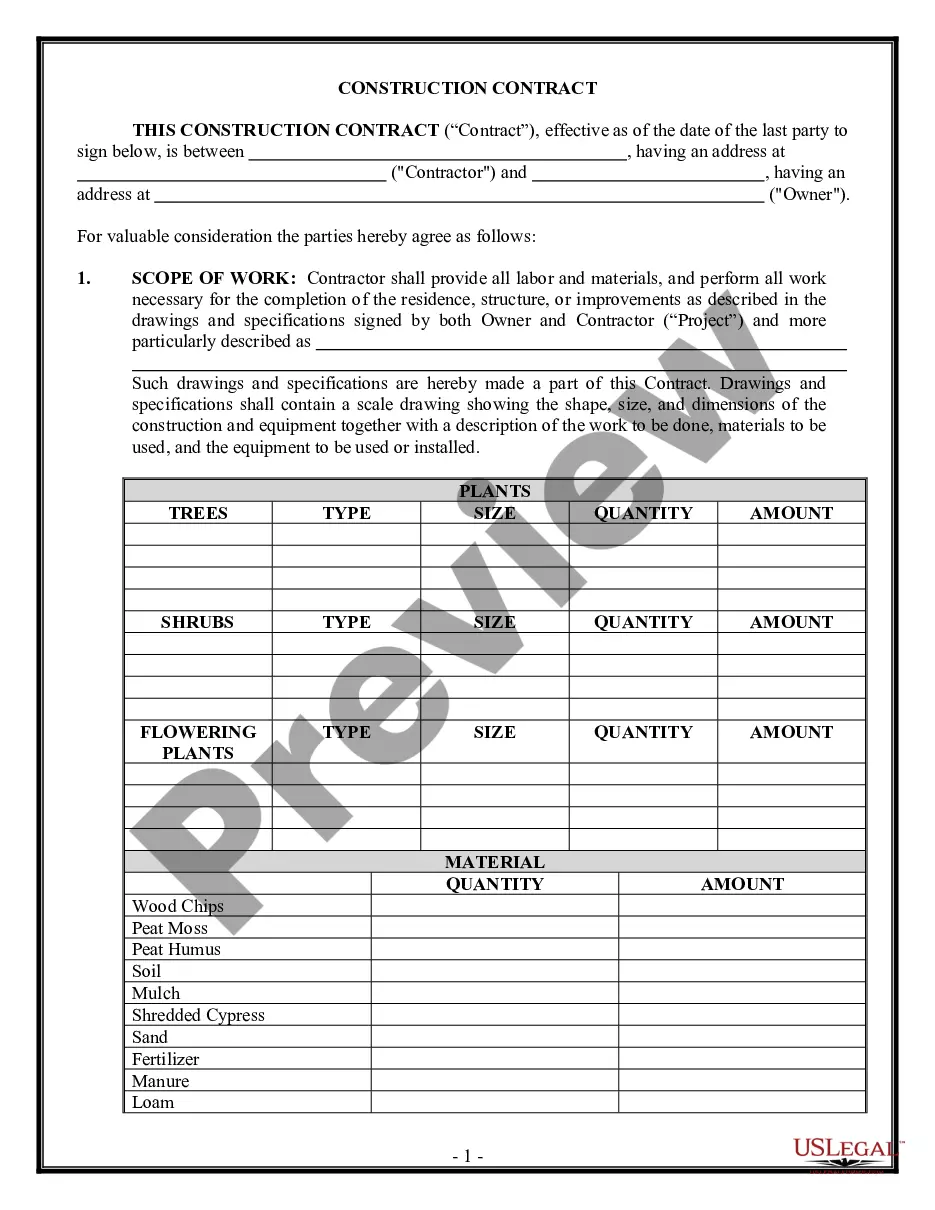

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the related document templates or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Chicago Disclosure and Consent for a Consumer and Investigative Report and Release Authorization.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Chicago Disclosure and Consent for a Consumer and Investigative Report and Release Authorization, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you need to deal with an exceptionally difficult case, we advise using the services of a lawyer to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant paperwork with ease!