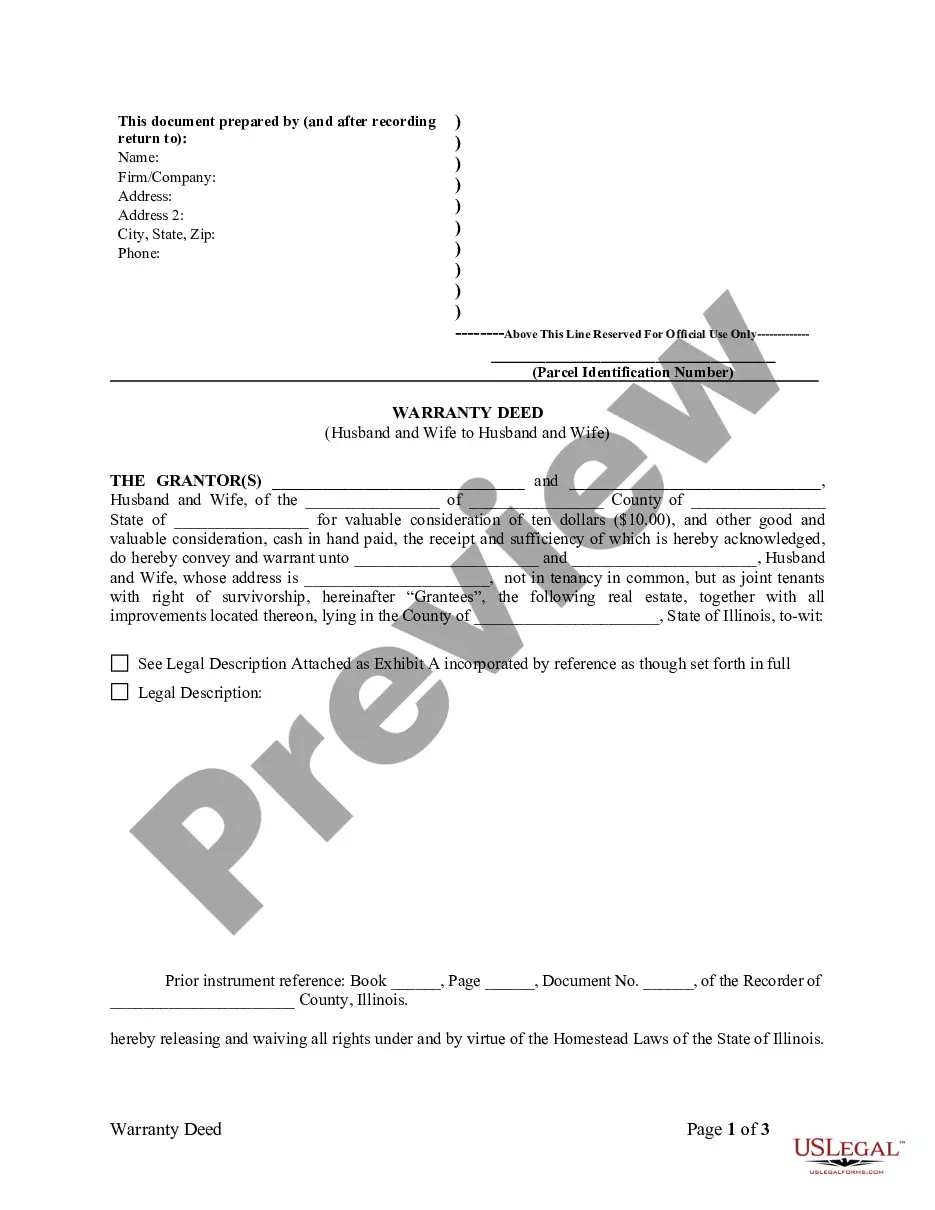

This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Palm Beach Florida Assumption Agreement of SBA Loan

Description

How to fill out Assumption Agreement Of SBA Loan?

Legislation and guidelines in each field differ from jurisdiction to jurisdiction.

If you're not an attorney, it's easy to become confused by a multitude of standards when it comes to creating legal documents.

To prevent expensive legal counsel when formulating the Palm Beach Assumption Agreement of SBA Loan, you need a validated template applicable to your region.

This is the easiest and most cost-effective method to obtain current templates for any legal situations. Access them quickly and maintain your documentation organized with US Legal Forms!

- Examine the webpage content to ensure you have located the correct sample.

- Make use of the Preview option or review the form description if available.

- Seek another document if there are discrepancies with any of your requirements.

- Use the Buy Now button to acquire the template when you discover the appropriate one.

- Pick one of the subscription plans and Log In or create an account.

- Decide how you would like to pay for your subscription (via credit card or PayPal).

- Choose the format you wish to save the file in and hit Download.

- Fill out and sign the template in writing after printing it, or perform all actions electronically.

Form popularity

FAQ

The SBA will be willing to release the mortgage/lien so that the owner can be allowed to sell or refinance the property under the proper circumstances. However, cooperation is required. Commitment on the borrower's behalf is also necessary. The borrower must not receive any of the sales or refinance consideration.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.

Assumption of SBA Loan. A borrower may request for another person to assume the borrower's legal obligations and benefits under the SBA loan documents. Essentially, the assignor-borrower is requesting that another person step into their shoes as it relates to the loan.

The EIDL will usually be paid at the closing based on the payoff letter from the SBA from the proceeds the seller is receiving from the sale. If the proceeds are insufficient, the seller will have to negotiate release of the EIDL lien and the due on sale provisions directly with the SBA.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.

Assumption of SBA Loan. A borrower may request for another person to assume the borrower's legal obligations and benefits under the SBA loan documents. Essentially, the assignor-borrower is requesting that another person step into their shoes as it relates to the loan.

Fortunately for borrowers, SBA loans, including the SBA 7(a) loan, are fully assumable with SBA approval. However, if you're selling your business, getting approval from the SBA for another borrower to assume your loan can be somewhat complex.

The current borrower (seller) must provide: A letter explaining the assumption, including an explanation of any cash paid to the seller by the individual assuming the loan. The letter must be signed and dated by all original borrows/guarantors (except in the case of death).