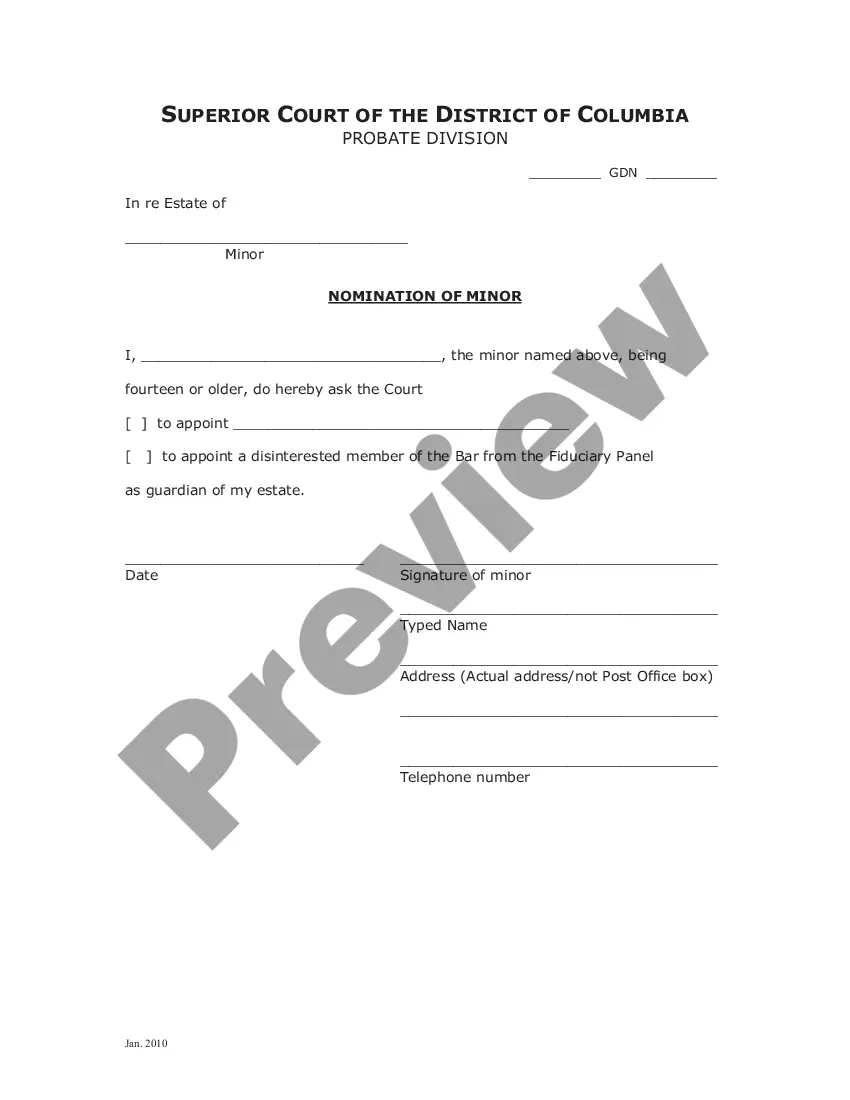

This form is a sample letter in Word format covering the subject matter of the title of the form.

Title: Exploring Cuyahoga County, Ohio: A Detailed Overview Introduction: Located in the state of Ohio, Cuyahoga County is one of the most vibrant and populous counties in the region. Maintaining financial stability is essential for homeowners in Cuyahoga County, especially when it comes to managing mortgage loans. To ensure a smooth process, borrowers often require a formalized Payoff Letter to present to their mortgage company. This article aims to provide a comprehensive understanding of what a Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company entails and how it can benefit borrowers. 1. Understanding the Payoff Letter: A Payoff Letter is a legally binding document that borrowers request from their mortgage company. It states the outstanding balance on their mortgage loan, the applicable interest rate, and any additional fees or charges required to pay off the loan entirely. This detail-oriented letter ensures both parties are on the same page and helps borrowers understand their repayment responsibilities. 2. Purpose of Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company: Borrowers residing in Cuyahoga County find Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company helpful in multiple ways: — Accurate Documentation: A sample letter ensures that all relevant information is included, such as loan account number, borrower's name and address, mortgage company's details, and loan terms. — Clarity in Transaction: The letter clearly defines the intent to pay off the loan, making it easier for the mortgage company to process the request. — Avoidance of Misunderstandings: By explicitly mentioning the amount required for full repayment, the sample letter helps avoid any confusion or disputes in the future. 3. Types of Cuyahoga Ohio Sample Letters for Payoff of Loan held by Mortgage Company: While there might not be specific variations of sample letters for Cuyahoga County, borrowers can personalize the content based on their situation. However, certain key elements remain the same in all Cuyahoga Ohio Sample Letters for Payoff of Loan held by Mortgage Company: — Borrower's Information: Clearly state the borrower's name, address, contact information, and loan account number. — Mortgage Company Details: Include the mortgage company's name, address, contact information, and relevant loan account details. — Loan Terms: Specify the terms of the loan, including the interest rate, loan duration, and any additional fees or charges. — Request for Payoff Amount: Clearly state the intent to pay off the loan and request the exact payoff amount. — Payment Details: Provide instructions on how the borrower will make the payment, including acceptable methods of payment, relevant deadlines, and contact information for queries. Conclusion: Using a carefully crafted Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company ensures a streamlined process for borrowers residing in Cuyahoga County. By encompassing all the crucial information required by the mortgage company, borrowers can minimize any potential delays or misunderstandings related to their loan repayment.Title: Exploring Cuyahoga County, Ohio: A Detailed Overview Introduction: Located in the state of Ohio, Cuyahoga County is one of the most vibrant and populous counties in the region. Maintaining financial stability is essential for homeowners in Cuyahoga County, especially when it comes to managing mortgage loans. To ensure a smooth process, borrowers often require a formalized Payoff Letter to present to their mortgage company. This article aims to provide a comprehensive understanding of what a Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company entails and how it can benefit borrowers. 1. Understanding the Payoff Letter: A Payoff Letter is a legally binding document that borrowers request from their mortgage company. It states the outstanding balance on their mortgage loan, the applicable interest rate, and any additional fees or charges required to pay off the loan entirely. This detail-oriented letter ensures both parties are on the same page and helps borrowers understand their repayment responsibilities. 2. Purpose of Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company: Borrowers residing in Cuyahoga County find Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company helpful in multiple ways: — Accurate Documentation: A sample letter ensures that all relevant information is included, such as loan account number, borrower's name and address, mortgage company's details, and loan terms. — Clarity in Transaction: The letter clearly defines the intent to pay off the loan, making it easier for the mortgage company to process the request. — Avoidance of Misunderstandings: By explicitly mentioning the amount required for full repayment, the sample letter helps avoid any confusion or disputes in the future. 3. Types of Cuyahoga Ohio Sample Letters for Payoff of Loan held by Mortgage Company: While there might not be specific variations of sample letters for Cuyahoga County, borrowers can personalize the content based on their situation. However, certain key elements remain the same in all Cuyahoga Ohio Sample Letters for Payoff of Loan held by Mortgage Company: — Borrower's Information: Clearly state the borrower's name, address, contact information, and loan account number. — Mortgage Company Details: Include the mortgage company's name, address, contact information, and relevant loan account details. — Loan Terms: Specify the terms of the loan, including the interest rate, loan duration, and any additional fees or charges. — Request for Payoff Amount: Clearly state the intent to pay off the loan and request the exact payoff amount. — Payment Details: Provide instructions on how the borrower will make the payment, including acceptable methods of payment, relevant deadlines, and contact information for queries. Conclusion: Using a carefully crafted Cuyahoga Ohio Sample Letter for Payoff of Loan held by Mortgage Company ensures a streamlined process for borrowers residing in Cuyahoga County. By encompassing all the crucial information required by the mortgage company, borrowers can minimize any potential delays or misunderstandings related to their loan repayment.