A Philadelphia Pennsylvania Corporate Resolution for SBA Loan is a legal document that authorizes a corporation based in Philadelphia, Pennsylvania, to apply for and secure a loan from the Small Business Administration (SBA). This resolution is crucial for corporate entities in Philadelphia seeking financial assistance from the SBA to expand their business operations, obtain working capital, or finance specific projects. The Philadelphia Pennsylvania Corporate Resolution for SBA Loan typically includes important details such as the corporate name, address, and legal structure, indicating the intention to pursue an SBA loan. It also states the authority of specific individuals within the corporation to act on behalf of the entity in relation to the loan application. These authorized individuals may include the board of directors, officers, or other stakeholders who are given the power to execute legal documents, provide financial information, and negotiate terms and conditions with the SBA. Different types of Philadelphia Pennsylvania Corporate Resolution for SBA Loan may vary depending on the specific purpose, structure, or circumstances of the corporation involved. Some common types include: 1. General Corporate Resolution for SBA Loan: This type of resolution grants broad authorization to designated individuals within the corporation to carry out all necessary actions related to the application and acquisition of an SBA loan. It covers various aspects, including preparing financial statements, gathering supporting documentation, executing loan agreements, and complying with any additional requirements imposed by the SBA. 2. Special Corporate Resolution for SBA Loan: In certain cases, a corporation may require a resolution specifically tailored for a unique circumstance related to the SBA loan application. This could involve granting authority to a specific officer or board member to negotiate unique provisions, such as collateral requirements, interest rates, or repayment terms, based on specific needs or constraints. 3. Emergency Corporate Resolution for SBA Loan: In urgent situations where immediate funding is required, an emergency resolution may be necessary to expedite the loan application process. This type of resolution typically grants authority to a designated officer or director to take swift action, accessing expedited procedures, if available, to secure the SBA loan without compromising legal compliance. Overall, regardless of the type of Philadelphia Pennsylvania Corporate Resolution for SBA Loan, it is critical for corporations to consult legal professionals, such as attorneys or corporate advisors, to ensure the document meets all legal requirements and accurately reflects the corporation's intentions and liabilities. This careful drafting and execution will help Philadelphia-based businesses navigate the SBA loan application process effectively, enhancing their chances of obtaining the necessary financial support for their growth and success.

Philadelphia Pennsylvania Corporate Resolution for SBA Loan

Description

How to fill out Philadelphia Pennsylvania Corporate Resolution For SBA Loan?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Philadelphia Corporate Resolution for SBA Loan without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Philadelphia Corporate Resolution for SBA Loan on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Philadelphia Corporate Resolution for SBA Loan:

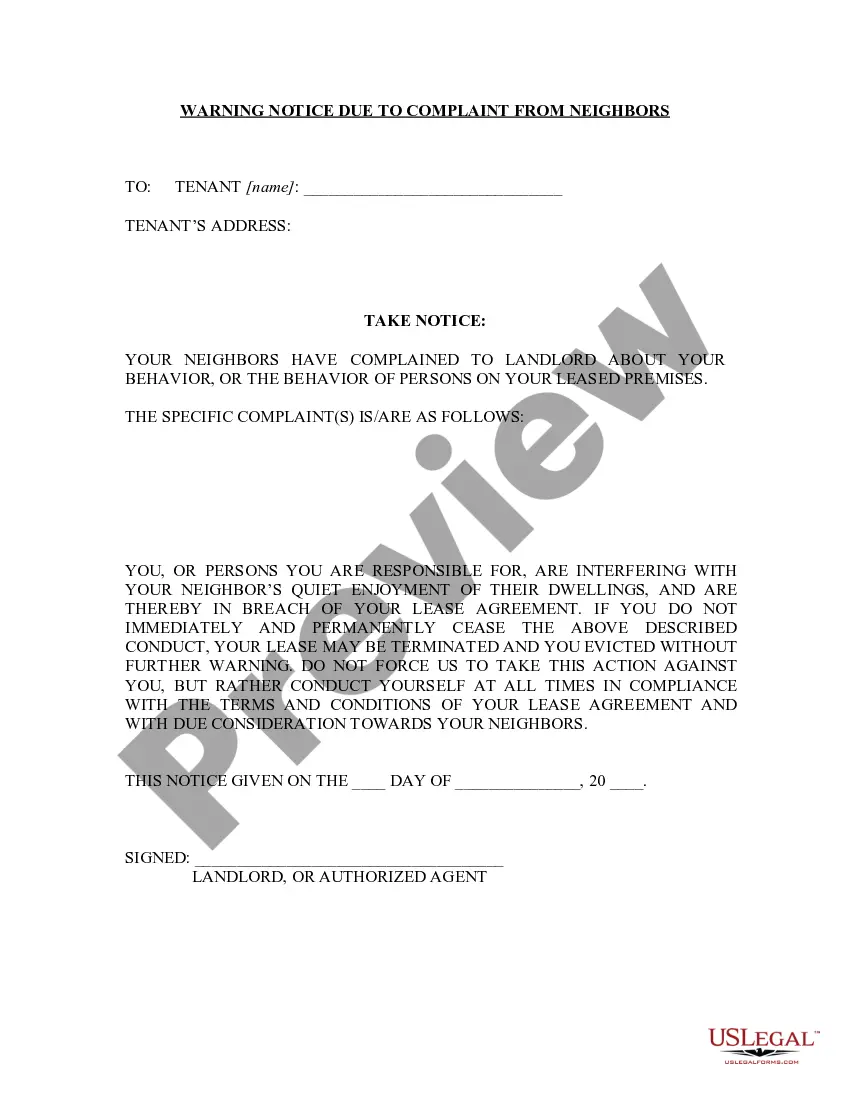

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!