Allegheny Pennsylvania Corporate Resolution for Bank Account is a legal document that authorizes and grants specific individuals within a corporation the power to open, manage, and conduct transactions on behalf of the corporation's bank account(s). This resolution is crucial in ensuring proper financial management and decision-making within the corporate structure. In Allegheny, Pennsylvania, there are different types of Corporate Resolutions for Bank Accounts, which include: 1. General Corporate Resolution: This type of resolution grants broad authority to one or more individuals, typically designated as officers or directors, to open and operate bank accounts on behalf of the corporation. It allows them to perform various routine banking transactions, such as depositing or withdrawing funds, signing checks, and engaging in electronic transfers. 2. Restricted Corporate Resolution: In some cases, corporations may prefer to limit the authority granted in the resolution. This type of resolution outlines specific restrictions or conditions for managing the bank account. It may specify transaction limits, require dual signatures for certain transactions, or provide guidelines for money transfers above a certain threshold. 3. Corporate Resolution for Special Transactions: This resolution is used for specific purposes or transactions outside the scope of routine banking activities. It authorizes designated individuals to engage in more complex financial transactions, such as obtaining loans or lines of credit, issuing bonds, or entering into significant investment agreements on behalf of the corporation. 4. Corporate Resolution for Account Closure or Change: When a corporation decides to close an existing bank account or switch to a new financial institution, this resolution grants authorization and outlines the necessary steps to be taken. It ensures a smooth transition, protects the corporation's financial interests, and prevents any unauthorized access to the account. The Allegheny Pennsylvania Corporate Resolution for Bank Account is a vital document that not only empowers individuals within a corporation to carry out financial transactions but also safeguards the corporation's interests by ensuring proper oversight and control. It is recommended to consult with legal professionals or financial experts to draft and execute precise and enforceable resolutions suitable for the specific needs and requirements of the corporation concerned.

Allegheny Pennsylvania Corporate Resolution for Bank Account

Description

How to fill out Allegheny Pennsylvania Corporate Resolution For Bank Account?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Allegheny Corporate Resolution for Bank Account, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Allegheny Corporate Resolution for Bank Account from the My Forms tab.

For new users, it's necessary to make several more steps to get the Allegheny Corporate Resolution for Bank Account:

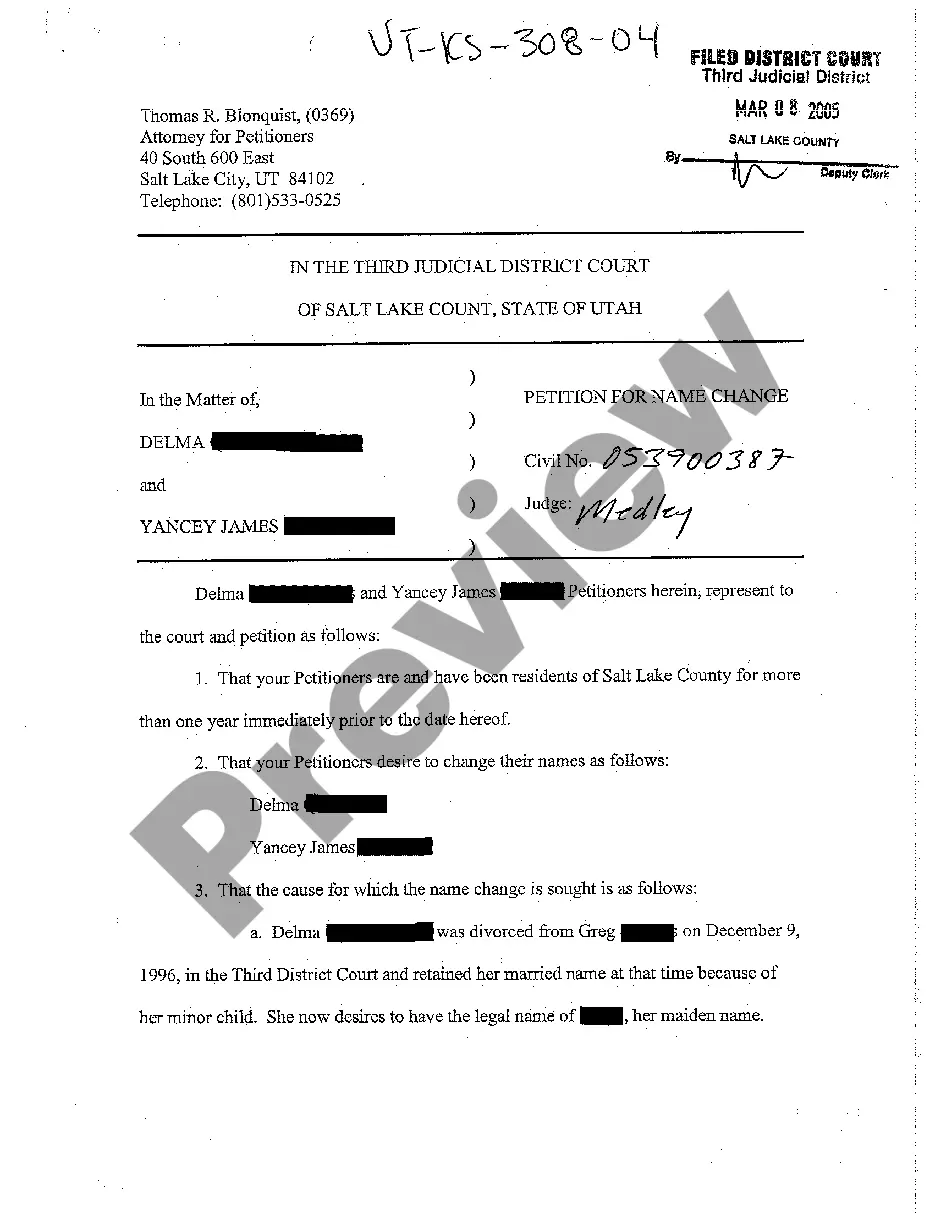

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!