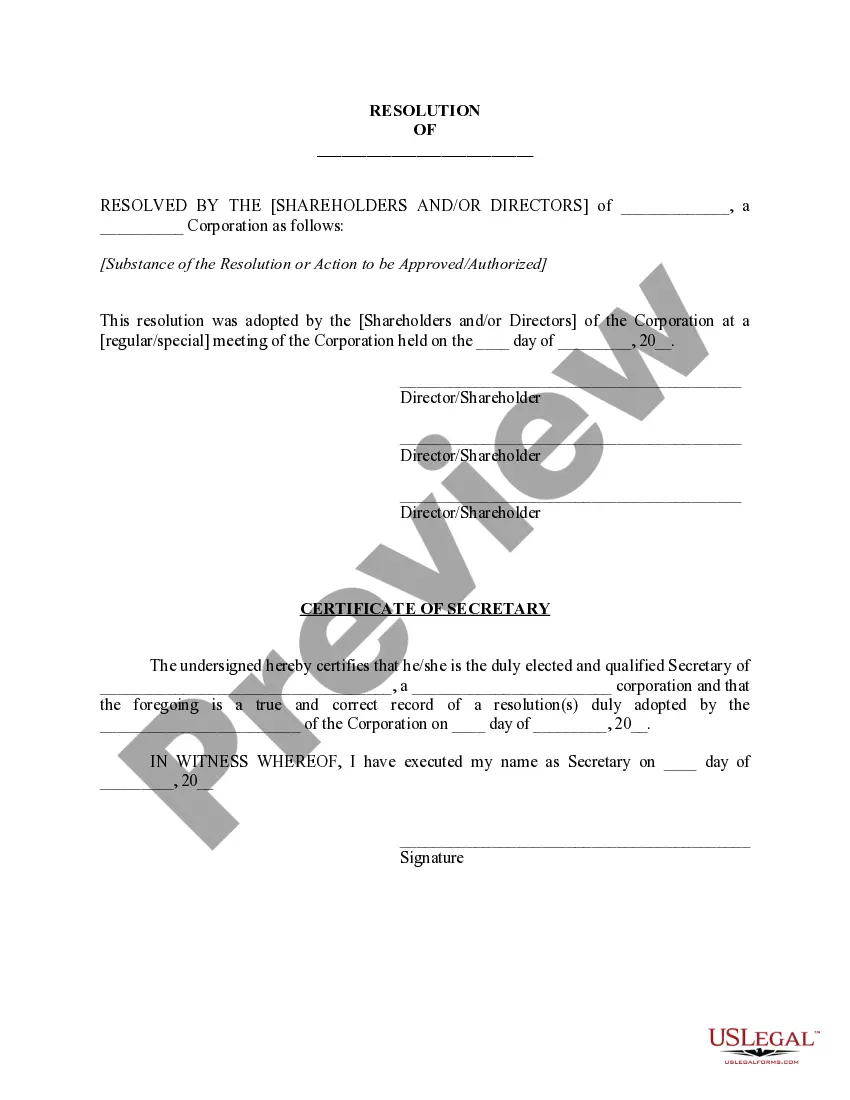

A Philadelphia Pennsylvania Corporate Resolution for PPP Loan refers to a legal document that outlines the decisions and actions taken by a corporation in Philadelphia, Pennsylvania, regarding obtaining a Paycheck Protection Program (PPP) loan. This resolution is crucial in demonstrating the corporation's intent and authority to enter into a loan agreement, as well as obtain the necessary funds to maintain and support its workforce during challenging times, such as the COVID-19 pandemic. The Philadelphia Pennsylvania Corporate Resolution for PPP Loan typically includes key details, such as the corporation's name, address, and tax identification number. It also highlights the rationale behind seeking a PPP loan, emphasizing the corporation's financial need and commitment to preserving job opportunities for its employees. Additionally, the resolution identifies the authorized representatives of the corporation responsible for negotiating, executing, and delivering all necessary loan documents and paperwork on behalf of the corporation. Keywords: Philadelphia Pennsylvania, Corporate Resolution, PPP Loan, Paycheck Protection Program, legal document, corporation, loan agreement, COVID-19 pandemic, funds, workforce, job opportunities, financial need, authorized representatives, negotiation, paperwork. Different types of Philadelphia Pennsylvania Corporate Resolution for PPP Loan can include: 1. Single-Member LLC Resolution: This type of resolution is specific to limited liability companies (LCS) with a single member. It authorizes the LLC owner to apply for and execute loan documents for the PPP loan on behalf of the company. 2. Multi-Member LLC Resolution: This resolution is applicable to multi-member LCS where multiple members participate in the decision-making process. It identifies the authorized members who are responsible for applying for and securing the PPP loan. 3. Corporation Board Resolution: In the case of corporations, a board resolution is required. This resolution outlines the decision taken by the board of directors to seek a PPP loan and appoints individuals within the board to complete the loan application and related paperwork. 4. Partnership Resolution: For partnerships, a resolution is created that reflects the agreement reached by the partners regarding the PPP loan. It designates the partners responsible for pursuing and finalizing the loan process. 5. Nonprofit Organization Resolution: Nonprofit organizations are also eligible for PPP loans. A resolution tailored for nonprofit entities is drafted to demonstrate the nonprofit's intention to apply for the loan, detailing the responsible officers who can represent the organization throughout the process. Keywords: Single-Member LLC Resolution, Multi-Member LLC Resolution, Corporation Board Resolution, Partnership Resolution, Nonprofit Organization Resolution, limited liability companies, LLC, board of directors, decision-making process, partners, nonprofit entities, loan process.

Philadelphia Pennsylvania Corporate Resolution for PPP Loan

Description

How to fill out Philadelphia Pennsylvania Corporate Resolution For PPP Loan?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Philadelphia Corporate Resolution for PPP Loan, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Philadelphia Corporate Resolution for PPP Loan from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Philadelphia Corporate Resolution for PPP Loan:

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!