Palm Beach, Florida is a beautiful coastal city renowned for its luxurious lifestyle, upscale shopping, and pristine beaches. As a popular vacation destination, it is also home to numerous businesses, both big and small. In light of recent events, such as the COVID-19 pandemic, many businesses in Palm Beach have sought financial assistance, including Economic Injury Disaster Loans (IDL), to help them overcome the challenges they face. A Palm Beach, Florida Corporate Resolution for IDL Loan is a legal document that outlines the decisions and actions taken by a corporation's board of directors or shareholders to obtain the loan. It serves as an official record providing evidence that the corporation has authorized the loan application and accepted the terms and conditions associated with it. The Corporate Resolution for IDL Loan typically includes important details such as the date of the resolution, the names and titles of the individuals involved, the loan amount being sought, and a clear explanation of how the loan funds will be used to address the economic injury suffered by the company. There are different types of Palm Beach, Florida Corporate Resolutions for IDL Loan, each catering to specific scenarios or structures within a corporation. Some common variations include: 1. Board of Directors Resolution: This type of resolution is typically used when the board of directors of a corporation approves and authorizes the loan application. It requires the directors to vote and record their decision, clearly stating the loan amount, repayment terms, and other relevant details. 2. Shareholder Resolution: In cases where a corporation has shareholders who hold voting rights, a shareholder resolution is necessary. This resolution involves the shareholders voting to authorize the loan application, with each shareholder's voting power determined by their ownership stake in the company. 3. Unanimous Written Consent: Instead of holding a formal meeting, some corporations may choose to pass a Corporate Resolution for IDL Loan through a unanimous written consent process. This allows all directors or shareholders to approve the loan application without physical attendance, provided they sign and submit the consent form. It is important for businesses in Palm Beach, Florida to have a well-drafted Corporate Resolution for IDL Loan, as it ensures compliance with legal requirements and demonstrates the corporation's commitment to responsibly handling its finances. Consulting with an attorney specializing in corporate law can provide invaluable guidance throughout the resolution drafting and approval process. In conclusion, Palm Beach, Florida Corporate Resolution for IDL Loan is a crucial document for corporations seeking financial assistance through the IDL program. By following the proper legal procedures and obtaining the necessary approvals, businesses can increase their chances of securing the funding required to overcome economic hardships and continue thriving in this vibrant city.

Palm Beach Florida Corporate Resolution for EIDL Loan

Description

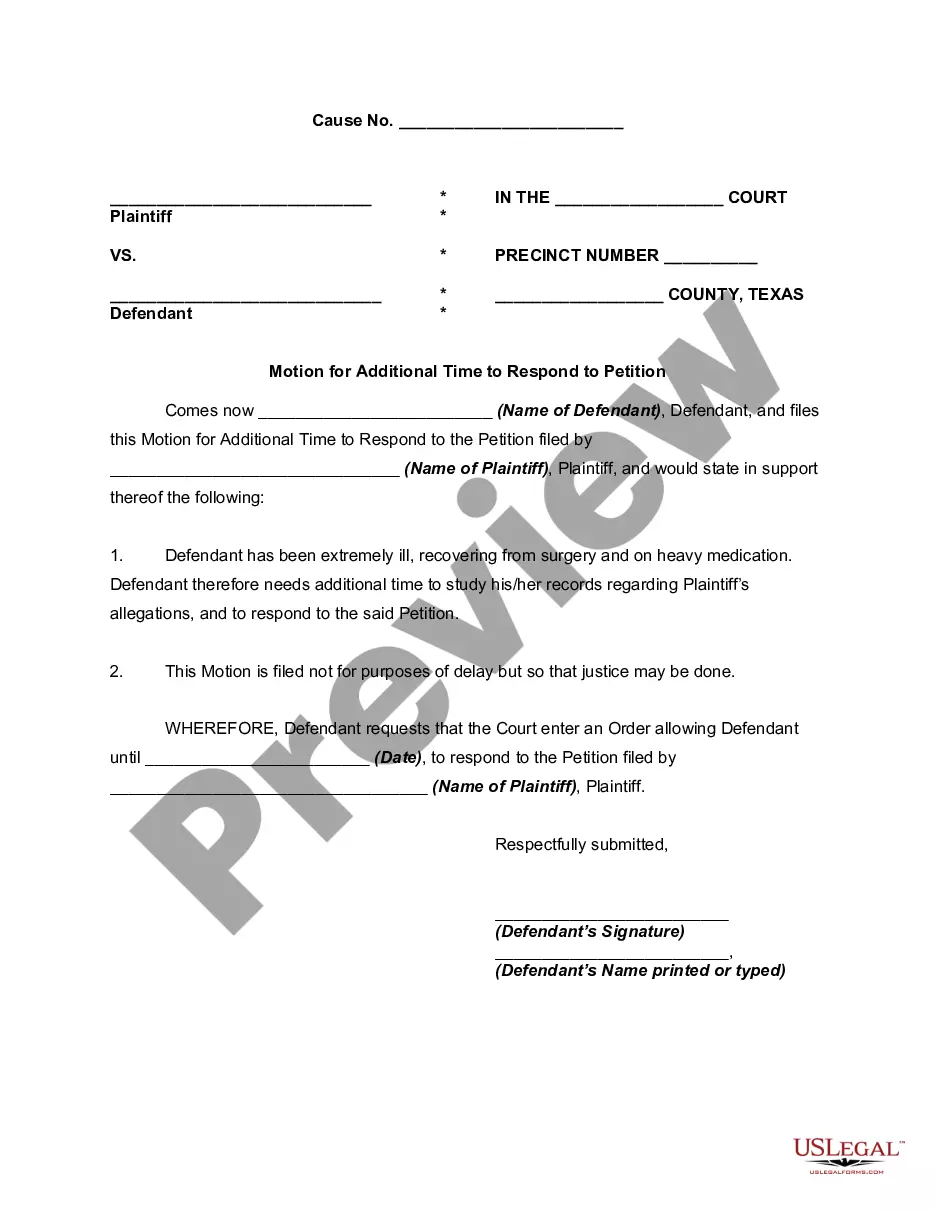

How to fill out Palm Beach Florida Corporate Resolution For EIDL Loan?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Palm Beach Corporate Resolution for EIDL Loan.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Palm Beach Corporate Resolution for EIDL Loan will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Palm Beach Corporate Resolution for EIDL Loan:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Palm Beach Corporate Resolution for EIDL Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

SBA Resolution of Board of Directors When applying for a Direct, Guaranteed, or Participation loan to expand an existing business the lender requires a corporate resolution. The latter confirms that the board of directors of a specific company has authorized a proposed loan.

A certified board resolution is a written document that provides an explanation of the actions of a company's board of directors that has been verified by the secretary of the organization and approved by the board's president.

Here's What You Need to Provide to Meet the SBA Loan Application Requirements:Personal Background Statement.Professional Resume.Personal Credit Report & Score.Business Credit Report.Personal Tax Returns.Legal Documents.Business Plan.Use of Loan.More items...?

Documentation RequiredEIDL loan applications may also request that you provide a current year-to-date profit-and-loss statement and a report of monthly sales figures (SBA Form 1368).

The form 5, IRS 4506T form, Personal Financial Statements, Schedule of Liabilities and Tax Returns. The form 5C, IRS 4506T form, Personal Financial Statement, Schedule of Liabilities and Tax Returns. Items with a must be completed. Include good email address and cell phone number.

The EIDL documents require a Board Resolution to be submitted within 6 months of loan disbursement. Proof of Hazard insurance is due within 1 year of loan disbursement.

There is no need to apply for EIDL forgiveness. Remember, EIDL loans cannot be forgiven. EIDL grants are automatically forgiven, provided you use the funds on approved expenses.

The SBA calculates your total possible EIDL loan amount based on your 2019 revenue and your cost of goods sold. You can check the total amount you qualify for by using the calculator on your Skip dashboard, or sign up here. However, that does not mean that you will be approved for that amount.

If you're approved for an EIDL loan, you'll be sent an email with details on how much you're eligible to borrow. Once you sign the agreement, loan proceeds will be deposited into your business bank account within five to 10 business days.

While there isn't technically EIDL loan forgiveness, there is EIDL Advance forgiveness, and there is a cap on this. You cannot have more than $15,000 forgiven across both the Targeted EIDL Advance and the Supplemental Targeted EIDL Advance.