Bronx New York Corporate Resolution for Nonprofit Organizations is a legal document that outlines the decision-making process within a nonprofit organization. It serves as an official record of the actions taken by the board of directors or trustees. This resolution typically involves matters related to the organization's operation, financial transactions, policies, and other significant decisions. The purpose of the Bronx New York Corporate Resolution for Nonprofit Organizations is to ensure that all actions taken by the organization's leadership are in compliance with applicable laws, regulations, and the organization's bylaws. It also helps to establish a clear record of authorization for these actions. Some different types of Bronx New York Corporate Resolution for Nonprofit Organizations include: 1. Financial Resolutions: These resolutions focus on financial matters such as budget approvals, opening or closing bank accounts, obtaining loans, authorizing payments, and accepting donations. 2. Board Governance Resolutions: These resolutions pertain to the organization's board of directors or trustees and may cover topics such as electing officers, appointing committee members, adopting bylaws, and setting policies. 3. Program and Service Resolutions: These resolutions deal with the organization's programs and services, including decisions on initiating new programs, expanding existing ones, or entering into partnerships. 4. Legal and Compliance Resolutions: These resolutions address legal and compliance matters for the nonprofit organization, such as obtaining licenses, complying with reporting requirements, and adhering to state and federal regulations. 5. Real Estate and Property Resolutions: These resolutions revolve around the nonprofit organization's real estate and property-related matters like leasing or purchasing property, entering into rental agreements, or making significant renovations. When drafting a Bronx New York Corporate Resolution for Nonprofit Organizations, it is crucial to consult an attorney familiar with nonprofit law to ensure compliance with all relevant regulations and guidelines. This will help protect the organization's best interests and ensure the actions taken are authorized and legally binding.

Bronx New York Corporate Resolution for Nonprofit Organizations

Description

How to fill out Bronx New York Corporate Resolution For Nonprofit Organizations?

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Bronx Corporate Resolution for Nonprofit Organizations is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Bronx Corporate Resolution for Nonprofit Organizations. Follow the guide below:

- Make certain the sample meets your individual needs and state law regulations.

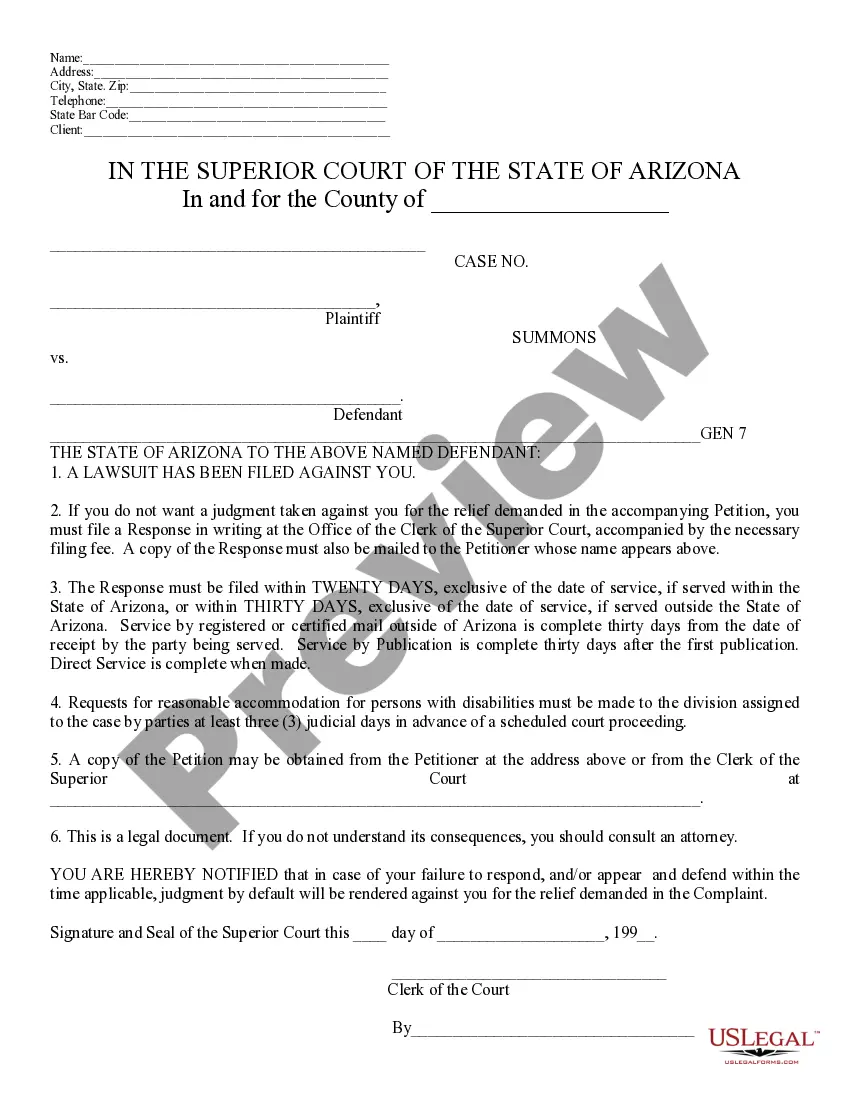

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Corporate Resolution for Nonprofit Organizations in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!