Cook Illinois Corporate Resolution for Single Member LLC is a legal document that a single member LLC operating in Cook County, Illinois, must adapt to record important decisions and actions taken by the company. This resolution serves as an official record of decisions made by the sole member regarding the LLC's operations, management, and financial matters. It helps to maintain proper corporate governance, establish clarity, and provide evidence of decisions made in the best interest of the business. Keywords: 1. Cook Illinois: Refers to the geographic jurisdiction where the resolution is applicable, i.e., Cook County, Illinois. 2. Corporate Resolution: It is a formal document that outlines decisions made by a company's directors or members regarding significant matters. 3. Single Member LLC: A limited liability company that has only one member who owns and manages the business. 4. Legal Document: A written instrument that defines and regulates legal rights, obligations, and relationships. 5. Corporate Governance: The system of rules, practices, and processes by which a company is directed and controlled. 6. Operations: The day-to-day activities carried out by the LLC to achieve its business objectives. 7. Management: The process of organizing and coordinating resources to accomplish the LLC's goals. 8. Financial Matters: Refers to decisions related to the LLC's finances, such as budgets, investments, loans, and distributions. Types of Cook Illinois Corporate Resolution for Single Member LLC: 1. Operating Agreement Adoption Resolution: Records the adoption and approval of the LLC's operating agreement by the single member. This resolution formalizes the agreement's terms and conditions, including the members' rights and responsibilities, profit distribution, and the LLC's management structure. 2. Appointment of Registered Agent Resolution: A resolution stating the appointment of a registered agent for the LLC in Cook County. The registered agent acts as the point of contact for official correspondence and legal documents on behalf of the single member LLC. 3. Banking Resolution: This resolution authorizes the opening of bank accounts, grants signatory authority, designates officers or managers authorized to manage the accounts, and outlines financial procedures to be followed when conducting business or handling finances. 4. Dissolution Resolution: In the event of the LLC's dissolution, this resolution documents the single member's decision to wind down the business, settle debts, distribute assets, and terminate any existing contracts or agreements. These are some key types of Cook Illinois Corporate Resolutions for Single Member LLC; however, additional resolutions specific to the LLC's unique circumstances and industry may also be required for legal compliance and effective management. It is advisable to consult legal professionals or use online resources to ensure the appropriate resolution is drafted and tailored to the specific needs of the LLC.

Cook Illinois Corporate Resolution for Single Member LLC

Description

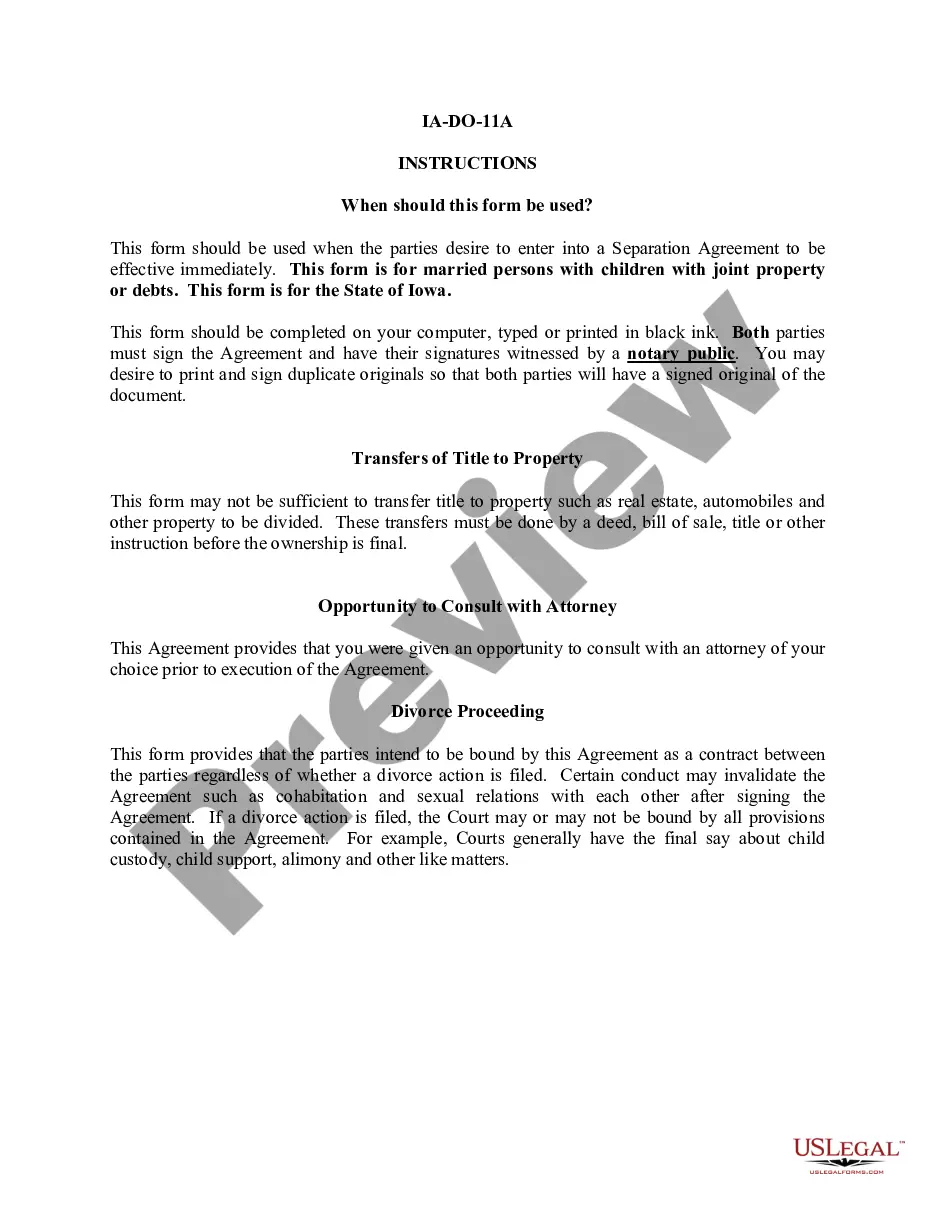

How to fill out Cook Illinois Corporate Resolution For Single Member LLC?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Cook Corporate Resolution for Single Member LLC meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Cook Corporate Resolution for Single Member LLC, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Cook Corporate Resolution for Single Member LLC:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cook Corporate Resolution for Single Member LLC.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

Corporate resolutions help to keep the board accountable with various laws and regulations as well as ensure that the board is upholding its fiduciary duty to the shareholders. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

Most banks will let Single-Member LLCs open a bank account with their SSN, and some might even suggest it. We recommend using your EIN instead of your SSN for privacy and easier record keeping. If you formed your LLC by following our LLC filing instructions, you should have obtained an EIN from the IRS.

Your SMLLC should have its own bank account. Payments your business receives for its goods and services should be deposited in that account, and money in the account should be used only for business purposes. (Paying yourself a salary is a legitimate business purpose and does not constitute commingling of funds.)

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.