Bronx New York Acknowledgment by Charitable or Educational Institution of Receipt of Gift is a crucial document that serves as proof of a charitable or educational organization's acknowledgment and appreciation of a gift received from a donor within the Bronx, New York area. This formal and detailed document helps both the institution and the donor maintain accurate records for tax and accounting purposes. Keywords: Bronx New York, acknowledgment, charitable institution, educational institution, receipt of gift, acknowledgment, donor, charitable organization, tax, accounting. There are several types of Bronx New York Acknowledgment by Charitable or Educational Institution of Receipt of Gift, each serving a specific purpose. Some commonly used types include: 1. Standard Acknowledgment: This type of acknowledgment is issued by charitable or educational institutions to donors who provide a non-monetary gift. It includes essential details such as the donor's name, contact information, description of the gift, estimated value, and a statement expressing gratitude for the generous contribution. 2. Monetary Gift Acknowledgment: This type of acknowledgment is specifically designed for monetary gifts provided by donors. It includes details such as the amount donated, the date of the gift, the purpose of the donation (if specified), the organization's tax-exempt status, and a statement expressing gratitude for the support. 3. In-kind Gift Acknowledgment: This type of acknowledgment is issued when a donor contributes a tangible item or service rather than a monetary gift. The acknowledgment includes a thorough description of the in-kind gift, its estimated value, and any limitations or restrictions associated with its use. Additionally, it expresses appreciation for the donor's support and specifies the tax implications, if applicable. 4. Sponsorship Acknowledgment: A sponsor may support a charitable or educational institution through financial or in-kind contributions in exchange for recognition and branding opportunities. A sponsorship acknowledgment is provided to acknowledge the sponsor's contribution, describe the benefits they receive (e.g., logo placement, event tickets), and express gratitude for their support. This type of acknowledgment often includes details about the sponsorship agreement, waivers, or contracts. In conclusion, Bronx New York Acknowledgment by Charitable or Educational Institution of Receipt of Gift is a vital document that ensures proper recognition and documentation of donations made to organizations in the Bronx, New York area. Whether it's a standard acknowledgment, monetary gift acknowledgment, in-kind gift acknowledgment, or sponsorship acknowledgment, these documents play a crucial role in maintaining transparency, gratitude, and compliance in charitable or educational endeavors.

Bronx New York Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Bronx New York Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Bronx Acknowledgment by Charitable or Educational Institution of Receipt of Gift is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Bronx Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law regulations.

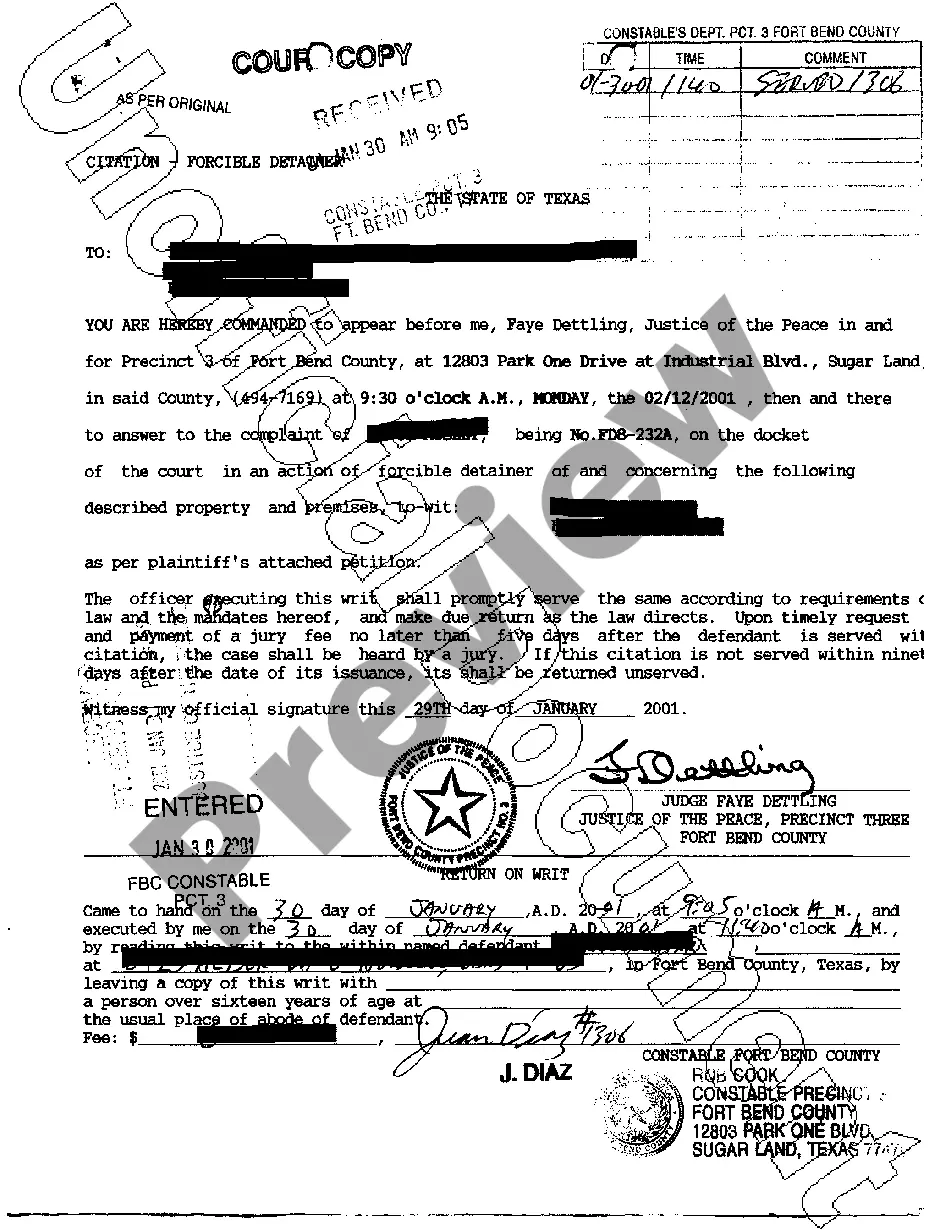

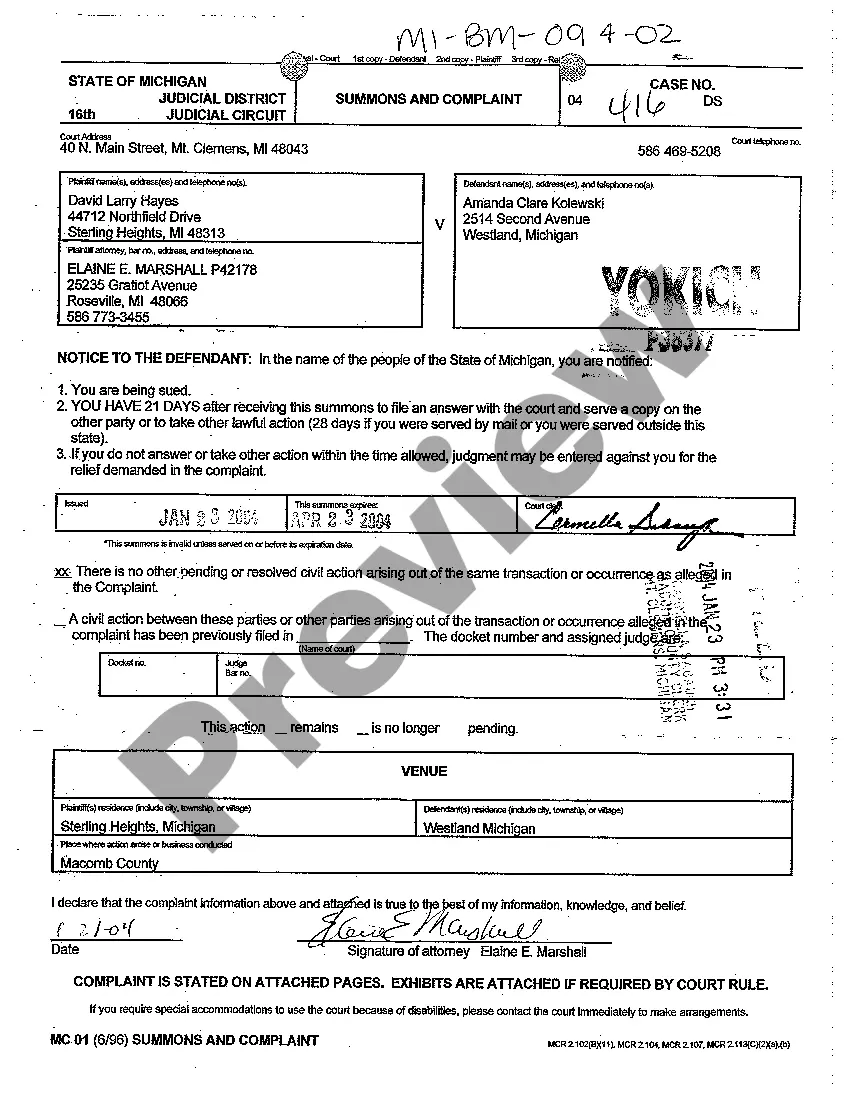

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Acknowledgment by Charitable or Educational Institution of Receipt of Gift in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Dear Name, Thank you so much for your gift of (gift amount) in memory of (person's name). Your donation is a thoughtful way to honor the life of (person's name) and their connection to (your organization). We notified the family of your gift.

Any donations worth $250 or more must be recognized with a receipt. The charity receiving this donation must automatically provide the donor with a receipt.

To write the perfect donation request letter, follow these simple steps:Start with a greeting.Explain your mission.Describe the current project/campaign/event.Include why this project is in need and what you hope to accomplish.Make your donation ask with a specific amount correlated with that amount's impact.

Here are the basic steps to create an acknowledgement receipt:Use a company letterhead.Give the receipt a title.Write the statement of acknowledgement.Create a place for signatures and the date of the transaction.Explain any next steps.Provide contact information for further questions.Be specific and detailed.Be formal.More items...?

In the U.S., the IRS requires proof for any contribution greater than $250 in cash or $500 in non-cash items. Non-cash items valued at over $5,000 must also come with an expert appraisal.

To be contemporaneous the written acknowledgment must generally be obtained by the donor no later than the date the donor files the return for the year the contribution is made. The written acknowledgment must state whether the donee provides any goods or services in consideration for the contribution.

Dear (Sir/Name/Uncle), We, at the (Foundation name), would like to express our gratitude for your generous gift of (Product/Item type and name) with (Support item type/money) and other accessories from (Institute/Supplier name) Association towards the noble cause of our organization. (Describe in your words).

In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received. A cash donation receipt provides written documentation of a cash gift.

Phrases to use while writing an AcknowledgementI'm extremely grateful to 2026I'd like to express my deepest thanks to2026This project would not have been possible without2026I cannot begin to express my thanks to20262026, who2026I would like to extend my deepest gratitude to2026I would like to pay my special regards to 2026More items...?

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.2 Sept 2021

Interesting Questions

More info

This program is a partnership with the District of Columbia's Department of Agriculture, Consumer Resources, and Economic Development

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.