Cuyahoga County, Ohio is located in northeastern part of the state and is the most populous county in Ohio. It is home to the city of Cleveland, which serves as the county seat and is a major cultural and economic center. Cuyahoga County offers a diverse range of attractions and amenities, including professional sports teams, museums, parks, and a thriving arts and entertainment scene. In Cuyahoga County, charitable and educational institutions play a vital role in supporting the local community. These institutions often rely on the generosity of donors to fund their programs and initiatives. To acknowledge the receipt of gifts, Cuyahoga County's charitable and educational institutions utilize the Cuyahoga Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift. The Cuyahoga Ohio Acknowledgment is an official document that confirms the receipt of a gift by a charitable or educational institution in Cuyahoga County. This acknowledgment serves as proof of the donation for the donor and allows them to claim any applicable tax benefits. There are different types of Cuyahoga Ohio Acknowledgments, each designed to meet specific requirements and needs. These include: 1. Cash Donations Acknowledgment: This type of acknowledgment is issued when a donor contributes cash or monetary gifts to a charitable or educational institution in Cuyahoga County. It includes details such as the amount of the donation, the date of receipt, and the recipient's information. 2. In-kind Donations Acknowledgment: When a donor donates tangible items, such as equipment, supplies, or property, an in-kind donations acknowledgment is provided. This document specifies the nature of the donated items, their estimated value, and other relevant details. 3. Planned Giving Acknowledgment: Charitable or educational institutions often receive gifts through planned giving, including wills, bequests, and trusts. A planned giving acknowledgment recognizes these types of donations and outlines the terms of the gift and any conditions associated with it. 4. Securities Donations Acknowledgment: If a donor contributes stocks, bonds, or other securities to a Cuyahoga County charitable or educational institution, a securities donations acknowledgment is issued. It includes information on the type and quantity of securities donated, their estimated value, and any restrictions or instructions provided by the donor. All Cuyahoga Ohio Acknowledgments ensure transparency and compliance with tax regulations, benefiting both the institutions and the donors. They facilitate accountability and help build trust between the organizations and their benefactors. If you have made a gift to a charitable or educational institution in Cuyahoga County, make sure to obtain an official Cuyahoga Ohio Acknowledgment. This document will not only serve as a record of your generosity but also enable you to make any necessary tax deductions.

Cuyahoga Ohio Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

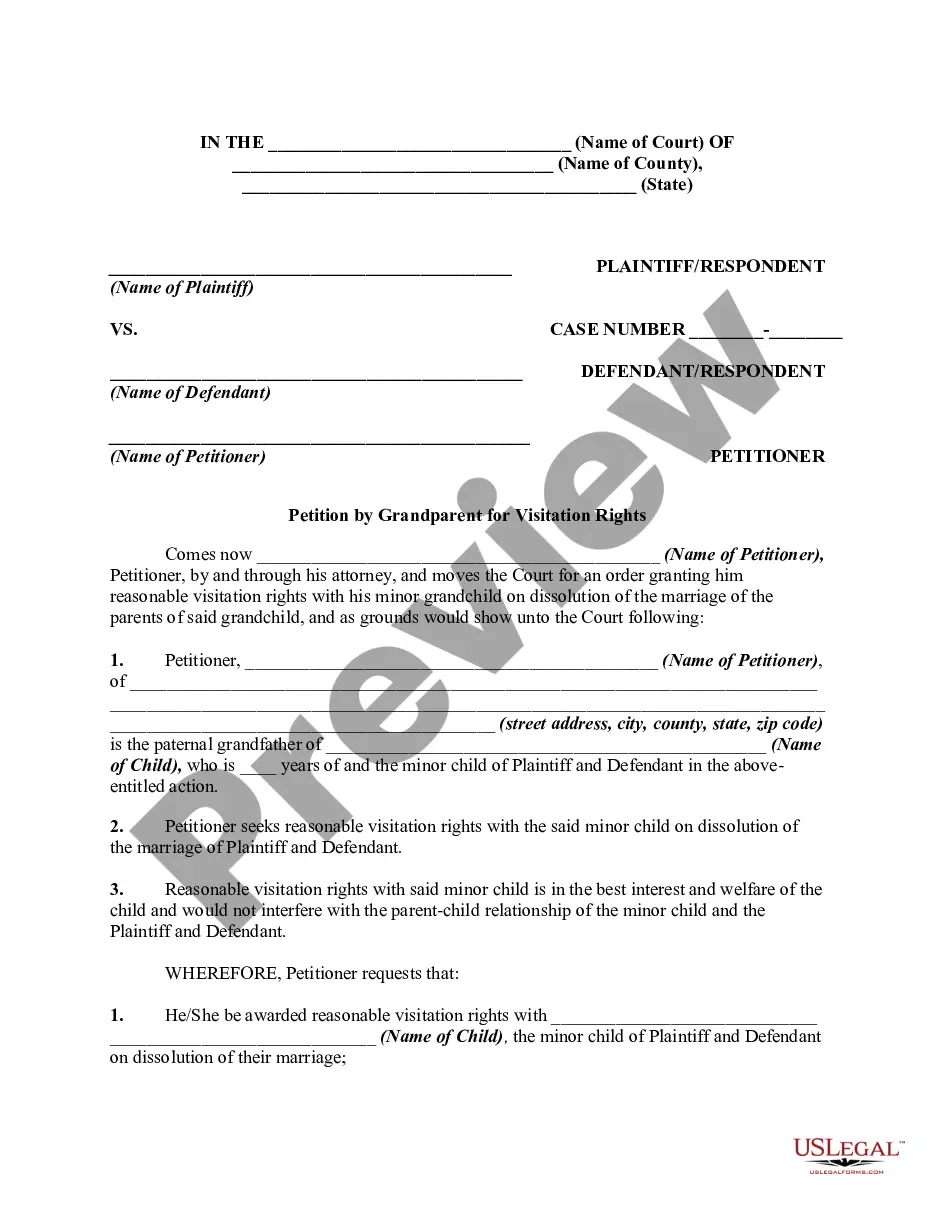

How to fill out Cuyahoga Ohio Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business objective utilized in your county, including the Cuyahoga Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Cuyahoga Acknowledgment by Charitable or Educational Institution of Receipt of Gift will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Cuyahoga Acknowledgment by Charitable or Educational Institution of Receipt of Gift:

- Make sure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Cuyahoga Acknowledgment by Charitable or Educational Institution of Receipt of Gift on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

To be contemporaneous the written acknowledgment must generally be obtained by the donor no later than the date the donor files the return for the year the contribution is made. The written acknowledgment must state whether the donee provides any goods or services in consideration for the contribution.

I would like to express my special thanks of gratitude to my teacher (Name of the teacher) as well as our principal (Name of the principal)who gave me the golden opportunity to do this wonderful project on the topic (Write the topic name), which also helped me in doing a lot of Research and i came to know about so many

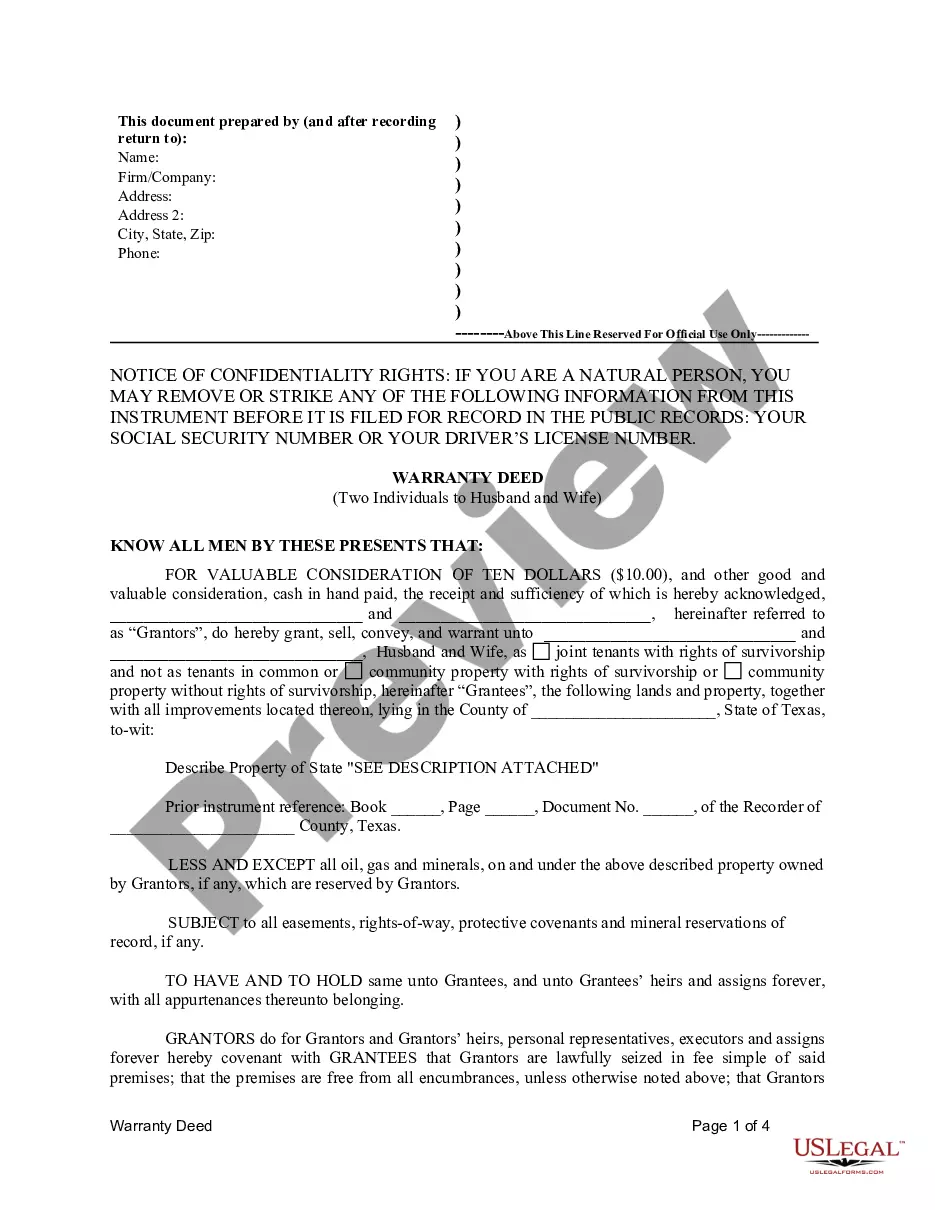

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.2 Sept 2021

Here's what to write on the association or charitable organization correspondence:The name of the deceased.The address of the deceased.The name of a close living family member.The address of the living family member.Your name.

Dear Name, Thank you so much for your gift of (gift amount) in memory of (person's name). Your donation is a thoughtful way to honor the life of (person's name) and their connection to (your organization). We notified the family of your gift.

An acknowledgement letter is a letter of receipt sent by an individual or business to the other end to make them know that you have received the offer, complaint, product, or any demand which is provided by another party or individual whomsoever is involved in the transaction.

Dear (Sir/Name/Uncle), We, at the (Foundation name), would like to express our gratitude for your generous gift of (Product/Item type and name) with (Support item type/money) and other accessories from (Institute/Supplier name) Association towards the noble cause of our organization. (Describe in your words).

We greatly appreciate your sympathy and kindness during this difficult time. We had received news of the donation you made in 's name. We want to express heartfelt gratitude for your generosity. This was a beautiful gesture in remembrance of and we know they would have felt the same way.

Here are the basic steps to create an acknowledgement receipt:Use a company letterhead.Give the receipt a title.Write the statement of acknowledgement.Create a place for signatures and the date of the transaction.Explain any next steps.Provide contact information for further questions.Be specific and detailed.Be formal.More items...?

Phrases to use while writing an AcknowledgementI'm extremely grateful to 2026I'd like to express my deepest thanks to2026This project would not have been possible without2026I cannot begin to express my thanks to20262026, who2026I would like to extend my deepest gratitude to2026I would like to pay my special regards to 2026More items...?