Harris Texas Acknowledgment by Charitable or Educational Institution of Receipt of Gift is an important document that plays a crucial role in ensuring transparency and compliance in the charitable or educational sector. This acknowledgment serves to officially acknowledge the receipt of a gift by an organization and provides necessary information for the donor and the institution. The Harris Texas Acknowledgment generally includes key details such as the name and contact information of the charitable or educational institution, along with the name and contact information of the donor. It outlines the date and description of the gifted item, including its estimated value. This document also indicates whether any goods or services were provided in exchange for the gift. The acknowledgment may undergo certain modifications depending on the nature of the gift. Different types of Harris Texas Acknowledgment by Charitable or Educational Institution of Receipt of Gift can include: 1. Cash Contributions: This type of acknowledgment is used when a donor makes a monetary donation to the organization without receiving any goods or services in return. 2. In-Kind Gifts: When a donor contributes non-monetary items such as equipment, supplies, or property, an in-kind gift acknowledgment is utilized. This document specifies the donated items, details their value, and includes a statement whether the institution will use the gift for its intended purpose or if it plans to sell or dispose of it. 3. Charitable Contributions with Benefits: In cases where a donor receives certain goods, services, or privileges in exchange for their contribution, this acknowledgment highlights the value of the benefit received. It also specifies whether the donor relinquishes their right to claim any additional tax deductions. 4. Qualified Conservation Contributions: If the gift involves a qualified conservation contribution, additional information regarding the conservation purpose, related cost, and information about any historic or open space easement is documented. 5. Non-Cash Contributions over $5,000: When a non-cash donation surpasses the $5,000 threshold, the acknowledgment must include more comprehensive details about the appraisal of the donated item, along with relevant requirements outlined by the IRS. It is crucial for charitable or educational institutions in Harris, Texas, to issue accurate and thorough acknowledgments for any received gifts. These acknowledgments not only facilitate compliance with tax laws but also encourage transparency and trust between the institution and its donors.

Harris Texas Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

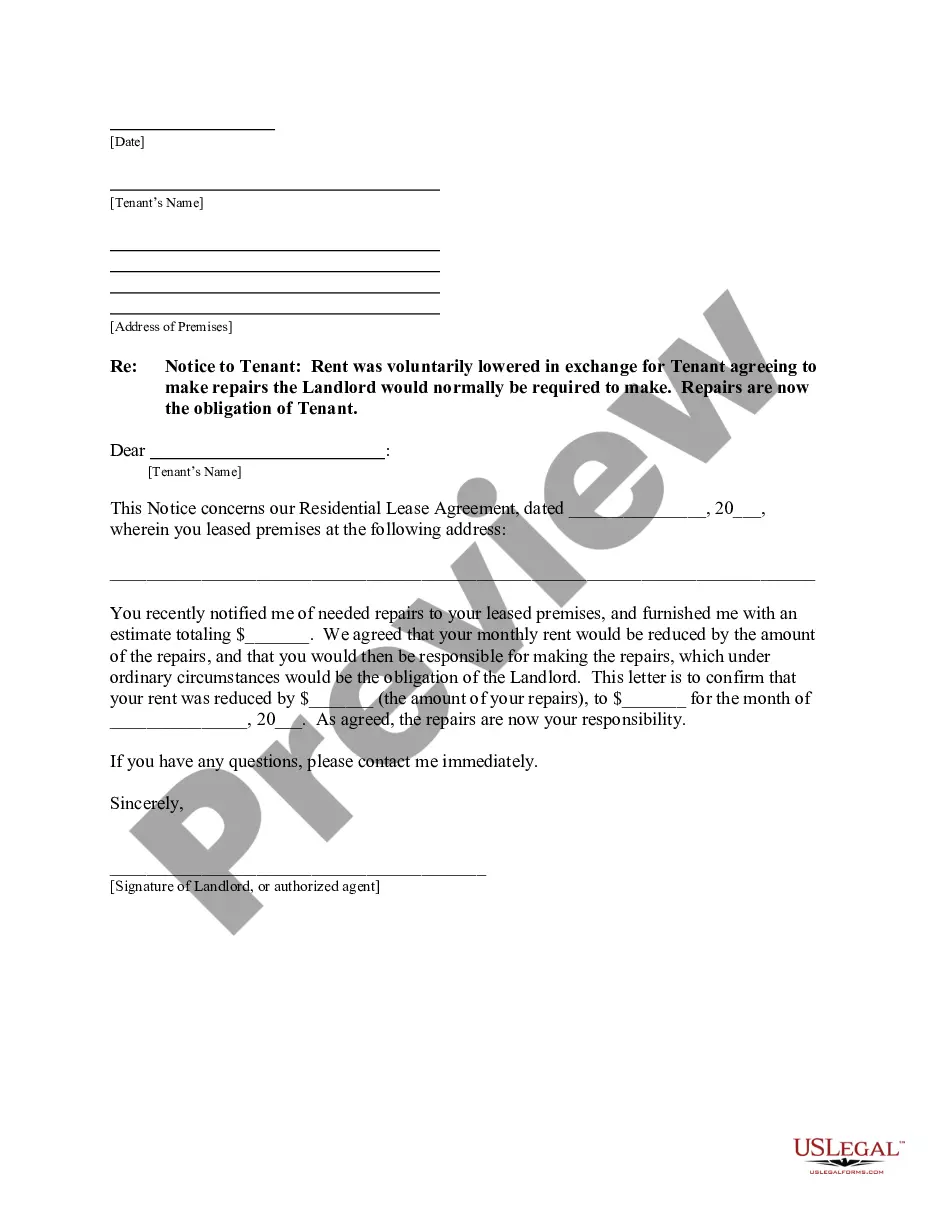

How to fill out Harris Texas Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Harris Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Harris Acknowledgment by Charitable or Educational Institution of Receipt of Gift will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Harris Acknowledgment by Charitable or Educational Institution of Receipt of Gift:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Harris Acknowledgment by Charitable or Educational Institution of Receipt of Gift on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!