Philadelphia Pennsylvania Acknowledgment by Charitable or Educational Institution of Receipt of Gift is an essential document that provides recognition and gratitude to individuals or organizations who generously contribute to the mission and work of a nonprofit in Philadelphia, Pennsylvania. This acknowledgment serves as proof of the gift received and allows the donor to claim tax deductions, if applicable. In Philadelphia, there are two primary types of acknowledgments that charitable or educational institutions may utilize: 1. Standard Acknowledgment: A standard acknowledgment is typically used when a donor contributes a monetary gift to the organization. It includes key details such as the donor's name, contact information, gift amount, the date of receipt, and a statement affirming that no goods or services were provided in exchange for the gift. This acknowledgment acknowledges the donor's generosity and serves as an official receipt for tax purposes. 2. In-Kind Acknowledgment: An in-kind acknowledgment is employed when a donor contributes non-cash items or services to the charitable or educational institution. This type of acknowledgment is provided to recognize the value of goods or services rather than monetary donations. It should include the donor's name, contact information, a description of the item or service donated, its fair market value, the date of receipt, and a statement confirming that no goods or services were provided in return. Both types of acknowledgments are crucial for maintaining transparency, establishing goodwill, and fostering continued engagement with donors in Philadelphia. They create a lasting impact by expressing appreciation for the donor's generosity and contributing to the organization's credibility and mission advancement. By utilizing relevant keywords such as "Philadelphia Pennsylvania," "acknowledgment," "charitable institution," "educational institution," "receipt of gift," "monetary gift," "in-kind donation," "tax deductions," and "transparency," charitable or educational institutions can effectively communicate their gratitude and adherence to legal requirements when acknowledging donors in the Philadelphia area.

Philadelphia Pennsylvania Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Philadelphia Pennsylvania Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Preparing papers for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Philadelphia Acknowledgment by Charitable or Educational Institution of Receipt of Gift without professional help.

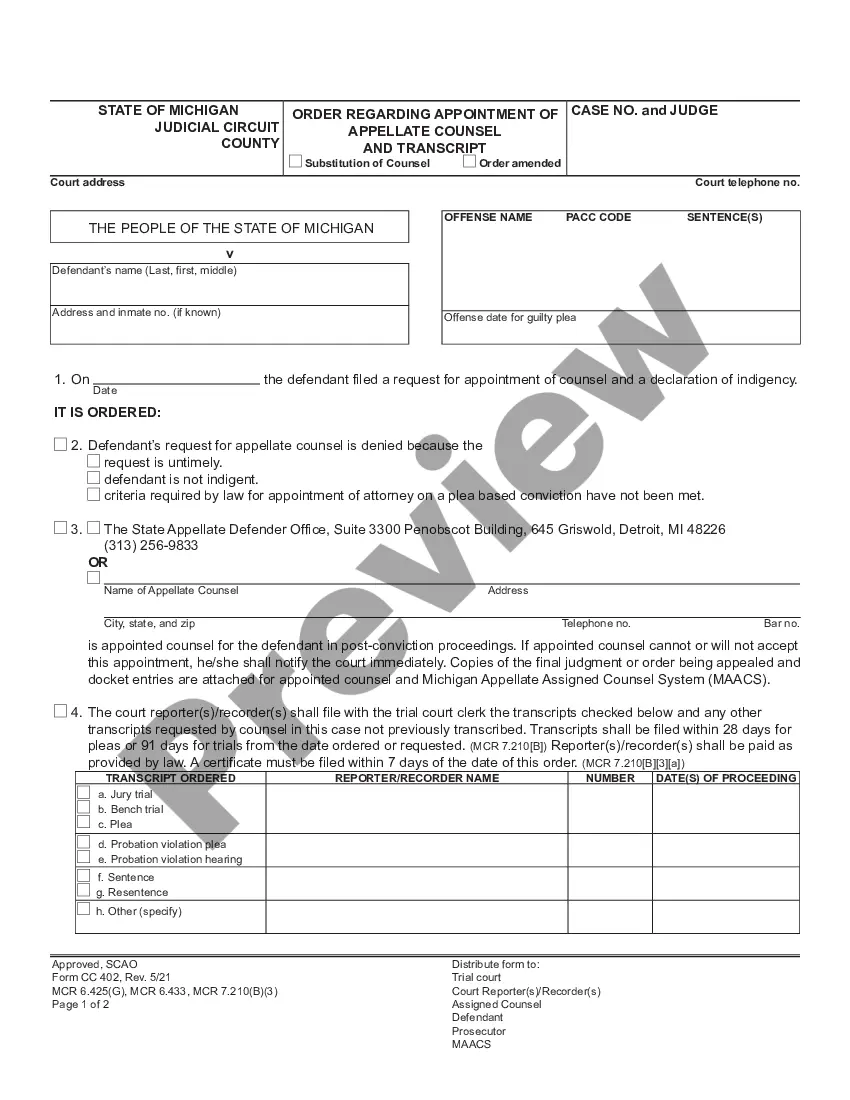

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Philadelphia Acknowledgment by Charitable or Educational Institution of Receipt of Gift by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Philadelphia Acknowledgment by Charitable or Educational Institution of Receipt of Gift:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

The purpose of letters of acknowledgment is to provide proof that you have received specific documents or a specific type of request. Letters of acknowledgment are often used for anything involved in a legal process.

As you write the letter or email, note that you received the gift via a donor-advised fund. Make sure you remove any reference that suggests that the donor is eligible to claim a tax deduction in connection to the donation. Restating that the donation is not tax-deductible as well can help avoid confusion.

In Kind refers to donations of goods instead of cash. Please note, according to IRS regulations, establishing a dollar value on donated items is the exclusive responsibility of the donor. Donated services are not tax deductible.

Dear Donor's name, Thank you for your great generosity! We, at charitable organization, greatly appreciate your donation, and your sacrifice. Your support helps to further our mission through general projects, including specific project or recipient.

Dear (Sir/Name/Uncle), We, at the (Foundation name), would like to express our gratitude for your generous gift of (Product/Item type and name) with (Support item type/money) and other accessories from (Institute/Supplier name) Association towards the noble cause of our organization. (Describe in your words).

Dear (Sir/Name/Uncle), We, at the (Foundation name), would like to express our gratitude for your generous gift of (Product/Item type and name) with (Support item type/money) and other accessories from (Institute/Supplier name) Association towards the noble cause of our organization. (Describe in your words).

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come

You can acknowledge their generosity in much the same way you thank your other donorswith just a few differences.Thank the donor who recommended the grant, not Fidelity Charitable.Eliminate all references to the gift being tax-deductible.Use a thank-you as an opportunity to drive future engagement.More items...

How to Write The Best Thank-You Letter for Donations + Three Templates and SamplesUse the donor's name.Send it promptly.Send it from a person.Show impact.Be warm and friendly.Use donor-centered language.Avoid empty jargon.Reference their history.More items...?