Collin Texas Acknowledgment by Debtor of Correctness of Account Stated is a legal document used in the state of Texas to verify the accuracy and validity of an account statement provided by a creditor. This specific type of acknowledgment holds significant importance in debt collection procedures and financial transactions. It ensures that debtors accept the correctness of the account balance, preventing any disputes or misunderstandings regarding their outstanding debts. When a debtor signs the Collin Texas Acknowledgment by Debtor of Correctness of Account Stated, they confirm that they have reviewed the account statement and agree that all the information provided is accurate. This acknowledgment serves as evidence that the debtor acknowledges the debt and the validity of the account balance disclosed. In Collin County, Texas, there are no specific variations or types of the Collin Texas Acknowledgment by Debtor of Correctness of Account Stated document. However, it is essential to adhere to the specific legal requirements outlined by the county and state to ensure its validity in debt collection proceedings. The keywords relevant to this topic include: 1. Collin Texas: Denotes the specific county in Texas where this acknowledgment is used. It implies adherence to the legal requirements and regulations specific to Collin County. 2. Acknowledgment: Refers to the act of recognizing and accepting the accuracy and validity of the information provided in the account statement. 3. Debtor: Indicates the individual who owes money or has an outstanding debt to the creditor. 4. Correctness: Highlights the significance of accuracy and truthfulness in the account statement. 5. Account Stated: Describes the document provided by the creditor, presenting the debtor's outstanding balance, including the principal amount, interest, fees, and any other relevant charges. 6. Legal Document: Emphasizes the importance of using a legally approved form to ensure compliance with state and county regulations. 7. Debt Collection: Indicates the process of collecting outstanding debts from debtors by following the legal procedures and documentation required. 8. Financial Transactions: Refers to the exchanges of money, payments, and accounts between creditors and debtors. By utilizing the Collin Texas Acknowledgment by Debtor of Correctness of Account Stated, both the creditor and debtor can establish a clear understanding and acceptance of the debt's validity. This acknowledgment protects the rights of both parties and helps maintain transparency and fairness in debt collection processes. Compliance with the county's legal standards is crucial to ensure the document's effectiveness and validity in any legal proceedings related to debt collection in Collin County, Texas.

Collin Texas Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Collin Texas Acknowledgment By Debtor Of Correctness Of Account Stated?

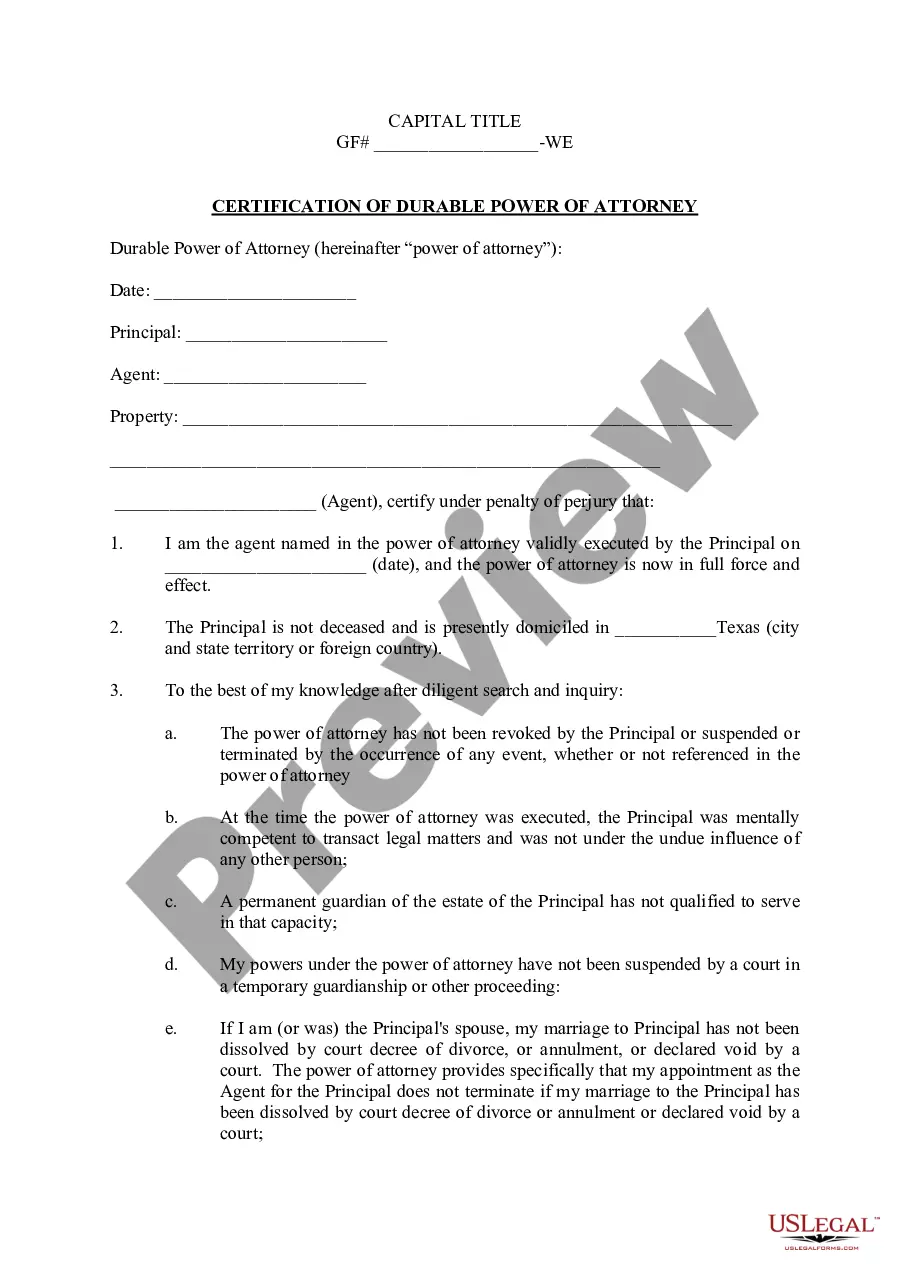

Drafting documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Collin Acknowledgment by Debtor of Correctness of Account Stated without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Collin Acknowledgment by Debtor of Correctness of Account Stated on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Collin Acknowledgment by Debtor of Correctness of Account Stated:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

12) How is Account Stated different from a breach of contract? An Account Stated establishes an implied contract whereas breach of contract traditionally refers to an expressly written contract. Account Stated is used when no contract exists, or when the plaintiff cannot prove the existence of the contract.

Under California law, "an account stated is an agreement, based on prior transactions between the parties, that the items of an account are true and that the balance struck is due and owing."4 The three elements of the claim are 1) previous transactions between the parties establishing the relationship between debtor

A debtor may overcome a prima facie case of an account stated by meeting the burden of proving fraud, mistake, or error in the account. The cause of action for an account stated is based on the agreement of the parties to pay the amount due upon the accounting, and not any written instrument.

Account stated refers to a document summarizing the amount a debtor owes a creditor, and account stated is a cause of action in many states that allows a creditor to sue for payment.

Under California law, "an account stated is an agreement, based on prior transactions between the parties, that the items of an account are true and that the balance struck is due and owing."4 The three elements of the claim are 1) previous transactions between the parties establishing the relationship between debtor

Account stated refers to a document summarizing the amount a debtor owes a creditor, and account stated is a cause of action in many states that allows a creditor to sue for payment.

The claimant must prove the cause of action with evidence on the balance of probabilities just as with the passing off claim above.

The elements of a cause of action for open book account are: Plaintiff and Defendant had financial transactions, Plaintiff kept an account of the debits and credits involved in the transactions, Defendant owes Plaintiff money on the account and, the amount of money Defendant owes Plaintiff.

Account stated is a cause of action for payment where one party sent an invoice to the other and the recipient of the invoice failed to object within a reasonable period. By failing to timely object, the recipient of an invoice may be liable for the entire amount of the invoice.