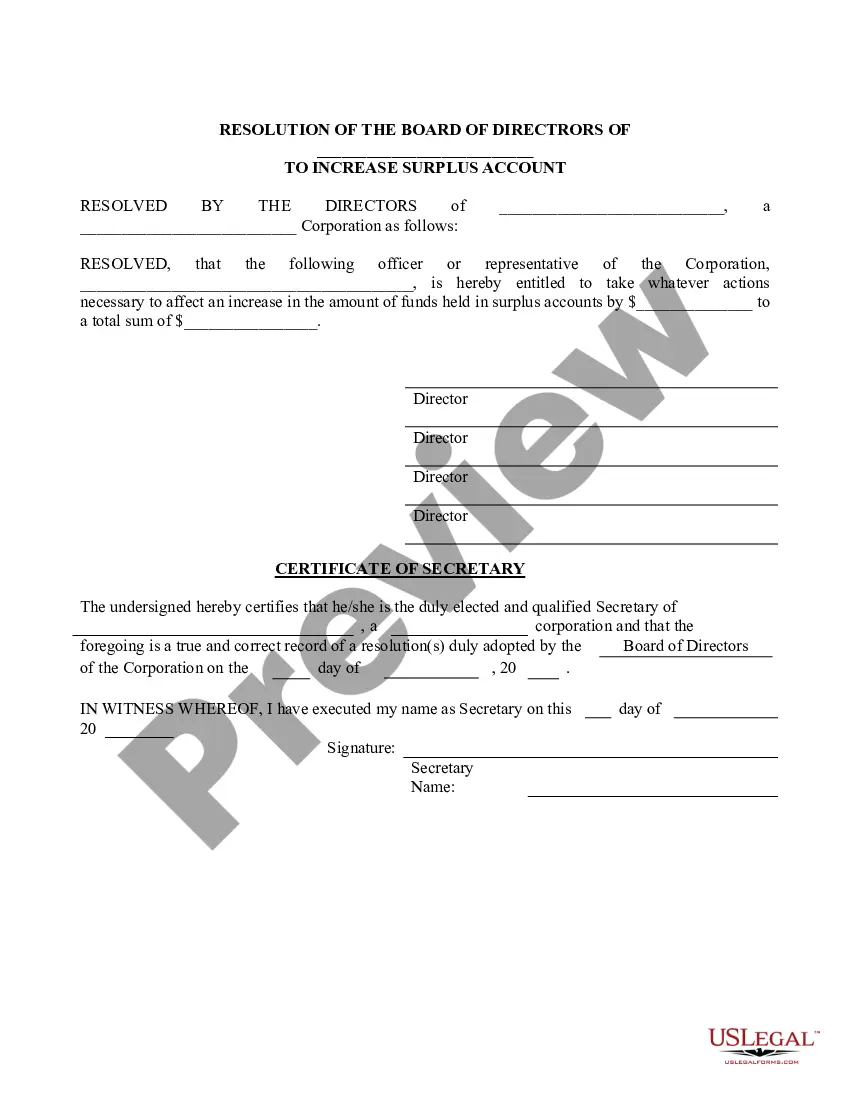

The Harris Texas Increase Surplus Account — Resolution For— - Corporate Resolutions is a vital document for businesses operating in Harris County, Texas. This detailed description aims to provide relevant information about this form, its purpose, and different types. The Harris Texas Increase Surplus Account — Resolution For— - Corporate Resolutions is primarily used to authorize an increase in a company's surplus account. The surplus account refers to the cumulative amount of retained earnings and other shareholder contributions beyond the company's established capital. By using this resolution form, businesses can legally document and approve the decision to boost their surplus account. The purpose of this form is to ensure transparency, accountability, and compliance within corporate governance practices. It allows companies to maintain accurate financial records and adhere to regulatory requirements. Increasing the surplus account can have various benefits for businesses, including financial stability, future investment opportunities, and potential tax advantages. Key elements typically included in the Harris Texas Increase Surplus Account — Resolution For— - Corporate Resolutions are: 1. Company Information: The form starts with essential details about the business, such as the legal name, registered address, tax identification number, and contact information. 2. Approval of Increase: This section outlines the resolution to increase the surplus account. It includes the proposed amount of the increase, the purpose of the increment, and the effective date. The resolution must be approved by the company's board of directors or relevant stakeholders. 3. Signatories: The form requires the signatures of authorized individuals, such as the company's president, secretary, or any other designated officers. These signatures validate the resolution and acknowledge the responsibility for its implementation. Different types of Harris Texas Increase Surplus Account — Resolution For— - Corporate Resolutions may exist depending on the specific circumstances or legal requirements of a company. Some possible variations include: 1. Regular Increase in Surplus Account: This type of resolution form is used when a company decides to incrementally increase its surplus account over time, usually to accumulate additional retained earnings. 2. Capital Contribution to Surplus Account: When shareholders or owners contribute additional capital to the company, a resolution form becomes necessary to document and authorize the transfer of these funds to the surplus account. 3. Special Surplus Account Increase: In some cases, businesses may require a temporary or one-time increase in their surplus account. This could be due to specific business needs, such as financing a strategic project or complying with regulatory requirements. It is important for businesses in Harris County, Texas, to consult legal professionals or corporate governance experts to ensure the correct Harris Texas Increase Surplus Account — Resolution For— - Corporate Resolutions is utilized. These experts can offer guidance on appropriate resolutions based on the company's unique circumstances and legal obligations.

Harris Texas Increase Surplus Account - Resolution Form - Corporate Resolutions

Description

How to fill out Harris Texas Increase Surplus Account - Resolution Form - Corporate Resolutions?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Harris Increase Surplus Account - Resolution Form - Corporate Resolutions.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Harris Increase Surplus Account - Resolution Form - Corporate Resolutions will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the Harris Increase Surplus Account - Resolution Form - Corporate Resolutions:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Harris Increase Surplus Account - Resolution Form - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers. Acceptance of the corporate bylaws. Creation of a corporate bank account. Designating which board members and officers can access the bank account.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

Board resolutions should be written on the organization's letterhead. The wording simply describes the action that the board agreed to take. It also shows the date of the action and it names the parties to the resolution.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

When you create a resolution to open a bank account, you need to include the following information:The legal name of the corporation.The name of the bank where the account will be created.The state where the business is formed.Information about the directors/members.More items...

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.